Understanding Bond Basics: Principal, Interest, and Term

To understand how to calculate bond payments, one must first grasp the fundamental concepts. The principal represents the initial loan amount. The interest rate is the percentage charged annually on the outstanding principal. The loan term defines the repayment period, typically expressed in months or years. These three factors—principal, interest rate, and loan term—interactively determine the size of each payment. A higher principal, a higher interest rate, or a longer loan term all result in larger monthly payments. Amortization is the process of gradually paying off the loan over time, with each payment covering both interest and principal. For example, a $200,000 loan at 5% interest over 30 years will have significantly higher monthly payments than a $100,000 loan at the same interest rate and term. Understanding this interplay is crucial for accurately calculating bond payments and making informed financial decisions. How to calculate bond payments effectively relies on a clear understanding of these core components.

Let’s illustrate with a simplified example. Imagine a bond with a $10,000 principal, a 10% annual interest rate, and a 1-year term. Without considering any calculation method, you can see that a larger principal would result in larger payments. Similarly, a higher interest rate would increase the payment amount and a longer repayment period (loan term) would decrease each individual payment, although increasing the total amount paid over the life of the loan. Understanding these basic relationships helps one to understand how the bond payment calculation works. This is critical when learning how to calculate bond payments accurately.

The process of amortization involves paying down both principal and interest each month. Early payments mostly consist of interest, while later payments consist primarily of principal. To calculate your monthly payments accurately, one must know how to account for this reduction in principal throughout the loan term. This gradual repayment is a key element of understanding how to calculate bond payments precisely. This understanding also enables the exploration of different loan scenarios and informed decision making regarding the total cost of borrowing.

The Formula Unveiled: Calculating Your Monthly Bond Payment

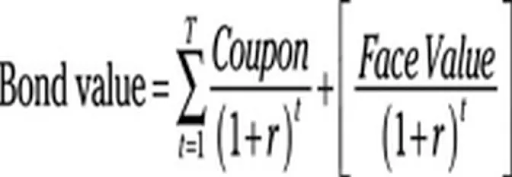

Understanding how to calculate bond payments involves using a specific formula. This formula considers three key factors: the principal loan amount (P), the monthly interest rate (r), and the total number of payments (n). The monthly interest rate is calculated by dividing the annual interest rate by 12. The total number of payments is determined by multiplying the loan term (in years) by 12. The formula itself provides a precise calculation for your monthly payment. It is crucial to accurately determine these values before proceeding with the calculation to ensure an accurate result when learning how to calculate bond payments.

The standard formula to calculate monthly bond payments is: M = P [ r(1 + r)^n ] / [ (1 + r)^n – 1]. In this equation, ‘M’ represents the monthly payment. ‘P’ represents the principal loan amount. ‘r’ represents the monthly interest rate. ‘n’ represents the total number of payments over the loan’s lifetime. This formula takes into account the compounding effect of interest, which means interest is calculated not just on the principal but also on accumulated interest. Accurately applying this formula is essential for determining the correct monthly payment. Mastering how to calculate bond payments efficiently requires a solid grasp of this formula and its components.

To illustrate, let’s consider a simple example. Suppose you borrow $100,000 (P) at an annual interest rate of 6% (meaning a monthly rate, r, of 0.06/12 = 0.005), with a loan term of 20 years (n = 20 * 12 = 240 payments). Plugging these values into the formula will reveal your precise monthly payment amount. Understanding how to calculate bond payments correctly is important for both borrowers and lenders. It ensures transparency and accuracy in financial transactions. The formula, while seemingly complex, provides a straightforward method for calculating monthly payments once you understand each component and how they interact. Accurate calculation of bond payments is critical for effective financial planning.

Step-by-Step Calculation: A Practical Example of How to Calculate Bond Payments

To understand how to calculate bond payments, let’s work through a practical example. Suppose a borrower takes out a loan of $200,000 (principal) at a fixed annual interest rate of 6%. The loan term is 25 years, meaning monthly payments are made over 300 months (25 years * 12 months/year). We’ll use the following formula: M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1], where M = monthly payment, P = principal, i = monthly interest rate (annual rate/12), and n = total number of payments.

First, calculate the monthly interest rate: i = 0.06/12 = 0.005. Next, calculate the numerator of the formula: 0.005 (1 + 0.005)^300 = 0.005 * 4.467744 = 0.0223387. Then, calculate the denominator: (1 + 0.005)^300 -1 = 4.467744 – 1 = 3.467744. Finally, divide the numerator by the denominator and multiply by the principal: M = $200,000 * (0.0223387 / 3.467744) = $1288.18. Therefore, the monthly payment for this bond is approximately $1288.18. This detailed explanation shows how to calculate bond payments accurately. Understanding this process is crucial for responsible financial planning.

This step-by-step guide on how to calculate bond payments clarifies the process. The formula may seem complex initially, but breaking it down into smaller, manageable steps simplifies the calculation. Remember to always double-check your figures. Accurate calculation of bond payments is essential for budgeting and financial forecasting. Using a spreadsheet program can further streamline this process and minimize calculation errors. It’s crucial to understand how to calculate bond payments for effective financial management.

Exploring Different Loan Types: Fixed-Rate vs. Variable-Rate Bonds

Understanding the difference between fixed-rate and variable-rate bonds is crucial when learning how to calculate bond payments. A fixed-rate bond offers a consistent interest rate throughout the loan term. This predictability simplifies the calculation process, as the monthly payment remains unchanged. Knowing how to calculate bond payments accurately under this stable interest rate scenario is fundamental. Borrowers appreciate the financial stability offered by a fixed-rate bond, allowing for better budgeting and financial planning. The total interest paid over the life of the loan is also known upfront, enabling informed borrowing decisions. Conversely, variable-rate bonds come with an interest rate that fluctuates based on market conditions. This variability directly impacts the monthly payment, which can increase or decrease over time. Accurately calculating bond payments for variable-rate loans requires a more dynamic approach, involving recalculation each time the interest rate changes. How to calculate bond payments in this context needs special care and understanding of the underlying market forces influencing the interest rate. While the initial payments may be lower, borrowers face greater uncertainty concerning their future financial commitments.

The choice between a fixed-rate and variable-rate bond depends largely on individual circumstances and market forecasts. If interest rates are expected to rise, a fixed-rate bond may be more appealing. This locks in a lower rate for the duration of the loan. Conversely, if interest rates are expected to fall, a variable-rate bond could offer lower payments initially, though this comes with the risk of increased payments in the future. When learning how to calculate bond payments, understanding these dynamics allows for a proper evaluation of financial risks and rewards. Careful consideration of personal risk tolerance and financial goals is paramount when deciding between these two loan types. For instance, a borrower with a stable income and long-term financial horizon might favor a variable-rate bond if rates are predicted to decline, aiming to benefit from lower initial payments. Conversely, those with fluctuating incomes might prefer the predictability of a fixed-rate bond to mitigate the risks associated with fluctuating payments.

Ultimately, knowing how to calculate bond payments for both fixed and variable rate loans empowers borrowers to make informed decisions. The ability to assess the potential impact of interest rate changes on monthly payments and the total cost of borrowing is critical to selecting the most suitable loan product. Thorough understanding of these calculations is essential for responsible financial management. Whether using a formula, online calculator, or spreadsheet, mastering how to calculate bond payments will lead to better financial outcomes.

Impact of Interest Rate Changes: Sensitivity Analysis

Understanding how interest rate fluctuations affect monthly bond payments is crucial when planning your finances. A sensitivity analysis helps visualize this impact. This analysis demonstrates how to calculate bond payments under varying interest rate scenarios. Consider a loan of $200,000 with a 5% annual interest rate over 25 years (300 monthly payments). Using the standard bond payment formula, the monthly payment is approximately $1,073.64. Now, let’s examine the effect of a 1% increase and a 1% decrease in the interest rate.

With a 6% annual interest rate, the monthly payment increases to roughly $1,200. This represents a $126.36 higher monthly outlay. Conversely, reducing the interest rate to 4% lowers the monthly payment to approximately $959.28. This is a saving of approximately $114.36 per month. The cumulative effect over the 25-year loan term is substantial. A higher interest rate significantly increases the total interest paid over the life of the loan. Conversely, a lower interest rate results in considerable savings. This highlights the importance of securing a favorable interest rate when taking out a bond. Careful consideration of interest rate fluctuations is key to effectively managing bond payments and overall financial planning. The impact on how to calculate bond payments is directly linked to interest rate variations. This exercise is vital for making well-informed financial decisions.

This sensitivity analysis demonstrates the power of even small interest rate changes. It’s a valuable tool when comparing different bond offers. The analysis allows for informed decisions based on understanding the long-term financial implications of various interest rates. By varying the interest rate input within the bond payment formula, one can easily determine the financial impact of different borrowing costs. This underscores the importance of how to calculate bond payments accurately, considering the sensitivity to interest rate fluctuations. Prospective borrowers should always carefully assess interest rate offers and conduct their own sensitivity analysis to make financially sound decisions. Accurate calculation of bond payments is essential for responsible financial planning.

Factors Influencing Your Bond Payment: Loan Term and Down Payment

Understanding the relationship between loan term and monthly payments is crucial when learning how to calculate bond payments. A shorter loan term means you pay off the debt faster. This results in higher monthly payments. However, you’ll pay significantly less interest overall. Conversely, a longer loan term leads to lower monthly payments. The trade-off is that you’ll pay substantially more interest over the life of the loan. Choosing the right loan term involves balancing affordability with the long-term cost of borrowing. This decision significantly impacts how to calculate bond payments accurately, reflecting the total cost of ownership.

The down payment also plays a pivotal role in determining your monthly bond payment. A larger down payment reduces the principal loan amount. This directly translates to lower monthly payments. By reducing the principal, you’re effectively reducing the amount on which interest is calculated. A substantial down payment can substantially reduce the total amount you pay over the loan term. Therefore, understanding how to calculate bond payments requires considering both the loan term and the down payment for a complete financial picture. The interplay of these factors demonstrates the importance of careful planning before committing to a bond.

To illustrate, consider two scenarios for a $200,000 bond at a 5% interest rate. A 15-year loan will have higher monthly payments than a 30-year loan. However, the total interest paid over 15 years will be considerably less than over 30 years. A larger down payment, say 20% versus 10%, will also reduce the monthly payment for both loan terms. Mastering how to calculate bond payments involves understanding these interactions and how they affect your overall financial obligations. This knowledge empowers you to make informed decisions aligned with your financial goals. Careful consideration of loan term and down payment will optimize how to calculate bond payments and ultimately, minimize your borrowing costs.

Using Online Calculators and Spreadsheets: Streamlining the Process

Calculating bond payments manually can be time-consuming and prone to errors. Fortunately, numerous online resources simplify the process. Many reputable financial websites offer free bond payment calculators. These calculators require users to input the principal loan amount, interest rate, and loan term. The calculator then performs the necessary calculations and provides the monthly payment amount. Using these tools significantly reduces the likelihood of mathematical mistakes and saves valuable time. Remember to always double-check the inputs to ensure accuracy in the results, particularly when learning how to calculate bond payments.

Alternatively, spreadsheet software like Microsoft Excel or Google Sheets provides a powerful way to calculate bond payments. These programs allow users to create custom formulas that automatically perform the calculations. This approach offers greater flexibility and transparency. Users can easily adjust input values and instantly see the impact on the monthly payment. A simple formula to calculate monthly bond payments in a spreadsheet is: `=PMT(rate/nper, nper, pv)`, where ‘rate’ is the annual interest rate divided by the number of payments per year, ‘nper’ is the total number of payments, and ‘pv’ is the present value (principal loan amount). Mastering how to calculate bond payments using spreadsheets gives you complete control over the calculations and enables scenario analysis by changing various parameters.

Understanding how to calculate bond payments using both online calculators and spreadsheets empowers individuals to make informed decisions regarding their borrowing. Whether using a quick online tool or a customizable spreadsheet, the goal remains the same: to accurately determine the monthly payment and the overall cost of the bond. By leveraging these tools, individuals can confidently manage their finances and plan effectively for their long-term financial goals. This comprehensive approach to understanding how to calculate bond payments allows for detailed analysis and better financial management. The accuracy of these calculations is critical for informed decision-making.

Avoiding Common Mistakes: Ensuring Accuracy in Your Calculations

Accurately calculating bond payments is crucial for financial planning. One common error involves misinterpreting the interest rate. The annual interest rate must be converted to a monthly rate before applying the formula for how to calculate bond payments. Failure to do so leads to significantly inaccurate results. Always divide the annual interest rate by 12 to obtain the correct monthly rate. Another frequent mistake is using an incorrect number of payments. The loan term must be expressed in months, not years. Multiply the loan term in years by 12 to determine the total number of payments. Carefully review these inputs to prevent errors in how to calculate bond payments.

Incorrectly applying the order of operations within the bond payment formula is another potential pitfall. Remember to follow the standard order of operations (PEMDAS/BODMAS) to ensure accurate calculations. Parentheses, exponents, multiplication and division (from left to right), and then addition and subtraction (from left to right) must be followed precisely. A small error in this process can lead to a substantial difference in the calculated monthly payment. Utilizing a calculator or spreadsheet program can help mitigate this risk. Always double-check your inputs and calculations to ensure accuracy when you learn how to calculate bond payments. Errors can arise from simple typos or miscalculations, highlighting the importance of careful review.

Finally, understanding the concept of compounding interest is essential. Many individuals overlook how interest accrues over time. Bond payment calculations involve compounding interest, meaning interest is calculated not only on the principal but also on the accumulated interest. Ignoring this aspect will lead to an underestimation of the total repayment amount. Mastering how to calculate bond payments correctly requires understanding the intricacies of compounding interest and applying the appropriate formula precisely. Using online calculators or spreadsheets can serve as a useful check to ensure that the calculations are performed correctly, offering a valuable tool for how to calculate bond payments and confirming the accuracy of manual calculations. Remember, careful attention to detail and a thorough understanding of the formula are key to accurate bond payment calculations.