Deciphering the Impact of Market Swings on Option Values

Implied volatility is a critical concept for options traders. It represents the market’s expectation of future price fluctuations of the underlying asset. It’s a forward-looking estimate derived from options prices themselves, reflecting the anticipated degree of price movement over the option’s lifespan. Understanding how does implied volatility affect options is paramount for successful trading strategies.

Unlike historical volatility, which measures past price swings, implied volatility is predictive. It is not based on what *has* happened, but what the market *expects* to happen. The difference between these two volatility measures is significant. Historical volatility can provide context, but implied volatility directly influences option premiums. Options traders use implied volatility to assess the potential risk and reward associated with an option. This assessment then informs their trading decisions.

Why is understanding how does implied volatility affect options crucial? Because it directly impacts the price you pay for an option. Higher implied volatility translates to higher option prices, and vice versa. This occurs because a higher expectation of price fluctuation increases the probability that the option will end up “in the money.” Therefore, grasping the dynamics of implied volatility allows traders to make informed decisions about buying or selling options. They can also implement strategies based on anticipated volatility changes.

How to Leverage Volatility Expectations in Options Trading

Changes in implied volatility significantly affect option premiums. Understanding how does implied volatility affect options is critical for successful trading. A rise in implied volatility typically leads to an increase in option prices for both calls and puts. This occurs because higher implied volatility suggests a greater potential for price fluctuations in the underlying asset. Conversely, a decrease in implied volatility usually results in lower option prices, reflecting an expectation of reduced price movement. Understanding how does implied volatility affect options is understanding markets.

The relationship between implied volatility and option prices is quantified by “vega.” Vega represents the sensitivity of an option’s price to a 1% change in implied volatility. For instance, an option with a vega of 0.05 will see its price increase by $0.05 for every 1% increase in implied volatility, all other factors remaining constant. Options traders must carefully monitor vega to manage their exposure to volatility risk. If a trader expects volatility to increase, they might purchase options (long vega) to profit from the anticipated rise in premiums. Conversely, if they expect volatility to decrease, they might sell options (short vega) to capitalize on the expected decline in premiums. Hedging strategies often involve balancing vega exposure to minimize the impact of unexpected volatility swings.

Different option strategies are affected differently depending on how does implied volatility affect options. For example, if a trader implements a calendar spread, which involves buying and selling options with different expiration dates but the same strike price, understanding the volatility term structure is crucial. If the trader expects short-term volatility to increase, they might buy a near-term option and sell a longer-term option. How does implied volatility affect options profitability in calendar spreads is that it allows traders to profit from the relative change in volatility between the two options. By carefully analyzing volatility expectations and understanding vega, options traders can strategically position themselves to profit from anticipated market movements or hedge against potential losses.

Exploring the Relationship Between Fear Gauge and Option Costs

The VIX index, often called the “fear gauge,” serves as a real-time indicator of market sentiment and expected volatility over the next 30 days. It is derived from the prices of S&P 500 index options. A high VIX reading signifies increased market uncertainty and fear, while a low VIX suggests complacency and stability. Understanding how does implied volatility affect options? Because VIX and implied volatility are closely correlated, a high VIX level typically corresponds to higher implied volatilities for options across the board. This increase in implied volatility directly translates to higher option premiums, reflecting the greater perceived risk of price swings.

Conversely, a low VIX generally accompanies lower implied volatilities and, consequently, cheaper option prices. The VIX is not a direct measure of how does implied volatility affect options, but it’s a strong indicator. Significant market events, such as economic announcements, geopolitical tensions, or unexpected corporate earnings reports, often trigger volatility spikes. For example, the release of inflation data could lead to a surge in the VIX if the figures deviate significantly from expectations. Similarly, a surprise interest rate hike by the Federal Reserve or an escalation of international conflict can send shockwaves through the market, causing implied volatilities to rise sharply and impacting option premiums. These events create opportunities and risks for options traders, depending on their positions and how well they anticipate and manage volatility changes. How does implied volatility affect options during these times? It can dramatically alter the profitability of various strategies.

The impact of such events on option premiums is not uniform across all options. Options closer to the money and those with shorter expiration dates tend to be more sensitive to changes in implied volatility. Traders should, therefore, carefully assess the potential impact of market events on their specific option positions. Monitoring the VIX and understanding its relationship with implied volatility is a crucial aspect of successful options trading. By staying informed about market sentiment and potential catalysts for volatility, traders can make more informed decisions about buying, selling, or adjusting their option positions to manage risk and capitalize on opportunities. It is essential to remember that the VIX is just one tool among many, and it should be used in conjunction with other forms of technical and fundamental analysis. How does implied volatility affect options? By understanding this relationship with the VIX, traders gain a valuable edge.

The Impact of High and Low Volatility on Different Option Strategies

Implied volatility profoundly influences the profitability of various options strategies. Understanding how does implied volatility affect options is essential for successful trading. Different strategies thrive under different volatility conditions. For instance, strategies like straddles and strangles are typically employed when high implied volatility is anticipated. These strategies involve simultaneously buying a call and a put option with the same strike price and expiration date (straddle), or with slightly different strike prices (strangle). The expectation is that the underlying asset’s price will make a significant move, either up or down, exceeding the combined premium paid for the options. In essence, these strategies profit from large price swings, regardless of direction. Therefore, how does implied volatility affect options? When volatility is high, options are more expensive, but the potential for a substantial payout also increases, making these strategies attractive.

Conversely, strategies like short strangles or short calls are often favored when implied volatility is low. A short strangle involves selling both a call and a put option with different strike prices. The trader profits if the underlying asset’s price remains within a defined range between the strike prices until expiration. Similarly, a short call involves selling a call option, anticipating that the underlying asset’s price will not rise above the strike price. These strategies benefit from time decay and stable market conditions. The lower the implied volatility, the cheaper the options are to sell, and the less likely it is that the options will be “in the money” at expiration. Therefore, how does implied volatility affect options? Low volatility environments favor strategies that profit from stability and limited price movement.

Consider this scenario: A trader believes a stock, currently trading at $50, will experience a significant price move due to an upcoming earnings announcement. Implied volatility is high. The trader might purchase a $50 straddle. If the stock price moves to $60 or $40, the trader profits. Another trader anticipates that a different stock, also trading at $50, will remain range-bound for the next month. Implied volatility is low. This trader could sell a $52 call option. If the stock stays below $52, the trader keeps the premium. These examples illustrate how does implied volatility affect options strategies and why selecting the appropriate strategy based on volatility expectations is crucial for maximizing potential profits and minimizing risk. Understanding these dynamics is crucial for any options trader.

Calendar Spreads and the Volatility Curve: A Strategic Approach

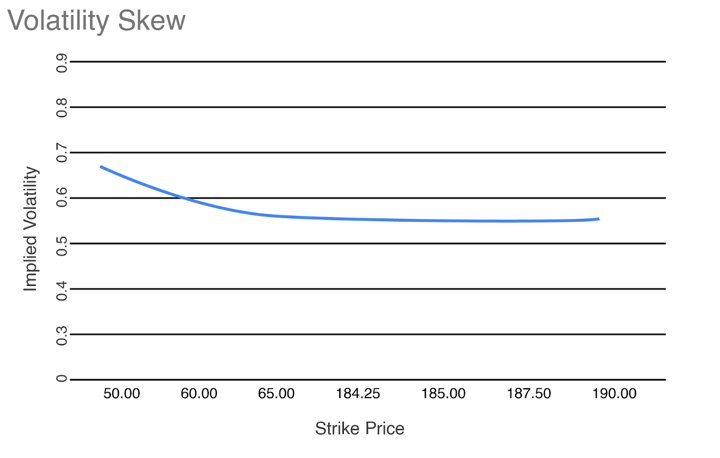

The implied volatility of an option is not a single number that applies to all options on a given underlying asset. Instead, it varies based on the option’s strike price and expiration date. This variation creates what’s known as the volatility smile (or skew) and the volatility term structure, also known as the volatility curve. These concepts are vital for understanding how does implied volatility affect options, and for employing sophisticated options strategies.

The volatility smile/skew refers to the phenomenon where options with strike prices further away from the current market price of the underlying asset (out-of-the-money options) tend to have higher implied volatilities than at-the-money options. The skew is especially noticeable in equity markets, where downside protection (puts) is often more expensive due to higher demand, reflecting a fear of market crashes. The volatility term structure, on the other hand, illustrates how implied volatility changes across different expiration dates. Typically, longer-dated options have higher implied volatilities than shorter-dated ones, as there is more uncertainty associated with predicting the future price of the underlying asset over a longer time horizon. However, this isn’t always the case, and the term structure can invert, especially during times of market stress.

Traders can exploit these differences in implied volatility through strategies like calendar spreads and butterfly spreads. A calendar spread involves simultaneously buying and selling options with the same strike price but different expiration dates. The trader profits if the implied volatility of the shorter-dated option increases relative to the longer-dated option. Butterfly spreads, on the other hand, are designed to profit from the expectation that implied volatility will remain stable. These strategies involve buying and selling options at three different strike prices, with the expectation that the underlying asset will trade within a defined range. Understanding how does implied volatility affect options with varying strike prices and expiration dates is crucial for successfully implementing these strategies and managing risk.

Real-World Examples of How Unexpected Volatility Shifts Affect Options Positions

Consider a trader who implements a short strangle strategy on a stock, expecting minimal price movement. The trader sells both an out-of-the-money call and an out-of-the-money put option. Initially, implied volatility is low, and the premiums received seem adequate for the perceived risk. However, unexpected news regarding the company’s earnings surfaces, triggering a significant surge in implied volatility. As how does implied volatility affect options, this sudden spike causes a substantial increase in the value of both the call and put options the trader sold. Even if the stock price remains relatively stable, the increase in implied volatility alone can lead to significant losses for the trader, as they would need to buy back the options at a much higher price than they initially sold them for. This scenario highlights the risk associated with strategies that profit from stable or declining volatility, emphasizing the importance of closely monitoring market news and potential catalysts for volatility spikes. Managing vega, the sensitivity of an option’s price to changes in implied volatility, becomes crucial in such situations.

Conversely, imagine a trader who buys a call option on a technology stock before a major product announcement. Implied volatility is relatively low, making the option premium affordable. If the product announcement is well-received by the market, the stock price is expected to increase. However, even before the stock price makes a substantial move, the anticipation surrounding the announcement can cause implied volatility to rise. As how does implied volatility affect options, this increase in implied volatility alone can boost the value of the call option, allowing the trader to potentially profit even if the stock price movement is modest. This demonstrates how purchasing options when implied volatility is low can be advantageous, as any subsequent increase in volatility can enhance the profitability of the position. It’s important to recognize that positive news events or anticipation of such news is what makes how does implied volatility affect options strategies to be profitable. Of course, if the product announcement disappoints, the opposite can occur: the stock price and implied volatility could both decline, leading to losses for the option buyer.

Another example involves a trader holding a calendar spread, which involves buying and selling options with different expiration dates but the same strike price. The strategy aims to profit from the difference in the rate of time decay between the near-term and the longer-term options. If implied volatility in the near-term option increases significantly due to an upcoming earnings release, while the implied volatility in the longer-term option remains relatively stable, the value of the calendar spread can decline. This happens because the short-term option, which the trader has sold, becomes more expensive due to the increase in implied volatility. As how does implied volatility affect options, the trader may need to close the position at a loss, or adjust it to mitigate the increased risk. These examples illustrate the complexities of options trading and the importance of understanding how does implied volatility affect options prices and the potential impact on various strategies. Effective risk management, including monitoring vega and adjusting positions based on volatility expectations, is essential for navigating the options market successfully.

Strategies for Managing Volatility Exposure in Option Portfolios

Managing volatility risk is crucial for successful options trading. Several strategies can help mitigate the impact of unexpected volatility changes on an options portfolio. One approach is to hedge with VIX futures or options. The VIX index reflects market expectations of future volatility, and instruments based on the VIX can offer a degree of protection against volatility spikes. When market uncertainty increases, and implied volatility rises, VIX-related instruments tend to increase in value, offsetting potential losses in other options positions. Understanding how does implied volatility affect options is key to employing this hedge effectively.

Adjusting position sizes based on volatility levels is another essential technique. When implied volatility is high, it might be prudent to reduce overall exposure to options, as the potential for significant price swings is elevated. Conversely, when implied volatility is low, increasing position sizes might be considered, but with careful risk assessment. Employing delta-neutral strategies can also minimize directional risk. Delta measures the sensitivity of an option’s price to changes in the underlying asset’s price. By constructing a portfolio with a net delta close to zero, traders can reduce the impact of price movements on the overall portfolio value, focusing instead on profiting from changes in implied volatility. The impact of how does implied volatility affect options positions cannot be overstated, making delta-neutral strategies a valuable tool.

Furthermore, diversification across different asset classes and options strategies can help manage volatility exposure. Spreading investments across various sectors can reduce the portfolio’s sensitivity to any single market event. Combining different options strategies, such as long and short volatility positions, can also create a more balanced portfolio. For instance, a trader might implement a long straddle (buying both a call and a put option with the same strike price and expiration date) to profit from a large market move, while simultaneously employing a short strangle (selling both a call and a put option with different strike prices and the same expiration date) to generate income in a stable market. This multifaceted approach provides a comprehensive framework for managing volatility risk and understanding how does implied volatility affect options trading outcomes.

Understanding Volatility’s Influence on Pricing Models

Implied volatility plays a critical role in option pricing models. The Black-Scholes model, a widely used tool, incorporates implied volatility as a key input. This input helps determine the theoretical fair value of an option. How does implied volatility affect options pricing within this framework? Higher implied volatility generally leads to a higher theoretical option price, reflecting the increased uncertainty of future price movements. Conversely, lower implied volatility results in a lower theoretical option price, suggesting a more stable market expectation.

However, it’s important to acknowledge the limitations of relying solely on models. The Black-Scholes model, for instance, assumes constant volatility over the life of the option. This assumption often deviates from real-world market conditions, where volatility fluctuates dynamically. The model’s reliance on constant volatility is a key limitation, particularly as how does implied volatility affect options in practice. Market dynamics and external events can significantly impact volatility, leading to pricing discrepancies between the model’s output and actual market prices. Understanding these discrepancies is crucial for identifying potential arbitrage opportunities and making informed trading decisions.

Despite these limitations, understanding how implied volatility interacts with pricing models remains essential. Recognizing the assumptions and limitations of these models, and combining model-driven insights with a deep understanding of market dynamics, can enhance a trader’s ability to assess option values and manage risk effectively. By considering the limitations, and by considering how does implied volatility affect options, traders can refine their strategies and navigate the complexities of the options market with greater precision. Therefore, a balanced approach that combines theoretical modeling with practical market awareness is paramount for successful options trading.