Unlocking the Secrets of Quantitative Analysis

In the world of finance, economics, and data-driven decision-making, quantitative analysis plays a vital role. It involves using mathematical and statistical techniques to analyze and interpret complex data, making it an essential tool for businesses, investors, and policymakers. To excel in this field, one must possess a deep understanding of quantitative analysis and its applications. A quant, or quantitative analyst, is responsible for developing and implementing mathematical models to drive business decisions, identify trends, and manage risk. To become a successful quant, one must possess strong analytical skills, a solid understanding of mathematical concepts, and the ability to communicate complex ideas effectively. By learning how to be a quant, individuals can unlock a rewarding and challenging career in quantitative finance.

Developing a Strong Foundation in Math and Programming

To succeed as a quant, one must possess a strong foundation in mathematical and programming skills. Linear algebra, calculus, and probability are essential mathematical concepts that form the basis of quantitative analysis. Proficiency in programming languages such as Python, R, or MATLAB is also crucial, as these tools are used to develop and implement mathematical models. A deep understanding of data structures, algorithms, and software design patterns is also necessary to efficiently process and analyze large datasets. By mastering these skills, individuals can develop a strong foundation in math and programming, paving the way to a successful career as a quant. Learning how to be a quant requires dedication and persistence, but the rewards are well worth the effort.

Mastering Financial Markets and Instruments

To succeed as a quant, it is essential to have a deep understanding of financial markets, instruments, and regulations. This includes knowledge of derivatives, such as options and futures, as well as risk management techniques, like value-at-risk and expected shortfall. Financial modeling is also a critical component, involving the development of mathematical models to analyze and predict market behavior. A quant must also be familiar with financial regulations, such as the Dodd-Frank Act and Basel Accords, which govern the financial industry. By mastering these concepts, individuals can gain a comprehensive understanding of the financial markets and instruments, a crucial step in learning how to be a quant. This knowledge will enable them to develop and implement effective trading strategies, manage risk, and drive business decisions.

Building a Career in Quantitative Finance

Breaking into the quantitative finance industry can be a challenging and competitive process. To increase their chances of success, individuals must develop a strong understanding of how to be a quant, including the skills and knowledge required to succeed in this field. Networking is a critical component, as it provides opportunities to connect with experienced professionals, learn about job opportunities, and stay up-to-date on industry trends. Building a strong resume, tailored to the quantitative finance industry, is also essential. This should include highlighting relevant mathematical and programming skills, as well as any experience working with financial markets and instruments. Acing interviews is also crucial, and individuals should be prepared to discuss their skills, experience, and knowledge of quantitative finance concepts. By following these tips, individuals can increase their chances of success and build a rewarding career in quantitative finance.

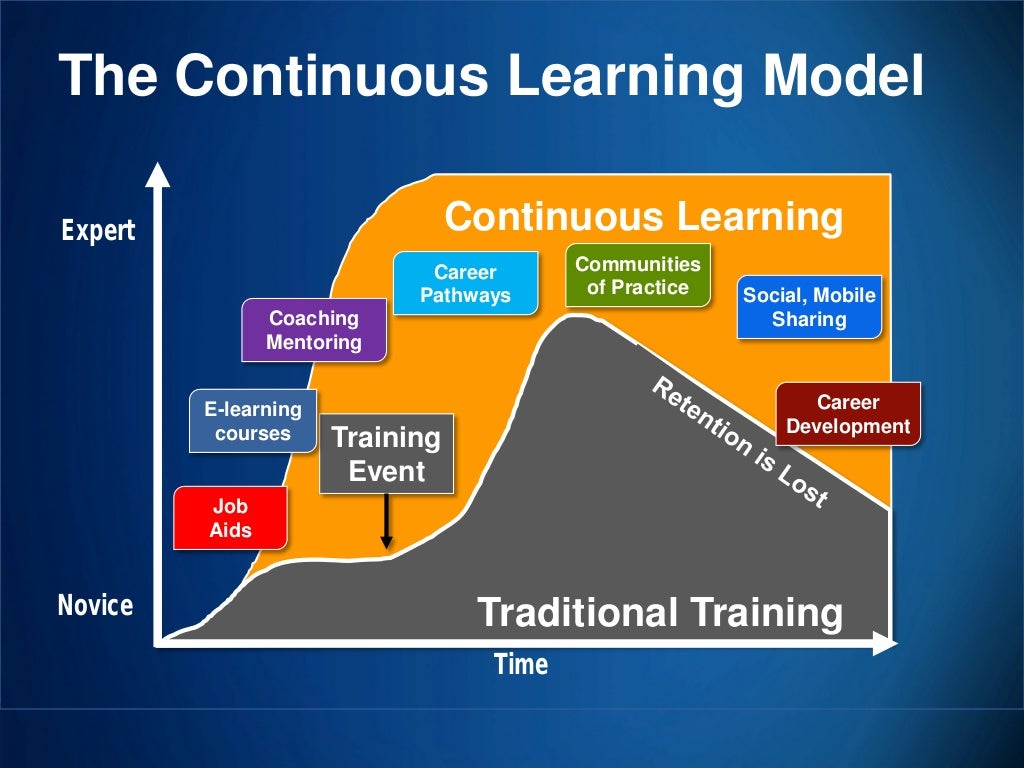

Staying Ahead of the Curve: Continuous Learning and Professional Development

The field of quantitative finance is constantly evolving, with new technologies, models, and techniques emerging regularly. To remain competitive and successful, quants must commit to ongoing learning and professional development. This involves staying up-to-date with the latest research and advancements in quantitative finance, as well as developing new skills and knowledge. Online courses, conferences, and industry publications are essential resources for quants looking to expand their expertise and stay current with industry trends. Additionally, participating in professional organizations and networking with other quants can provide valuable opportunities for learning and growth. By prioritizing continuous learning and professional development, individuals can increase their chances of success and achieve their goals of how to be a quant. This commitment to ongoing education and training is critical for staying ahead of the curve and achieving long-term success in the field of quantitative finance.

Essential Tools and Technologies for Quants

To succeed as a quant, it is essential to have a strong understanding of the key tools and technologies used in the field. Data visualization software, such as Tableau or Power BI, is critical for communicating complex data insights to stakeholders. Statistical packages, like R or Python, are also essential for data analysis and modeling. Additionally, cloud computing platforms, such as Amazon Web Services or Google Cloud, provide quants with the scalability and flexibility needed to handle large datasets and complex computations. Furthermore, programming languages like Python, MATLAB, or Julia are widely used in quantitative finance for tasks such as data manipulation, algorithm development, and model implementation. By mastering these essential tools and technologies, individuals can gain a competitive edge in the field and increase their chances of success in achieving their goal of how to be a quant. Staying up-to-date with the latest advancements in these tools and technologies is also crucial, as it enables quants to stay ahead of the curve and drive innovation in the field.

Overcoming Common Challenges Faced by Quants

As a quant, one is likely to encounter various challenges that can hinder success. Data quality issues, for instance, can lead to inaccurate models and poor decision-making. To overcome this challenge, quants must develop robust data cleaning and preprocessing techniques, as well as implement data validation and verification procedures. Model risk is another common challenge, where models may not accurately capture market dynamics or may be overly complex. To mitigate this risk, quants can employ techniques such as model validation, backtesting, and sensitivity analysis. Communication barriers can also arise when quants struggle to convey complex technical concepts to non-technical stakeholders. To overcome this challenge, quants must develop strong communication skills, including the ability to distill complex ideas into simple, actionable insights. By understanding these common challenges and developing strategies to overcome them, individuals can increase their chances of success in achieving their goal of how to be a quant. By staying vigilant and proactive in addressing these challenges, quants can drive innovation and growth in the field of quantitative finance.

Achieving Success as a Quant: Real-World Examples and Case Studies

To illustrate the path to success in quantitative finance, let’s examine real-world examples and case studies of successful quants. One notable example is a quant who developed a proprietary trading algorithm that generated significant returns for a major investment bank. This individual’s success was attributed to their strong foundation in mathematical modeling, programming skills in Python, and ability to communicate complex ideas to stakeholders. Another example is a quant who built a risk management framework for a leading financial institution, which resulted in significant cost savings and improved regulatory compliance. This individual’s achievement was due to their expertise in financial modeling, data analysis, and collaboration with cross-functional teams. By studying these examples and case studies, individuals can gain valuable insights into the skills, knowledge, and strategies required to achieve success as a quant and learn how to be a quant. These real-world examples demonstrate the impact that quants can have on the financial industry and provide inspiration for those pursuing a career in quantitative finance.