Understanding the True Cost of Borrowing

In the realm of corporate finance, making informed decisions is crucial to drive business growth and profitability. One critical aspect of this decision-making process is understanding the true cost of borrowing, which involves calculating the pre-tax cost of debt. This metric is essential because it represents the actual cost of debt financing before considering tax implications, providing a more accurate picture of a company’s financial health. Unlike post-tax cost of debt, which takes into account the tax benefits of interest expenses, pre-tax cost of debt offers a clearer understanding of the true burden of debt on a company’s bottom line. Accurate calculation of pre-tax cost of debt is vital, as it directly affects capital budgeting decisions, cash flow, and ultimately, a company’s ability to thrive in a competitive market. In this article, we’ll explore the significance of pre-tax cost of debt and provide a step-by-step guide on how to calculate it accurately, empowering businesses to make informed decisions that drive long-term success.

What is Pre-Tax Cost of Debt and Why Does it Matter?

The pre-tax cost of debt is a crucial financial metric that represents the actual cost of borrowing before considering tax implications. It is essential in capital budgeting decisions, as it directly affects a company’s profitability and cash flow. In simple terms, pre-tax cost of debt is the rate of return a company must earn on its investments to justify the use of debt financing. This metric is critical because it helps businesses evaluate the feasibility of projects, determine the cost of capital, and make informed financing decisions. By understanding the pre-tax cost of debt, companies can optimize their capital structure, minimize costs, and maximize returns on investments. In the following sections, we will delve into the calculation of pre-tax cost of debt and explore its applications in business decision-making.

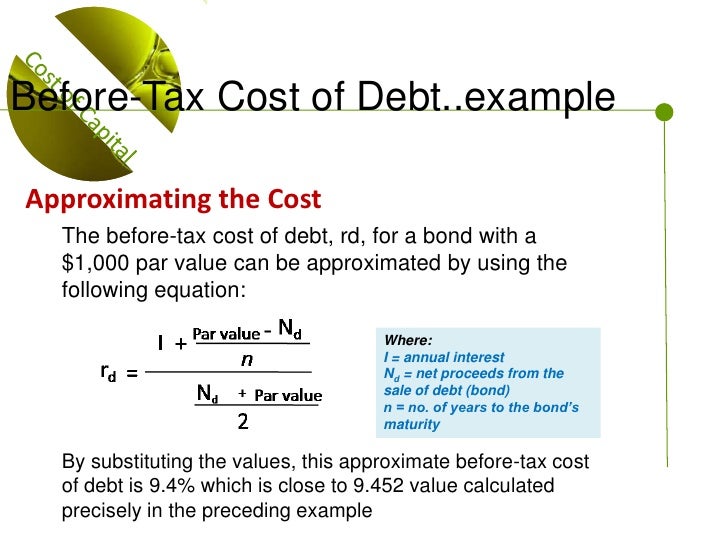

How to Calculate Pre-Tax Cost of Debt: A Simple Formula

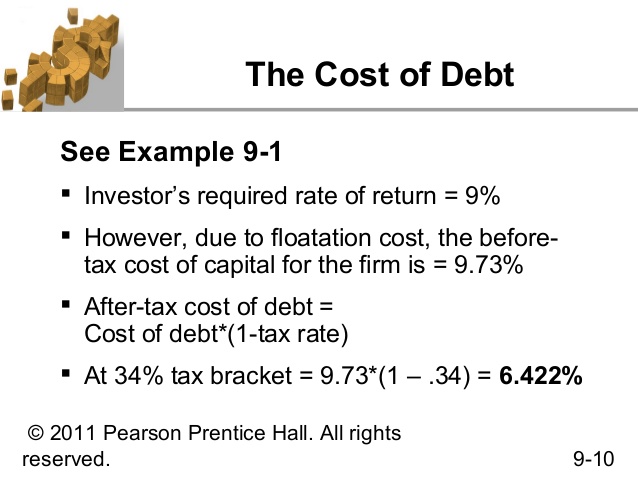

Calculating the pre-tax cost of debt is a straightforward process that involves a simple formula. The formula is: Pre-tax cost of debt = (Interest expense / Total debt) x (1 – Tax rate). This formula takes into account the interest expense incurred on a company’s debt, the total amount of debt, and the tax rate applicable to the company. By multiplying the interest expense by the inverse of the tax rate, we can determine the pre-tax cost of debt. For instance, if a company has an interest expense of $10,000, a total debt of $100,000, and a tax rate of 25%, the pre-tax cost of debt would be: (10,000 / 100,000) x (1 – 0.25) = 8%. This means that the company must earn at least 8% on its investments to justify the use of debt financing. In the next section, we will explore the various factors that influence the pre-tax cost of debt, including interest rates, tax rates, debt maturity, and credit ratings.

Factors Affecting Pre-Tax Cost of Debt: Interest Rates, Tax Rates, and More

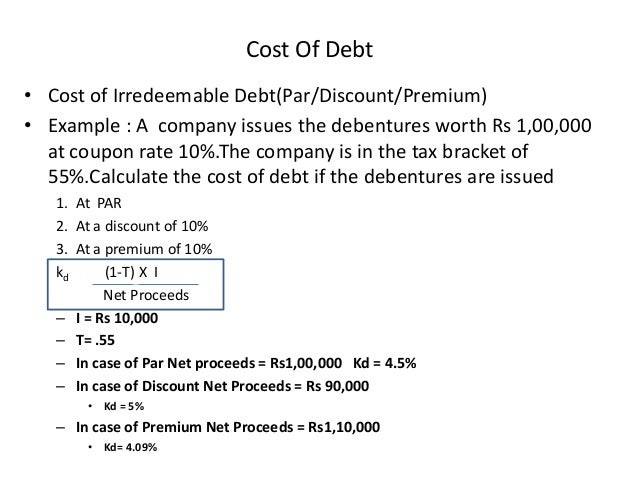

The pre-tax cost of debt is influenced by several factors, including interest rates, tax rates, debt maturity, and credit ratings. Understanding how these factors impact the pre-tax cost of debt is crucial for making informed business decisions. Interest rates, for instance, have a direct impact on the pre-tax cost of debt. An increase in interest rates will result in a higher pre-tax cost of debt, making it more expensive for companies to borrow. Tax rates also play a significant role, as a change in tax rates will affect the pre-tax cost of debt. A decrease in tax rates, for example, will reduce the pre-tax cost of debt, making borrowing more attractive. Debt maturity is another important factor, as longer-term debt typically has a higher pre-tax cost of debt compared to shorter-term debt. Credit ratings also influence the pre-tax cost of debt, with companies having a higher credit rating typically enjoying a lower pre-tax cost of debt. By understanding how these factors interact and impact the pre-tax cost of debt, companies can make more informed decisions about their capital structure and financing strategies.

Real-World Examples: Calculating Pre-Tax Cost of Debt for Different Industries

To illustrate the application of the pre-tax cost of debt formula in different scenarios, let’s consider three examples from various industries. First, suppose we have a retail company, “FashionForward,” with an interest expense of $50,000, total debt of $500,000, and a tax rate of 20%. Using the formula, we can calculate the pre-tax cost of debt as: (50,000 / 500,000) x (1 – 0.20) = 8%. This means that FashionForward must earn at least 8% on its investments to justify the use of debt financing.

Next, consider a manufacturing company, “SteelCorp,” with an interest expense of $200,000, total debt of $2,000,000, and a tax rate of 25%. The pre-tax cost of debt for SteelCorp would be: (200,000 / 2,000,000) x (1 – 0.25) = 7.5%. Finally, let’s look at a finance company, “BankOnIt,” with an interest expense of $1,000,000, total debt of $10,000,000, and a tax rate of 30%. The pre-tax cost of debt for BankOnIt would be: (1,000,000 / 10,000,000) x (1 – 0.30) = 7%. These examples demonstrate how to calculate pre-tax cost of debt in different industries and scenarios, highlighting the importance of understanding this concept in making informed business decisions.

Common Mistakes to Avoid When Calculating Pre-Tax Cost of Debt

When calculating the pre-tax cost of debt, it’s essential to avoid common mistakes that can lead to inaccurate results. One common error is failing to account for the tax rate correctly. This can result in an incorrect calculation of the pre-tax cost of debt, which can have significant implications for business decisions. Another mistake is neglecting to consider the total debt amount, including both short-term and long-term debt. This can lead to an incomplete picture of the company’s debt obligations and, consequently, an inaccurate pre-tax cost of debt calculation.

Additionally, companies may mistakenly use the post-tax cost of debt instead of the pre-tax cost of debt in their capital budgeting decisions. This can result in an underestimation of the true cost of debt and lead to poor investment decisions. To avoid these mistakes, it’s crucial to carefully follow the formula for calculating pre-tax cost of debt and ensure that all relevant data is accurate and up-to-date. By doing so, companies can make informed decisions about their debt financing strategies and optimize their capital structure.

Best practices for calculating pre-tax cost of debt include regularly reviewing and updating debt data, using a consistent methodology for calculating the pre-tax cost of debt, and considering multiple scenarios to account for potential changes in interest rates and tax rates. By following these best practices and avoiding common mistakes, companies can ensure that their pre-tax cost of debt calculations are accurate and reliable, ultimately leading to better business decisions.

Using Pre-Tax Cost of Debt in Capital Budgeting Decisions

Accurately calculating the pre-tax cost of debt is crucial in capital budgeting decisions, as it helps companies evaluate investment opportunities, determine the cost of capital, and make informed financing decisions. By understanding the pre-tax cost of debt, companies can assess the viability of potential projects and investments, and make decisions that align with their overall business strategy.

For instance, when evaluating an investment opportunity, a company can use the pre-tax cost of debt to determine the minimum rate of return required to justify the investment. If the expected return on investment is higher than the pre-tax cost of debt, the company may decide to pursue the investment. On the other hand, if the expected return is lower than the pre-tax cost of debt, the company may reject the investment.

In addition, the pre-tax cost of debt can be used to determine the cost of capital, which is essential in capital budgeting decisions. By calculating the weighted average cost of capital (WACC), companies can evaluate the overall cost of financing their operations and make decisions about the optimal capital structure. The pre-tax cost of debt is a critical component of the WACC calculation, and accurate calculation is essential to ensure that companies make informed decisions.

Furthermore, the pre-tax cost of debt can inform financing decisions, such as whether to issue debt or equity to raise capital. By understanding the pre-tax cost of debt, companies can determine the most cost-effective way to finance their operations and make decisions that minimize their cost of capital.

In conclusion, accurately calculating the pre-tax cost of debt is essential in capital budgeting decisions. By understanding the pre-tax cost of debt, companies can make informed decisions about investment opportunities, determine the cost of capital, and optimize their financing strategies. By following the steps outlined in this article, companies can ensure that they accurately calculate the pre-tax cost of debt and make decisions that drive business success.

Conclusion: Mastering the Art of Pre-Tax Cost of Debt Calculation

In conclusion, accurately calculating the pre-tax cost of debt is a crucial step in making informed business decisions. By understanding the factors that influence pre-tax cost of debt and how to calculate it accurately, companies can make better decisions about investments, financing, and capital budgeting. Remember, how to calculate pre-tax cost of debt is not just a mathematical exercise, but a critical component of a company’s overall financial strategy.

Throughout this article, we have provided a step-by-step guide on how to calculate pre-tax cost of debt, discussed the factors that affect it, and demonstrated its application in real-world scenarios. By following these guidelines and avoiding common mistakes, companies can ensure that their pre-tax cost of debt calculations are accurate and reliable.

Ultimately, mastering the art of pre-tax cost of debt calculation is essential for companies to achieve their financial goals and stay competitive in today’s fast-paced business environment. By prioritizing accurate calculation and application of pre-tax cost of debt, companies can make informed decisions, optimize their capital structure, and drive long-term success.