Understanding Investment Returns: Beyond Simple Gains

When evaluating investment performance, it’s crucial to move beyond the simplicity of basic returns. A simple return, calculated as the profit divided by the initial investment, provides a snapshot of gains or losses relative to the starting capital. While this is a straightforward calculation, it fails to accurately capture the real-world dynamics of long-term investing, particularly when considering the reinvestment of profits or the impact of fluctuating market conditions. In contrast, cumulative return offers a comprehensive view of total investment performance over a specified period. This is achieved by taking into account the growth on both the initial investment and any subsequent gains, effectively illustrating the powerful effect of compounding. Compounding, the process where earnings generate further earnings, is the cornerstone of long-term wealth accumulation. This crucial element is not reflected in simple returns, making cumulative return the more accurate and insightful metric for assessing investment efficacy. Understanding how to calculate cumulative return is therefore essential for making informed financial decisions. It allows for a clearer picture of growth trajectory, and provides a more accurate representation of an investment’s true performance over time. The focus needs to shift from a single period gain to the overall growth path that accounts for the reinvestment of earnings. This approach will give an investor a better indication of their wealth creation over the long term as it addresses the complex interplay of market movement and capital growth.

The difference between these two methods becomes especially pronounced when reinvesting profits. Simple returns only consider the return on the original principal, ignoring the potential for those gains to also generate returns. This creates a misleading impression of actual growth. Cumulative return, on the other hand, calculates returns based on the overall value at the beginning of each period. This reflects the true power of reinvestment and compounding. For instance, an initial investment that provides a 10% return, which is then reinvested to gain an additional 10%, yields a higher cumulative return than a simple 20% gain. This is because the second 10% return is based on a larger base value. When considering how to calculate cumulative return, it’s critical to remember that each subsequent gain is based on the new total value of the investment, which is what makes compounding so powerful. This makes cumulative return a far superior metric when evaluating long term gains and when comparing the performance of different investment strategies. By moving beyond simple returns and focusing on how to calculate cumulative return, investors are able to make more accurate assessments and strategic decisions, resulting in better financial outcomes over time.

How to Calculate Cumulative Return: A Step-by-Step Approach

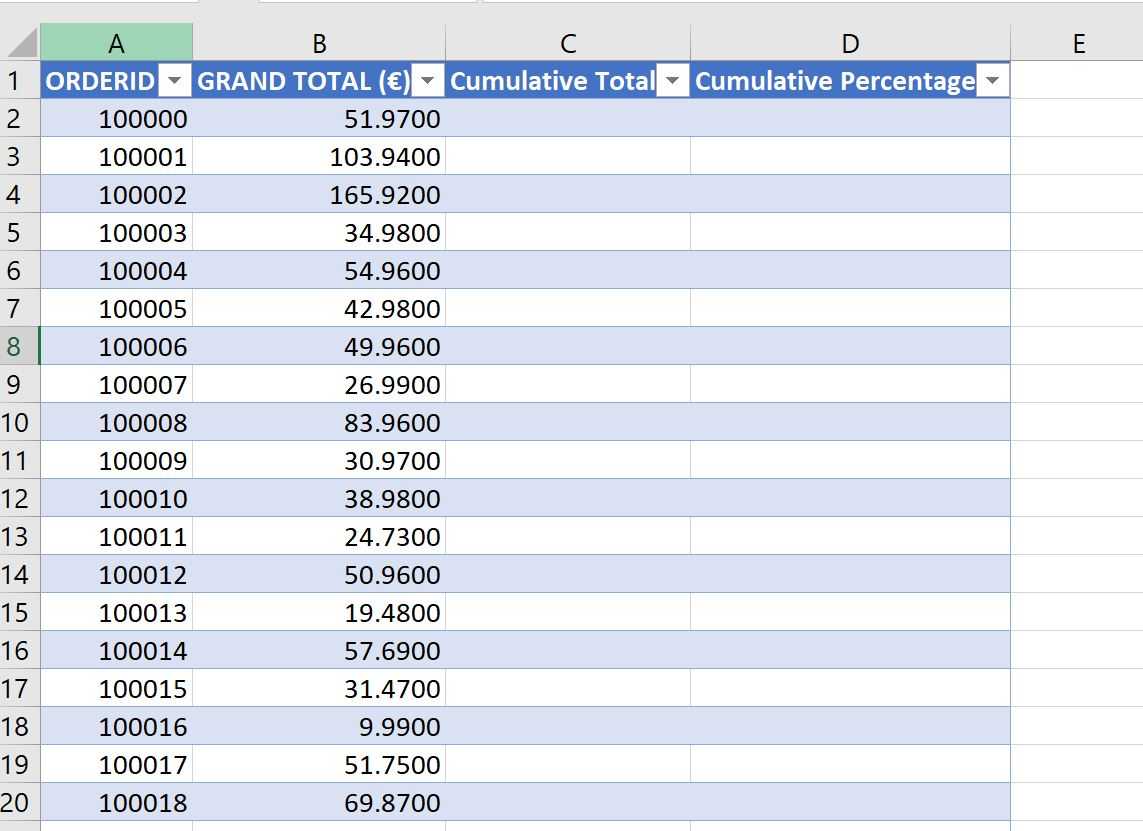

To understand how to calculate cumulative return, one must follow a clear, step-by-step process. Let’s illustrate this with a simple example. Imagine an initial investment of $1,000. After the first year, the investment grows to $1,100. This represents a 10% return ($100 profit/$1,000 initial investment). In the second year, the investment grows to $1,250. To calculate the cumulative return, one cannot simply add the annual returns. The cumulative return takes into account the compounding effect. The process involves using the following formula: Cumulative Return = ((Final Value / Initial Investment) – 1) * 100. In this example, the initial investment is $1,000 and the final value after two years is $1,250. The variables are defined as follows: Initial Investment (the starting amount), Periodic Returns (the gains or losses in each period, though not directly used in this formula), and Final Value (the value of the investment after all periods). Using the formula, the cumulative return is calculated as (($1,250 / $1,000) – 1) * 100 = 25%. This signifies that the investment has grown by 25% over the two-year period. A simple table can help to track these values effectively. For instance, a table with columns such as Year, Start Value, End Value, and Return would make it easy to visualize the investment’s progression over time.

The above example simplifies how to calculate cumulative return; a more nuanced look considers the impact of compounding. When calculating cumulative return, it’s crucial to recognize that the final value is not just the sum of individual period returns, but rather the result of each period’s return being applied to the prior periods’ cumulative sum. The step-by-step process involves taking the final value of the investment, dividing it by the initial investment, subtracting 1, and then multiplying by 100 to express the result as a percentage. Let’s emphasize once more the formula for how to calculate cumulative return: Cumulative Return = ((Final Value / Initial Investment) – 1) * 100. Using this calculation, investors can accurately assess their portfolio performance. Understanding how to calculate cumulative return allows investors to gauge the true effectiveness of their investment strategies.

Handling Multiple Periods and Reinvestment: Building Wealth Over Time

Moving beyond single-period calculations, understanding how to calculate cumulative return across multiple investment periods is crucial for long-term wealth building. This is particularly relevant when considering the power of compounding, where profits are reinvested, generating further returns. For instance, consider an initial investment of $1,000. In the first year, a 10% return yields a profit of $100, bringing the total value to $1,100. If this $100 profit is reinvested and the investment gains another 10% in the second year, the return is not simply 10% of the original $1,000. Instead, the 10% is applied to the new value of $1,100, generating $110 in profit, totaling $1,210. The cumulative return over the two years is therefore 21%, not 20%. This simple example demonstrates that returns are calculated on the new total, not just the initial investment. To more clearly show how to calculate cumulative return with reinvestment across multiple periods, let’s consider an investment that begins with $5,000. Assume that the investment generates returns of 5% in year one, 8% in year two, and 12% in year three, and that all profits are reinvested. The calculation would proceed as follows: Year 1: $5,000 * 1.05 = $5,250. Year 2: $5,250 * 1.08 = $5,670. Year 3: $5,670 * 1.12 = $6,350.40. The total cumulative return is ($6,350.40-$5,000)/$5,000 = 27.008%. This illustrates how cumulative return increases significantly when returns are reinvested over several periods, accelerating wealth growth over time.

To further clarify how to calculate cumulative return in a more realistic scenario, it’s important to also consider different compounding frequencies. For instance, an investment might generate monthly returns rather than annual ones. Let’s consider an example with an initial investment of $2,000 that experiences the following monthly returns: 1% in the first month, 1.5% in the second, -0.5% in the third, 2% in the fourth and 0.75% in the fifth, reinvesting all profits. These monthly returns are compounded each month. At the end of month 1, the value is $2,000 * 1.01 = $2,020. At the end of month 2, $2,020 * 1.015 = $2,050.30. After the third month, $2,050.30 * 0.995 = $2,040.05. The fourth month results in $2,040.05 * 1.02 = $2,080.85 and finally at the end of month five, $2,080.85 * 1.0075 = $2,096.45. Therefore, the cumulative return over five months is ($2,096.45 – $2,000) / $2,000 = 4.82%. This more frequent compounding can boost the overall cumulative return over the same timeframe as opposed to annual compounding. The general principle is that the more frequent compounding, the higher the cumulative returns, given the same periodic returns, illustrating the power of compounding in building wealth. The formula used to calculate cumulative return with reinvestment can also be expressed as: Final value divided by initial investment minus one.

Calculating Cumulative Return with Dividends: A Comprehensive Approach

Understanding how dividends impact investment returns is crucial for a complete performance evaluation. Dividends represent a portion of a company’s profits distributed to shareholders and contribute to the overall return in addition to capital appreciation. When calculating cumulative return, one must account for these payments. The process involves tracking both the price changes of the asset and the dividend income received. For example, consider an investment of $1,000 in a stock. If after one year the stock’s value has increased to $1,100 and the investor received $50 in dividends, the total return isn’t simply the $100 gain in stock price. Instead, the total return is $150, combining both the capital gain and the dividend income. This total return of $150 is then used to calculate the cumulative return. To accurately reflect the complete picture of investment growth, it is imperative to incorporate all dividend payments.

The formula to calculate cumulative return with dividends is as follows: first calculate the total return in each period by adding any capital gains (or losses) to dividend income. In the scenario above the total return is $150. Then, to find the total percentage return, this total return of $150 is divided by the initial investment of $1,000 resulting in a 15% return. When we have multiple periods, we must calculate the total returns for each period and then use these to determine the cumulative return. For example, with an initial investment of $1,000, a 10% return in year one, and a 5% return in year two on the total value, the cumulative return is calculated not by adding 10% and 5%, which would be a simple return of 15%, but by using the formula: ((1+return in period 1) * (1+return in period 2)…)-1. This would be ((1+0.1) * (1+0.05)) -1 = 0.155, thus the cumulative return is 15.5%. This demonstrates how to calculate cumulative return when taking dividends into account and illustrates the power of compounding.

It is important to recognize that dividend payments can occur on different schedules, such as quarterly or annually. Therefore, calculating cumulative return accurately necessitates tracking dividend income for each period and incorporating it into the appropriate period’s return. The dividend amount should be added to any changes in value of the asset to find each period’s total return. These period returns are then used in the calculations for cumulative return across multiple periods. Failing to account for dividends will understate the total return an investor has achieved. Understanding this concept is key to accurately calculating the total and cumulative return, allowing investors to make well-informed investment decisions. Therefore, when considering how to calculate cumulative return, dividends are an essential component and should not be ignored.

Dealing with Losses: Accounting for Negative Returns

Investment performance isn’t always positive; periods of loss are a natural part of market cycles. Understanding how to calculate cumulative return when experiencing negative returns is crucial for a complete assessment of investment performance. Negative returns, unlike profits, reduce the overall value of the investment. To accurately reflect this in the cumulative return calculation, the same principles apply, but with a negative sign. For example, if an investment loses 10% in a period, this return is represented as -0.10. This negative value is incorporated into the return calculation the same way a positive return would be. Consider a scenario where an initial investment of $100 experiences a 20% loss in the first period, resulting in a value of $80. If, in the subsequent period, it gains 10%, the new value would be $88. To calculate the cumulative return, you would need to track both the negative and positive returns. The calculation incorporates the starting value, the losses, and then the gains in sequence. It is not enough to simply average gains and losses without considering that losses affect the base value which will influence all future values. This is an important concept to grasp when learning how to calculate cumulative return. This also applies to a portfolio with different assets, where some can produce positive returns and others negative returns. How to calculate cumulative return in these scenarios requires a correct understanding of how gains and losses impact the overall outcome.

To illustrate how to calculate cumulative return with losses, let’s continue the example. With a starting investment of $100, a 20% loss results in a value of $80 and with a subsequent 10% gain, a new value of $88. Using the same cumulative calculation method described previously, the cumulative return is calculated as (Final Value – Initial Investment) / Initial Investment, which is ($88 – $100) / $100 = -0.12 or -12%. This clearly shows the investment is down 12%, despite experiencing a gain in the second period. It is vital to remember that a loss requires a larger percentage gain in the subsequent period to return to the initial investment value due to the lower capital base. For instance, after a 20% loss, the $80 investment needs a 25% gain to return to $100. Investors should not shy away from incorporating negative returns in their calculation process; it’s essential for accurately assessing true performance. Understanding both how to calculate cumulative return with positive returns and how to calculate cumulative return with negative returns gives a holistic view of the investment’s trajectory and is vital for informed decision-making. Failing to account for losses will only paint a partially accurate picture, which can be misleading.

Beyond the Numbers: Interpreting Your Cumulative Return

The calculated cumulative return provides a powerful snapshot of an investment’s overall performance over a specific period. Understanding how to calculate cumulative return is only half the battle; interpreting the result is equally crucial. This figure represents the total growth of the investment, encompassing both gains and losses, and provides a clear picture of the effectiveness of the chosen investment strategy. A high cumulative return suggests strong performance, while a low or negative return indicates underperformance. However, interpreting this figure requires context. For instance, a seemingly high cumulative return might not be impressive if the overall market experienced significantly higher growth during the same period. Therefore, comparing the investment’s cumulative return against relevant benchmarks, such as market indices or similar investment vehicles, is essential for a fair assessment. This comparative analysis helps determine whether the investment outperformed, underperformed, or matched the market’s overall trajectory.

Risk tolerance plays a vital role in interpreting cumulative return. A higher-risk investment might yield a significantly higher cumulative return than a lower-risk investment, but this comes with increased volatility and the possibility of substantial losses. Therefore, the acceptable level of risk should always be considered alongside the cumulative return when evaluating investment performance. Investors with a lower risk tolerance might prioritize stability and consistency over exceptionally high returns, even if that means a lower cumulative return. How to calculate cumulative return and the resulting figure should not be viewed in isolation; rather, it needs to be evaluated within the larger context of risk-adjusted performance. This might involve calculating metrics such as the Sharpe ratio, which accounts for both return and risk, providing a more nuanced view of investment success.

Furthermore, understanding the underlying factors contributing to the cumulative return is vital. Did the growth stem from successful market timing, skillful stock picking, or simply favorable market conditions? Identifying the drivers of the return allows for a more informed evaluation of the investment strategy’s effectiveness. Investors can use this insight to refine their approach in the future, potentially optimizing their investment strategies for improved returns and risk management. Analyzing the cumulative return in conjunction with other relevant factors, such as portfolio diversification and expense ratios, provides a holistic understanding of long-term investment success. Remember, consistently applying the knowledge of how to calculate cumulative return, coupled with a thorough analysis of its implications, is essential for making well-informed investment decisions and achieving long-term financial goals.

Comparing Investment Strategies: Using Cumulative Return for Decision-Making

Investors frequently face the challenge of selecting the most suitable investment strategy from a range of options. Understanding how to calculate cumulative return is crucial for making informed decisions. By calculating the cumulative return for each potential investment, a direct comparison of their overall performance becomes possible. This allows investors to assess which strategy generated the highest overall growth over the chosen investment period. For instance, an investor considering investing in either a stock portfolio or a bond portfolio can calculate the cumulative return for each over a five-year period. The higher cumulative return indicates the superior performing investment during that specific time frame. Remember, however, that past performance is not necessarily indicative of future results. It’s important to consider other factors like risk tolerance and investment goals before making any investment choices.

A comparative example can illustrate this effectively. Suppose an investor has two options: Option A (a diversified stock portfolio) and Option B (a conservative bond portfolio). Over a 10-year period, Option A shows an initial investment of $10,000 growing to $17,000, while Option B grows from $10,000 to $13,000. Calculating the cumulative return for both using the formula ((Final Value / Initial Value) -1) * 100%, Option A exhibits a 70% cumulative return, and Option B a 30% cumulative return. This clearly shows the superior growth generated by Option A over the 10-year period. However, this comparison doesn’t account for the risk profile of each investment. Option A, with its higher growth, likely carried higher risk. Understanding how to calculate cumulative return allows for a quantitative comparison, but qualitative factors must also be considered for a holistic investment strategy assessment.

The process of how to calculate cumulative return provides a valuable tool for comparing different investment vehicles, allowing investors to make more data-driven decisions. When comparing investment strategies, the cumulative return offers a concise metric to evaluate long-term performance, highlighting the overall growth achieved by each option. This facilitates a more informed selection process and helps align investment choices with the investor’s risk tolerance and objectives. This method underscores the importance of calculating cumulative return across multiple periods and investments to make intelligent decisions about portfolio construction and management. Remember to always consider the context of market conditions and the inherent risks associated with each investment when interpreting cumulative return data.

Advanced Techniques for Calculating Cumulative Return (Optional)

While the previous sections detail how to calculate cumulative return under relatively straightforward conditions, real-world investing often presents more complex scenarios. Understanding how to adapt the calculation to these situations allows for a more precise reflection of investment performance. One such scenario involves irregular contributions or withdrawals. The standard methods for calculating cumulative return assume consistent investment amounts over time. However, if an investor makes additional contributions or withdraws funds at various points, a more sophisticated approach is needed. This often involves breaking down the investment period into smaller intervals, calculating the return for each interval, and then compounding those returns to arrive at the overall cumulative return. This process can be significantly more involved and may necessitate the use of specialized financial software or spreadsheet applications. Mastering how to calculate cumulative return in this context offers a more accurate portrayal of investment growth under dynamic conditions.

Another area of complexity lies in varying compounding frequencies. The examples provided have focused on annual or periodic compounding. However, some investments may compound daily, monthly, or even continuously. The frequency of compounding significantly impacts the final cumulative return. Daily compounding, for instance, will generally result in a slightly higher cumulative return compared to annual compounding for the same annual interest rate, due to the effects of interest earned on interest. Therefore, knowing how to calculate cumulative return under different compounding frequencies is crucial for comparing investments with varying terms and interest accrual schedules. Precisely calculating this requires familiarity with different compounding formulas or financial calculators designed to handle these variations. This also improves one’s understanding of how to calculate cumulative return holistically.

Finally, it’s important to recognize that while this guide provides a solid foundation for understanding how to calculate cumulative return, advanced investment strategies often involve multiple asset classes, complex tax implications, and other factors that necessitate more advanced modeling techniques. These may include Monte Carlo simulations or other statistical methods to account for the inherent uncertainty in investment returns. While these advanced techniques are beyond the scope of this introductory guide, understanding the basic principles of how to calculate cumulative return forms an essential building block for tackling these more sophisticated financial analyses. A thorough understanding of how to calculate cumulative return provides a strong base for future growth in financial literacy and investment strategy development.