Why Expected Return Matters in Investment Decisions

When it comes to stock market investing, understanding expected return is crucial for making informed investment decisions. Expected return represents the anticipated profit or loss of an investment, providing a framework for investors to evaluate potential opportunities and manage risk. By grasping the concept of expected return, investors can create a well-diversified portfolio, set realistic investment goals, and ultimately, achieve long-term financial success. In essence, expected return serves as a guiding light, illuminating the path to profitable investments and helping investors navigate the complexities of the stock market. To unlock the full potential of expected return, it’s essential to know how to calculate expected return on a stock, a skill that can significantly impact portfolio performance and risk management.

Understanding the Basics of Expected Return: A Refresher

Expected return is a fundamental concept in investment analysis, representing the anticipated profit or loss of an investment. It’s essential to grasp the basics of expected return to make informed investment decisions and navigate the complexities of the stock market. There are three primary types of expected return: historical return, which is based on past performance; expected return, which is a forecast of future performance; and required return, which is the minimum return an investor demands for taking on a certain level of risk. Understanding these types of expected return is crucial for investors, as it helps them evaluate investment opportunities, manage risk, and set realistic investment goals. By knowing how to calculate expected return on a stock, investors can make more informed decisions and increase their chances of achieving long-term financial success.

How to Calculate Expected Return on a Stock: A Step-by-Step Guide

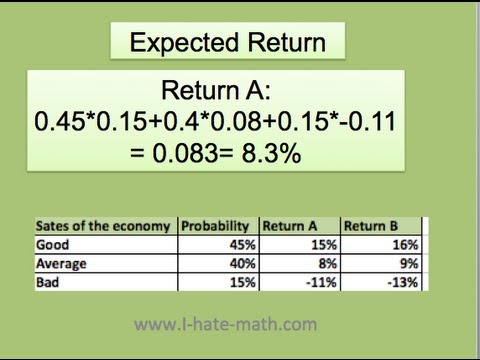

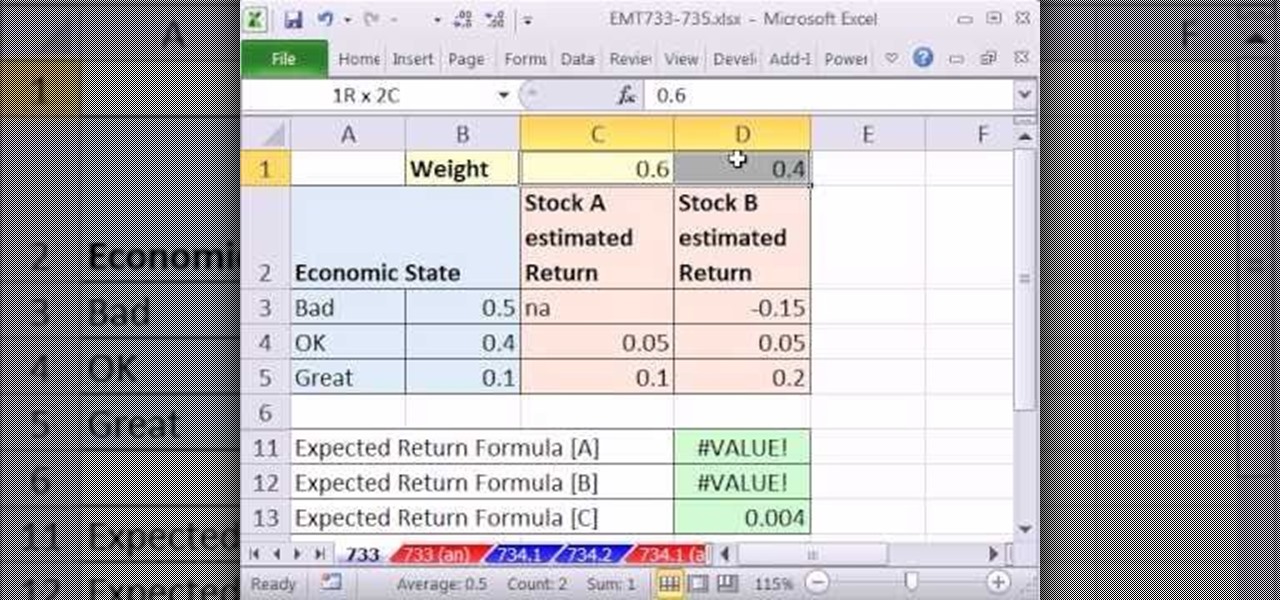

Calculating expected return on a stock is a crucial step in investment analysis, allowing investors to forecast potential profits and make informed decisions. The expected return formula is a powerful tool, providing a quantitative measure of a stock’s potential performance. To calculate expected return, investors need to understand the variables involved and how to apply them in a real-world scenario. The formula for expected return is: Expected Return = Risk-Free Rate + Beta \* (Market Return – Risk-Free Rate). In this formula, the risk-free rate represents the return on a risk-free investment, beta measures the stock’s volatility relative to the market, and market return is the expected return of the overall market. By plugging in these variables, investors can calculate the expected return on a stock and make more informed investment decisions. For example, if the risk-free rate is 2%, beta is 1.2, and the market return is 8%, the expected return would be 9.6%. By mastering how to calculate expected return on a stock, investors can gain a competitive edge in the market and increase their chances of achieving long-term financial success.

The Role of Risk-Free Rate, Beta, and Market Return in Expected Return Calculations

In the expected return formula, three critical variables play a significant role in determining the anticipated profit or loss of an investment: risk-free rate, beta, and market return. Understanding these variables is essential to accurately calculate expected return on a stock and make informed investment decisions. The risk-free rate represents the return on a risk-free investment, such as U.S. Treasury bonds, and serves as a benchmark for the minimum return an investor expects. Beta, on the other hand, measures the stock’s volatility relative to the market, with a beta of 1 indicating the stock moves in line with the market, and a beta greater than 1 indicating higher volatility. The market return represents the expected return of the overall market, which can be estimated using historical data or market indices. To estimate these variables, investors can use various methods, such as analyzing historical data, using financial models, or consulting with financial experts. By accurately estimating these variables and incorporating them into the expected return formula, investors can gain a more accurate understanding of a stock’s potential performance and make more informed investment decisions. For instance, if the risk-free rate is 2%, beta is 1.2, and the market return is 8%, the expected return would be 9.6%. By mastering how to calculate expected return on a stock, investors can better navigate the complexities of the stock market and increase their chances of achieving long-term financial success.

Common Pitfalls to Avoid When Calculating Expected Return

When calculating expected return on a stock, investors often make mistakes that can lead to inaccurate results and poor investment decisions. One common pitfall is relying solely on historical data, which may not accurately reflect future performance. Another mistake is ignoring risk, failing to consider the potential downsides of an investment. Additionally, investors may neglect to consider multiple scenarios, such as different economic conditions or market trends, which can impact expected return. Furthermore, using incorrect or outdated estimates of risk-free rate, beta, and market return can also lead to inaccurate expected return calculations. To avoid these pitfalls, investors should use a combination of historical data, financial models, and expert analysis to estimate these variables. They should also consider multiple scenarios and stress-test their calculations to ensure they are prepared for different market conditions. By being aware of these common pitfalls, investors can improve the accuracy of their expected return calculations and make more informed investment decisions. For instance, when calculating the expected return on a stock, investors should avoid using historical data alone and instead consider multiple scenarios, such as a recession or a bull market, to get a more comprehensive understanding of the stock’s potential performance. By doing so, investors can increase their chances of achieving long-term financial success.

Real-World Examples: Calculating Expected Return for Popular Stocks

To illustrate the application of the expected return formula, let’s consider a few real-world examples of calculating expected return for popular stocks. For instance, suppose we want to calculate the expected return on a stock like Apple (AAPL). Using the Capital Asset Pricing Model (CAPM) formula, we can estimate the expected return as follows: Expected Return = Risk-Free Rate + Beta \* (Market Return – Risk-Free Rate). Assuming a risk-free rate of 2%, a beta of 1.2, and a market return of 8%, the expected return on AAPL would be approximately 9.6%. Similarly, if we want to calculate the expected return on a stock like Amazon (AMZN), we can use the same formula with different estimates of risk-free rate, beta, and market return. For example, if the risk-free rate is 2.5%, beta is 1.5, and market return is 10%, the expected return on AMZN would be approximately 12.25%. These examples demonstrate how to calculate expected return on stock using the CAPM formula and highlight the importance of accurately estimating the variables involved. By applying this formula to different stocks, investors can gain a better understanding of the potential returns and risks associated with their investments. For example, when learning how to calculate expected return on a stock, investors can use these examples to compare the expected returns of different stocks and make more informed investment decisions. By doing so, investors can increase their chances of achieving long-term financial success.

Using Expected Return to Inform Investment Decisions: A Practical Approach

Now that we’ve covered the basics of expected return and how to calculate it, let’s discuss how to integrate expected return into investment decisions. Expected return is a powerful tool that can help investors evaluate stock performance, set investment goals, and create a diversified portfolio. By understanding the expected return on a stock, investors can make more informed decisions about whether to buy, hold, or sell a particular stock. For instance, if the expected return on a stock is higher than the market return, it may be a good investment opportunity. On the other hand, if the expected return is lower than the market return, it may be wise to reconsider the investment. Additionally, expected return can be used to set investment goals, such as targeting a certain level of returns over a specific time period. By using expected return to inform investment decisions, investors can increase their chances of achieving long-term financial success. Furthermore, expected return can be used to create a diversified portfolio by selecting stocks with different expected returns and risk profiles. This can help investors manage risk and increase potential returns over the long term. For example, when learning how to calculate expected return on a stock, investors can use the expected return to evaluate the performance of different stocks and create a diversified portfolio that meets their investment goals. By doing so, investors can increase their chances of achieving long-term financial success.

Maximizing Long-Term Returns: Strategies for Success

To achieve long-term financial success in the stock market, it’s essential to adopt a disciplined investment approach that incorporates expected return calculations. By understanding how to calculate expected return on a stock, investors can make informed decisions that maximize returns over the long term. Here are some actionable tips and strategies to help investors achieve their investment goals: Diversification is key to managing risk and increasing potential returns. By diversifying a portfolio across different asset classes, sectors, and geographic regions, investors can reduce their exposure to market volatility and increase their chances of achieving long-term success. Regular portfolio rebalancing is also crucial to maintaining an optimal asset allocation and maximizing returns. By periodically reviewing and adjusting their portfolio, investors can ensure that their investments remain aligned with their goals and risk tolerance. A disciplined investment approach is also essential to achieving long-term success. This involves setting clear investment goals, developing a long-term investment strategy, and avoiding emotional decisions based on short-term market fluctuations. By adopting a disciplined approach, investors can avoid common pitfalls such as buying high and selling low, and instead focus on making informed decisions that drive long-term growth. Additionally, investors should consider using dollar-cost averaging to reduce the impact of market volatility on their investments. This involves investing a fixed amount of money at regular intervals, regardless of the market’s performance, to reduce the overall cost of investing. By incorporating these strategies into their investment approach, investors can increase their chances of achieving long-term financial success and maximizing their returns in the stock market.

/dotdash_INV_final_Calculating_CAPM_in_Excel_Know_the_Formula_Jan_2021-01-547b1f61b3ae45d7a4908a551c7e7bbd.jpg)