Unlocking the Power of Effective Interest Rate Calculations

In the realm of finance, effective interest rates play a vital role in decision-making. Whether you’re evaluating investment opportunities, assessing loan options, or creating financial models, understanding how to calculate effective interest rates in Excel is essential. By leveraging Excel’s capabilities, you can accurately calculate effective interest rates, gain valuable insights, and make informed decisions. In this article, we’ll delve into the world of effective interest rates, exploring their significance, calculation methods, and practical applications in Excel.

What is Effective Interest Rate and Why Does it Matter?

In finance, interest rates are a crucial component of investment and borrowing decisions. However, there are two types of interest rates: nominal and effective. The nominal interest rate is the rate charged on a loan or investment, while the effective interest rate takes into account the compounding frequency, revealing the true cost of borrowing or return on investment. Understanding the difference between these two rates is vital, as it can significantly impact financial decisions. Effective interest rates provide a more accurate representation of the actual interest paid or earned, enabling individuals and organizations to make informed decisions. In the context of Excel, knowing how to calculate effective interest rate in Excel is essential for precise financial analysis and modeling.

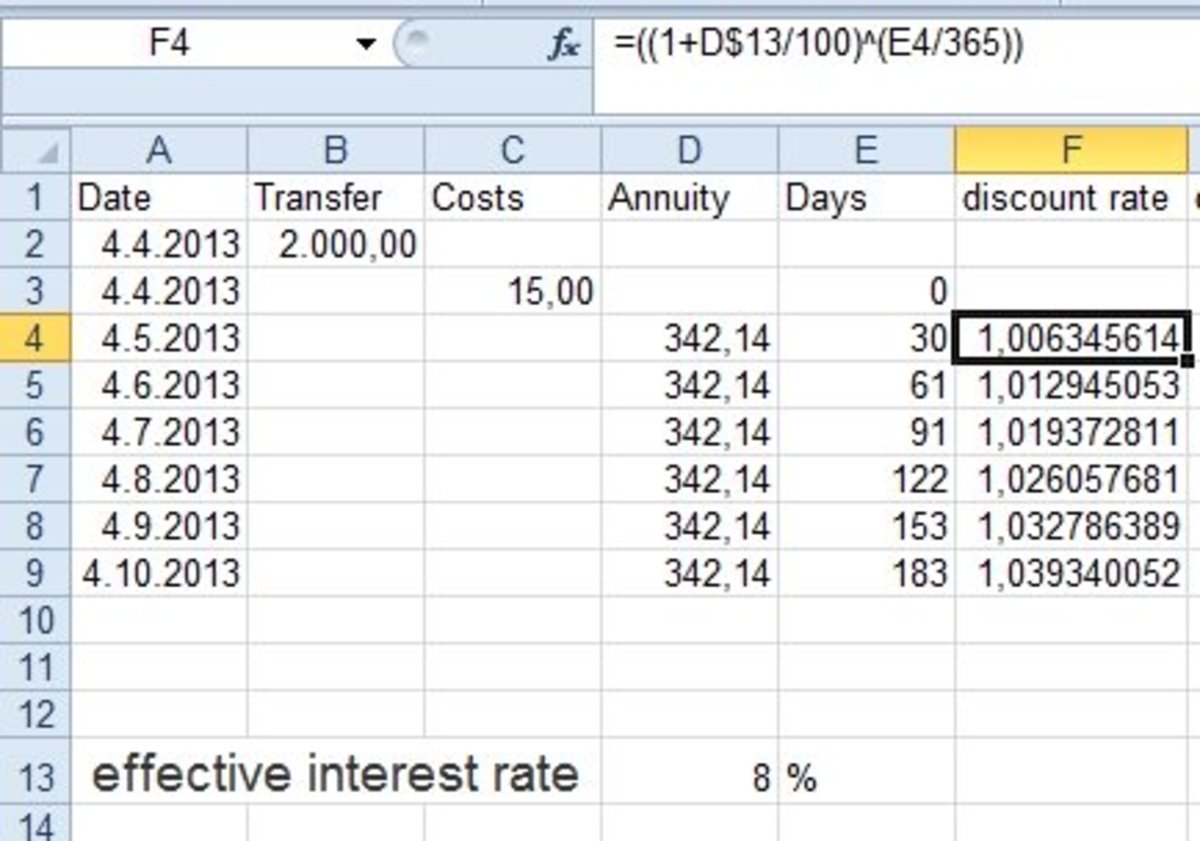

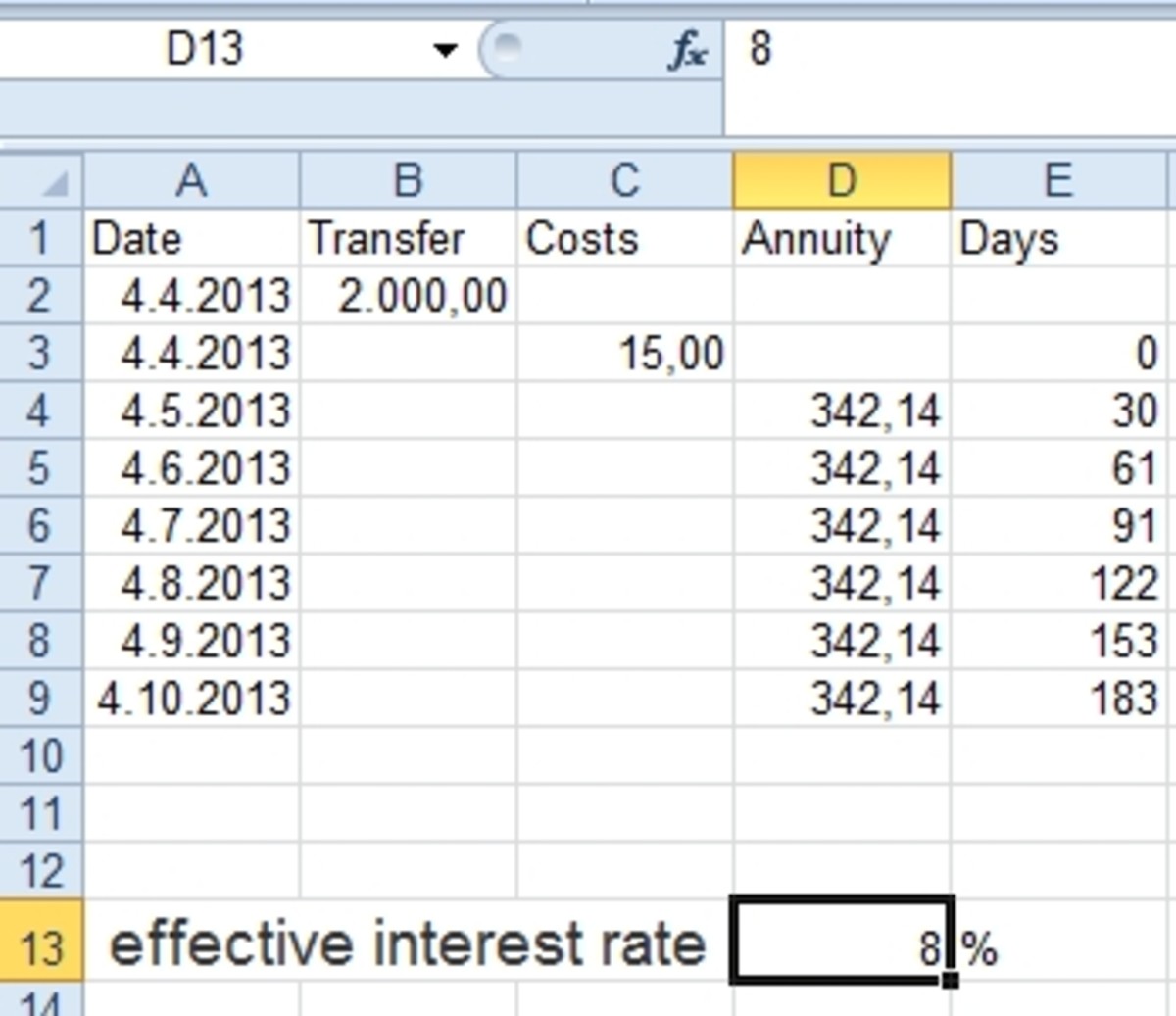

How to Calculate Effective Interest Rate in Excel: A Simple Formula

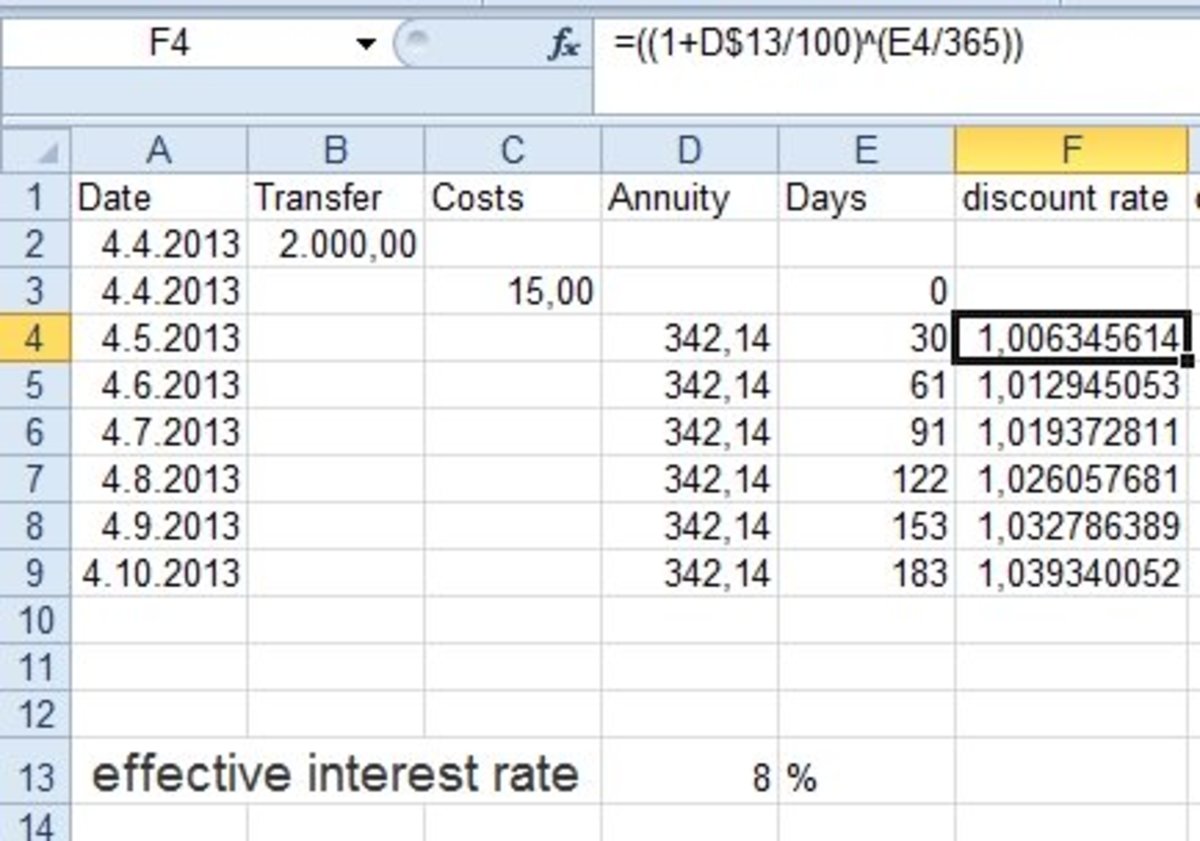

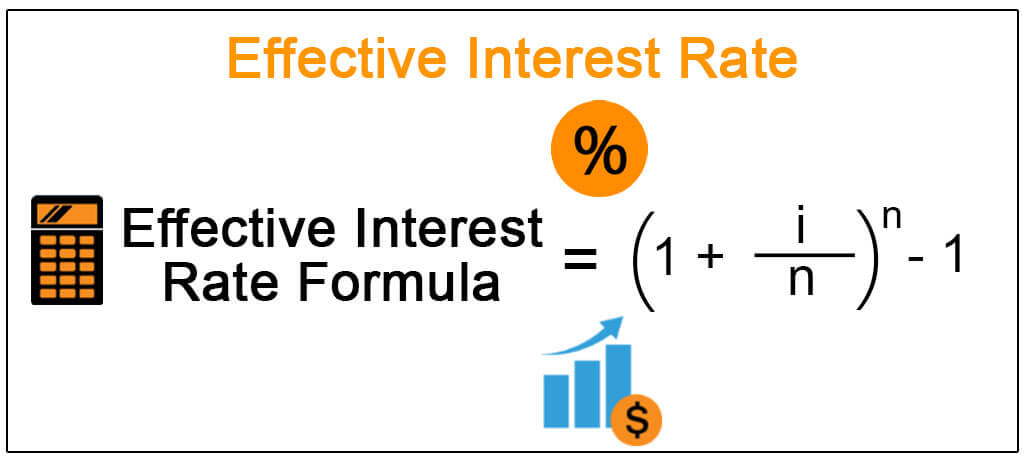

Calculating effective interest rate in Excel is a straightforward process that requires a basic understanding of the formula and its components. The effective interest rate formula in Excel is as follows: = (1 + (nominal_interest_rate/n))^n - 1, where nominal_interest_rate is the stated interest rate, n is the number of compounding periods per year, and ^ denotes exponentiation. To apply this formula in Excel, follow these steps:

Step 1: Enter the nominal interest rate and compounding frequency in separate cells.

Step 2: Enter the formula in a new cell, replacing the variables with the corresponding cell references.

Step 3: Press Enter to calculate the effective interest rate.

For example, if the nominal interest rate is 8% compounded quarterly, the formula would be: = (1 + (0.08/4))^4 - 1. This would result in an effective interest rate of 8.24%.

By mastering this simple formula, you can accurately calculate effective interest rates in Excel, enabling you to make informed financial decisions and create robust financial models. Remember to adjust the compounding frequency and nominal interest rate according to your specific needs, and you’ll be well on your way to unlocking the power of effective interest rate calculations in Excel.

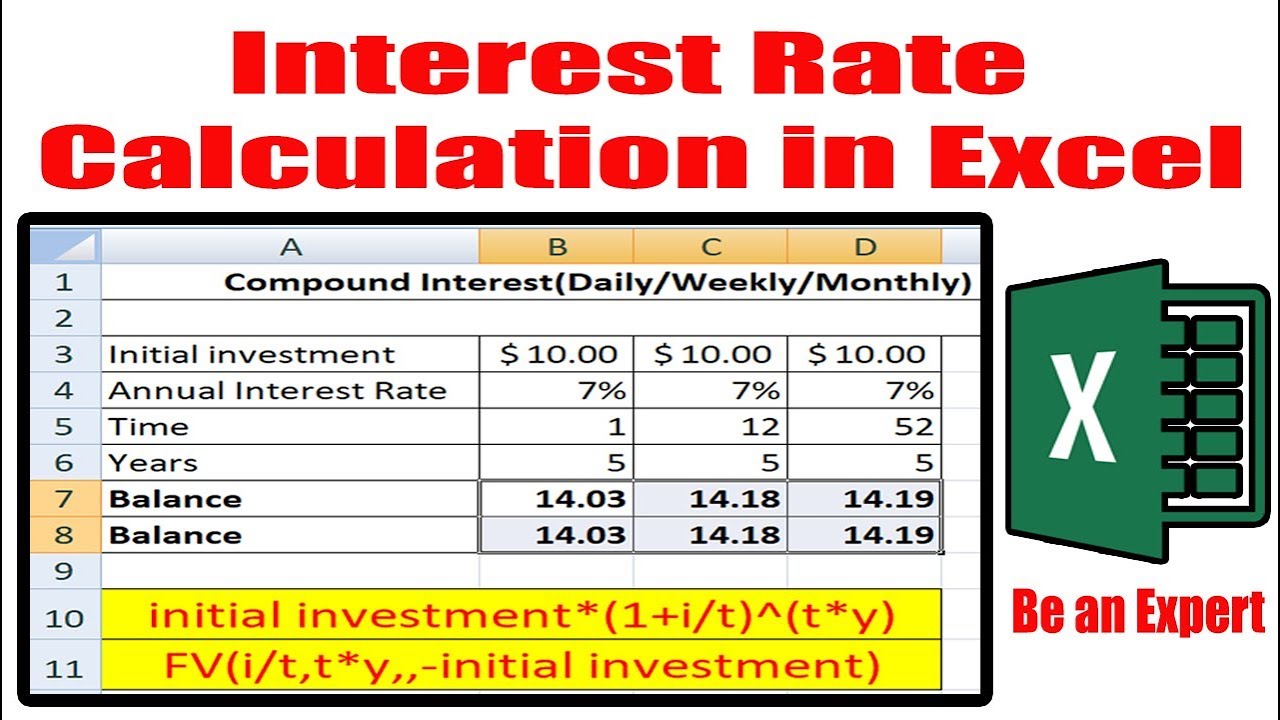

Understanding the Role of Compounding in Effective Interest Rate Calculations

Compounding plays a crucial role in effective interest rate calculations, as it significantly impacts the actual interest paid or earned over time. In essence, compounding refers to the process of earning interest on both the principal amount and any accrued interest. This can lead to a substantial difference between the nominal interest rate and the effective interest rate.

In Excel, it’s essential to account for compounding when calculating effective interest rates. The frequency of compounding can vary, with common examples including annual, semi-annual, quarterly, and monthly compounding. To accurately calculate the effective interest rate, you must specify the compounding frequency in the formula.

For instance, if a loan has a nominal interest rate of 10% compounded quarterly, the effective interest rate would be higher than if it were compounded annually. This is because the interest is compounded more frequently, resulting in a greater amount of interest earned over the same period.

To illustrate the impact of compounding, consider the following example: a 10-year investment with a nominal interest rate of 8% compounded annually versus quarterly. Using the effective interest rate formula in Excel, we can calculate the effective interest rate for each scenario. The results show that the effective interest rate for the quarterly compounding scenario is 8.24%, compared to 8.00% for the annual compounding scenario.

By understanding the role of compounding in effective interest rate calculations, you can make more informed financial decisions and create more accurate financial models in Excel. Remember to always specify the compounding frequency when calculating effective interest rates to ensure accurate results.

Real-World Applications of Effective Interest Rate Calculations in Excel

Effective interest rate calculations are crucial in various real-world financial scenarios, where accurate calculations can make a significant difference in investment decisions, loan evaluations, and financial modeling. In this section, we’ll explore some practical applications of effective interest rate calculations in Excel.

Investment Analysis: When evaluating investment opportunities, understanding the effective interest rate is vital. By calculating the effective interest rate, investors can compare different investment options and make informed decisions. For instance, if an investor is considering two investment options with different compounding frequencies, the effective interest rate calculation can help determine which option yields a higher return.

Loan Evaluations: Effective interest rate calculations are essential when evaluating loan options. By calculating the effective interest rate, borrowers can determine the true cost of borrowing and make informed decisions. For example, a borrower may be considering two loan options with different nominal interest rates and compounding frequencies. The effective interest rate calculation can help determine which loan option is more cost-effective.

Financial Modeling: Effective interest rate calculations are a critical component of financial modeling. By incorporating effective interest rates into financial models, analysts can create more accurate forecasts and predictions. This is particularly important in scenarios where compounding frequencies vary, such as in mortgage calculations or investment portfolios.

In addition to these scenarios, effective interest rate calculations are also applicable in other areas, such as credit card interest rates, savings accounts, and annuities. By mastering how to calculate effective interest rate in Excel, financial professionals can make more informed decisions, create more accurate financial models, and ultimately drive business growth.

Tips and Tricks for Accurate Effective Interest Rate Calculations in Excel

When it comes to calculating effective interest rates in Excel, accuracy is crucial. A small mistake can lead to significant errors in financial analysis and decision-making. In this section, we’ll provide expert advice on how to avoid common errors, use Excel functions efficiently, and troubleshoot issues in effective interest rate calculations.

Avoiding Common Errors: One of the most common errors in effective interest rate calculations is incorrect input values. Ensure that the nominal interest rate, compounding frequency, and time period are accurate and consistent. Additionally, be mindful of the units used for the time period, as this can affect the calculation.

Using Excel Functions Efficiently: Excel provides a range of functions that can be used to calculate effective interest rates, including the EFFECT function and the POWER function. To use these functions efficiently, ensure that you understand the syntax and input requirements. For example, the EFFECT function requires the nominal interest rate and compounding frequency as inputs.

Troubleshooting Issues: When troubleshooting issues in effective interest rate calculations, it’s essential to check the input values and formula syntax. Ensure that the formula is correctly referencing the input cells and that the units are consistent. If you’re still experiencing issues, try breaking down the calculation into smaller components to identify the source of the error.

Best Practices for Effective Interest Rate Calculations: To ensure accurate and efficient effective interest rate calculations in Excel, follow these best practices:

- Use a consistent unit for the time period throughout the calculation.

- Verify the input values and formula syntax to avoid errors.

- Use Excel functions efficiently to simplify the calculation.

- Break down complex calculations into smaller components to troubleshoot issues.

By following these tips and tricks, you can ensure accurate and efficient effective interest rate calculations in Excel. Remember, mastering how to calculate effective interest rate in Excel is crucial for making informed financial decisions and driving business growth.

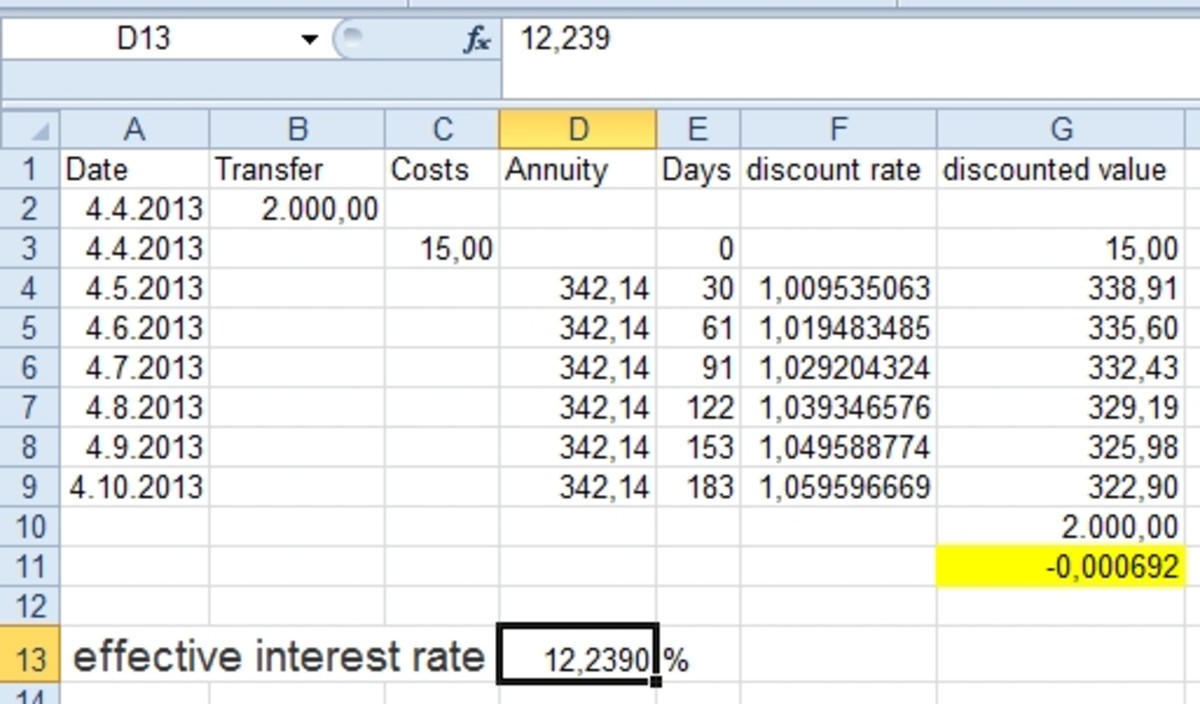

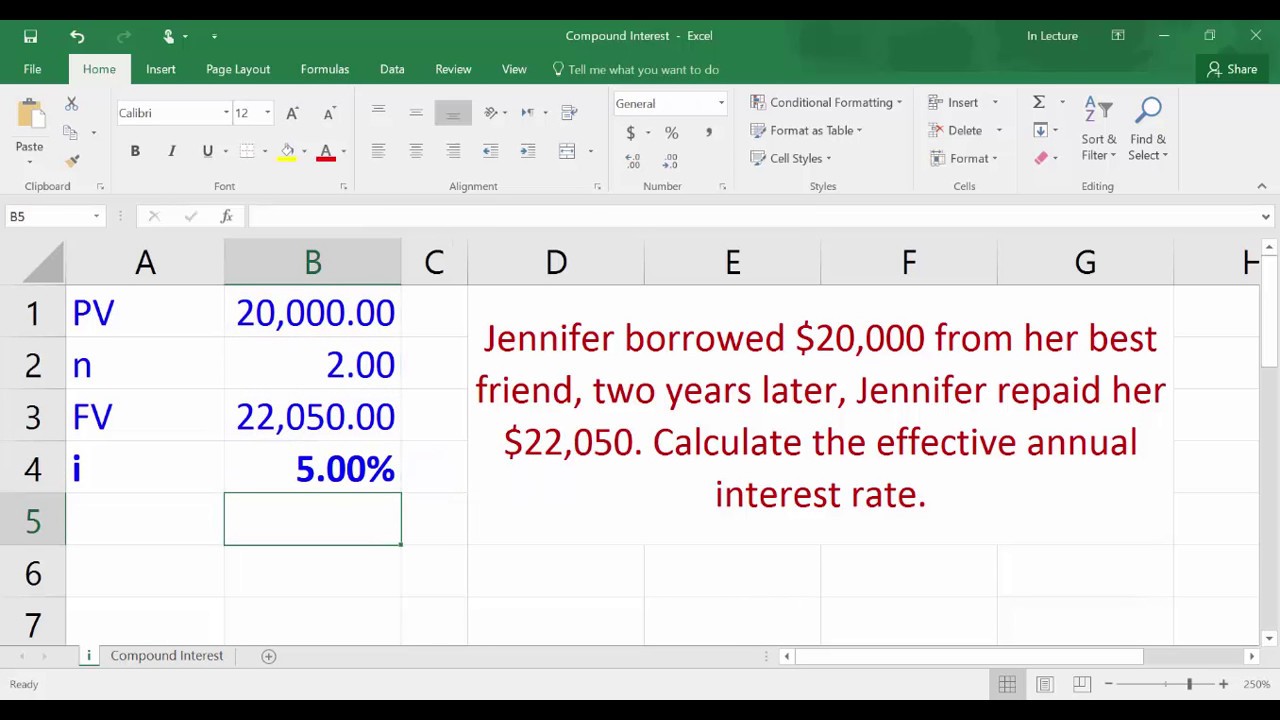

Effective Interest Rate Calculation Examples in Excel: A Walkthrough

In this section, we’ll provide detailed examples of effective interest rate calculations in Excel, including scenarios with different compounding frequencies and interest rates. These examples will help illustrate how to apply the effective interest rate formula in real-world financial analysis.

Example 1: Annual Compounding

Suppose an investment offers a nominal interest rate of 8% per annum, compounded annually. To calculate the effective interest rate, we can use the formula:

EFFECTIVE INTEREST RATE = (1 + (NOMINAL INTEREST RATE/n))^n – 1

Where n is the number of times the interest is compounded per year. In this case, n = 1.

Using Excel, we can set up the calculation as follows:

= (1 + (0.08/1))^1 – 1

The result is an effective interest rate of 8.00%.

Example 2: Quarterly Compounding

Suppose a loan has a nominal interest rate of 12% per annum, compounded quarterly. To calculate the effective interest rate, we can use the same formula:

EFFECTIVE INTEREST RATE = (1 + (NOMINAL INTEREST RATE/n))^n – 1

Where n is the number of times the interest is compounded per year. In this case, n = 4.

Using Excel, we can set up the calculation as follows:

= (1 + (0.12/4))^4 – 1

The result is an effective interest rate of 12.55%.

Example 3: Monthly Compounding

Suppose a savings account offers a nominal interest rate of 6% per annum, compounded monthly. To calculate the effective interest rate, we can use the same formula:

EFFECTIVE INTEREST RATE = (1 + (NOMINAL INTEREST RATE/n))^n – 1

Where n is the number of times the interest is compounded per year. In this case, n = 12.

Using Excel, we can set up the calculation as follows:

= (1 + (0.06/12))^12 – 1

The result is an effective interest rate of 6.17%.

These examples demonstrate how to calculate effective interest rates in Excel using different compounding frequencies and interest rates. By mastering how to calculate effective interest rate in Excel, you can make more informed financial decisions and drive business growth.

Conclusion: Taking Your Financial Analysis to the Next Level with Effective Interest Rate Calculations in Excel

Mastering how to calculate effective interest rate in Excel is a crucial skill for anyone involved in financial analysis and decision-making. By understanding the concept of effective interest rate and how to calculate it accurately, you can make more informed investment decisions, evaluate loan options more effectively, and create more accurate financial models.

In this article, we’ve provided a comprehensive guide on how to calculate effective interest rate in Excel, including the formula, examples, and tips for accurate calculations. We’ve also explored the importance of compounding in effective interest rate calculations and discussed real-world applications of effective interest rate calculations in Excel.

By applying the skills and knowledge gained from this article, you can take your financial analysis to the next level and drive business growth. Whether you’re a financial analyst, investor, or business owner, mastering effective interest rate calculations in Excel can give you a competitive edge in the market.

Remember, accurate effective interest rate calculations are critical in financial decision-making. By following the steps and tips outlined in this article, you can ensure that your calculations are accurate and reliable, and make more informed financial decisions as a result.

With the power of effective interest rate calculations in Excel, you can unlock new insights and opportunities in financial analysis. So, start calculating and take your financial analysis to the next level today!