What is a Discount Rate and Why is it Important?

In the world of finance, a discount rate is a crucial concept that plays a vital role in investment decisions. It is a rate used to calculate the present value of future cash flows, enabling investors to determine the feasibility of a project or investment opportunity. The discount rate represents the rate of return an investor expects to earn from an investment, and it is a key component in capital budgeting and investment analysis. To make informed investment decisions, it is essential to understand how to calculate discount rate and its significance in finance. The purpose of calculating a discount rate is to evaluate the profitability of a project or investment, taking into account the time value of money and the risk associated with the investment. The discount rate has numerous applications in various industries, including real estate, corporate finance, and investment banking.

Understanding the Time Value of Money

The concept of time value of money is fundamental to understanding how to calculate discount rate. It is based on the idea that a dollar received today is worth more than a dollar received in the future, due to the potential to earn interest or returns on investment. This concept is crucial in finance, as it allows investors to compare the value of cash flows received at different points in time. The time value of money is comprised of two key components: present value and future value. Present value represents the current value of a future cash flow, while future value represents the value of a current cash flow at a future date. Interest rates play a vital role in determining the time value of money, as they reflect the rate at which money can be borrowed or lent. In the context of discount rate calculation, understanding the time value of money is essential, as it enables investors to determine the present value of future cash flows and make informed investment decisions.

The Formula for Calculating Discount Rate

The formula for calculating discount rate is a crucial component in finance, as it enables investors to determine the present value of future cash flows. The formula is as follows: Discount Rate = (Cost of Capital x Risk-Free Rate) + (Market Rate x Beta). This formula takes into account several key variables, including the cost of capital, risk-free rate, market rate, and beta. The cost of capital represents the minimum return required by investors, while the risk-free rate reflects the rate of return on a risk-free investment. The market rate represents the average return on investment in the market, and beta measures the systematic risk of an investment. Understanding each variable’s significance is essential when learning how to calculate discount rate, as it enables investors to accurately determine the present value of future cash flows and make informed investment decisions.

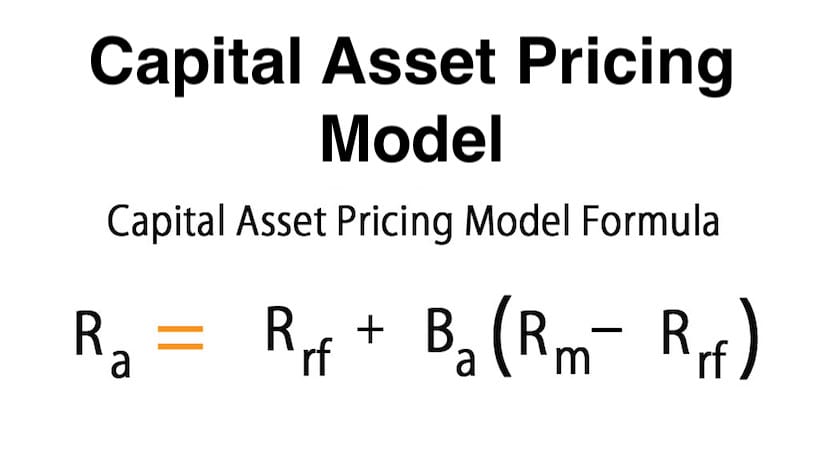

How to Calculate Discount Rate Using the Capital Asset Pricing Model (CAPM)

The Capital Asset Pricing Model (CAPM) is a widely used method for calculating discount rate. The CAPM formula is: Discount Rate = Risk-Free Rate + Beta x (Market Rate – Risk-Free Rate). To calculate discount rate using CAPM, follow these steps: 1) Determine the risk-free rate, which is typically the yield on a long-term government bond. 2) Calculate the market rate, which is the average return on investment in the market. 3) Estimate the beta of the investment, which measures its systematic risk. 4) Plug in the values into the CAPM formula to calculate the discount rate. For example, if the risk-free rate is 2%, the market rate is 8%, and the beta is 1.2, the discount rate would be 2% + 1.2 x (8% – 2%) = 9.6%. Understanding how to calculate discount rate using CAPM is essential for investors, as it enables them to accurately determine the present value of future cash flows and make informed investment decisions.

Alternative Methods for Calculating Discount Rate

In addition to the Capital Asset Pricing Model (CAPM), there are alternative methods for calculating discount rate. Two such methods are the Weighted Average Cost of Capital (WACC) method and the Arbitrage Pricing Theory (APT) method. The WACC method calculates the discount rate as a weighted average of the cost of debt and equity, taking into account the company’s capital structure. This method is useful for companies with complex capital structures. The APT method, on the other hand, calculates the discount rate based on multiple factors, including macroeconomic variables and industry-specific factors. This method is useful for companies operating in multiple industries or with diverse business segments. While these methods differ from the CAPM method, they all share the same goal of determining the appropriate discount rate for investment decisions. Understanding how to calculate discount rate using these alternative methods provides investors with a more comprehensive toolkit for making informed investment decisions. By learning how to calculate discount rate using different methods, investors can adapt to changing market conditions and make more accurate investment decisions.

Common Mistakes to Avoid When Calculating Discount Rate

When calculating discount rate, it’s essential to avoid common mistakes that can lead to inaccurate results. One of the most critical errors is using incorrect input values, such as an incorrect risk-free rate or market rate. This can significantly impact the calculated discount rate, leading to poor investment decisions. Another common mistake is misunderstanding the formula, which can result in incorrect calculations. For instance, failing to account for beta or using an incorrect beta value can lead to an inaccurate discount rate. Additionally, ignoring risk factors, such as inflation or market volatility, can also lead to incorrect discount rate calculations. Furthermore, using outdated or irrelevant data can also result in inaccurate discount rates. To avoid these mistakes, it’s crucial to understand the formula and its components, use accurate and up-to-date data, and consider all relevant risk factors. By being aware of these common mistakes, investors can ensure accurate discount rate calculations and make informed investment decisions. Remember, learning how to calculate discount rate accurately is crucial for making successful investment decisions.

Real-World Applications of Discount Rate Calculation

Discount rate calculation has numerous real-world applications in various industries, including finance, investment, and corporate finance. One of the primary applications is in investment analysis, where discount rate is used to evaluate the potential return on investment (ROI) of a project or asset. By calculating the discount rate, investors can determine the present value of future cash flows and make informed decisions about whether to invest or not. Another application is in capital budgeting, where discount rate is used to evaluate the feasibility of projects and determine which projects to pursue. Additionally, discount rate calculation is used in project evaluation, where it helps to determine the net present value (NPV) of a project and assess its viability. Furthermore, discount rate calculation is also used in mergers and acquisitions, where it helps to determine the value of a target company. In essence, understanding how to calculate discount rate is crucial for making informed investment decisions and maximizing returns. By applying discount rate calculation in real-world scenarios, investors and businesses can make better decisions and achieve their financial goals.

Conclusion: Mastering the Art of Discount Rate Calculation

In conclusion, understanding how to calculate discount rate is a crucial skill for anyone involved in finance and investment decisions. By grasping the concepts of time value of money, the formula for calculating discount rate, and the various methods for doing so, investors and businesses can make informed decisions that maximize returns and minimize risk. It is essential to avoid common mistakes and pitfalls, such as incorrect input values and misunderstanding the formula, to ensure accurate discount rate calculations. By applying discount rate calculation in real-world scenarios, such as investment analysis, capital budgeting, and project evaluation, investors and businesses can achieve their financial goals. Remember, mastering the art of discount rate calculation requires practice and patience, but the rewards are well worth the effort. By following the guidelines and best practices outlined in this article, readers can develop a deep understanding of how to calculate discount rate and make informed investment decisions.