Understanding Discount Rates: The Foundation

A discount rate represents the return an investor expects on an investment. It’s crucial for determining the present value of future cash flows. Essentially, it reflects the time value of money; receiving $100 today is worth more than receiving $100 a year from now due to potential investment opportunities. This principle is fundamental to various financial decisions, impacting investment appraisals, project feasibility studies, and valuation of assets. Understanding how to calculate a discount rate in Excel is key to accurate financial modeling. The discount rate is used across many industries, including finance, real estate, and business analysis, for valuing projects and investments.

The choice of discount rate significantly affects the outcome of financial analyses. An inappropriate discount rate can lead to flawed investment decisions. For example, an overly optimistic discount rate could lead to accepting unprofitable projects, while an overly conservative rate could cause the rejection of potentially profitable ventures. Learning how to calculate a discount rate in Excel correctly is therefore vital. Different methods exist for determining the appropriate discount rate, depending on the context and risk involved. Choosing the appropriate methodology is critical for sound financial analysis.

Consider the scenario of evaluating a potential business venture. To assess its profitability, one must project future cash inflows and discount them back to their present value using an appropriate discount rate. This discounted cash flow (DCF) analysis enables a comparison of the investment’s present value against its initial cost. How to calculate a discount rate in Excel, therefore, directly impacts the accuracy of this crucial valuation. The higher the perceived risk of the venture, the higher the discount rate applied, reducing the present value of future cash flows. A low-risk investment would use a lower discount rate, reflecting the lower expected return.

Different Methods for Determining the Discount Rate

Several approaches exist for determining the appropriate discount rate. Understanding how to calculate a discount rate in Excel is crucial for accurate financial modeling. The Weighted Average Cost of Capital (WACC) represents a company’s overall cost of financing, considering both debt and equity. It weighs each source of capital by its proportion in the company’s capital structure. The calculation involves determining the cost of equity and the cost of debt, then weighting them accordingly. Limitations include the assumptions about the stability of the capital structure and the cost of each component. For example, fluctuations in market conditions can significantly impact the cost of equity.

The Capital Asset Pricing Model (CAPM) provides another method to determine the discount rate, focusing on the risk associated with an investment. How to calculate a discount rate in Excel using CAPM involves identifying the risk-free rate, the market risk premium, and the investment’s beta. The risk-free rate represents the return on a virtually risk-free investment, like a government bond. The market risk premium measures the excess return of the market over the risk-free rate. Beta reflects the investment’s volatility relative to the overall market. CAPM offers a systematic way to assess and incorporate risk into the discount rate calculation. A key limitation lies in accurately estimating the inputs, particularly beta, which can vary depending on the estimation method and time period considered. Understanding how to calculate a discount rate in Excel using CAPM requires careful consideration of data reliability.

Finally, the risk-free rate of return can serve as a discount rate, particularly for low-risk investments. This straightforward approach simplifies the calculation. It assumes no risk associated with the investment, leading to a lower discount rate. The risk-free rate typically comes from government bond yields. This method is simple to implement, but it may not accurately reflect the risk inherent in many real-world investment scenarios. How to calculate a discount rate in Excel using the risk-free rate is particularly simple, making it a practical option when dealing with low-risk projects. However, relying solely on the risk-free rate can underestimate the true opportunity cost of capital in riskier ventures. Determining the appropriate discount rate method depends heavily on the specific investment and its inherent risk profile. Accurate application of these methods is essential for sound financial decision-making.

Calculating Discount Rates Using the WACC Method in Excel

This section details how to calculate a discount rate in Excel using the Weighted Average Cost of Capital (WACC) method. The WACC represents a company’s overall cost of financing, considering both debt and equity. Understanding how to calculate a discount rate in excel using the WACC is crucial for valuing projects and investments. To calculate the WACC, one needs several key inputs. These include the cost of equity, the cost of debt, the tax rate, and the proportions of debt and equity in the company’s capital structure. Accurate calculation of the discount rate is vital for effective financial modeling.

Let’s use a hypothetical example. Suppose a company has a cost of equity of 12%, a cost of debt of 6%, a tax rate of 30%, and a debt-to-equity ratio of 0.4. This means that 40% of the company’s financing comes from debt, and 60% comes from equity. In Excel, you would input these values into separate cells. For instance, cell A1 could contain the cost of equity (0.12), cell B1 the cost of debt (0.06), cell C1 the tax rate (0.30), cell D1 the weight of debt (0.40), and cell E1 the weight of equity (0.60). The formula to calculate the WACC in cell F1 would be: `= (B1 * (1-C1) * D1) + (A1 * E1)`. This formula calculates the after-tax cost of debt and weighs it by the proportion of debt in the capital structure, adds it to the cost of equity, which is weighted by the proportion of equity. The result in cell F1 will represent the WACC, which serves as the discount rate. Learning how to calculate a discount rate in excel efficiently is paramount for financial analysis.

Using screenshots would visually enhance this explanation. A screenshot showing the Excel sheet with the input values and the formula would provide a clear and concise visual guide. Remember, accurate data input is paramount when learning how to calculate a discount rate in Excel. Incorrect input can lead to inaccurate WACC calculations and flawed financial decisions. Always double-check your data entries and formulas to ensure the accuracy of your discount rate calculation. Mastering how to calculate a discount rate in Excel empowers you to make informed financial decisions. The ability to accurately determine a company’s discount rate enables more precise valuations, better investment choices and improved overall financial planning. Regular practice and attention to detail are key to becoming proficient in this essential skill.

Employing the CAPM Approach in Excel for Discount Rate Determination

The Capital Asset Pricing Model (CAPM) offers another method to determine the discount rate. This model considers the risk-free rate, the market risk premium, and the beta of the investment. Learning how to calculate a discount rate in Excel using CAPM involves understanding these key inputs. The risk-free rate represents the return on a virtually risk-free investment, often approximated by the yield on government bonds. The market risk premium reflects the extra return investors demand for taking on market risk, typically calculated as the difference between the expected market return and the risk-free rate. Beta measures the investment’s volatility relative to the overall market; a beta of 1 indicates the investment moves in line with the market, while a beta greater than 1 suggests higher volatility. To calculate the discount rate using CAPM, one employs the following formula: Discount Rate = Risk-Free Rate + Beta * Market Risk Premium. Mastering how to calculate a discount rate in Excel using this method is crucial for accurate financial analysis.

Let’s illustrate a practical example. Assume a risk-free rate of 2%, a market risk premium of 6%, and a beta of 1.2 for a specific investment. To calculate the discount rate in Excel, you would enter these values into separate cells (e.g., A1 for Risk-Free Rate, A2 for Beta, A3 for Market Risk Premium). In a fourth cell (e.g., A4), you’d input the formula: =A1+A2*A3. This formula directly implements the CAPM equation, providing the discount rate as the output. This straightforward approach demonstrates how to calculate a discount rate in Excel efficiently and effectively. The result (10%) represents the discount rate appropriate for that specific investment, considering its risk profile relative to the market. Understanding how to calculate a discount rate in Excel using the CAPM method allows for a more nuanced and risk-adjusted approach to financial decision-making.

Excel’s capabilities extend beyond simple calculations. For instance, you could use data validation to ensure accurate input of the risk-free rate, beta, and market risk premium. This reduces errors commonly encountered when calculating a discount rate in Excel. Furthermore, you can easily adapt this method to analyze multiple investments simultaneously by creating a table with separate rows for each investment and using corresponding cell references in the formula. Remember that the accuracy of the CAPM-derived discount rate hinges on the accuracy of its inputs; using reliable data sources for the risk-free rate, market risk premium, and beta is paramount. Regularly reviewing and updating these inputs ensures that the discount rate calculation remains relevant and reflects current market conditions. Effectively employing the CAPM within Excel allows for a robust and adaptable approach to how to calculate a discount rate in Excel for various investment scenarios. This detailed process significantly aids in producing more precise and insightful financial models.

Using the Risk-Free Rate as a Discount Rate: When and Why

The risk-free rate represents the theoretical rate of return of an investment with zero risk. It’s often used as a benchmark for evaluating riskier investments. Understanding how to calculate a discount rate in Excel, even a simple one like the risk-free rate, is fundamental. This rate provides a baseline for comparison, reflecting the time value of money without considering any investment risk. Government bonds, particularly long-term Treasury bonds, are commonly used as proxies for the risk-free rate, as they are considered exceptionally low-risk.

Employing the risk-free rate as a discount rate is appropriate when evaluating investments with minimal risk. For example, it might be suitable for discounting the future cash flows of a highly secure government-backed investment. This simplicity makes it valuable for situations where detailed risk analysis might be impractical or unnecessary. To obtain the risk-free rate for discount rate calculations in Excel, one might access yield data from financial websites, such as government bond yield curves. These curves display yields for various maturities. Selecting an appropriate maturity depends on the investment’s cash flow timeframe. For instance, if projecting cash flows over five years, the five-year Treasury bond yield would serve as a suitable risk-free rate.

Once the risk-free rate is obtained, incorporating it into Excel for discounting future cash flows is straightforward. Assume a series of future cash flows and a risk-free rate. The present value of each cash flow is calculated by dividing the future cash flow by (1 + risk-free rate)^n, where ‘n’ is the number of periods until the cash flow is received. Excel’s built-in functions, such as PV, simplify this process. Remember that while using the risk-free rate simplifies how to calculate a discount rate in Excel, it ignores investment-specific risks. This method is suitable only for low-risk scenarios, not suitable for all situations where a more complex calculation, such as WACC or CAPM, would be more appropriate. Accurate application of this approach relies on selecting a relevant risk-free rate and appropriately adjusting it for the investment’s timeframe.

Applying Discount Rates to Calculate Net Present Value (NPV)

The discount rate, calculated using methods like WACC or CAPM, is crucial for determining the Net Present Value (NPV) of an investment. NPV represents the difference between the present value of cash inflows and the present value of cash outflows over a period of time. A positive NPV suggests the investment is likely profitable, while a negative NPV indicates it may result in a loss. Learning how to calculate a discount rate in excel is essential for accurate NPV calculations. To find the present value of future cash flows, one uses the discount rate within Excel’s NPV function. This function efficiently handles the discounting of multiple cash flows to their present values, providing a single NPV value. The formula considers the timing and magnitude of each cash flow, providing a comprehensive evaluation of the investment’s worth.

Excel’s NPV function simplifies the process significantly, automating the calculations involved in discounting each future cash flow. The function requires the discount rate as a key input alongside a series of future cash flows. The output is the total NPV, a critical metric in investment appraisal. Understanding how to calculate a discount rate in excel and utilizing the NPV function effectively is fundamental for informed financial decision-making. For example, given a discount rate of 10% and a series of annual cash flows, the NPV function will return a single value representing the net present worth of these future earnings at the present time. This makes it straightforward to compare different investment opportunities based on their NPVs.

Interpreting the NPV requires understanding its implications. A positive NPV signifies that the present value of future cash inflows exceeds the initial investment cost. This suggests the investment is likely to generate a return exceeding the required rate of return (the discount rate). Conversely, a negative NPV indicates that the present value of cash inflows is less than the investment cost; hence the investment may not be worthwhile. Accurate calculation of the discount rate and proficient use of Excel’s NPV function are critical for correct interpretation. Mastering how to calculate a discount rate in excel, therefore, empowers users to make well-informed financial decisions based on sound NPV analysis. Remember, the choice of discount rate significantly influences the NPV calculation; therefore, a thorough understanding of appropriate discount rate selection methods is essential.

Advanced Techniques and Scenarios: Handling Variable Discount Rates

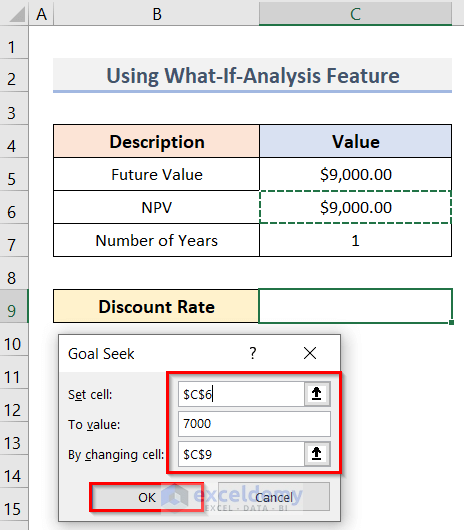

In many real-world financial scenarios, the discount rate remains constant throughout a project’s lifespan. However, understanding how to calculate a discount rate in Excel becomes more complex when dealing with variable discount rates. This often reflects changing risk profiles or anticipated economic shifts. For instance, a startup company might face a higher discount rate initially due to higher perceived risk, which gradually decreases as the business matures and becomes more stable. To account for this, one cannot simply use a single discount rate in Excel’s NPV function. Instead, each cash flow needs to be discounted individually using its corresponding discount rate for that specific period.

One method to handle this in Excel involves creating a separate column for each year’s discount rate. Then, for each cash flow, the present value is calculated by dividing the future cash flow by (1 + discount rate)^number of years. This formula is applied cell by cell, ensuring each cash flow uses its appropriate discount rate. Summing these individual present values provides the total Net Present Value (NPV) for the project, even with fluctuating discount rates. This approach requires careful data organization in the Excel spreadsheet and precise formula application, which is crucial for how to calculate a discount rate in Excel accurately. Visual aids, such as color-coding or conditional formatting, can enhance clarity and aid in error detection.

Another sophisticated technique involves using Excel’s XIRR function (Internal Rate of Return) instead of NPV. XIRR can directly calculate the discount rate that makes the NPV of a series of cash flows equal to zero, even with irregular cash flows and varying discount rates implied within the cash flow timing. This approach offers a more holistic view of project valuation when dealing with variable discount rates, providing a more accurate representation of the overall project return. Mastering how to calculate a discount rate in Excel using these advanced methods is vital for sophisticated financial modeling and provides invaluable insight into project viability and profitability under diverse economic conditions. Remember, data validation and thorough result checking remain paramount, regardless of the method used.

Troubleshooting Common Errors and Best Practices When Calculating Discount Rates in Excel

Accurately calculating a discount rate in Excel requires meticulous attention to detail. One common error involves incorrect data entry. Double-check all inputs, such as the cost of equity, cost of debt, tax rate, risk-free rate, market risk premium, and beta, for accuracy. Small errors in these inputs can significantly impact the final discount rate calculation. How to calculate a discount rate in excel accurately relies on validating your data before proceeding with calculations. Use Excel’s data validation tools to ensure data integrity. For instance, you can restrict inputs to numerical values or specific ranges. This prevents accidental entry of incorrect data types, a frequent source of errors when learning how to calculate a discount rate in excel.

Another frequent issue arises from misunderstanding Excel formulas. Ensure you use the correct syntax and cell references within formulas like those for WACC or CAPM. Understanding the order of operations within complex formulas is vital. Consult Excel’s help documentation or online resources if you encounter difficulties interpreting or troubleshooting specific formulas. When learning how to calculate a discount rate in excel, remember to clearly label all cells and inputs to improve readability and reduce errors. Organize your spreadsheet logically, using separate sections for inputs, calculations, and results. This structured approach aids in both efficiency and debugging. Employing clear and concise labels reduces confusion and makes it easier to identify the source of any errors. Regular checks during your calculation process will also help prevent significant problems.

Beyond formula accuracy, understanding the limitations of each discount rate method is crucial. The WACC, for example, assumes a constant capital structure. The CAPM relies on accurate estimations of beta and the market risk premium, which can be challenging. The risk-free rate itself can fluctuate. How to calculate a discount rate in excel effectively involves recognizing these limitations and choosing the appropriate method based on the specific circumstances of the investment. The method you choose also depends on the nature of the project. Remember to always document your assumptions and the rationale for your chosen method. Documenting your process also helps others understand and review your calculations. Consistent review helps ensure accuracy and consistency. By addressing these common pitfalls and adhering to these best practices, you will improve the accuracy and reliability of your discount rate calculations in Excel. This is essential for making sound investment decisions.