Unlocking the Power of Covariance in Data Analysis

In data analysis, understanding the relationship between variables is crucial for making informed decisions. Covariance, a statistical measure, helps achieve this by quantifying the linear relationship between two variables. It is a fundamental concept in statistics, widely used in various fields, including finance, economics, and science. By calculating covariance, analysts can identify patterns, trends, and correlations, ultimately leading to better decision-making. In this article, we will explore how to calculate covariance in Excel, a powerful tool for data analysis, and delve into its practical applications.

Understanding the Formula: A Deep Dive into Covariance Calculation

The mathematical formula for calculating covariance is a fundamental concept in statistics. It is denoted by the symbol σ (sigma) and is calculated as the average of the product of deviations of each variable from their respective means. The formula is represented as:

σ(x, y) = Σ[(xi – x̄)(yi – ȳ)] / (n – 1)

where σ(x, y) is the covariance between variables x and y, xi and yi are individual data points, x̄ and ȳ are the

How to Calculate Covariance in Excel: A Step-by-Step Tutorial

Calculating covariance in Excel is a straightforward process using the COVAR function. This function takes two ranges of data as input and returns the covariance between them. To calculate covariance in Excel, follow these steps:

Step 1: Prepare your data by organizing it into two columns, one for each variable. Ensure that the data is in a numerical format and free of errors.

Step 2: Select a cell where you want to display the covariance result.

Step 3: Type “=COVAR(array1, array2)” and press Enter. Replace “array1” and “array2” with the ranges of cells containing your data.

For example, if your data is in cells A1:A10 and B1:B10, the formula would be “=COVAR(A1:A10, B1:B10)”.

Step 4: Excel will return the covariance value, which can be a positive or negative number.

By following these steps, you can easily calculate covariance in Excel and gain insights into the relationship between two variables. Remember, understanding how to calculate covariance in Excel is a crucial skill for data analysts and is widely used in various fields, including finance, economics, and science.

Using Excel Formulas: An Alternative Method for Calculating Covariance

In addition to using the COVAR function, Excel provides an alternative method for calculating covariance using formulas. This approach can be useful when working with large datasets or when the COVAR function is not available. To calculate covariance using Excel formulas, follow these steps:

Step 1: Calculate the mean of each variable using the AVERAGE function.

Step 2: Calculate the deviations of each data point from the mean using the formula “(xi – x̄)” and “(yi – ȳ)”.

Step 3: Calculate the product of the deviations using the formula “(xi – x̄) * (yi – ȳ)”.

Step 4: Calculate the sum of the products using the SUM function.

Step 5: Divide the sum of the products by the number of data points minus one (n-1) to get the covariance.

The formula for calculating covariance using Excel formulas is:

=SUMPRODUCT((A1:A10-AVERAGE(A1:A10))*(B1:B10-AVERAGE(B1:B10)))/(COUNT(A1:A10)-1)

where A1:A10 and B1:B10 are the ranges of cells containing the data.

This approach provides an alternative method for calculating covariance in Excel and can be useful in certain situations. However, it requires more steps and calculations compared to using the COVAR function. Understanding how to calculate covariance in Excel using formulas can be a valuable skill for data analysts and can provide an additional tool for data analysis.

Interpreting Covariance Results: What Do the Numbers Mean?

Once you have calculated the covariance between two variables, it’s essential to understand what the results mean. Interpreting covariance results is crucial in data analysis, as it helps in identifying the strength and direction of the relationship between the variables.

A positive covariance indicates that the variables tend to increase or decrease together. For example, if the covariance between the number of hours studied and the grade achieved is positive, it means that as the number of hours studied increases, the grade achieved also tends to increase. The strength of the relationship is indicated by the magnitude of the covariance value.

A negative covariance indicates that the variables tend to move in opposite directions. For instance, if the covariance between the amount of rainfall and the number of ice cream sales is negative, it means that as the amount of rainfall increases, the number of ice cream sales tends to decrease.

A covariance value close to zero indicates that there is no linear relationship between the variables. This does not necessarily mean that there is no relationship at all, but rather that the relationship is not linear.

When interpreting covariance results, it’s essential to consider the context and the variables involved. A high covariance value may not always be meaningful if the variables are not relevant to each other. On the other hand, a low covariance value may be significant if the variables are closely related.

In addition to understanding the direction and strength of the relationship, covariance results can also be used to identify patterns and trends in the data. By analyzing the covariance between different variables, data analysts can gain insights into the underlying relationships and make informed decisions.

In the context of how to calculate covariance in Excel, understanding how to interpret the results is crucial in extracting meaningful insights from the data. By applying the concepts discussed in this article, data analysts can unlock the power of covariance and gain a deeper understanding of the relationships between variables.

Real-World Applications of Covariance: Examples and Case Studies

Covariance is a powerful statistical tool with numerous practical applications in various fields. Understanding how to calculate covariance in Excel is essential for data analysts and professionals who work with data. In this section, we’ll explore some real-world examples and case studies that demonstrate the importance of covariance in finance, economics, and science.

In finance, covariance is used to analyze the relationship between different asset classes, such as stocks and bonds. By calculating the covariance between these assets, investors can identify the risk and potential returns of their portfolios. For instance, a study by the Journal of Financial Economics found that covariance analysis can help investors optimize their portfolios and reduce risk.

In economics, covariance is used to study the relationship between macroeconomic variables, such as GDP and inflation. By analyzing the covariance between these variables, economists can identify patterns and trends that can inform policy decisions. For example, a study by the International Monetary Fund used covariance analysis to examine the relationship between economic growth and inflation in developing countries.

In science, covariance is used to analyze the relationship between different variables in complex systems. For instance, in climate science, covariance is used to study the relationship between temperature and precipitation patterns. By analyzing the covariance between these variables, scientists can identify patterns and trends that can inform climate models and predictions.

A case study by the Harvard Business Review illustrates the practical application of covariance in business. The study analyzed the relationship between customer satisfaction and employee satisfaction in a retail company. By calculating the covariance between these variables, the company was able to identify a strong positive relationship, which informed their strategy to improve customer satisfaction by investing in employee satisfaction.

These examples and case studies demonstrate the importance of covariance in real-world scenarios. By understanding how to calculate covariance in Excel, data analysts and professionals can unlock the power of covariance and gain insights into complex relationships between variables.

Troubleshooting Common Issues: Overcoming Covariance Calculation Errors

When learning how to calculate covariance in Excel, it’s essential to be aware of common errors and issues that may arise. In this section, we’ll address some common problems that can occur when calculating covariance in Excel, including data formatting problems and function syntax errors.

Data Formatting Problems:

One common issue that can occur when calculating covariance in Excel is data formatting problems. If the data is not formatted correctly, the COVAR function may return an error or produce incorrect results. To avoid this, ensure that the data is in a numerical format and that there are no blank cells or text values in the dataset.

Function Syntax Errors:

Another common issue is function syntax errors. The COVAR function requires two range arguments, and if these arguments are not specified correctly, the function will return an error. To avoid this, ensure that the range arguments are specified correctly, and that the function is formatted as follows: COVAR(range1, range2).

Other Common Issues:

Other common issues that can occur when calculating covariance in Excel include:

- Incorrect data types: Ensure that the data is in a numerical format.

- Missing or blank cells: Ensure that there are no blank cells or missing values in the dataset.

- Incorrect function syntax: Ensure that the COVAR function is formatted correctly.

Troubleshooting Tips:

To troubleshoot common issues when calculating covariance in Excel, follow these tips:

- Check the data formatting and ensure that it is in a numerical format.

- Verify that there are no blank cells or missing values in the dataset.

- Check the function syntax and ensure that it is formatted correctly.

- Use the Excel formula auditing tools to identify and fix errors.

By being aware of these common issues and following these troubleshooting tips, you can overcome errors and ensure accurate covariance calculations in Excel. Remember, understanding how to calculate covariance in Excel is essential for data analysis, and by mastering this skill, you can unlock the power of covariance and gain insights into complex relationships between variables.

Advanced Covariance Techniques: Going Beyond the Basics

While understanding how to calculate covariance in Excel is essential, there are advanced techniques that can take your data analysis to the next level. In this section, we’ll explore advanced covariance techniques, including calculating covariance for multiple variables and using covariance matrices.

Calculating Covariance for Multiple Variables:

In many cases, data analysts need to calculate covariance for more than two variables. This can be achieved using the COVAR function in Excel, but it requires a different approach. One way to calculate covariance for multiple variables is to use the COVAR function in combination with the INDEX and MATCH functions. This allows you to calculate covariance for multiple variables and identify the relationships between them.

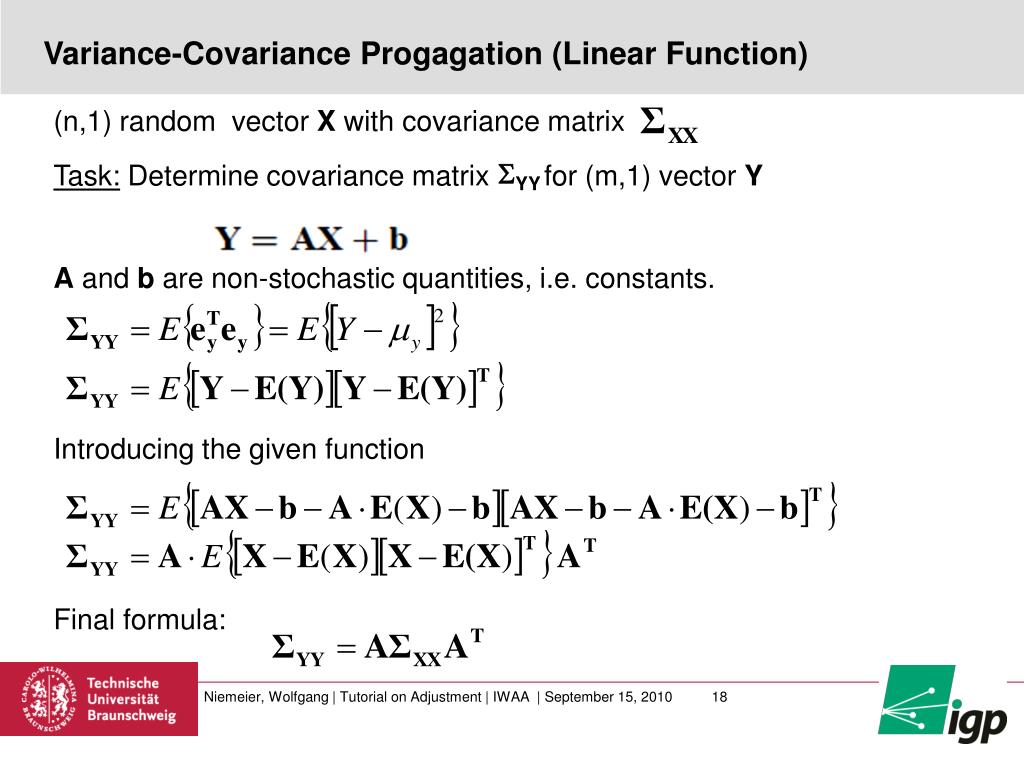

Using Covariance Matrices:

A covariance matrix is a table that displays the covariance between different variables. It’s a powerful tool for data analysis, as it allows you to visualize the relationships between multiple variables. In Excel, you can create a covariance matrix using the COVAR function and the MMULT function. This allows you to calculate the covariance between multiple variables and display the results in a matrix format.

Applications of Advanced Covariance Techniques:

Advanced covariance techniques have numerous applications in real-world scenarios. For example, in finance, covariance matrices are used to analyze the relationships between different asset classes and identify potential risks and opportunities. In economics, covariance matrices are used to study the relationships between macroeconomic variables, such as GDP and inflation. In science, covariance matrices are used to analyze the relationships between different variables in complex systems.

Benefits of Advanced Covariance Techniques:

The benefits of advanced covariance techniques are numerous. They allow data analysts to:

- Analyze the relationships between multiple variables

- Identify patterns and trends in complex data sets

- Make more accurate predictions and forecasts

- Optimize business decisions and strategies

By mastering advanced covariance techniques, data analysts can unlock the full potential of covariance analysis and gain a deeper understanding of complex relationships between variables. Whether you’re working in finance, economics, science, or any other field, advanced covariance techniques can help you make more informed decisions and drive business success.