Unlocking the Power of Compound Interest

In the realm of finance, effective interest rate plays a vital role in calculating the true cost of borrowing or the true return on investment. It is essential to understand the concept of effective interest rate, as it helps individuals and businesses make informed financial decisions. When it comes to calculating effective interest rate, Excel is a powerful tool that can simplify the process. By learning how to calculate effective interest rate in Excel, individuals can gain a deeper understanding of compound interest and its impact on financial calculations. In this article, we will explore the world of effective interest rate calculations in Excel, providing a comprehensive guide on how to calculate effective interest rate Excel.

Understanding the Formula: Breaking Down the Effective Interest Rate Calculation

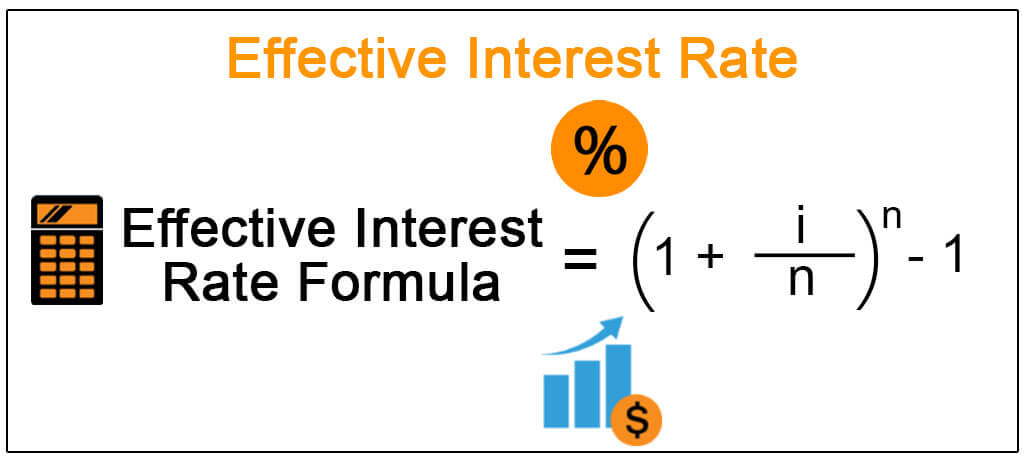

The effective interest rate formula is a crucial component in calculating the true cost of borrowing or the true return on investment. The formula is as follows: Effective Interest Rate = (1 + (Nominal Interest Rate/n))^n – 1, where n represents the number of times interest is compounded per year. To apply this formula in Excel, it’s essential to understand the variables involved, including the nominal interest rate and the compounding frequency. By grasping the effective interest rate formula and its application in Excel, individuals can accurately calculate the true cost of borrowing or the true return on investment, ultimately making informed financial decisions. In the next section, we will provide a step-by-step example of how to calculate effective interest rate in Excel, using a real-world scenario to illustrate the process.

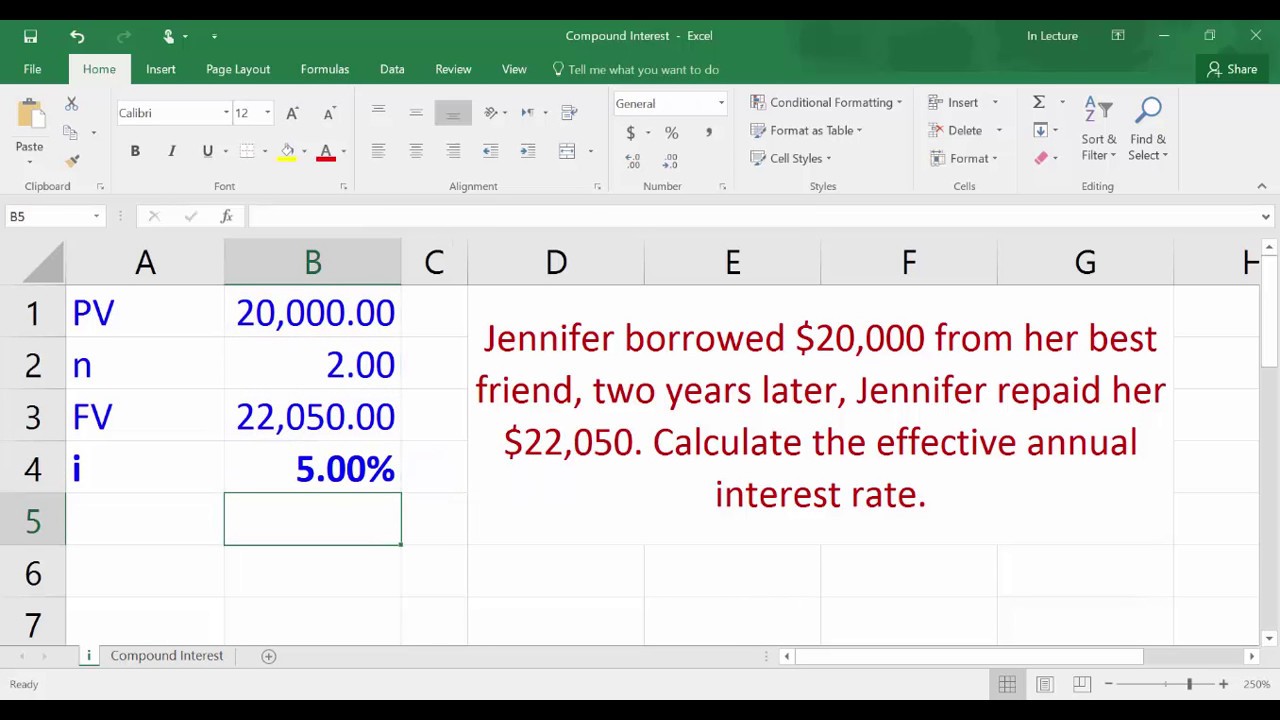

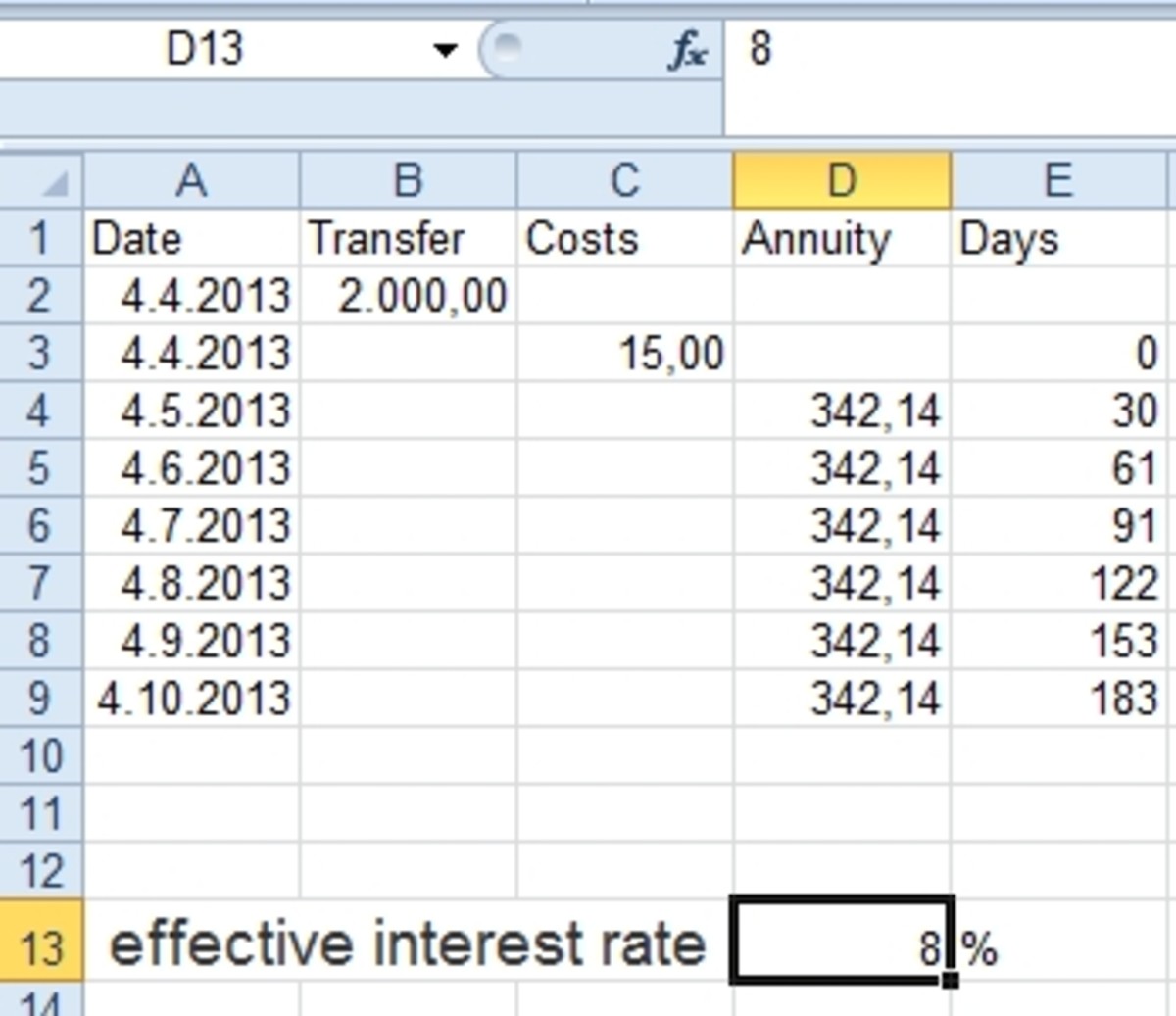

How to Calculate Effective Interest Rate in Excel: A Practical Example

Let’s consider a real-world scenario to illustrate how to calculate effective interest rate in Excel. Suppose an individual invests $1,000 in a savings account that offers a nominal interest rate of 8% per annum, compounded quarterly. To calculate the effective interest rate, we can use the formula: Effective Interest Rate = (1 + (Nominal Interest Rate/n))^n – 1, where n represents the number of times interest is compounded per year. In this case, n = 4, since the interest is compounded quarterly.

In Excel, we can set up the calculation as follows:

Cell A1: Nominal Interest Rate = 8%

Cell A2: Compounding Frequency = 4

Cell A3: Effective Interest Rate = =(1 + (A1/A2))^(A2) – 1

By entering the formula in Cell A3, we get an effective interest rate of 8.24%. This means that the true return on investment is 8.24%, which is higher than the nominal interest rate of 8%. By understanding how to calculate effective interest rate in Excel, individuals can make informed financial decisions and optimize their investments.

Tips and Tricks: Overcoming Common Challenges in Effective Interest Rate Calculations

When calculating effective interest rate in Excel, individuals may encounter common challenges that can lead to inaccurate results. To overcome these challenges, it’s essential to understand the potential pitfalls and best practices to avoid them. Here are some tips and tricks to help you master effective interest rate calculations in Excel:

1. **Accurate input values**: Ensure that the nominal interest rate and compounding frequency are accurate and consistent. A small error in these values can lead to significant differences in the effective interest rate.

2. **Compounding frequency**: Be mindful of the compounding frequency, as it can significantly impact the effective interest rate. For example, a nominal interest rate of 8% compounded quarterly will result in a higher effective interest rate than the same rate compounded annually.

3. **Rounding errors**: Avoid rounding errors by using precise calculations and formatting in Excel. Rounding errors can lead to inaccurate results, especially when working with large datasets.

4. **Formula errors**: Double-check the formula for calculating effective interest rate to ensure it is correct and accurate. A small mistake in the formula can lead to incorrect results.

5. **Using Excel functions**: Utilize Excel functions, such as the EFFECT function, to simplify effective interest rate calculations and reduce the risk of errors.

By following these tips and tricks, individuals can overcome common challenges in effective interest rate calculations and ensure accurate results in Excel. Remember, accurate effective interest rate calculations are crucial in making informed financial decisions, and Excel can be a powerful tool in simplifying the process. For more information on how to calculate effective interest rate in Excel, refer to our previous sections.

Real-World Applications: How Effective Interest Rate Impacts Financial Decision-Making

The effective interest rate has significant implications for financial decision-making, influencing the outcome of various financial transactions. Understanding how to calculate effective interest rate in Excel is crucial in making informed decisions in areas such as investments, loans, and credit cards.

In investments, a higher effective interest rate can result in greater returns over time. For instance, a savings account with a nominal interest rate of 5% compounded quarterly may have an effective interest rate of 5.09%. This means that the investment will earn a higher return than expected, making it a more attractive option.

In loans, the effective interest rate can significantly impact the total cost of borrowing. A loan with a nominal interest rate of 10% compounded monthly may have an effective interest rate of 10.47%. This means that the borrower will pay more in interest over the life of the loan, making it essential to consider the effective interest rate when evaluating loan options.

Credit cards are another area where the effective interest rate plays a critical role. A credit card with a nominal interest rate of 18% compounded daily may have an effective interest rate of 19.56%. This means that the cardholder will pay more in interest over time, making it essential to pay off the balance quickly or consider alternative credit options.

In conclusion, understanding how to calculate effective interest rate in Excel is vital in making informed financial decisions. By considering the effective interest rate, individuals can optimize their investments, minimize borrowing costs, and make smart credit decisions. In the next section, we will explore the distinction between nominal and effective interest rates, highlighting the importance of understanding both concepts in financial calculations.

Comparing Nominal and Effective Interest Rates: What’s the Difference?

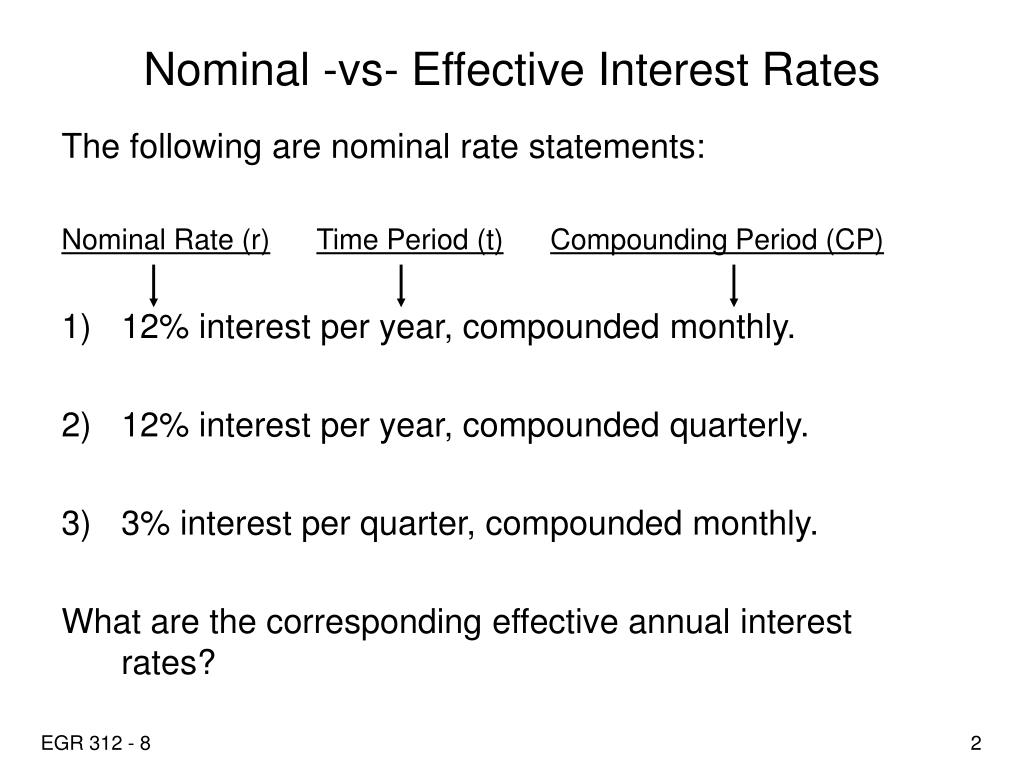

In financial calculations, it’s essential to understand the distinction between nominal and effective interest rates. While both rates are used to express the interest earned or paid on an investment or loan, they convey different information and are calculated differently.

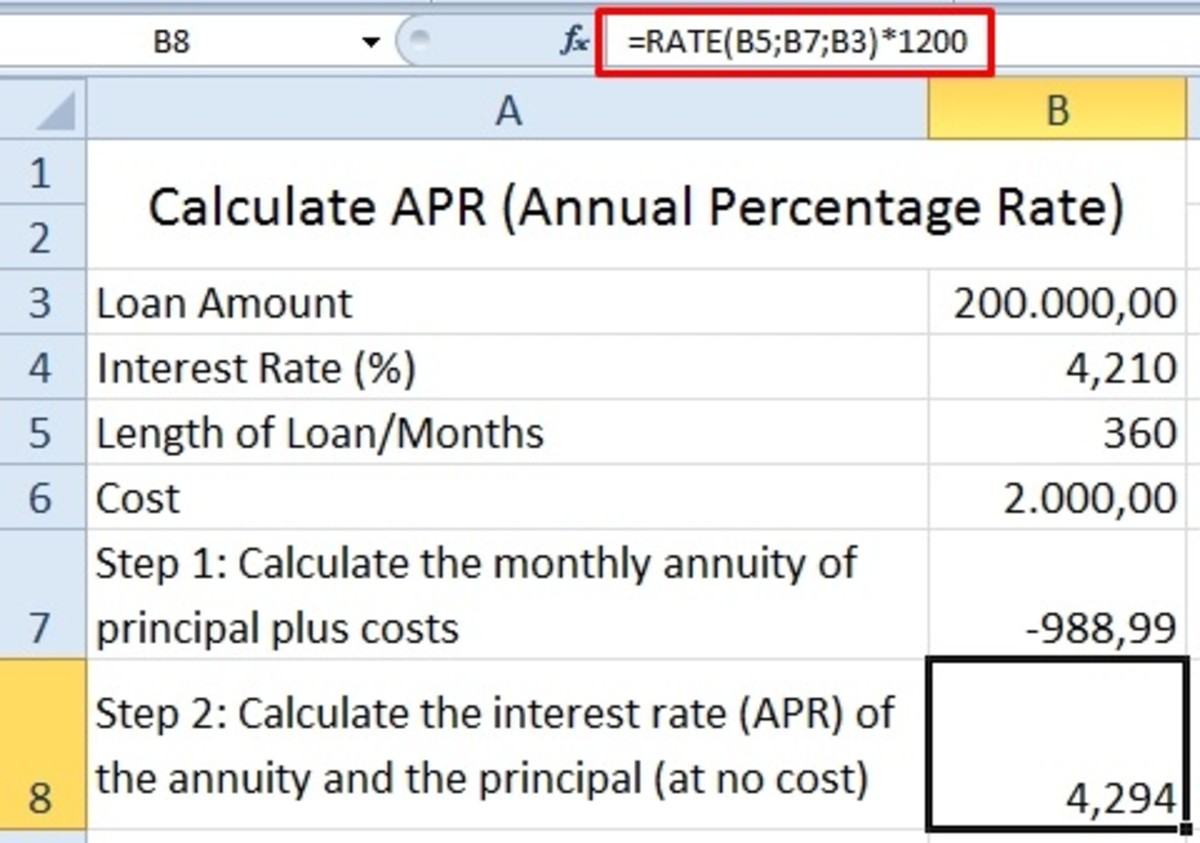

The nominal interest rate, also known as the annual percentage rate (APR), is the rate of interest charged on a loan or investment over a specific period, usually a year. It does not take into account the compounding frequency, which can significantly impact the actual interest earned or paid.

In contrast, the effective interest rate is the rate of interest that takes into account the compounding frequency, providing a more accurate representation of the interest earned or paid over time. The effective interest rate is always higher than the nominal interest rate, except when the compounding frequency is annual.

To illustrate the difference, consider a savings account with a nominal interest rate of 5% compounded quarterly. The effective interest rate would be approximately 5.09%, indicating that the account will earn a higher return than expected due to the compounding frequency.

Understanding the distinction between nominal and effective interest rates is crucial in making informed financial decisions. By recognizing the impact of compounding frequency on interest rates, individuals can optimize their investments, minimize borrowing costs, and make smart financial decisions. In the next section, we will explore how to simplify effective interest rate calculations using Excel functions, such as the EFFECT function.

Using Excel Functions: Simplifying Effective Interest Rate Calculations

Excel provides a range of functions that can simplify effective interest rate calculations, saving time and reducing errors. One such function is the EFFECT function, which calculates the effective interest rate based on the nominal interest rate and compounding frequency.

The syntax for the EFFECT function is EFFECT(nominal_rate, npery), where nominal_rate is the nominal interest rate and npery is the number of times the interest is compounded per year. For example, if the nominal interest rate is 6% compounded quarterly, the EFFECT function would be =EFFECT(0.06, 4), returning an effective interest rate of 6.14%.

Another useful function is the XNPV function, which calculates the present value of a series of cash flows. By using the XNPV function in conjunction with the EFFECT function, users can calculate the effective interest rate for more complex financial scenarios.

In addition to these functions, Excel’s built-in formulas can also be used to calculate effective interest rate. For instance, the formula = (1 + (nominal_rate/npery))^(npery) – 1 can be used to calculate the effective interest rate, where nominal_rate is the nominal interest rate and npery is the number of times the interest is compounded per year.

By leveraging these Excel functions and formulas, users can streamline their effective interest rate calculations, reducing errors and increasing efficiency. In the next section, we will summarize the key takeaways from this article, highlighting the importance of accurate effective interest rate calculations in financial decision-making and the role of Excel in simplifying the process.

Conclusion: Mastering Effective Interest Rate Calculations in Excel

In conclusion, mastering effective interest rate calculations in Excel is crucial for making informed financial decisions. By understanding the concept of effective interest rate, its significance in financial calculations, and how to calculate it using Excel formulas and functions, individuals can optimize their investments, minimize borrowing costs, and make smart financial decisions.

Throughout this article, we have covered the importance of compound interest, the formula for calculating effective interest rate, and a practical example of how to calculate it in Excel. We have also explored the distinction between nominal and effective interest rates, and introduced Excel functions that can simplify effective interest rate calculations.

By applying the knowledge and skills outlined in this article, individuals can accurately calculate effective interest rates and make data-driven decisions. Remember, effective interest rate is a critical component of financial calculations, and understanding how to calculate it in Excel is essential for achieving financial success. With practice and patience, anyone can master effective interest rate calculations in Excel and take their financial analysis to the next level.