What is Alpha and Why Does it Matter?

In investment, alpha represents the excess return of an investment relative to a benchmark index, such as the S&P 500. It is a key metric for evaluating investment performance. Investors actively seek investments with positive alpha, as it signals outperformance compared to the market. This indicates the investment has generated returns above what would be expected based on its risk profile. The ability to identify and capitalize on investments with positive alpha is central to successful portfolio management. Understanding alpha begins with a grasp of the Capital Asset Pricing Model (CAPM). The CAPM provides a theoretical framework for understanding the relationship between risk and expected return, laying the foundation for understanding how to calculate capm alpha in excel and estimating alpha. It is essential to know how to calculate capm alpha in excel for investment analysis.

The CAPM serves as a benchmark for assessing whether an investment’s returns are justified by its level of risk. Investors want to know how to calculate capm alpha in excel to gauge true performance. A positive alpha suggests the investment’s return exceeds what the CAPM predicts. This implies the investment has added value beyond what is attributable to market risk. Conversely, a negative alpha indicates underperformance relative to the risk-adjusted expected return. Therefore, understanding how to calculate capm alpha in excel is vital for informed decision-making. Alpha, in essence, quantifies the value added (or subtracted) by a portfolio manager’s investment decisions.

The CAPM offers a baseline expectation. However, alpha represents the deviation from that expectation. The quest for positive alpha drives many investment strategies. This highlights the importance of mastering how to calculate capm alpha in excel. While the CAPM has its limitations, it provides a useful starting point for evaluating investment performance. It helps to determine if returns are simply a result of market movements or the manager’s skill. Knowing how to calculate capm alpha in excel is crucial for separating luck from skill in investment outcomes.

Understanding the CAPM Formula Components

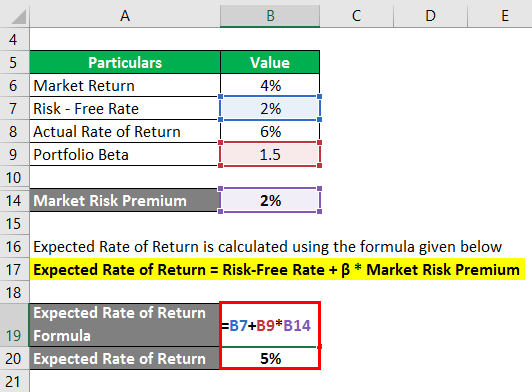

The Capital Asset Pricing Model (CAPM) is a financial model that calculates the expected rate of return for an asset or investment. Knowing how to calculate CAPM alpha in excel is crucial for investors. The formula is: Required Return = Risk-Free Rate + Beta * (Market Return – Risk-Free Rate). Each component plays a vital role in determining the expected return.

The risk-free rate represents the theoretical return of an investment with zero risk. Typically, this is the yield on a government bond, such as a U.S. Treasury bill. The yield reflects the return an investor can expect without taking substantial risk. Data for the risk-free rate is readily available from government websites, such as the U.S. Department of the Treasury. These websites provide current and historical data on Treasury yields, which can be directly used in how to calculate CAPM alpha in excel. It is important to utilize the most recent and accurate risk-free rate to ensure the CAPM calculation is relevant.

Beta is a measure of an asset’s volatility relative to the market. A beta of 1 indicates that the asset’s price will move with the market. A beta greater than 1 suggests the asset is more volatile than the market, and a beta less than 1 indicates lower volatility. Market return represents the expected return of the overall market, often proxied by a broad market index like the S&P 500. Historical market returns can be obtained from financial data providers like Yahoo Finance, Bloomberg, or Reuters. When calculating how to calculate CAPM alpha in excel, it’s crucial to use consistent historical data for both the asset and the market to ensure an accurate comparison. Understanding these components allows for a more informed approach to how to calculate CAPM alpha in excel.

How to Calculate Expected Return with CAPM in Excel

This section details how to calculate CAPM alpha in Excel, offering a practical guide to implementing the Capital Asset Pricing Model (CAPM) formula. The CAPM formula (Required Return = Risk-Free Rate + Beta * (Market Return – Risk-Free Rate)) can be easily translated into an Excel calculation to determine the expected return of an investment. This expected return is crucial when you want to know how to calculate capm alpha in excel.

To begin, open a new Excel spreadsheet. Designate specific cells for each variable in the CAPM formula: the risk-free rate, beta, and market return. For example, cell A1 could hold the risk-free rate, cell A2 the beta, and cell A3 the market return. Input the corresponding values into these cells. Ensure these values are expressed in the same format (e.g., as decimals or percentages). The risk-free rate might be 0.03 (3%), beta could be 1.2, and the market return could be 0.08 (8%). Next, in a separate cell (e.g., A4), enter the CAPM formula using cell references. The formula in cell A4 would be: =A1 + A2 * (A3 – A1). This Excel formula calculates the expected return based on the provided inputs. After entering the formula, cell A4 will display the calculated expected return. This shows you exactly how to calculate capm alpha in excel.

Let’s consider a detailed example. Assume the risk-free rate is 4% (0.04), beta is 1.15, and the expected market return is 10% (0.10). Input these values into Excel. Using the CAPM formula, the calculation would be: 0.04 + 1.15 * (0.10 – 0.04). In Excel, with the values in cells A1, A2, and A3 respectively, the formula =A1 + A2 * (A3 – A1) would yield an expected return of 0.109, or 10.9%. By calculating the expected return, you’re setting the stage for further analysis. This step is critical to understand how to calculate capm alpha in excel, where you compare this expected return to the asset’s actual return. Therefore, this process demonstrates how to calculate capm alpha in excel using the CAPM model effectively.

Gathering the Necessary Data for Your Analysis

To effectively estimate alpha and understand how to calculate capm alpha in excel, gathering accurate and relevant data is essential. Beta, a measure of an investment’s volatility relative to the market, is a key input for the Capital Asset Pricing Model (CAPM). Reputable financial websites like Yahoo Finance, Bloomberg, and Reuters are valuable resources for obtaining beta values. When selecting a beta, consider using an adjusted beta, which statistically adjusts the raw beta towards 1, reflecting the tendency of beta to revert to the mean over time. Understanding how to calculate capm alpha in excel begins with sourcing the right inputs, and adjusted beta can provide a more stable estimate for your calculations.

Obtaining the risk-free rate is another crucial step in how to calculate capm alpha in excel. The yield on a U.S. Treasury bond with a maturity similar to the investment horizon is commonly used as the risk-free rate. Websites of government agencies, such as the U.S. Department of the Treasury, provide access to current and historical Treasury yields. For market return data, consider using a broad market index like the S&P 500. Historical data for market returns can be found on financial data provider websites and academic databases. Ensure that the time period for the market return data aligns with the time period used for calculating the asset’s returns, ensuring consistency in your analysis. Learning how to calculate capm alpha in excel relies on consistent and reliable data.

When gathering data, the importance of using consistent data sources and time periods cannot be overstated when considering how to calculate capm alpha in excel. If the beta is from one provider, the market return data should ideally come from the same or a highly reputable source to minimize discrepancies. The time frame over which data is collected significantly impacts the results; a shorter time frame might be more sensitive to recent market conditions, while a longer timeframe provides a broader perspective. Documenting data sources and time periods is important for transparency and replicability. The accuracy of your alpha estimate depends on the quality and consistency of the data used in the CAPM calculation. Understanding how to calculate capm alpha in excel accurately requires careful attention to data gathering and validation.

Calculating Historical Alpha: Finding the Difference

Historical alpha represents the actual excess return an investment generated compared to its expected return, as predicted by the Capital Asset Pricing Model (CAPM). This involves comparing past performance against what the CAPM suggested the investment should have returned, given its risk profile and market conditions. To determine how to calculate CAPM alpha in Excel, one must first gather the necessary historical data.

Begin by collecting historical return data for the asset being analyzed. This data should span a significant period (e.g., monthly or yearly for at least 3-5 years) to provide a reasonable sample size. Simultaneously, gather corresponding historical data for the risk-free rate (e.g., Treasury yields) and the market return (e.g., S&P 500 index returns) for the same period. These data points are crucial for calculating the expected return using the CAPM formula for each period. With this information, you will know how to calculate CAPM alpha in Excel more proficiently. In Excel, input the historical risk-free rate, beta, and market return into separate columns. Then, apply the CAPM formula (Expected Return = Risk-Free Rate + Beta * (Market Return – Risk-Free Rate)) to calculate the expected return for each period. Finally, subtract the calculated expected return from the actual historical return of the asset to determine the historical alpha for that period. This difference reveals the investment’s outperformance (positive alpha) or underperformance (negative alpha) relative to the CAPM’s prediction. Analyzing these alpha values over time provides insights into the investment’s consistency in generating excess returns.

For example, assume you have historical data for a stock, the risk-free rate, and the S&P 500 returns for a specific year. Using the CAPM formula in Excel, you calculate an expected return of 10% for the stock. If the stock’s actual return for that year was 15%, the historical alpha would be 5% (15% – 10%). Repeat this calculation for each year or month in your dataset to create a series of alpha values. This series can then be analyzed to identify trends and patterns in the investment’s performance. Knowing how to calculate CAPM alpha in Excel using historical data provides a valuable tool for evaluating investment performance. This approach facilitates a more informed assessment of an investment’s ability to generate returns above what is expected based on its risk profile and prevailing market conditions, which is key to understanding how to calculate CAPM alpha in Excel.

Analyzing Alpha Results and Identifying Trends

The interpretation of calculated alpha is crucial for evaluating investment performance. A positive alpha indicates that the investment has outperformed its expected return based on the Capital Asset Pricing Model (CAPM). Conversely, a negative alpha suggests underperformance, meaning the investment yielded lower returns than anticipated given its risk profile. A zero alpha implies the investment performed exactly as predicted by the CAPM model. Investors often seek investments that demonstrate a consistent positive alpha, signaling a potential for superior returns. Understanding how to calculate capm alpha in excel is essential for this analysis.

Excel offers powerful tools for visualizing alpha over time. By creating line charts, you can observe trends and patterns in the alpha values. These charts can reveal whether alpha is consistently positive, negative, or fluctuating. To calculate the average alpha over a specific period, use the AVERAGE() function in Excel. This provides a single metric summarizing the overall performance of the investment relative to its expected return. For example, if analyzing monthly alpha values, the formula would be “=AVERAGE(range of alpha values)”. How to calculate capm alpha in excel can be more easier using excel functions.

It’s important to consider the time period over which alpha is measured. A short-term alpha might be influenced by market volatility or specific events, while a long-term alpha provides a more reliable indication of consistent outperformance or underperformance. However, remember that historical alpha is not necessarily a predictor of future performance. Market conditions, company-specific factors, and other variables can all impact future returns. While knowing how to calculate capm alpha in excel is helpful, the CAPM has limitations and historical alpha is just one piece of the puzzle. Also, remember to use active voice instead of passive voice. Furthermore, it can be combined with other investment analysis techniques to get better insights on how to calculate capm alpha in excel.

Limitations and Considerations When Using CAPM

The Capital Asset Pricing Model (CAPM), while a valuable tool, possesses inherent limitations. These limitations should be acknowledged when interpreting alpha calculations. One key limitation is its reliance on historical data. The model assumes that past relationships between risk and return will hold true in the future, which may not always be the case. Market conditions and investor sentiment can shift, altering these relationships and impacting the accuracy of the expected return. Understanding how to calculate CAPM alpha in excel requires awareness of these assumptions.

Another consideration is the assumption of efficient markets. CAPM operates under the assumption that markets are efficient, meaning that all available information is already reflected in asset prices. In reality, markets are not always perfectly efficient, and opportunities for abnormal returns (alpha) may exist due to market inefficiencies or behavioral biases. Furthermore, the beta coefficient, a crucial input in the CAPM formula, can be unstable and influenced by various factors. Changes in a company’s financial structure, industry dynamics, or macroeconomic conditions can all impact its beta, affecting the accuracy of the CAPM-derived expected return. It’s important to note that beta is often calculated using historical data, which may not accurately reflect future volatility. To effectively calculate how to calculate CAPM alpha in excel, one must consider these influencing factors on beta.

The CAPM should not be viewed as a perfect predictor of investment performance. The model is a simplification of complex market dynamics and may oversimplify investment risk. Other factors, such as company-specific news, industry trends, and macroeconomic events, can significantly influence asset returns. Therefore, the CAPM should be used in conjunction with other investment analysis techniques, such as fundamental analysis and technical analysis, to gain a more comprehensive understanding of an investment’s potential. Investors seeking how to calculate CAPM alpha in excel should remember that it is a tool to be used with careful consideration of its limitations, rather than a definitive answer. While useful, one should not consider it the final word for investment decisions. Understanding how to calculate CAPM alpha in excel necessitates a comprehensive approach to investment analysis, integrating CAPM with other methods.

Beyond the Basics: Refining Your Alpha Calculation

To enhance the accuracy and relevance of your alpha calculation, several refinements can be implemented. Instead of relying solely on a broad market index like the S&P 500, consider incorporating different market benchmarks that more closely align with the asset’s specific characteristics. For instance, if analyzing a small-cap stock, utilizing a small-cap index as the benchmark might provide a more meaningful comparison. Similarly, for international investments, employing a relevant international market index is advisable. This targeted approach allows for a more precise assessment of excess return relative to a comparable market segment. Furthermore, exploring adjustments to the beta value can significantly impact the final alpha calculation. Standard beta values often reflect overall market sensitivity but may not fully capture industry-specific risks or company-specific factors. Industry-adjusted beta, which considers the volatility of companies within the same sector, can offer a more nuanced perspective on an asset’s risk profile. How to calculate capm alpha in excel using different beta values enhances the robustness of the analysis.

More sophisticated risk models beyond the traditional Capital Asset Pricing Model (CAPM) can also be used. Factor models, such as the Fama-French three-factor model or other multi-factor models, account for additional risk factors beyond market risk, like size and value premiums. These models may provide a more accurate estimate of expected return, leading to a more reliable alpha calculation. While a detailed exploration of these models is beyond the scope of this guide, understanding their existence and potential benefits is crucial for advanced investment analysis. Remember that how to calculate capm alpha in excel is a starting point, and further refinement is often necessary.

Continuously refining and improving your investment analysis process is paramount. Regularly review the data sources, methodologies, and assumptions used in your alpha calculation. Stay updated on new research and developments in financial modeling. Experiment with different approaches and compare the results. Embrace a mindset of continuous learning and adaptation to ensure that your investment analysis remains relevant and effective. Remember that how to calculate capm alpha in excel provides a solid foundation, but ongoing effort is essential for achieving superior investment outcomes. By incorporating these enhancements and maintaining a commitment to improvement, investors can gain a deeper understanding of asset performance and make more informed investment decisions. Also, the process of how to calculate capm alpha in excel can be automated using excel formulas, reducing manual errors and saving time.