Why Calculating Portfolio Rate of Return Matters

Calculating portfolio rate of return is a vital component of investment management, as it provides a clear understanding of an investment’s performance and informs investment decisions. This metric has a significant impact on investment decisions, as it enables investors to compare the performance of different investments and allocate their resources more efficiently. By understanding how to calculate portfolio rate of return, investors can evaluate the effectiveness of their investment strategies, identify areas for improvement, and adjust their portfolios accordingly. Moreover, calculating portfolio rate of return is essential for risk management, as it helps investors identify potential pitfalls and adjust their strategies to minimize losses. In today’s competitive investment landscape, knowing how to calculate portfolio rate of return is vital for achieving financial success. It empowers investors to take control of their financial futures, make progress towards their long-term financial goals, and unlock the full potential of their portfolios. By grasping the importance of calculating portfolio rate of return, investors can set themselves up for long-term success and achieve their financial objectives. Furthermore, understanding how to calculate portfolio rate of return can help investors avoid common pitfalls, such as incorrect data or inconsistent time periods, and make more informed decisions about their investments. As investors navigate the complex world of investments, knowing how to calculate portfolio rate of return is essential for making informed decisions and achieving financial success. By doing so, investors can optimize their investment strategies, minimize risks, and maximize returns, ultimately leading to a more secure financial future.

Understanding the Time Value of Money

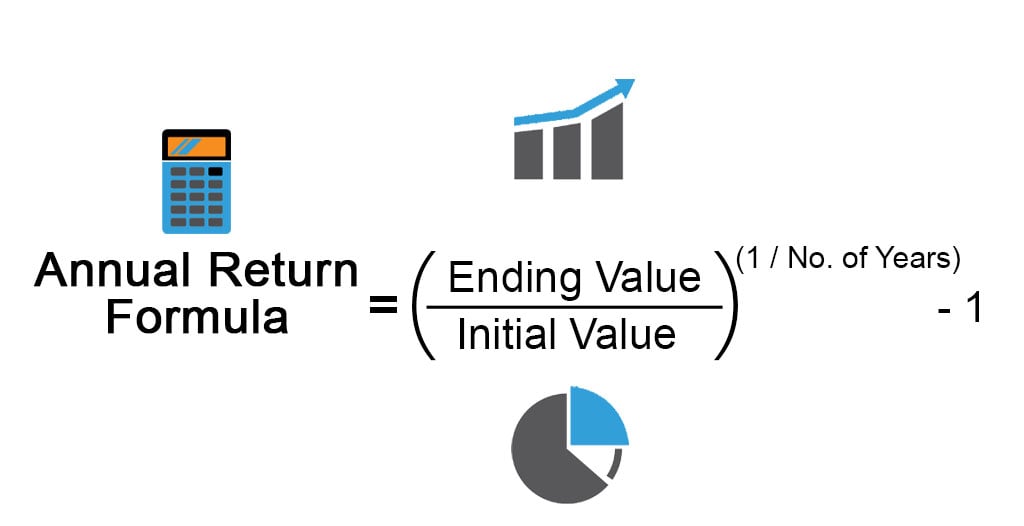

The concept of time value of money is a fundamental principle in finance that plays a crucial role in understanding investment returns. It states that a dollar received today is worth more than a dollar received in the future, due to the potential to earn interest or returns on that dollar over time. This concept is essential when learning how to calculate portfolio rate of return, as it affects the overall performance of an investment. Compounding, which is the process of earning interest on both the principal amount and any accrued interest, can significantly impact investment returns over time. On the other hand, discounting, which is the process of determining the present value of a future cash flow, is also critical in understanding the time value of money. By grasping the concept of time value of money, investors can better understand how their investments are performing and make more informed decisions about their portfolios. For instance, when calculating portfolio rate of return, investors must consider the impact of compounding and discounting on their investments. This includes understanding how different asset classes, such as stocks and bonds, are affected by the time value of money. By doing so, investors can gain a deeper understanding of their investments and make more informed decisions about their portfolios. Ultimately, understanding the time value of money is essential for achieving long-term financial success and maximizing portfolio performance.

How to Calculate Portfolio Rate of Return: The Basics

Calculating portfolio rate of return is a crucial step in evaluating the performance of an investment portfolio. The basic formula for calculating portfolio rate of return is: (Gain / Cost) x 100, where Gain is the total return on investment, including dividends, interest, and capital gains, and Cost is the initial investment amount. Understanding how to calculate portfolio rate of return is essential for investors, as it provides a clear picture of their investment’s performance and helps them make informed decisions about their portfolios. When calculating portfolio rate of return, it’s essential to consider all sources of return, including dividends, interest, and capital gains. Dividends, for instance, are a key component of total return, as they provide a regular income stream to investors. Interest, on the other hand, is earned on fixed-income investments, such as bonds. Capital gains, which occur when an investment is sold for a profit, are also a critical component of total return. By understanding how to calculate portfolio rate of return, investors can gain a deeper understanding of their investments and make more informed decisions about their portfolios. This, in turn, can help them achieve their long-term financial goals and maximize their portfolio’s performance. To get the most out of their investments, investors must know how to calculate portfolio rate of return and use this information to inform their investment decisions.

Weighted Average Return: A Deeper Dive

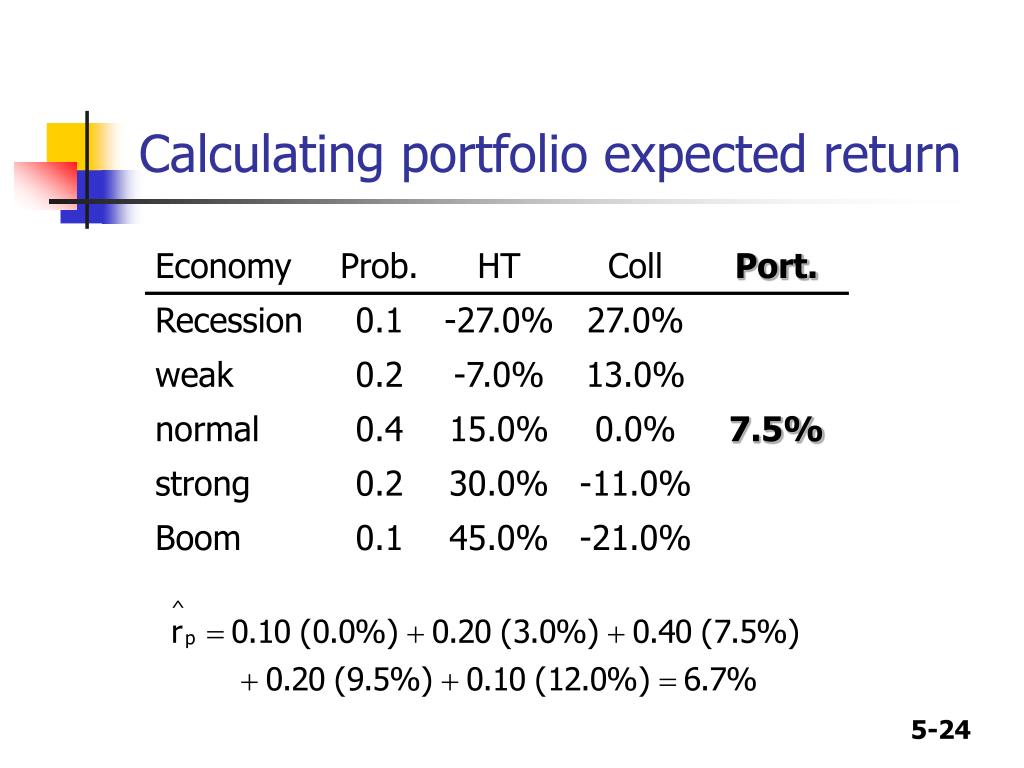

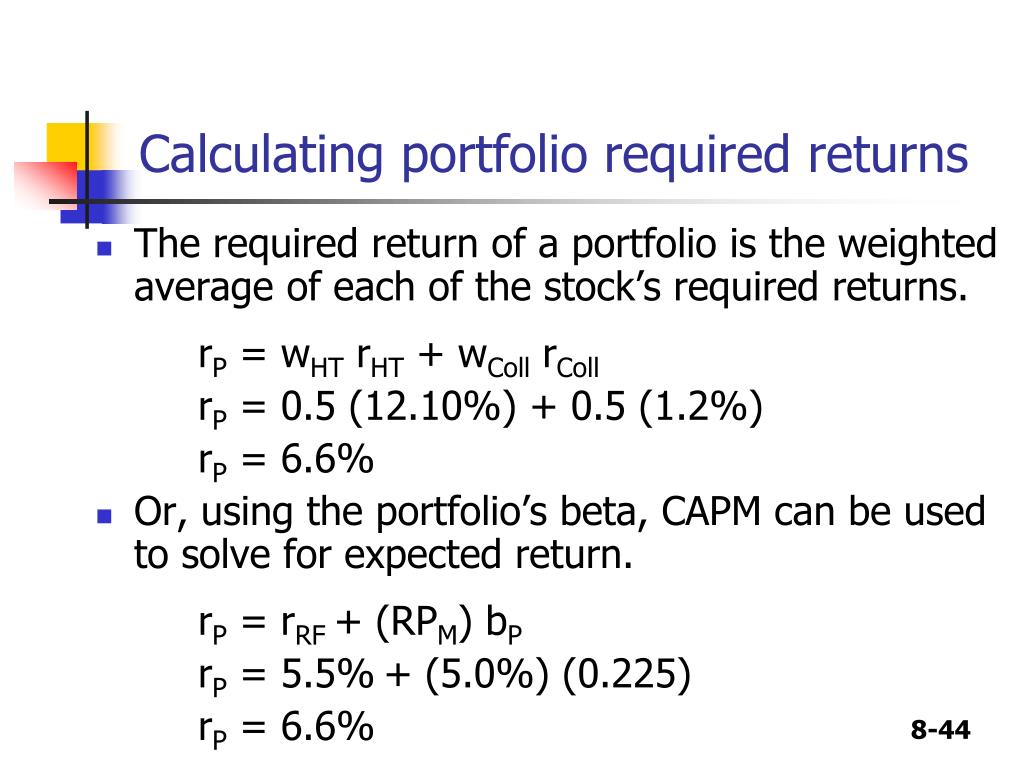

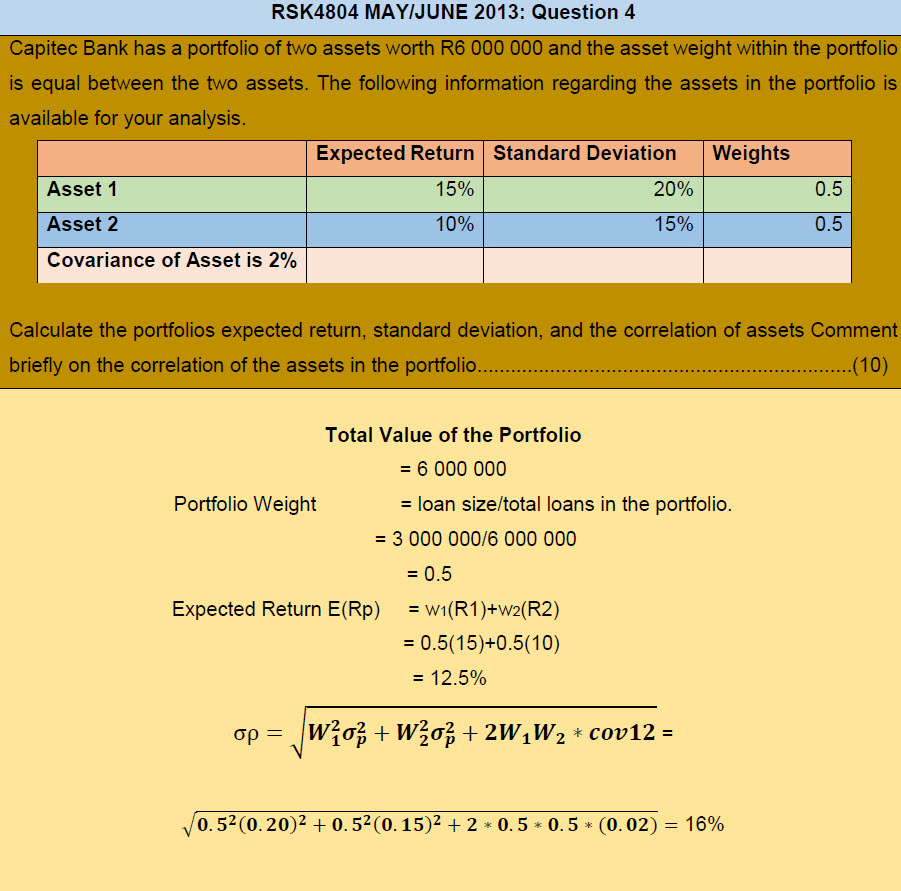

When learning how to calculate portfolio rate of return, it’s essential to understand the concept of weighted average return. This approach takes into account the different asset classes within a portfolio, each with its respective weight or proportion. The weighted average return is calculated by multiplying the return of each asset class by its corresponding weight, and then summing up the results. This approach provides a more accurate representation of a portfolio’s performance, as it acknowledges the varying contributions of each asset class. For instance, a portfolio with a 60% allocation to stocks and 40% allocation to bonds would assign a weight of 0.6 to the stock return and 0.4 to the bond return. By applying the weighted average return approach, investors can gain a deeper understanding of their portfolio’s performance and make more informed decisions about their investments. This approach is particularly useful when dealing with complex portfolios comprising multiple asset classes, each with its unique return profile. By mastering the weighted average return approach, investors can refine their understanding of how to calculate portfolio rate of return and unlock the full potential of their investments.

Handling Multiple Investments: The Aggregated Return Approach

When learning how to calculate portfolio rate of return, it’s essential to understand how to handle multiple investments with different return profiles. The aggregated return approach is a useful method for calculating portfolio rate of return when dealing with multiple investments. This approach involves calculating the return of each individual investment and then aggregating them to obtain the overall portfolio return. To apply the aggregated return approach, investors must first calculate the return of each investment using the basic formula: (Gain / Cost) x 100. Next, they must weight each investment’s return by its respective proportion of the overall portfolio. Finally, the weighted returns are summed up to obtain the overall portfolio return. For instance, if a portfolio consists of two investments, A and B, with returns of 10% and 15%, respectively, and A accounts for 60% of the portfolio, the aggregated return would be (0.6 x 10%) + (0.4 x 15%) = 12%. By mastering the aggregated return approach, investors can accurately calculate their portfolio rate of return, even when dealing with complex portfolios comprising multiple investments. This, in turn, enables them to make informed decisions about their investments and optimize their portfolio’s performance.

Common Pitfalls to Avoid When Calculating Portfolio Rate of Return

When learning how to calculate portfolio rate of return, it’s essential to be aware of common mistakes that can lead to inaccurate results. One of the most critical pitfalls to avoid is using incorrect data, such as outdated or incomplete information. This can lead to a distorted view of a portfolio’s performance, which can, in turn, result in poor investment decisions. Another common mistake is using inconsistent time periods, which can make it challenging to accurately compare returns across different investments. Ignoring fees and expenses is another pitfall to avoid, as these can significantly impact a portfolio’s overall return. Additionally, failing to account for compounding and discounting can lead to inaccurate calculations of portfolio rate of return. Furthermore, using a single return metric, such as the arithmetic mean, without considering the portfolio’s volatility and risk profile, can provide a misleading picture of its performance. By being aware of these common pitfalls, investors can ensure that their calculations of portfolio rate of return are accurate and reliable, enabling them to make informed decisions about their investments and optimize their portfolio’s performance.

Real-World Examples: Calculating Portfolio Rate of Return in Practice

To illustrate how to calculate portfolio rate of return in practice, let’s consider a few real-world examples. Suppose an investor has a portfolio consisting of 60% stocks and 40% bonds, with a total value of $100,000. The stocks have a return of 8% over a year, while the bonds have a return of 4%. To calculate the portfolio rate of return, the investor would use the weighted average return approach, resulting in a portfolio return of (0.6 x 8%) + (0.4 x 4%) = 6.4%. Another example is a portfolio with a mix of high-risk and low-risk investments, such as a 50% allocation to emerging market stocks and a 50% allocation to U.S. Treasury bonds. In this case, the portfolio rate of return would need to be calculated using the aggregated return approach, taking into account the different return profiles of each investment. By applying the concepts learned in this guide, investors can calculate their portfolio rate of return in a variety of scenarios, including those with different asset allocations, risk profiles, and investment horizons. This, in turn, enables them to make informed decisions about their investments and optimize their portfolio’s performance. For instance, an investor may use the calculated portfolio rate of return to determine whether their investments are aligned with their long-term financial goals or to identify areas for improvement. By mastering how to calculate portfolio rate of return, investors can unlock the full potential of their investments and achieve their financial objectives.

Maximizing Portfolio Performance: Tips and Strategies

Now that you’ve learned how to calculate portfolio rate of return, it’s essential to understand how to maximize portfolio performance. One key strategy is diversification, which involves spreading investments across different asset classes to minimize risk. Regular rebalancing is another crucial step, as it helps maintain an optimal asset allocation and ensures that the portfolio remains aligned with its investment objectives. Tax-efficient investing is also vital, as it can help minimize tax liabilities and maximize after-tax returns. Additionally, investors should consider adopting a long-term perspective, as this can help ride out market fluctuations and capture the benefits of compounding. Furthermore, investors should be mindful of fees and expenses, as these can erode portfolio returns over time. By implementing these strategies and regularly calculating their portfolio rate of return, investors can unlock the full potential of their investments and achieve their long-term financial goals. For instance, by diversifying their portfolio, investors can reduce their exposure to market volatility and increase their potential for long-term growth. By regularly rebalancing their portfolio, investors can ensure that their investments remain aligned with their risk tolerance and investment objectives. By adopting a tax-efficient investment approach, investors can minimize their tax liabilities and maximize their after-tax returns. By mastering how to calculate portfolio rate of return and implementing these strategies, investors can take control of their investments and achieve financial success.