Unlocking Bond Yields: A Guide to Coupon Rate Calculation

A bond represents a debt instrument where an investor loans money to an entity (corporate or governmental) that borrows the funds for a defined period with a fixed interest rate. Understanding bonds requires familiarity with key components. These include the face value (or par value), which is the amount the issuer repays at maturity. Another component is the coupon rate, the bond’s interest rate. The maturity date signifies when the principal is repaid. Knowing how to calculate coupon rate is vital for understanding bond yields. The coupon rate is a critical element. It dictates the periodic interest payments received by the bondholder.

The coupon rate, also known as the nominal yield, is the annual interest rate stated on the bond when it’s issued. It is expressed as a percentage of the bond’s face value. For example, a bond with a $1,000 face value and a 5% coupon rate pays $50 in interest annually. Grasping how to calculate coupon rate provides insight into the bond’s income stream. This rate remains fixed throughout the bond’s life, irrespective of market fluctuations. This fixed nature makes it a predictable income source for investors.

To fully understand a bond’s worth and potential return, it’s essential to know how to calculate coupon rate and to differentiate it from other yield measures. The initial step in bond evaluation involves understanding the stated coupon rate. This is foundational to assessing its attractiveness. The process of how to calculate coupon rate involves dividing the annual coupon payments by the bond’s face value. Consider a bond with a face value of $1,000 that pays $60 annually. The coupon rate is 6% ($60 / $1,000 = 0.06). This simple calculation reveals the bond’s annual return based on its face value, highlighting the importance of knowing how to calculate coupon rate for investment decisions.

Decoding the Formula for Coupon Rate

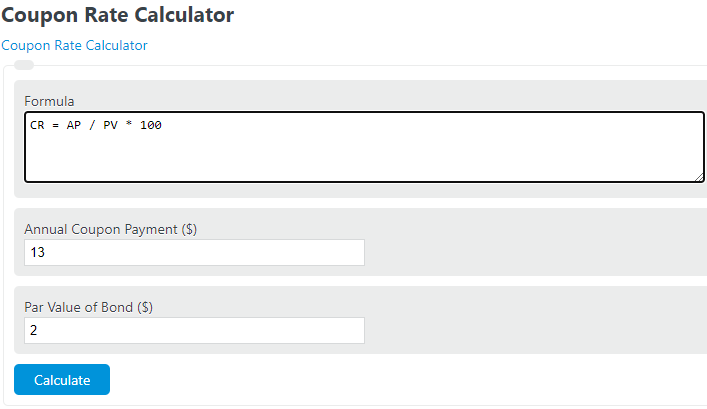

The coupon rate is a fundamental aspect of bond valuation. It represents the annual interest income a bondholder receives, expressed as a percentage of the bond’s face value. Understanding how to calculate coupon rate is crucial for investors. The basic formula is: Coupon Rate = (Annual Coupon Payment / Face Value) * 100. This formula provides the stated annual interest rate of the bond.

To further clarify how to calculate coupon rate, let’s break down each component. The “Annual Coupon Payment” is the total amount of interest paid out by the bond in a year. The “Face Value,” also known as par value, is the amount the bond issuer will repay at maturity. The result of dividing the annual coupon payment by the face value gives the coupon rate as a decimal. Multiplying by 100 converts this decimal into a percentage, expressing the coupon rate in its standard form. This percentage signifies the annual return an investor receives based on the bond’s face value, before considering market price fluctuations.

For example, consider a bond with a face value of $1,000 and an annual coupon payment of $50. To calculate the coupon rate, we would divide $50 by $1,000, resulting in 0.05. Multiplying this by 100 gives a coupon rate of 5%. This indicates that the bondholder will receive $50 in interest annually for every $1,000 of face value. This is a straightforward calculation, but it’s essential to remember that this is the bond’s stated or nominal yield, not necessarily the actual return an investor will realize, especially if the bond is bought at a price other than its face value. Understanding how to calculate coupon rate provides a foundation for grasping more complex bond yield calculations.

Illustrative Examples: Calculating Coupon Rate in Practice

To solidify understanding of how to calculate coupon rate, let’s explore a few practical examples with varying bond characteristics. Remember, the coupon rate is the annual coupon payment divided by the bond’s face value.

Example 1: Imagine a bond with a face value of $1,000 that pays an annual coupon of $50. To determine how to calculate coupon rate, we divide the annual coupon payment ($50) by the face value ($1,000). The calculation is $50 / $1,000 = 0.05, or 5%. Therefore, the coupon rate for this bond is 5%. This means that for every $1,000 of face value, the bondholder receives $50 in interest payments annually. The formula to calculate coupon rate is straightforward in this instance.

Example 2: Consider a bond with a face value of $500 and an annual coupon payment of $25. The process to calculate coupon rate remains the same: divide the annual coupon payment by the face value. In this case, $25 / $500 = 0.05, or 5%. Even though the face value and coupon payment are different from the first example, the coupon rate is still 5%. Understanding how to calculate coupon rate allows investors to compare bonds with different face values. Another bond has a face value of $5,000 and pays an annual coupon of $250. To calculate coupon rate, we perform the calculation: $250 / $5,000 = 0.05, which is 5%. These examples highlight how to calculate coupon rate, showing that regardless of the face value or coupon payment amount, the percentage remains consistent if the ratio is the same.

Example 3: Now, let’s say a bond has a face value of $10,000 and pays an annual coupon of $600. Applying the formula, we get $600 / $10,000 = 0.06, or 6%. This bond has a higher coupon rate than the previous examples. This illustrates how different issuers offer varying coupon rates to attract investors, based on factors like creditworthiness and market conditions. Knowing how to calculate coupon rate helps investors evaluate the relative attractiveness of different bond offerings. These examples demonstrate that understanding how to calculate coupon rate is vital for comparing bond investments effectively.

Navigating Bonds with Semi-Annual Coupon Payments

Many bonds distribute coupon payments semi-annually, meaning investors receive interest twice a year instead of once. This requires a slight adjustment to the standard formula for understanding how to calculate coupon rate and its implications. The stated coupon rate is still an annual figure, but the actual payment received each period is half of the annual coupon payment. To accurately determine the periodic payment, divide the annual coupon rate by two. For example, a bond with a face value of $1,000 and a coupon rate of 6% paid semi-annually would distribute two payments of $30 each year ($1,000 * 0.06 / 2 = $30). Understanding how to calculate coupon rate in this context is crucial for investors.

To illustrate, consider a bond with a $5,000 face value and an 8% coupon rate, paid semi-annually. First, calculate the annual coupon payment: $5,000 * 0.08 = $400. Since the payments are semi-annual, divide the annual payment by two: $400 / 2 = $200. Therefore, the investor receives $200 every six months. This adjustment is vital when comparing bonds with different payment frequencies. Remember that while the annual coupon rate remains the same, the timing of the payments impacts the overall return and perceived value, reinforcing the need to know how to calculate coupon rate effectively.

Another crucial aspect to consider when dealing with semi-annual coupon payments is their impact on calculating the yield to maturity (YTM). The YTM calculation becomes slightly more complex as it needs to account for the compounding effect of receiving payments more frequently. While the basic principle of how to calculate coupon rate remains the same, understanding its application in different payment schedules is fundamental for making informed investment decisions. Investors should always clarify the payment frequency before evaluating a bond and determining its suitability for their portfolio. Knowing how to calculate coupon rate in these instances will provide a strong understanding of your potential investment return.

The Relationship Between Coupon Rate and Current Yield

Understanding how to calculate coupon rate is fundamental, but it’s also crucial to differentiate it from the current yield. The coupon rate represents the bond’s fixed annual interest rate, expressed as a percentage of its face value. However, the current yield reflects the bond’s annual income relative to its current market price. This distinction is vital because bond prices fluctuate in the market.

The market price of a bond directly impacts its current yield. When a bond trades at a premium (above its face value), the current yield will be lower than the coupon rate. This is because the investor is paying more for the bond, effectively reducing the return on investment based on the price paid. Conversely, when a bond trades at a discount (below its face value), the current yield will be higher than the coupon rate. The investor is paying less for the bond, increasing the return relative to the investment. Learning how to calculate coupon rate provides a baseline, while current yield offers a real-time perspective.

Consider a bond with a face value of $1,000 and a coupon rate of 5%. This means the bond pays $50 in annual interest. If the bond is trading at $1,100, the current yield is $50/$1,100 = 4.55%. If the bond is trading at $900, the current yield is $50/$900 = 5.56%. Even though the coupon rate remains constant at 5%, the current yield varies based on the market price. The coupon rate is a fixed characteristic, while the current yield is a dynamic measure reflecting market conditions. Knowing how to calculate coupon rate is the first step, but understanding its relationship to current yield is key to informed bond investing. This rate doesn’t change and is fixed at the time of issue and is important to know how to calculate coupon rate to properly analyze a bond.

Coupon Rate vs. Yield to Maturity: What’s the Difference?

Understanding the nuances between the coupon rate and the Yield to Maturity (YTM) is critical for bond investors. The coupon rate represents the bond’s stated interest rate, a fixed percentage of the face value that the issuer promises to pay annually. It is a straightforward measure of the annual interest income an investor can expect. Knowing how to calculate coupon rate is fundamental, as it directly influences the income stream.

YTM, on the other hand, provides a more comprehensive view of a bond’s potential return. It considers not only the coupon payments but also the difference between the bond’s purchase price and its face value. If a bond is purchased at a discount (below face value), the YTM will be higher than the coupon rate. Conversely, if a bond is purchased at a premium (above face value), the YTM will be lower than the coupon rate. Calculating how to calculate coupon rate remains essential for understanding the base interest, but YTM offers insight into overall profitability.

The YTM calculation assumes that all coupon payments are reinvested at the same rate as the YTM. It also assumes the bond is held until maturity. Because of these factors, YTM is often considered a more accurate reflection of the total return an investor can expect. While the coupon rate indicates the annual income, the YTM provides a broader perspective, particularly useful when comparing bonds with different coupon rates and purchase prices. Understanding how to calculate coupon rate is step one; YTM adds the layer of price fluctuation and its impact on total return. Investors should be aware of both metrics to make informed decisions. This helps them understand the true potential profitability of the bond investment.

Using Online Tools and Calculators for Quick Coupon Rate Determination

Online bond calculators offer a swift method to determine the coupon rate. These tools require specific inputs. Information like the bond’s face value and annual coupon payments are needed. After entering the data, the calculator quickly computes the coupon rate. This simplifies the process of understanding how to calculate coupon rate.

Several reputable resources exist for bond information. Websites like FINRA and the U.S. Treasury provide bond data. Many financial news sites also offer bond calculators. It is wise to use these tools to verify manual calculations. This ensures accuracy and reinforces your understanding of how to calculate coupon rate. Remember that while calculators are helpful, grasping the underlying formula remains essential. This knowledge empowers you to interpret the results and understand the bond’s characteristics.

These calculators instantly show the coupon rate. This helps investors quickly assess a bond’s potential income. However, familiarity with the calculation method is always valuable. Understanding how to calculate coupon rate allows for a more informed investment decision. It also enables you to analyze the bond’s yield in various market conditions. Being able to independently verify the coupon rate contributes to confident and well-informed investing. Therefore, while online tools expedite the process, a solid understanding of how to calculate coupon rate remains indispensable for bond investors.

Factors Influencing Coupon Rate Decisions

When determining a bond’s coupon rate, issuers carefully consider several key factors to attract investors while managing their borrowing costs. Prevailing interest rates are paramount. If market interest rates are high, the issuer must offer a competitive coupon rate to make the bond appealing. Conversely, in a low-interest-rate environment, a lower coupon rate might suffice. The issuer’s creditworthiness also plays a significant role. Entities with strong credit ratings (e.g., AAA) can typically offer lower coupon rates because investors perceive them as less risky. Issuers with lower credit ratings (e.g., BB) must offer higher coupon rates to compensate investors for the increased risk of default. How to calculate coupon rate is also important for the issuers to manage the bond’s value.

The bond’s maturity, or the length of time until the principal is repaid, also affects the coupon rate. Longer-term bonds generally carry higher coupon rates than shorter-term bonds because investors demand more compensation for the increased uncertainty over a longer investment horizon. Call provisions, which give the issuer the right to redeem the bond before its maturity date, can also influence the coupon rate. Bonds with call provisions often have slightly higher coupon rates to compensate investors for the risk that the bond might be called away before maturity. Furthermore, specific features embedded in the bond, such as convertibility into stock, can impact the coupon rate. Convertible bonds typically offer lower coupon rates because investors are willing to accept a lower interest payment in exchange for the potential upside of converting the bond into equity. Understanding how to calculate coupon rate helps investors evaluate these features.

The interplay of these factors determines the attractiveness of a bond to investors. A well-balanced coupon rate reflects the issuer’s creditworthiness, the prevailing market conditions, and the bond’s specific features. Investors must understand these factors to assess whether a bond offers an adequate return for the level of risk they are assuming. Knowing how to calculate coupon rate and comparing it to other bonds with similar characteristics is a crucial step in bond valuation. Ultimately, the coupon rate is a fundamental element in determining a bond’s value and its suitability for an investor’s portfolio.