Understanding Callable Debt Securities: What Triggers a Bond’s Redemption?

Callable bonds are debt instruments that give the issuer the right, but not the obligation, to redeem the bond before its maturity date. Corporations issue callable bonds to gain flexibility in managing their debt. This is very useful to take advantage of potentially lower interest rates. The issuer may choose to refinance the debt at a lower rate if market conditions become favorable.

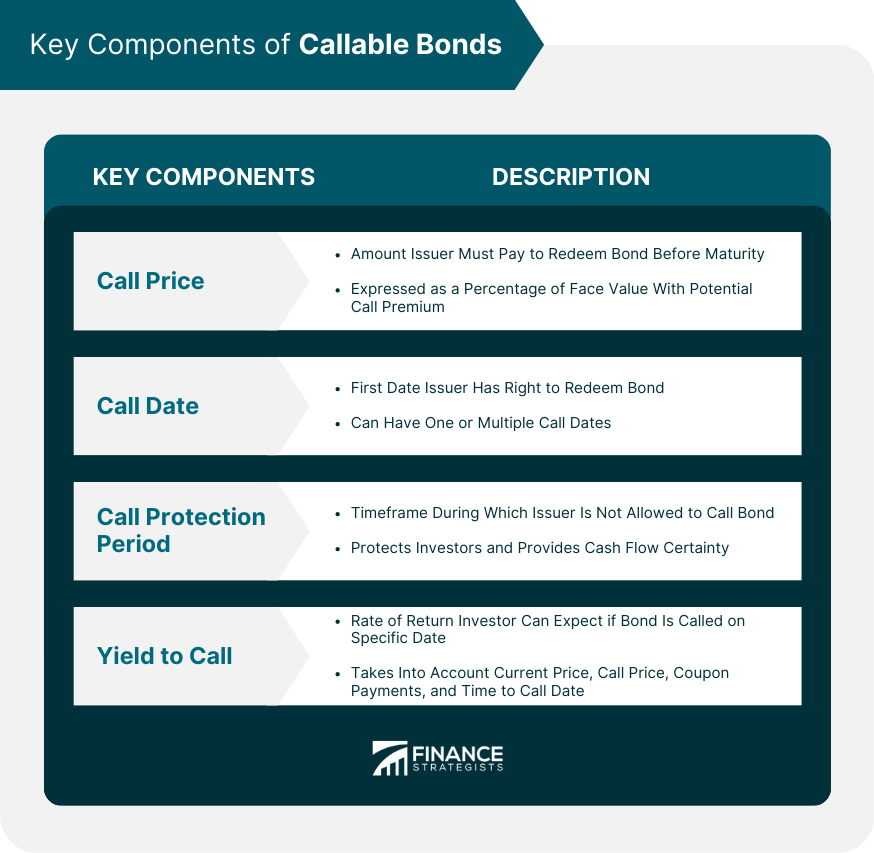

A key feature of a callable bond is the “call provision.” The call provision outlines the terms under which the bond can be redeemed. It also specifies the “call price,” which is the price the issuer must pay to redeem the bond. The call price is often at a premium over the bond’s face value. This premium compensates the bondholder for the early redemption. Understanding these basic elements is essential to grasping the complexities of callable bonds and determining how often are callable bonds called.

Several factors can influence a company’s decision to call its bonds. Interest rate fluctuations are a primary driver. Improved credit ratings and available cash flow also play significant roles. These factors interact to determine the likelihood of a call. Before investing, it’s important to note that determining how often are callable bonds called involves careful consideration of these conditions. Understanding the call provision, call price, and the broader context sets the stage for further exploration. This allows one to estimate the potential for redemption and assess the associated risks and rewards. The decision of if and how often are callable bonds called depends on various interconnected economical factors.

Factors Influencing a Company’s Decision to Redeem Bonds

A company’s decision to call its bonds hinges on several key financial factors. Fluctuating interest rates play a significant role. If interest rates decline after a company issues callable bonds, it might be advantageous to redeem the existing bonds. The company can then issue new bonds at a lower interest rate, reducing its overall borrowing costs. This is a primary driver in determining how often are callable bonds called.

An improved credit rating also influences a company’s decision. If a company’s financial health strengthens, credit rating agencies might upgrade its rating. A better credit rating allows the company to borrow money at more favorable terms. Refinancing existing debt with new bonds at lower interest rates becomes an attractive option. This situation often leads to the company calling its outstanding callable bonds. The availability of cash flow is another critical consideration. A company with strong and stable cash flow is better positioned to redeem its bonds. Sufficient cash reserves provide the financial flexibility needed to manage debt obligations effectively. A company might choose to call its bonds even if interest rates haven’t changed dramatically. This is an option if it has excess cash and wants to reduce its debt burden.

These factors often interact. For example, a company might experience both an improved credit rating and increased cash flow. This confluence of positive financial indicators makes redeeming callable bonds highly likely. Consider a hypothetical example: ABC Corporation issued callable bonds with a 6% interest rate. Subsequently, interest rates fall to 4%, and ABC’s credit rating improves. Furthermore, the company generates substantial profits, leading to a significant increase in cash flow. In this scenario, ABC Corporation would almost certainly call its bonds. It would refinance the debt at the lower interest rate, saving the company a considerable amount of money over the remaining life of the bonds. Understanding these drivers is key to assessing how often are callable bonds called. Another scenario involves a company with a stable credit rating but a significant increase in cash reserves. Even without a drop in interest rates, the company might strategically call a portion of its bonds to optimize its capital structure and reduce its overall debt.

How to Estimate the Likelihood of a Bond Being Redeemed

Assessing the probability of a callable bond being redeemed requires careful analysis. While predicting the future with certainty is impossible, investors can evaluate several factors to gauge the likelihood of a call. Understanding these indicators can inform investment decisions and manage risk effectively.

One crucial step is locating and reviewing the bond indenture. This legal document outlines the specific terms of the bond, including the call provisions. Pay close attention to the call schedule, which details when the bond can be called and at what price. Also, examine the issuer’s financial reports. These reports offer insights into the company’s financial health, debt structure, and cash flow. Strong financials and a desire to reduce debt costs increase the probability of a call. Monitoring prevailing interest rates is also vital. If interest rates have fallen significantly since the bond was issued, the issuer may be incentivized to call the bond and refinance at a lower rate. Credit spreads, which reflect the perceived riskiness of the issuer, also play a role. Narrowing credit spreads suggest improved financial stability, potentially leading to a call. Analyzing these metrics provides a more informed perspective on how often are callable bonds called.

Beyond these quantitative measures, consider qualitative factors. Has the company announced any plans to restructure its debt? Are there any upcoming events, such as mergers or acquisitions, that could influence its decision to call the bonds? Understanding the issuer’s strategic goals and financial objectives can provide valuable context. Remember that no single factor guarantees a call. The decision is complex and depends on a confluence of circumstances. However, by diligently gathering and analyzing relevant information, investors can make more informed assessments of the likelihood of a bond being redeemed and get a better grasp of how often are callable bonds called. This proactive approach allows for better risk management and portfolio optimization. It’s important to remember that even with thorough research, the precise timing of when and how often are callable bonds called can be challenging to predict.

Callable Bonds vs. Non-Callable Bonds: A Comparative Analysis

Callable bonds and non-callable bonds represent two distinct categories within the fixed-income market. Understanding their differences is crucial for both issuers and investors. Corporations issue callable bonds to maintain financial flexibility. This allows them to refinance debt when interest rates decline. Non-callable bonds, conversely, do not grant the issuer this option. How often are callable bonds called? The answer lies in the prevailing economic conditions and the issuer’s financial health.

For investors, the primary difference lies in the call risk. Callable bonds may be redeemed by the issuer before their maturity date. This can disrupt an investor’s income stream. Non-callable bonds provide certainty of cash flows until maturity. To compensate for the call risk, callable bonds typically offer a higher yield compared to similar non-callable bonds. This yield differential reflects the potential for early redemption and the associated reinvestment risk. How often are callable bonds called is a question tied to this yield premium.

The trade-offs are significant. Issuers of callable bonds benefit from the potential to lower their borrowing costs. However, they may need to offer a higher initial yield to attract investors. Investors in callable bonds receive a higher yield, but face the uncertainty of a potential call. Non-callable bonds offer stability and predictable income. However, they may offer lower yields than their callable counterparts. Analyzing historical redemption rates can provide some insight into how often are callable bonds called. Ultimately, the choice between callable and non-callable bonds depends on the investor’s risk tolerance, investment objectives, and outlook on interest rate movements. A comprehensive understanding of these factors is essential for making informed investment decisions. Consideration of factors influencing a company’s decision to redeem bonds is also key. How often are callable bonds called is also dependent on these company specific factors.

The Impact of Redemption on Bondholders

When a callable bond is redeemed, bondholders receive the call price, which is typically par value plus a small premium. While receiving funds back might seem positive, the implications are often more complex. One of the primary concerns for bondholders is reinvestment risk. This arises because the bond is being called, which typically happens when interest rates have fallen. Finding a new investment with a comparable yield can be challenging in a lower-interest-rate environment. Investors may be forced to accept lower returns on their reinvested capital, impacting their overall investment income.

Another factor to consider is the potential tax implications of a bond redemption. The difference between the price the bondholder originally paid for the bond and the call price received could be subject to capital gains taxes. This can reduce the net return received from the investment. It’s crucial for bondholders to understand these tax consequences and factor them into their financial planning. Understanding how often are callable bonds called helps investors anticipate potential reinvestment needs and tax liabilities. Some investors might find that their investment goals are no longer aligned with the current market conditions after the bond is called, requiring a reassessment of their portfolio strategy.

Furthermore, the call feature introduces an element of uncertainty for bondholders. While the higher yield of callable bonds compensates for this risk, the possibility of early redemption can disrupt long-term investment plans. For instance, an investor relying on a steady stream of income from a bond may need to quickly find a replacement income source if the bond is called. This highlights the importance of carefully evaluating the call provisions of a bond before investing. How often are callable bonds called is influenced by prevailing economic conditions and the issuer’s financial health, adding to the complexity of the investment decision. Investors should also consider consulting with a financial advisor to assess the suitability of callable bonds within their overall investment strategy and to navigate the potential challenges associated with bond redemptions and how often are callable bonds called.

Analyzing Historical Redemption Rates: Trends and Patterns

Historical data reveals trends in how often are callable bonds called, though specific dates and figures should be avoided due to their potential to become outdated. Economic cycles and interest rate environments heavily influence call activity. Periods of low interest rates often correlate with increased redemption activity. Issuers are more likely to call bonds when they can refinance their debt at a lower cost. This is a key factor in understanding how often are callable bonds called.

Conversely, periods of rising interest rates typically see a slowdown in bond redemptions. Companies are less inclined to call bonds when refinancing would result in higher interest expenses. Therefore, call activity tends to cluster around periods of favorable interest rate conditions for issuers. Another factor influencing redemption rates is the overall health of the economy. During economic expansions, companies often have stronger cash flows and improved credit ratings. This makes them more capable of redeeming outstanding debt. Economic downturns, on the other hand, can lead to decreased call activity as companies prioritize liquidity and conserve cash. How often are callable bonds called fluctuates with these macroeconomic factors.

Furthermore, industry-specific trends can also play a role. Certain sectors may be more sensitive to interest rate changes or have different debt management strategies. For example, a capital-intensive industry with significant borrowing needs might be more proactive in calling bonds during periods of low rates. Credit rating upgrades also significantly impact redemption decisions. When a company’s credit rating improves, it can access cheaper financing. This creates an incentive to call existing bonds and issue new ones at a lower interest rate. Investors need to monitor these economic and corporate factors to better understand how often are callable bonds called and assess the potential for bond redemptions in their portfolios. Changes in regulatory environments can also influence how often are callable bonds called.

Navigating the Risks and Rewards of Callable Securities

Investors must carefully evaluate callable bonds within the context of their broader investment strategy. Understanding individual risk tolerance is paramount when considering these securities. The investor’s investment horizon also plays a crucial role. How long until the investor needs the principal? This timeline helps determine if the call risk is acceptable. The need for liquidity is another essential factor. Callable bonds may present liquidity challenges if called unexpectedly, potentially disrupting investment plans. Therefore, a thorough assessment is essential before investing in callable bonds.

Callable bonds can be a valuable addition to a portfolio, but they require careful consideration. Investors must understand the trade-offs between higher yields and the risk of early redemption. Consider the current and projected interest rate environment. A falling rate environment increases the likelihood that the bond will be called. Understanding credit ratings and the issuer’s financial health is also vital. All these factors will impact the likelihood of a bond being called. Investors often wonder: how often are callable bonds called? The answer isn’t simple, as it varies greatly depending on market conditions and the specific bond.

Seeking advice from a qualified financial advisor is highly recommended. A financial advisor can provide personalized guidance. They can help you assess your specific financial situation and investment goals. They can also help you determine if callable bonds are suitable for your portfolio. The advisor can also provide insight into the nuances of specific callable bond offerings. This can greatly improve your understanding of how often are callable bonds called in similar situations. A well-informed decision, guided by professional advice, is the best approach. This ensures that callable bonds align with your overall financial objectives and risk profile.

Understanding Call Protection and Its Importance

Call protection is a critical feature for investors in callable bonds. It refers to a specific period during which the issuer is prohibited from redeeming the bond. This period provides bondholders with a degree of certainty regarding their investment’s income stream. Understanding call protection is essential when assessing the risks and rewards of callable securities, and to understand how often are callable bonds called.

The length of the call protection period can vary significantly from bond to bond. It can range from a few years to a substantial portion of the bond’s overall term. A longer call protection period generally offers greater stability for investors seeking predictable income. This is because it shields them from reinvestment risk, the risk that they will have to reinvest their principal at a lower interest rate if the bond is called. Investors should carefully examine the bond indenture to determine the exact duration of the call protection period and how often are callable bonds called.

The presence of call protection influences the yield offered on a callable bond. Bonds with longer call protection periods typically offer lower yields compared to those with shorter or no call protection. This reflects the reduced risk for the investor. Conversely, bonds that are immediately callable or have very short call protection periods usually offer higher yields to compensate investors for the increased uncertainty and potential for early redemption. Therefore, when evaluating callable bonds, it’s crucial to consider the trade-off between yield and call protection. A thorough understanding of the bond’s indenture, particularly the call provisions, is paramount for making informed investment decisions, and knowing how often are callable bonds called, especially in relation to the call protection period, is key to managing risk.