Demystifying the Role of Market Makers in the Financial Ecosystem

Market makers play a vital role in the financial ecosystem by providing liquidity, ensuring that there are always buyers and sellers available for a particular asset. A market maker is essentially a broker-dealer that quotes both a buy (bid) and sell (ask) price in a specific security, derivative, or currency, standing ready to buy or sell at those quoted prices. This dual quoting obligation is what sets them apart from other market participants. Their primary responsibility is to facilitate smooth trading and efficient price discovery. Without market makers, it would be difficult for investors to quickly buy or sell assets, especially in less liquid markets. The constant presence of bid and ask prices narrows the bid-ask spread, reducing transaction costs and making markets more attractive for all participants. Understanding how market makers make money is essential to grasping the inner workings of financial markets.

The presence of market makers enhances market efficiency. By continuously providing quotes, they reduce the information asymmetry that can exist between buyers and sellers. This allows prices to reflect information more accurately and quickly. Institutions, individual investors, and other entities rely on market makers to execute their trades efficiently. A market maker’s willingness to buy when there are primarily sellers and sell when there are primarily buyers stabilizes prices and prevents excessive volatility. The function of how market makers make money also helps maintaining orderly markets and attracting more participation. In essence, they act as intermediaries, connecting buyers and sellers and ensuring that trading can occur seamlessly. This function is particularly crucial during times of market stress or uncertainty, when liquidity can dry up and price swings can be more pronounced.

To understand how market makers make money, consider their role in the broader financial landscape. Their activities are critical for the proper functioning of stock exchanges, options markets, and foreign exchange markets. Market makers are subject to regulatory oversight, ensuring they meet certain capital requirements and adhere to fair trading practices. These regulations are designed to protect investors and maintain market integrity. The role of market makers has evolved with technology, with high-frequency trading firms now playing a significant part. Despite these changes, the fundamental responsibility of providing liquidity remains the same. Market makers are essential for maintaining the efficiency, stability, and accessibility of financial markets for all participants, and therefore a key piece of the puzzle of how market makers make money.

How to Understand Bid-Ask Spreads and Their Impact on Market Maker Revenue

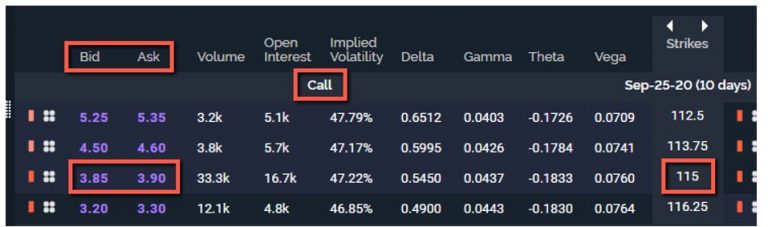

The bid-ask spread is fundamental to understanding how market makers make money. It represents the difference between the highest price a buyer is willing to pay (the bid) and the lowest price a seller is willing to accept (the ask). Market makers profit by simultaneously quoting both bid and ask prices, essentially acting as intermediaries. They buy at the bid price and sell at the ask price, capturing the spread as their revenue. This seemingly small difference, when multiplied across numerous transactions, forms the basis of how market makers make money.

The size of the bid-ask spread is not static. It fluctuates based on several factors. Market volatility significantly impacts the spread; higher volatility typically leads to wider spreads as market makers demand greater compensation for the increased risk. Trading volume also plays a crucial role. Assets with high trading volumes tend to have tighter spreads due to increased competition among market makers. Conversely, thinly traded assets often exhibit wider spreads. The asset class itself is another determinant. For example, highly liquid stocks will generally have narrower spreads than less liquid derivatives or obscure bonds. This competitive landscape means market makers are constantly adjusting their quotes to attract order flow while managing their risk, directly impacting how market makers make money.

To further illustrate how market makers make money through the bid-ask spread, consider a hypothetical scenario. A market maker might quote a bid price of $10.00 and an ask price of $10.01 for a particular stock. If the market maker buys 1,000 shares at $10.00 and immediately sells them at $10.01, they earn a profit of $10 (excluding any fees or commissions). This illustrates the fundamental principle. In highly liquid markets, the bid-ask spread can be incredibly tight, sometimes just a fraction of a cent. In these cases, market makers rely on high-frequency trading and large volumes to generate substantial profits. The profitability depends on accurately assessing and managing risk, alongside attracting a significant portion of order flow, showcasing the complexities of how market makers make money.

The Inventory Management Game: Balancing Risk and Opportunity

Market makers face significant challenges in managing their inventory of assets. This involves a delicate balance between the risks associated with holding inventory and the opportunities to profit from future trades. If a market maker holds too much of a particular asset and the price declines, they risk incurring substantial losses. Conversely, insufficient inventory can lead to missed profit opportunities when buy or sell orders arrive. Effective inventory management is, therefore, crucial to how market makers make money consistently.

One of the key strategies employed by market makers is to carefully monitor their inventory levels and adjust their bid-ask spreads accordingly. For example, if a market maker finds themselves with a large inventory of a specific stock, they may widen the bid-ask spread to discourage further buying and encourage selling, thus reducing their inventory. Conversely, if their inventory is low, they might narrow the spread to attract more buy orders. These adjustments are essential for maintaining a balanced inventory and mitigating potential losses, which contributes directly to how market makers make money. Sophisticated market makers utilize complex algorithms to dynamically adjust spreads based on real-time market conditions and inventory levels. These algorithms consider factors such as order flow, volatility, and overall market sentiment to optimize inventory management decisions.

Inventory management also involves strategies such as hedging. Market makers may use derivatives, such as options or futures contracts, to hedge their inventory risk. For example, if a market maker holds a large inventory of a stock, they might purchase put options on that stock to protect against potential price declines. The cost of hedging is a factor that market makers must consider when determining their optimal inventory levels and bid-ask spreads. Successful inventory management is integral to how market makers make money and requires a deep understanding of market dynamics, risk management techniques, and advanced trading strategies. It’s a continuous balancing act, where missteps can quickly erode profits, emphasizing the complexity and skill involved in the role of a market maker. The ability to effectively manage inventory directly impacts a market maker’s ability to provide liquidity and profit from the bid-ask spread, thus showcasing how market makers make money in the financial markets.

Order Flow Analysis: Gaining an Edge in the Market

Market makers analyze order flow to anticipate price movements and improve their trading decisions. Understanding order flow is essential to see how market makers make money. Order flow represents the total volume and direction of orders entering the market. This information provides clues about potential future price changes. Different types of orders create different impacts. Institutional orders, for example, often signal significant buying or selling interest. Retail orders, while smaller individually, can collectively influence market direction. Market makers interpret these signals to adjust their bid and ask prices accordingly.

Several techniques help market makers analyze order flow effectively. Volume analysis involves tracking the number of shares or contracts traded at different price levels. A sudden surge in volume can indicate strong buying or selling pressure. Depth of market analysis, also known as Level 2 data, displays the list of outstanding buy and sell orders at various price points. This information reveals the potential liquidity and support/resistance levels in the market. By combining volume and depth of market analysis, market makers gain a clearer picture of the current market sentiment. This allows them to anticipate short-term price fluctuations and position themselves advantageously. How market makers make money also depends on their ability to adapt to evolving order flow patterns.

Advanced algorithms assist market makers in processing vast amounts of order flow data in real-time. These algorithms identify patterns and anomalies that might be missed by human traders. For example, an algorithm might detect a large hidden order slowly accumulating shares, suggesting an impending price increase. By identifying these hidden signals, market makers can adjust their strategies before the market reacts. This proactive approach contributes significantly to how market makers make money. Furthermore, market makers often use historical order flow data to train their algorithms and improve their predictive capabilities. Constant learning and adaptation are crucial for success in the dynamic world of market making, and ultimately, understanding order flow is critical to see how market makers make money.

Rebates and Incentives: Earning Money from Exchange Programs

Exchanges often provide rebate programs to incentivize market makers to supply liquidity, which is a significant way how market makers make money. These programs reward market makers for posting quotes and executing trades, enhancing market depth and efficiency. Rebates serve as a crucial component of a market maker’s revenue model, supplementing profits earned from the bid-ask spread. The structure of these rebates can vary, but generally, market makers receive a payment for each share or contract they provide liquidity for, encouraging continuous quoting and tighter spreads.

How market makers make money through these rebates depends on their trading volume and the specific terms of the exchange’s incentive program. For example, an exchange might offer a higher rebate for providing liquidity during off-peak hours or for specific securities with lower trading volumes. These incentives encourage market makers to participate actively in less liquid markets, promoting price discovery and reducing volatility. The rebates received can significantly offset the costs associated with market making, such as infrastructure, personnel, and capital requirements. This ultimately contributes to their overall profitability, making it an essential aspect of how market makers make money.

However, the existence of rebates also raises regulatory considerations. Concerns have been voiced about potential conflicts of interest and the impact on market quality. Regulators scrutinize rebate programs to ensure they do not lead to manipulative trading practices or unfairly disadvantage certain market participants. For instance, some argue that rebates could incentivize market makers to prioritize maximizing rebate capture over providing the best prices for all investors. Therefore, exchanges and regulators continuously evaluate and refine these programs to strike a balance between incentivizing liquidity provision and maintaining market integrity. Understanding how these rebates function is crucial to understanding how market makers make money and the regulatory landscape they navigate.

High-Frequency Trading (HFT) and its Influence on Market Making

High-frequency trading (HFT) has become an integral part of modern market making, significantly shaping how market makers make money. HFT firms utilize sophisticated algorithms and powerful computer systems to execute a high volume of orders at extremely high speeds. These firms often compete with traditional market makers, impacting bid-ask spreads and order flow dynamics. The speed at which HFT firms operate allows them to react swiftly to market changes, potentially capturing fleeting arbitrage opportunities and providing liquidity in certain market conditions. However, the presence of HFT in market making is not without controversy, raising questions about fairness, market stability, and the potential for manipulation.

One of the primary ways HFT impacts market making is through its influence on bid-ask spreads. By rapidly quoting and updating prices, HFT firms can narrow spreads, potentially reducing the profitability for traditional market makers who may not possess the same technological capabilities. HFT firms also engage in order anticipation, attempting to identify and capitalize on large orders before they are fully executed. This practice can lead to concerns about front-running and unfair advantages. Furthermore, the speed and complexity of HFT algorithms can contribute to market volatility during periods of stress, as these algorithms may exacerbate price swings and liquidity shortages. Despite these concerns, HFT firms also contribute to market efficiency by providing liquidity and facilitating price discovery.

Regulators and market participants continue to debate the appropriate role of HFT in market making. Some argue that HFT improves market quality by narrowing spreads and increasing liquidity, benefiting all investors. Others express concerns about the potential for unfair advantages and the risks associated with algorithmic trading. As technology continues to evolve, the relationship between HFT and traditional market making will likely continue to evolve as well. Understanding the dynamics of HFT is crucial for anyone seeking to understand how market makers make money in today’s complex financial markets. Further analysis is needed to fully assess the long-term impact of HFT on market structure and investor confidence.

The Impact of Volatility on Market Maker Profitability

Market volatility significantly influences how market makers make money. Increased volatility often leads to wider bid-ask spreads. This widening offers greater potential profits for market makers. They can capitalize on larger differences between buying and selling prices. However, heightened volatility also brings increased risks. Rapid price swings can result in substantial losses if a market maker’s inventory moves against them.

To manage volatility risk, market makers employ various strategies. Hedging with options and futures contracts is a common technique. These instruments allow them to offset potential losses from adverse price movements. By using options, they can protect themselves against significant downside risk. Futures contracts provide a way to lock in prices and mitigate future uncertainty. Effective risk management is crucial for how market makers make money consistently in volatile markets.

Market making plays a vital role during periods of crises or heightened volatility. When markets become turbulent, liquidity often dries up. Market makers step in to provide continuous trading opportunities. This helps to maintain market stability and prevent extreme price dislocations. The ability to navigate these challenging conditions demonstrates the resilience and importance of market makers. During these times, although riskier, opportunities to capture larger spreads emerge, further influencing how market makers make money. Their presence helps ensure the market functions, even under stress.

Navigating Regulatory Landscapes: Compliance and Ethical Considerations

The regulatory landscape significantly shapes how market makers make money and operate. Market makers must adhere to a complex web of rules designed to ensure fair and transparent markets. These regulations aim to prevent market manipulation, insider trading, and other unethical practices that could harm investors. Compliance is not merely a legal obligation; it is fundamental to maintaining trust and confidence in the financial system. Understanding these regulations is crucial for market makers to operate ethically and sustainably, ensuring long-term profitability.

Key regulations governing market making activities include rules related to best execution, which mandates that market makers must execute orders at the most favorable terms reasonably available. This ensures that customers, particularly retail investors, receive fair prices. Regulations also address issues such as order handling, requiring market makers to prioritize customer orders over their own proprietary trades in certain circumstances. Furthermore, rules against market manipulation prohibit activities like creating artificial price movements or disseminating false information to influence trading decisions. These regulations protect market integrity and provide a level playing field for all participants. Understanding how market makers make money within these constraints is essential for their continued success.

Ethical considerations are equally important for market makers. While maximizing profit is a primary goal, it should not come at the expense of integrity and fairness. Market makers have a responsibility to provide liquidity and maintain orderly markets, especially during times of stress or high volatility. Engaging in practices that exploit informational advantages or disadvantage retail investors is not only unethical but also carries significant legal and reputational risks. Transparency, honesty, and a commitment to ethical conduct are essential for building trust with customers and regulators. By adhering to the highest ethical standards and strictly complying with all applicable regulations, market makers can contribute to a more stable and efficient financial ecosystem, ensuring that how market makers make money aligns with the broader interests of market participants and the public.