Market Return Calculation: A Crucial Element in Investment Analysis

Calculating market returns is a fundamental aspect of investment analysis, providing investors with valuable insights into the performance of their portfolios, individual securities, and various investment options. By understanding how to calculate market returns, investors can effectively track their portfolio’s progress, make informed decisions, and compare different investment opportunities.

Market returns represent the change in the value of an investment over a specific period, accounting for both capital appreciation (price changes) and income (dividends). This metric is essential for assessing the efficiency of investment strategies, identifying potential risks, and evaluating the performance of fund managers. Moreover, calculating market returns enables investors to establish realistic expectations, allocate resources effectively, and optimize their investment decisions for long-term success.

Breaking Down the Components: Price Change and Dividends

At the heart of market return calculation are two primary components: price change and dividends. Price change, also known as capital appreciation, represents the difference between the purchase price and the selling price of a security. Dividends, on the other hand, are the distributions of a portion of a company’s earnings to shareholders, typically paid on a regular basis, such as quarterly or annually.

Price Change

To calculate the price change, subtract the purchase price from the selling price:

Price Change = Selling Price – Purchase Price

For example, if an investor purchases a stock for $50 and sells it for $75, the price change would be $25.

Dividends

Dividends are calculated as a percentage of the stock’s price, known as the dividend yield. To determine the dividend yield, divide the annual dividend per share by the stock’s current price:

Dividend Yield = Annual Dividend per Share / Stock’s Current Price

For instance, if a stock has an annual dividend of $2 and a current price of $100, the dividend yield would be 2%.

It is essential to consider both price change and dividends when calculating market returns, as they both contribute to the overall performance of an investment. Neglecting either component can result in an incomplete and potentially misleading assessment of an investment’s worth.

The Role of Time: Periodic vs. Annualized Market Returns

Time plays a crucial role in calculating market returns, as it allows investors to assess performance over various periods and compare different investment options. The two primary methods for expressing market returns over time are periodic and annualized returns.

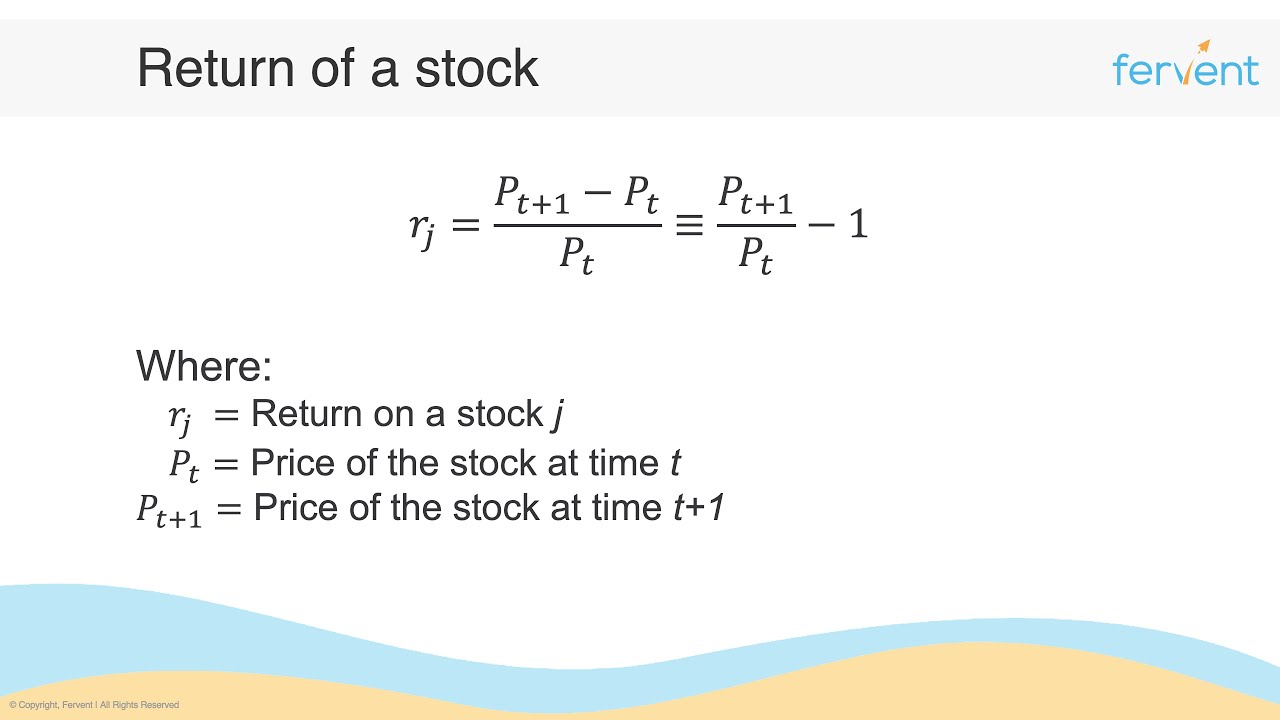

Periodic Market Returns

Periodic market returns represent the change in value over a specific, finite period, such as daily, weekly, monthly, or quarterly returns. These returns are calculated by comparing the value of an investment at the beginning and end of the chosen period:

Periodic Return = (Ending Value / Beginning Value) ^ (1 / Number of Periods) – 1

For example, if an investment is worth $1,000 at the beginning of a year and $1,100 at the end of the year, the annual periodic return would be 10%.

Annualized Market Returns

Annualized market returns, on the other hand, express the average return over a longer period, such as multiple years, on an annual basis. This method is particularly useful when comparing the long-term performance of different investments:

Annualized Return = (Ending Value / Beginning Value) ^ (1 / Number of Years) – 1

For instance, if an investment starts at $1,000 and grows to $1,300 over three years, the annualized return would be approximately 7.1%.

Understanding the difference between periodic and annualized market returns is essential for investors, as it enables them to evaluate investment performance accurately and make informed decisions based on historical data.

Calculating Price Change: The Basics of Capital Appreciation

Calculating the price change of a security is a fundamental aspect of market return calculation, focusing on the capital appreciation component. The price change is determined by subtracting the purchase price from the selling price:

Price Change = Selling Price – Purchase Price

For example, if an investor purchases a stock for $50 and sells it for $75, the price change would be $25.

While this basic formula is straightforward, it has limitations. For instance, it does not account for fees, commissions, or taxes associated with the transaction. These additional costs can significantly impact the overall return on an investment, so it is essential to consider them when calculating market returns.

To improve the accuracy of price change calculations, investors can make adjustments for transaction costs, such as:

Adjusted Price Change = Selling Price – Purchase Price – Transaction Costs

For example, if an investor sells a stock for $75, but incurs a $5 commission, the adjusted price change would be $20.

By understanding how to calculate price change and accounting for transaction costs, investors can more accurately assess the performance of their investments and make informed decisions.

Capturing Dividends: The Often-Overlooked Component of Market Returns

Dividends, the distributions of a portion of a company’s earnings to shareholders, often play a significant role in market returns. However, they are frequently overlooked or underestimated in the calculation process.

To accurately incorporate dividends into market return calculations, investors must first determine the dividend yield. The dividend yield is the annual dividend per share divided by the stock’s current price:

Dividend Yield = Annual Dividend per Share / Stock’s Current Price

For example, if a stock has an annual dividend of $2 and a current price of $100, the dividend yield would be 2%.

Once the dividend yield is calculated, it can be incorporated into the market return calculation. The formula for calculating market returns with dividends is:

Market Return = (1 + Price Change) x (1 + Dividend Yield) – 1

Using the previous example, if the price change is 10%, the market return would be:

(1 + 0.10) x (1 + 0.02) – 1 = 12.2%

By including dividends in market return calculations, investors can more accurately assess the performance of their investments and make informed decisions based on the true value of their portfolios.

From Components to the Whole: A Step-by-Step Guide to Calculating Market Returns

Calculating market returns involves combining the individual components of price change and dividends. By following a detailed, step-by-step process, investors can accurately assess the performance of their investments.

Step 1: Determine the Beginning and Ending Prices

Identify the purchase and sale prices of the security during the specified time frame.

Step 2: Calculate the Price Change

Calculate the price change using the formula:

Price Change = Selling Price – Purchase Price

Step 3: Calculate the Dividend Yield

Determine the dividend yield using the formula:

Dividend Yield = Annual Dividend per Share / Stock’s Current Price

Step 4: Incorporate Dividends into the Market Return Calculation

Combine the price change and dividend yield to calculate the market return:

Market Return = (1 + Price Change) x (1 + Dividend Yield) – 1

For example, if the price change is 10% and the dividend yield is 2%, the market return would be:

(1 + 0.10) x (1 + 0.02) – 1 = 12.2%

By following this step-by-step process, investors can accurately calculate market returns, incorporating both price change and dividends. This information can be used to track portfolio performance, make informed decisions, and compare investment options.

Beyond the Basics: Advanced Market Return Calculation Techniques

In addition to the fundamental market return calculation techniques, investors can utilize more advanced methods to assess the performance of their investments. These advanced techniques include total return, internal rate of return, and the modified dietz method.

Total Return

Total return is a comprehensive measure of an investment’s performance, incorporating both capital gains and dividends. It is calculated as follows:

Total Return = (Current Price + Dividends) / Initial Price – 1

For example, if an investment starts at $100, pays $5 in dividends, and is sold for $120, the total return would be:

($120 + $5) / $100 – 1 = 27%

Internal Rate of Return (IRR)

IRR is a discount rate that makes the net present value of an investment’s cash flows equal to zero. It is a sophisticated method for evaluating the profitability of an investment, taking into account the timing and magnitude of cash inflows and outflows. IRR can be calculated using financial calculators or spreadsheet software.

Modified Dietz Method

The modified dietz method is a technique for estimating the time-weighted rate of return of an investment, adjusting for cash inflows and outflows during the investment period. This method is particularly useful when dealing with irregular cash flows. The formula for the modified dietz method is:

Modified Dietz Method = [(Ending Value + Cash Inflows) – (Beginning Value + Cash Outflows)] / (Beginning Value + Average Cash)

For example, if an investment starts at $100, receives $20 in cash inflows, pays $10 in cash outflows, and is sold for $130, the modified dietz method return would be:

($130 + $20 – ($100 + $10)) / ($100 + ($20 + $10) / 2) = 28.57%

By understanding and utilizing these advanced market return calculation techniques, investors can make more informed decisions and effectively evaluate the performance of their investments.

Applying Market Return Calculation: Real-World Applications and Best Practices

Calculating market returns is a crucial skill for investors, enabling them to track portfolio performance, make informed decisions, and compare investment options. By following best practices and utilizing advanced techniques, investors can ensure accurate, consistent results.

Portfolio Tracking

Regularly calculating market returns for individual securities and the overall portfolio can help investors monitor performance and identify areas for improvement. By tracking returns over time, investors can make adjustments to their portfolios to optimize performance and minimize risk.

Investment Research

Calculating market returns can also be valuable in investment research, helping investors identify trends, evaluate strategies, and compare investment options. By incorporating market returns into their research process, investors can make more informed decisions and improve their overall investment performance.

Decision-Making

Understanding market returns is essential for making informed investment decisions. By accurately calculating returns, investors can assess the performance of their investments, compare different options, and make decisions based on reliable data. This information can help investors allocate assets, manage risk, and achieve their financial goals.

Best Practices

To ensure accurate and consistent market return calculations, investors should follow these best practices:

- Regularly update market values and cash flows

- Consider the role of time in market returns

- Incorporate both price change and dividends in calculations

- Utilize advanced techniques, such as total return and modified dietz method

- Document and review calculations regularly

By following these best practices and incorporating market return calculation into their investment process, investors can make more informed decisions, effectively track portfolio performance, and ultimately achieve their financial goals.