What is Yield to Maturity and Why Does it Matter?

In the world of bond investing, yield to maturity (YTM) is a crucial concept that helps investors evaluate the potential return on investment and make informed decisions. YTM represents the total return an investor can expect to earn from a bond if it is held until maturity. It takes into account the bond’s coupon rate, face value, and market price, providing a comprehensive picture of the bond’s potential return. By understanding how to calculate YTM, investors can answer the question, “how do you calculate ytm” and make data-driven decisions to achieve their investment goals. In essence, YTM is a powerful tool that helps investors navigate the complex world of bond investing and make informed decisions about their investment portfolio.

Understanding the Components of Yield to Maturity

Yield to Maturity (YTM) is a complex concept that relies on several key components to provide an accurate picture of a bond’s potential return. The three main components of YTM are the bond’s face value, coupon rate, and market price. The face value, also known as the principal, is the amount that the bond issuer agrees to repay to the investor at maturity. The coupon rate, on the other hand, is the interest rate that the bond issuer agrees to pay to the investor periodically, usually semi-annually or annually. The market price is the current price of the bond in the market, which can fluctuate based on various market and economic factors. By understanding how these components interact, investors can gain a deeper insight into how to calculate YTM and make informed investment decisions. For instance, when calculating YTM, investors need to consider how the coupon rate and face value affect the bond’s yield, and how changes in market price can impact the bond’s overall return. By grasping these components, investors can better answer the question, “how do you calculate ytm” and make data-driven decisions to achieve their investment goals.

How to Calculate Yield to Maturity: A Step-by-Step Guide

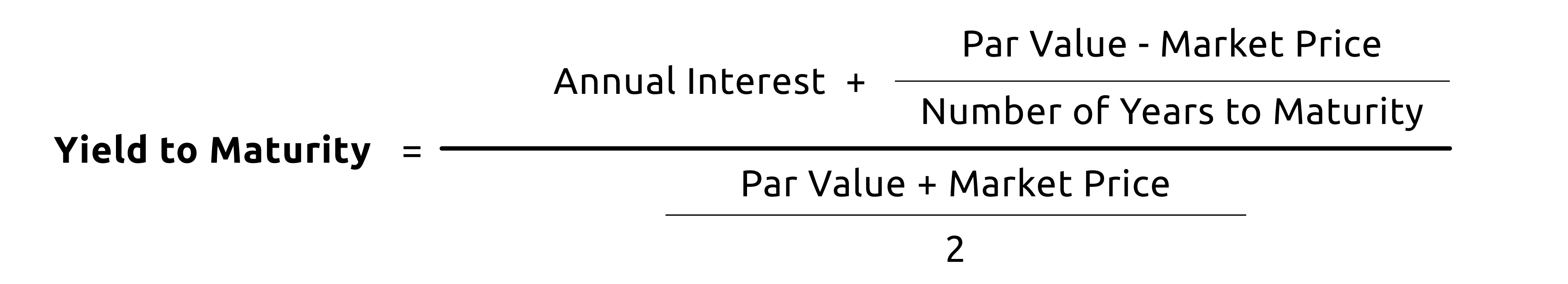

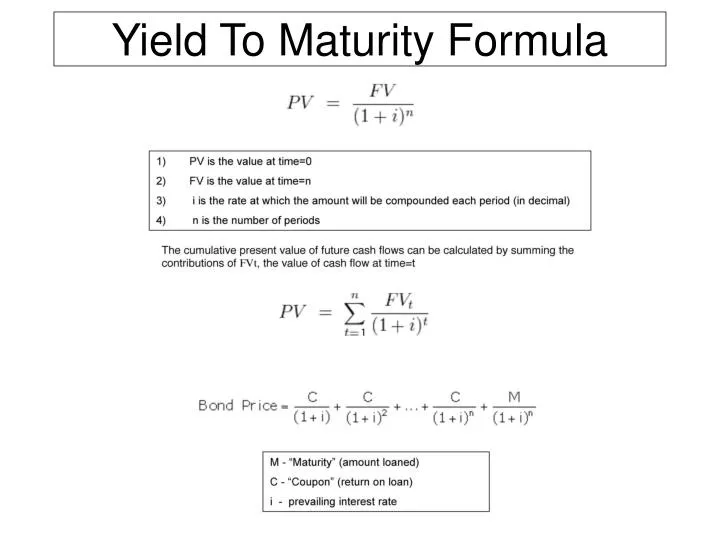

Calculating Yield to Maturity (YTM) can seem daunting, but with a step-by-step approach, investors can easily determine the total return on investment of a bond. The formula to calculate YTM is as follows: YTM = (Coupon Payment + (Face Value – Market Price) / Years to Maturity) / ((Face Value + Market Price) / 2). To break it down, let’s go through each step:

Step 1: Determine the coupon payment, which is the periodic interest payment made by the bond issuer. This is usually expressed as a percentage of the face value.

Step 2: Calculate the difference between the face value and market price, which represents the capital gain or loss if the bond is held until maturity.

Step 3: Divide the result from Step 2 by the number of years to maturity, which represents the time period over which the bond will be held.

Step 4: Add the coupon payment to the result from Step 3, which gives the total return on investment.

Step 5: Divide the result from Step 4 by the average of the face value and market price, which gives the YTM as a percentage.

For example, let’s say we have a bond with a face value of $1,000, a coupon rate of 5%, and a market price of $900. If the bond has 5 years to maturity, the YTM would be approximately 6.38%. This means that if an investor holds the bond until maturity, they can expect a total return of 6.38% per annum. By understanding how to calculate YTM, investors can answer the question, “how do you calculate ytm” and make informed decisions about their bond investments.

Factors Affecting Yield to Maturity: What You Need to Know

Yield to Maturity (YTM) is not a fixed value, but rather a dynamic concept that can be influenced by various factors. Understanding these factors is crucial for investors to accurately calculate YTM and make informed investment decisions. Some of the key factors that can affect YTM include:

Changes in Interest Rates: When interest rates rise, the value of existing bonds with lower coupon rates decreases, causing YTM to increase. Conversely, when interest rates fall, the value of existing bonds with higher coupon rates increases, causing YTM to decrease.

Credit Ratings: A bond’s credit rating can significantly impact its YTM. Bonds with higher credit ratings tend to have lower YTM, as they are considered safer investments. On the other hand, bonds with lower credit ratings tend to have higher YTM, as they are considered riskier investments.

Market Conditions: Economic indicators, such as inflation and GDP growth, can also impact YTM. For example, during periods of high inflation, investors may demand higher yields to compensate for the erosion of purchasing power.

Time to Maturity: The time to maturity of a bond can also affect its YTM. Bonds with longer maturities tend to have higher YTM, as investors demand higher returns for tying up their capital for longer periods.

By understanding these factors, investors can better appreciate how they impact YTM and make more informed decisions when calculating YTM. For instance, when asking “how do you calculate ytm”, investors should consider these factors to ensure accurate calculations. By doing so, investors can optimize their bond portfolios and achieve their investment goals.

Real-World Examples of Yield to Maturity in Action

To illustrate the practical application of Yield to Maturity (YTM), let’s consider a few real-world examples. These scenarios will help demonstrate how YTM is used in bond investing and how it can impact investor returns.

Example 1: High-Yield Bond

Suppose an investor purchases a 10-year bond with a face value of $1,000, a coupon rate of 8%, and a market price of $900. Using the YTM formula, the investor calculates a YTM of 9.5%. This means that if the investor holds the bond until maturity, they can expect a total return of 9.5% per annum. In this scenario, the YTM is high due to the bond’s lower credit rating and higher coupon rate.

Example 2: Low-Yield Bond

Consider a 5-year bond with a face value of $1,000, a coupon rate of 3%, and a market price of $1,050. The YTM calculation yields a result of 2.8%. This indicates that if the investor holds the bond until maturity, they can expect a total return of 2.8% per annum. In this scenario, the YTM is low due to the bond’s high credit rating and lower coupon rate.

Example 3: Government Bond

A government bond with a 20-year maturity, a face value of $1,000, and a coupon rate of 4% is currently trading at a market price of $1,100. The YTM calculation yields a result of 3.2%. This means that if the investor holds the bond until maturity, they can expect a total return of 3.2% per annum. In this scenario, the YTM is relatively low due to the bond’s high credit rating and lower coupon rate.

These examples demonstrate how YTM is used in different bond investing scenarios. By understanding how to calculate YTM, investors can make informed decisions about their bond investments and optimize their portfolios for maximum returns. When asking “how do you calculate ytm”, investors can refer to these examples to better understand the practical application of YTM.

Common Mistakes to Avoid When Calculating Yield to Maturity

When calculating Yield to Maturity (YTM), it’s essential to avoid common mistakes that can lead to inaccurate results. These mistakes can be costly, as they may cause investors to make poor investment decisions. Here are some common mistakes to avoid when calculating YTM:

Ignoring Compounding

One common mistake is ignoring compounding when calculating YTM. Compounding occurs when interest is earned on both the principal amount and any accrued interest. Failing to account for compounding can result in a lower YTM, which may lead investors to underestimate the bond’s potential return.

Using Incorrect Inputs

Another mistake is using incorrect inputs when calculating YTM. This can include using the wrong face value, coupon rate, or market price. Even small errors in these inputs can significantly impact the YTM calculation, leading to inaccurate results.

Not Considering the Bond’s Credit Rating

A bond’s credit rating can significantly impact its YTM. Failing to consider the credit rating can result in an inaccurate YTM calculation, which may lead investors to misjudge the bond’s risk and potential return.

Not Accounting for Taxes

Taxes can also impact the YTM calculation. Failing to account for taxes can result in an inaccurate YTM, which may lead investors to overestimate the bond’s potential return.

To avoid these mistakes, it’s essential to carefully review the inputs and calculations when determining YTM. By doing so, investors can ensure accurate calculations and make informed investment decisions. When asking “how do you calculate ytm”, investors should be aware of these common mistakes and take steps to avoid them.

Yield to Maturity vs. Current Yield: What’s the Difference?

When it comes to bond investing, two important concepts are often confused with one another: Yield to Maturity (YTM) and Current Yield. While both metrics are used to evaluate the potential return on investment, they serve distinct purposes and provide different insights into a bond’s performance.

Yield to Maturity (YTM)

YTM represents the total return an investor can expect to earn from a bond if they hold it until maturity. It takes into account the bond’s coupon rate, face value, market price, and time to maturity. YTM provides a comprehensive picture of a bond’s potential return, including the impact of compounding and the bond’s credit rating.

Current Yield

Current Yield, on the other hand, represents the bond’s annual return based on its current market price and coupon rate. It does not take into account the bond’s face value, time to maturity, or credit rating. Current Yield provides a snapshot of a bond’s current income generation, but it does not provide a complete picture of the bond’s potential return.

Key Differences

The main difference between YTM and Current Yield lies in their scope and purpose. YTM provides a long-term perspective, while Current Yield offers a short-term view. YTM is a more comprehensive metric, as it considers multiple factors that impact a bond’s return. Current Yield, while simpler to calculate, only provides a partial picture of a bond’s performance.

When to Use Each

Investors should use YTM when evaluating a bond’s potential long-term return or comparing bonds with different maturities. Current Yield is more suitable for evaluating a bond’s current income generation or comparing bonds with similar maturities. By understanding the differences between YTM and Current Yield, investors can make more informed decisions and optimize their bond portfolios.

In conclusion, while both YTM and Current Yield are essential metrics in bond investing, they serve distinct purposes and provide different insights into a bond’s performance. By grasping the differences between these two metrics, investors can better navigate the complex world of bond investing and make informed decisions. When asking “how do you calculate ytm”, investors should also consider the role of Current Yield in their investment strategy.

Conclusion: Mastering Yield to Maturity for Investment Success

By now, it’s clear that Yield to Maturity (YTM) is a crucial concept in bond investing. Understanding YTM helps investors evaluate the potential return on investment, make informed decisions, and optimize their bond portfolios. By grasping the components of YTM, learning how to calculate it, and recognizing the factors that affect it, investors can unlock the secrets of bond investing and achieve their investment goals.

Remember, YTM is not just a complex mathematical formula; it’s a powerful tool that can help investors navigate the complex world of bond investing. By avoiding common mistakes and understanding the differences between YTM and current yield, investors can make more informed decisions and maximize their returns.

As you embark on your bond investing journey, keep in mind that YTM is a dynamic concept that requires ongoing attention and analysis. Stay up-to-date with market trends, interest rates, and credit ratings to ensure that your YTM calculations remain accurate and relevant.

By mastering YTM, you’ll be well-equipped to make informed investment decisions and achieve your financial objectives. So, the next time you ask “how do you calculate ytm”, you’ll be confident in your ability to unlock the secrets of bond investing and achieve investment success.