Understanding Holding Period Return: A Simple Definition

Holding period return (HPR) measures the total return on an investment over a specific period. It considers both the change in the investment’s value and any income generated during that time. This crucial metric helps investors evaluate the performance of their investments. For example, imagine buying a single share of stock for $100. If you sell it later for $120, your HPR is 20%. Understanding how to calculate holding period return is vital for assessing investment success. Investors use HPR to compare the profitability of different investments, helping them make informed decisions about their portfolios. The importance of accurately calculating HPR cannot be overstated for effective investment management. This metric provides a clear picture of an investment’s overall performance.

HPR is a straightforward yet powerful tool. It provides a simple way to gauge an investment’s success. A positive HPR indicates a profit, while a negative HPR represents a loss. The calculation is easily adaptable to various investments, making it applicable across different asset classes, from stocks and bonds to real estate. Learning how to calculate holding period return empowers investors to analyze their investment performance effectively. By understanding how HPR works, investors can develop more informed investment strategies.

Calculating and interpreting HPR is essential for sound financial planning. It allows for a direct comparison of returns across different investments. This is critical when evaluating the success of different investment strategies. Understanding how to calculate holding period return is crucial for long-term investment planning. Investors benefit from mastering this fundamental concept for making smart financial decisions. Investors can readily compare investments using HPR, making it a valuable metric in portfolio management. The process of learning how to calculate holding period return is an investment in itself, leading to better decision-making and improved investment outcomes.

Gathering Essential Data for Accurate Calculation

To accurately calculate holding period return, investors need specific data points. These include the initial investment cost, representing the purchase price of the asset. For stocks, this is the price per share multiplied by the number of shares purchased. For bonds, it’s the purchase price, including any premiums or discounts. Real estate requires the total cost, encompassing the purchase price, closing costs, and any initial renovations. Knowing how to calculate holding period return accurately depends on obtaining this foundational information.

Equally crucial is accounting for any income generated during the holding period. This comprises dividends for stocks, interest payments for bonds, and rental income for real estate. Investors should meticulously record all such payments. The final piece of the puzzle is the sale price or current market value of the asset at the end of the holding period. For stocks and bonds, this is readily available through online brokerage accounts or financial news websites. Determining the current market value for real estate often involves a professional appraisal.

Gathering this information may require accessing various sources. Brokerage statements provide details on stock and bond transactions, including purchase prices and dividend payments. Bank statements track interest income. Tax records can be helpful in compiling a complete picture of income received. Real estate investors should maintain detailed records of all expenses and rental income. Understanding where to find this information is key to mastering how to calculate holding period return and ensuring accurate results. The precision of the calculation directly depends on the accuracy of this collected data. Carefully documenting all relevant financial information is essential for a reliable holding period return calculation.

How to Calculate Holding Period Return: A Step-by-Step Guide

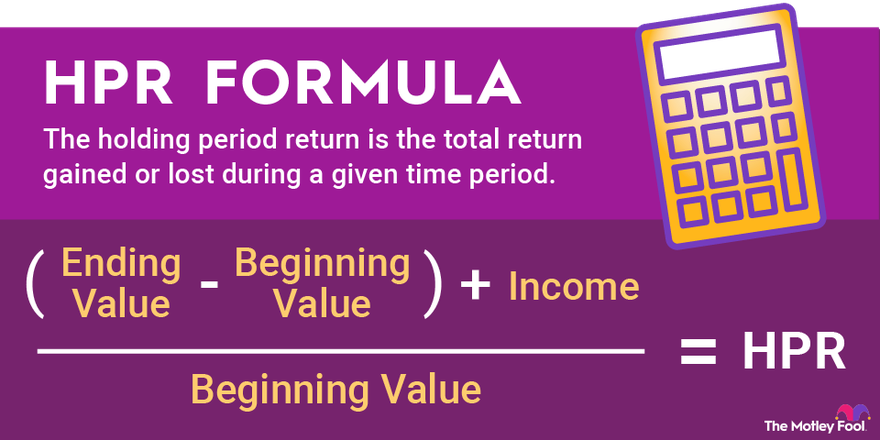

Learning how to calculate holding period return is essential for every investor. This crucial metric helps evaluate investment performance. The formula for calculating holding period return (HPR) is straightforward. It considers the initial investment cost, any income received, and the final value of the investment. The basic HPR formula is: HPR = [(Sale Price – Purchase Price) + Income Received] / Purchase Price. Let’s illustrate this with an example. Suppose you purchased 100 shares of a company’s stock at $50 per share. Your total investment is $5,000 ($50 x 100). After one year, you sold these shares for $60 each. Your sale proceeds total $6,000 ($60 x 100). Applying the formula: HPR = [($6,000 – $5,000) + $0] / $5,000 = 0.20 or 20%. This indicates a 20% return on your initial investment. This simple example demonstrates how to calculate holding period return effectively.

To make the calculation of holding period return even clearer, consider a table summarizing the process. This visual representation simplifies the steps involved in determining your HPR. The table will clearly show each component of the calculation. We can further break down how to calculate holding period return with a more detailed example. This time, we include income received during the holding period. Imagine you invested $10,000 in a bond. Over the year, you received $400 in interest payments. At the end of the year, you sold the bond for $10,800. Using the formula, which considers income received, we calculate HPR as follows: HPR = [($10,800 – $10,000) + $400] / $10,000 = 0.12 or 12%. This shows that, including the interest earned, your holding period return is 12%. The inclusion of income received demonstrates the more comprehensive nature of the HPR calculation. Remember that understanding how to calculate holding period return is vital for making informed investment decisions.

The formula for how to calculate holding period return remains the same regardless of the asset type. Whether you’re dealing with stocks, bonds, or real estate, the core principle applies. The key is to accurately determine the purchase price, sale price (or current market value), and any income received during the holding period. Understanding how to calculate holding period return allows investors to compare the performance of different assets and investment strategies effectively. Accurate calculation of HPR provides a clear picture of investment performance, facilitating informed decision-making. Mastering how to calculate holding period return empowers investors to track their progress and refine their investment approaches over time. Remember, consistently applying the HPR formula allows for better monitoring of portfolio performance and strategic adjustments as needed. This helps investors make more data-driven decisions and achieve their financial goals.

Calculating HPR with Dividends or Interest Income

Understanding how to calculate holding period return (HPR) becomes more nuanced when incorporating income received during the investment period. Dividends from stocks or interest payments from bonds directly contribute to the overall return. To accurately reflect this, the formula needs adjustment. The additional income enhances the final value available to the investor.

Let’s illustrate with an example. Suppose an investor purchased 100 shares of a stock at $50 per share, for a total investment of $5,000. During the year, the stock paid a $2 dividend per share, totaling $200. At the end of the year, the investor sold the shares for $60 each. The total proceeds from the sale are $6,000. To calculate the HPR, we add the dividend income to the sale proceeds before dividing by the initial investment. The formula becomes: HPR = [(Sale Proceeds + Dividend Income) – Initial Investment] / Initial Investment. In this case, the calculation is: HPR = [($6,000 + $200) – $5,000] / $5,000 = 0.24 or 24%. This demonstrates how including dividend income significantly increases the calculated HPR. Remember, understanding how to calculate holding period return accurately requires careful consideration of all income streams.

It’s crucial to remember that the frequency of dividend or interest payments impacts the calculation. For instance, quarterly dividends should be summed for the entire holding period. Similarly, bond interest payments received over the holding period need to be added to the final sale price. Accurate data collection is paramount when learning how to calculate holding period return. Ignoring income sources will lead to an underestimation of the actual return achieved on the investment. The process of how to calculate holding period return, while seemingly simple, requires meticulous attention to detail to ensure accuracy and a true reflection of investment performance. This comprehensive approach to calculating HPR provides a more complete and realistic view of investment success. Using this method provides a more holistic understanding of investment performance.

Interpreting Your Holding Period Return: What the Numbers Mean

A positive holding period return (HPR) signifies that the investment has generated a profit. The investment’s final value, including any income received, exceeded the initial investment cost. Conversely, a negative HPR indicates a loss; the final value is less than the initial investment. Understanding how to calculate holding period return is crucial for interpreting these results effectively. The magnitude of the HPR reflects the size of the profit or loss relative to the initial investment. A larger positive HPR suggests a more successful investment than a smaller one. Similarly, a smaller negative HPR indicates a less substantial loss compared to a larger negative HPR. Several factors influence the HPR, including market conditions, the investment’s inherent risk, and the length of the holding period. Remember, a high HPR doesn’t necessarily mean the investment was superior. Consider the risk level and the time frame involved when analyzing HPR figures. How to calculate holding period return accurately is key for making sound investment decisions.

When comparing HPRs, it’s important to consider the duration of the investment. A higher HPR over a shorter period might not always be superior to a lower HPR over a longer period. To make accurate comparisons, investors should consider the annualized return, which accounts for the time value of money. This provides a more standardized way to compare investment performance across different time horizons. Annualized return adjusts for the investment’s holding period, allowing for fairer comparisons between various investments and strategies. By understanding how to calculate holding period return and annualized returns, investors can make well-informed decisions based on a complete picture of investment performance. This knowledge is essential for evaluating the efficacy of different investments and for developing a strong investment strategy.

The interpretation of HPR is context-dependent. A seemingly high HPR might be less impressive if achieved in a bull market with low-risk investments. Conversely, a modest HPR could be excellent in a bear market or for a high-risk venture. Therefore, the importance of evaluating the investment’s risk profile alongside the HPR cannot be overstated. Always consider the overall market environment and the inherent risk associated with the asset when analyzing the results from calculating holding period return. This holistic approach will lead to more informed and accurate assessments of investment performance. The ultimate goal of understanding how to calculate holding period return is not just to determine profit or loss, but to make smarter and more strategic investment decisions over the long term. Considering factors beyond the raw HPR number enhances the usefulness of this key metric.

Comparing Investment Performance Using HPR

Holding period return (HPR) provides a straightforward method for comparing investment performance. Investors can use HPR to assess the profitability of different assets over various timeframes. For instance, consider two stocks: Stock A and Stock B. Suppose Stock A was purchased for $100 and sold for $120 after one year, while Stock B, purchased for $50, sold for $75 in the same period. Calculating the HPR for each reveals which investment performed better. Stock A’s HPR is 20% (($120-$100)/$100), while Stock B’s is 50% (($75-$50)/$50). This simple comparison illustrates how to calculate holding period return and highlights Stock B’s superior performance, despite the lower initial investment. Remember that this is a simplified comparison; factors such as risk and dividend payouts are not included in this basic HPR calculation. Knowing how to calculate holding period return is key to making informed investment choices.

The power of HPR extends beyond single asset comparisons. It facilitates the evaluation of diverse investment strategies. Imagine an investor employing two distinct approaches: a conservative strategy focused on bonds and an aggressive strategy concentrated in growth stocks. By tracking the HPR for each strategy over a set period, one can directly compare their relative successes. For example, the bond strategy might yield a modest 5% HPR, while the growth stock strategy, though riskier, might show a 15% HPR. This comparison helps investors assess the risk-reward trade-off associated with different strategies. The ability to compare different strategies, informed by how to calculate holding period return, is a valuable tool for portfolio management and optimization. This detailed analysis allows for better understanding of the risk and reward profile associated with various investment approaches.

Furthermore, HPR allows for comparisons across different time horizons. An investor might want to assess the performance of a specific stock over a short-term period (e.g., three months) versus a longer-term period (e.g., three years). Calculating the HPR for each time period directly reveals the impact of holding the asset for varying durations. This flexibility demonstrates the practicality of HPR in investment analysis. Understanding how to calculate holding period return allows for comprehensive evaluation of investments regardless of investment period. The comparative nature of HPR aids in identifying which investment approach and timeframe maximizes returns, providing a powerful tool for making sound investment decisions. This enables a thorough understanding of investment performance over time, a crucial component of long-term investment planning.

Limitations of Using Holding Period Return

While understanding how to calculate holding period return is crucial for evaluating investment performance, it’s important to acknowledge its limitations. A significant drawback is its failure to account for the time value of money. Money available today is worth more than the same amount in the future due to its potential earning capacity. HPR doesn’t adjust for this, potentially misrepresenting the true return, especially over longer periods. For instance, a high HPR achieved over ten years might appear superior to a lower HPR achieved over one year. However, the annualized return of the latter might be higher, reflecting a better investment strategy. This is because the annualized return considers the time value of money, providing a more accurate comparison. This is why understanding how to calculate holding period return is just one aspect of investment analysis.

Furthermore, HPR doesn’t inherently consider risk. Two investments might yield the same HPR, but one might have involved significantly higher risk. HPR alone doesn’t capture this crucial difference. Risk-adjusted return metrics, such as the Sharpe ratio or Sortino ratio, provide a more comprehensive picture by incorporating both return and risk. These metrics normalize returns against the level of risk undertaken, allowing investors to make more informed comparisons. Learning how to calculate holding period return is a starting point; investors should use this in conjunction with other metrics to fully understand performance and risk.

In summary, while knowing how to calculate holding period return is essential for a basic understanding of investment performance, it’s not a standalone measure. Investors should supplement HPR with other metrics to obtain a complete view that considers the time value of money and risk. Using HPR in isolation can lead to misleading conclusions about investment success. More sophisticated tools offer a more nuanced and accurate reflection of the investment’s true performance. Therefore, while understanding how to calculate holding period return is a valuable skill, it should be used in conjunction with a wider range of analytical tools.

Applying HPR to Real-World Investment Decisions

Understanding how to calculate holding period return is crucial for making informed investment decisions. Investors can use HPR to determine the profitability of past investments. This allows for a retrospective analysis of investment strategies. By comparing HPR across different assets, investors can identify superior performers. This data-driven approach helps refine future investment strategies. Knowing how to calculate holding period return empowers investors to make better choices.

The ability to calculate holding period return aids in the timing of asset sales. If an investment consistently shows a high HPR, it might signal the potential for continued growth. Conversely, a consistently low or negative HPR might suggest it’s time to divest. This information helps investors optimize their portfolio. They can then allocate capital to more profitable opportunities. Mastering how to calculate holding period return allows for more effective portfolio management.

Moreover, HPR facilitates the comparison of different investment opportunities. Before committing capital, investors can calculate the potential HPR for various options. This allows for a direct comparison of returns. The calculation helps investors choose investments that align with their risk tolerance and financial goals. Ultimately, understanding how to calculate holding period return provides a valuable tool for improving investment outcomes. It helps investors make more reasoned and profitable investment decisions.