Grasping the Concept of Average Investment Growth

Understanding average investment growth is crucial for evaluating the performance of investments over time. It provides a summary measure of how an investment has performed, enabling investors to compare different investment options and make informed decisions. The concept of average return may seem straightforward, but different types of averages exist, each with its own strengths and weaknesses. For instance, the arithmetic mean, calculated by summing the returns and dividing by the number of periods, is a common measure, but it can be misleading when dealing with investment returns. This is because investment returns often fluctuate, including both gains and losses, and the arithmetic mean does not accurately reflect the impact of these fluctuations, especially the effect of compounding. Therefore, when analyzing investment returns, it’s essential to understand how to calculate geometric average return, which provides a more accurate representation of investment performance over time. Recognizing the need for a more precise average leads us to the geometric mean, a superior method for calculating average investment growth rates.

Several methods exist for calculating averages, but the geometric mean stands out as particularly relevant in finance. The geometric mean considers the compounding effect of returns, which is essential for long-term investment analysis. It acknowledges that investment returns in one period influence the base upon which returns are calculated in subsequent periods. Therefore, to accurately assess investment performance, it’s important to know how to calculate geometric average return and its advantages over other averaging methods. While the arithmetic mean simply averages the returns, the geometric mean calculates the average rate of return that, when compounded over the investment period, results in the actual terminal value of the investment. This provides a more realistic picture of the investment’s actual growth.

In summary, understanding how to calculate geometric average return is vital for any investor seeking to evaluate investment performance accurately. By considering the compounding effect of returns, the geometric mean provides a more reliable measure of long-term investment growth than the arithmetic mean. As we delve deeper, we will explore why the arithmetic mean falls short in investment analysis and provide a step-by-step guide on how to calculate geometric average return. This knowledge will empower investors to make more informed decisions and better understand the true performance of their investments.

Why the Arithmetic Mean Falls Short in Investment Analysis

The arithmetic mean, often referred to as the simple average, is a common method for calculating the average of a set of numbers. However, when it comes to investment returns, relying solely on the arithmetic mean can be misleading. This is because it doesn’t accurately reflect the impact of compounding, a crucial element in long-term investment growth. Understanding how to calculate geometric average return is vital because it addresses this shortcoming.

Consider a simplified example: An investment increases by 50% in the first year and decreases by 50% in the second year. The arithmetic mean would suggest an average return of 0% ((50% + (-50%)) / 2 = 0%). However, if you start with $100, after the first year, you would have $150. After the second year, a 50% loss on $150 leaves you with $75. This demonstrates that, despite the arithmetic mean suggesting no loss or gain, the investment actually resulted in a 25% decrease. This discrepancy arises because the arithmetic mean doesn’t account for the fact that the loss in the second year is calculated on a different base amount than the gain in the first year. Therefore, the arithmetic mean provides an inflated view of investment performance when significant volatility exists. Knowing how to calculate geometric average return provides a more accurate depiction of how your investments are really performing.

The limitations of the arithmetic mean become even more pronounced when dealing with investments that experience substantial gains and losses over extended periods. High gains can skew the arithmetic mean upwards, creating a false impression of consistently positive returns. Conversely, significant losses can have a disproportionately negative impact. Because investment returns are multiplicative rather than additive in their effect on principal, the arithmetic mean fails to capture the true average return experienced by an investor over time. It is essential to understand how to calculate geometric average return as it provides a more reliable measure of actual investment performance, reflecting the real-world impact of compounding gains and losses. Investors seeking a clear understanding of their investment’s average growth should prioritize learning how to calculate geometric average return over relying on the simpler, but often misleading, arithmetic mean.

Calculating Geometric Mean: A Step-by-Step Approach

To understand investment performance accurately, it’s essential to know how to calculate geometric average return. The geometric mean provides a more accurate representation of average returns than the arithmetic mean, especially when dealing with fluctuating investment returns over time. Here is a step-by-step guide to computing the geometric mean for a series of investment returns.

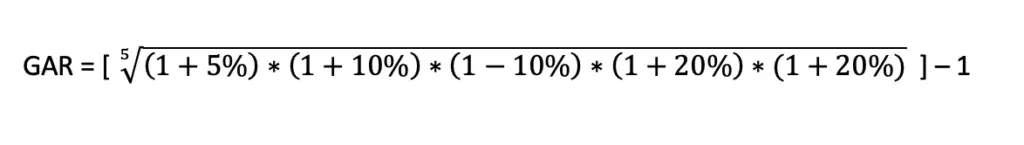

First, list all the investment returns for each period (e.g., year). Convert each percentage return into a decimal and add 1. For example, a 10% return becomes 1 + 0.10 = 1.10, and a -5% return becomes 1 + (-0.05) = 0.95. Next, multiply all these values together. Then, take the nth root of the result, where n is the number of periods. Finally, subtract 1 from the result and multiply by 100 to express the geometric mean as a percentage. The formula is: Geometric Mean = [(1 + Return1) * (1 + Return2) * … * (1 + Returnn)](1/n) – 1. This process shows how to calculate geometric average return effectively.

Let’s illustrate this with a simple example. Suppose an investment has returns of 15%, -10%, and 5% over three years. Convert these to 1.15, 0.90, and 1.05. Multiply them together: 1.15 * 0.90 * 1.05 = 1.08675. Now, take the cube root (since there are three years): 3√1.08675 = 1.028. Subtract 1: 1.028 – 1 = 0.028. Finally, multiply by 100 to get 2.8%. Therefore, the geometric mean return is 2.8%. Understanding how to calculate geometric average return helps investors assess the real growth rate of their investments, accounting for the effects of compounding. This method offers a clearer picture compared to simply averaging the returns, showing the true average annual growth rate, essential for making informed investment decisions and seeing the power of compounding truly at work.

A Practical Demonstration: Finding Geometric Average Return with Example Data

To solidify understanding of how to calculate geometric average return, let’s delve into a practical example using realistic investment data. Imagine an investment portfolio with the following annual returns over a five-year period: Year 1: 10%, Year 2: -5%, Year 3: 15%, Year 4: 8%, and Year 5: 12%. The goal is to determine the geometric average return for this investment over the five years. This calculation will provide a more accurate reflection of the investment’s growth compared to a simple arithmetic average, especially given the volatility in returns.

The first step in how to calculate geometric average return is to add 1 to each return (expressed as a decimal). This converts the percentages into growth factors: 1.10, 0.95, 1.15, 1.08, and 1.12. Next, multiply these growth factors together: 1.10 * 0.95 * 1.15 * 1.08 * 1.12 = 1.4575. This product represents the total growth of the investment over the entire period. Now, take the fifth root (since there are five years of data) of this product. This can be done using a calculator or spreadsheet software. The fifth root of 1.4575 is approximately 1.0785. Finally, subtract 1 from this result to obtain the geometric average return as a decimal: 1.0785 – 1 = 0.0785. Converting this to a percentage, the geometric average return is 7.85%. This demonstrates how to calculate geometric average return in a practical scenario.

It’s crucial to emphasize accuracy when performing these calculations. Ensure that returns are converted to decimals correctly (e.g., 10% = 0.10) and that the correct root is taken (based on the number of periods). A common mistake is using the arithmetic mean instead of the geometric mean, which, as illustrated earlier, can be misleading, especially with fluctuating returns. Remember, the geometric average return provides a more accurate representation of the actual return experienced by the investor, taking into account the effects of compounding. This detailed example underscores the importance of understanding how to calculate geometric average return for informed investment analysis. The resulting 7.85% geometric average return signifies the constant rate at which the investment would have had to grow each year to achieve the same overall growth as the actual, fluctuating returns.

The Power of Compounding: Geometric Mean and Long-Term Growth

The geometric mean is a powerful tool because it accurately reflects the impact of compounding on investment returns. Understanding how to calculate geometric average return is crucial for evaluating long-term investment performance. Compounding refers to the process where earnings from an investment are reinvested to generate additional earnings. This creates a snowball effect, significantly increasing the overall return over time. The geometric mean takes these compounding effects into account, providing a more realistic picture of investment growth than the arithmetic mean.

The arithmetic mean, which simply averages the returns, fails to capture the sequence of returns and their cumulative impact. To illustrate, consider an investment that gains 10% in the first year and loses 10% in the second year. The arithmetic mean would suggest an average return of 0%. However, the actual return is not zero. If you start with $100, a 10% gain results in $110. A 10% loss on $110 results in $99. The investment actually lost $1. How to calculate geometric average return reveals the true performance. The geometric mean, in this case, would show a negative average return, accurately reflecting the loss due to the sequence of gains and losses. This difference becomes more pronounced over longer periods and with more volatile returns.

For long-term investors, the geometric mean is an indispensable metric. It demonstrates the real-world growth of an investment portfolio, factoring in the ups and downs of the market. While simple interest calculates returns only on the principal amount, compounding, as reflected in the geometric mean, calculates returns on both the principal and accumulated interest. Therefore, learning how to calculate geometric average return gives investors a clearer understanding of their portfolio’s true growth potential. This knowledge enables more informed decisions regarding asset allocation, risk management, and long-term financial planning. It is essential to look beyond superficial averages and delve into the geometric mean to understand the true compounded growth rate of investments.

Tools for Calculation: Using Excel and Online Resources

Calculating the geometric mean can be efficiently done using spreadsheet software and online tools. This section offers guidance on how to leverage these resources to accurately determine investment performance. Understanding how to calculate geometric average return is crucial, and these tools simplify the process.

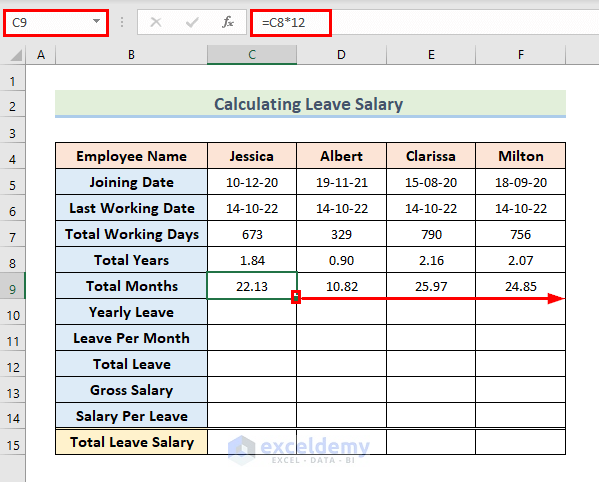

Microsoft Excel and Google Sheets are excellent options for calculating geometric mean. In Excel, the “GEOMEAN” function is specifically designed for this purpose. To use it, simply enter the investment returns for each period into separate cells. Then, in another cell, type “=GEOMEAN(number1, number2, …)”, replacing “number1, number2, …” with the cell range containing your return data (e.g., “=GEOMEAN(A1:A5)”). Google Sheets operates similarly. Ensure that the returns are entered as decimals (e.g., a 5% return should be entered as 1.05). A common mistake is entering percentages directly without converting them to decimals; this will lead to inaccurate results. Double-check your data entry to avoid errors. For those seeking a quick solution, numerous reputable online geometric mean calculators are available. These calculators typically require you to input the investment returns, and they will compute the geometric mean instantly. However, verifying the source’s credibility is always a good practice to ensure the accuracy of the calculation. Knowing how to calculate geometric average return accurately is essential for investment analysis.

When using these tools, it’s beneficial to set up your calculations clearly and logically. For example, in Excel, label each column with the year and the corresponding investment return. This makes it easier to track your data and identify potential errors. Additionally, consider using the built-in error checking features of Excel to ensure that your formulas are correct. For online calculators, compare the results from multiple sources to confirm consistency. Remember that while these tools simplify the calculation, understanding the underlying formula and its implications remains crucial for interpreting the results effectively. These tools make calculating geometric average return more accessible, empowering investors to make informed decisions. Remember to correctly input your data and utilize the tool’s functions to get the right answer on how to calculate geometric average return.

Interpreting the Results: What Does the Geometric Mean Tell You?

The geometric mean return offers a valuable perspective on investment performance. It reveals the actual compounded rate of growth achieved over a specific period. Unlike the arithmetic mean, it accurately reflects the impact of volatility. It shows how ups and downs affect the overall return. Understanding how to calculate geometric average return is crucial for investors.

Interpreting the geometric mean involves comparing it to relevant benchmarks. These benchmarks could include market indices like the S&P 500 or specific investment category averages. A geometric mean that consistently outperforms its benchmark suggests strong investment management. However, it’s important to consider the risk associated with achieving that return. Higher returns often come with higher volatility. The geometric mean provides a more realistic view of long-term growth potential. Investors can use this information to refine their strategies. Knowing how to calculate geometric average return helps in making informed decisions. It allows for a clearer comparison of different investments over time.

Furthermore, the geometric mean should be considered alongside other factors. These factors include investment goals, risk tolerance, and time horizon. An investment with a high geometric mean might not be suitable for a risk-averse investor. Similarly, it could be inappropriate for someone with a short time horizon. The geometric mean is most useful when assessing long-term investment performance. It shows the compounded growth rate, providing a more accurate picture than simple averages. Therefore, understanding how to calculate geometric average return is essential for anyone seeking to make sound investment choices. It enables a more nuanced understanding of past performance. This understanding helps investors project potential future growth with greater confidence. Always remember that past performance is not indicative of future results. However, the geometric mean provides a valuable tool for analysis.

Comparing Different Investment Options Using Geometric Average

When evaluating investment opportunities, the geometric average return provides a valuable tool for comparison. Imagine two investment options: Option A and Option B. To accurately compare these options, it is crucial to know how to calculate geometric average return for each over the same period. Suppose Option A demonstrates annual returns of 10%, 15%, -5%, and 8% over four years, while Option B shows returns of 5%, 12%, 2%, and 7%. Calculating the geometric average return for each option reveals the true compounded annual growth rate. This method offers a more realistic view of performance than simply averaging the returns arithmetically, especially when volatility is present. The geometric average return helps illustrate the impact of compounding and drawdowns on overall investment growth. Investors can use this to compare the compounded growth of different assets.

While the geometric average return is a critical metric, it shouldn’t be the sole determining factor. An investor’s risk tolerance plays a significant role in selecting an investment. Option A might have a higher geometric average return, but its negative return in one year could be unacceptable for a risk-averse investor. Diversification is another key consideration. Spreading investments across different asset classes can mitigate risk. For instance, combining Option B with other low-volatility investments might provide a more stable portfolio overall, even if the geometric average return of the total portfolio is slightly lower than that of Option A alone. Investors should also know how to calculate geometric average return for their whole portfolio.

Furthermore, investors must also consider associated expenses. Expense ratios and management fees can significantly impact net returns. An investment option with a slightly lower geometric average return but considerably lower expenses might ultimately yield better results than an option with a higher geometric average return and high costs. When choosing an investment, it is important to consider factors beyond just the average returns, such as risk tolerance, investment goals, diversification, and expense ratios. By understanding how to calculate geometric average return and considering these additional factors, investors can make more informed decisions aligned with their financial objectives and comfort level.