What is Bond Market Value and Why is it Important?

Bond market value, a crucial concept in finance, refers to the current worth of a bond. It is essential to understand this concept, as it plays a vital role in investment decisions. Accurate bond valuation helps investors determine the potential return on investment, make informed buying or selling decisions, and optimize their investment portfolios. On the other hand, inaccurate bond valuation can lead to significant financial losses. Therefore, it is essential to grasp the concept of bond market value and its significance in investment decisions. In this article, we will explore the factors that influence bond market value, provide a step-by-step guide on how to calculate the market value of a bond, and discuss the importance of accurate valuation in investment decisions.

Understanding Bond Pricing: The Factors that Influence Market Value

When it comes to determining the market value of a bond, several factors come into play. These factors can be broadly categorized into three groups: interest rates, credit ratings, and market conditions. Interest rates, in particular, have a significant impact on bond market value. When interest rates rise, the market value of existing bonds with lower interest rates decreases, making them less attractive to investors. On the other hand, when interest rates fall, the market value of existing bonds with higher interest rates increases, making them more attractive to investors. Credit ratings, assigned by credit rating agencies, also play a crucial role in determining bond market value. Bonds with higher credit ratings are considered less risky and, therefore, have a higher market value. Market conditions, such as economic growth, inflation, and supply and demand, also influence bond market value. Understanding these factors is essential to accurately calculate the market value of a bond and make informed investment decisions. By grasping how these factors interact, investors can better navigate the bond market and optimize their investment portfolios.

How to Calculate Bond Market Value: A Step-by-Step Guide

To calculate the market value of a bond, investors need to follow a step-by-step process. The first step is to gather the necessary information, including the bond’s face value, coupon rate, yield to maturity, and time to maturity. The next step is to determine the present value of the bond’s cash flows, which include the coupon payments and the face value. This can be done using the present value formula: PV = FV / (1 + r)^n, where PV is the present value, FV is the face value, r is the yield to maturity, and n is the time to maturity. The present value of each cash flow is then calculated and summed up to arrive at the total present value of the bond. This total present value represents the bond’s market value. For example, if an investor wants to know how do you calculate the market value of a bond with a face value of $1,000, a coupon rate of 5%, and a yield to maturity of 4%, they would first calculate the present value of each coupon payment and the face value, and then sum them up to arrive at the bond’s market value. By following this step-by-step guide, investors can accurately calculate the market value of a bond and make informed investment decisions.

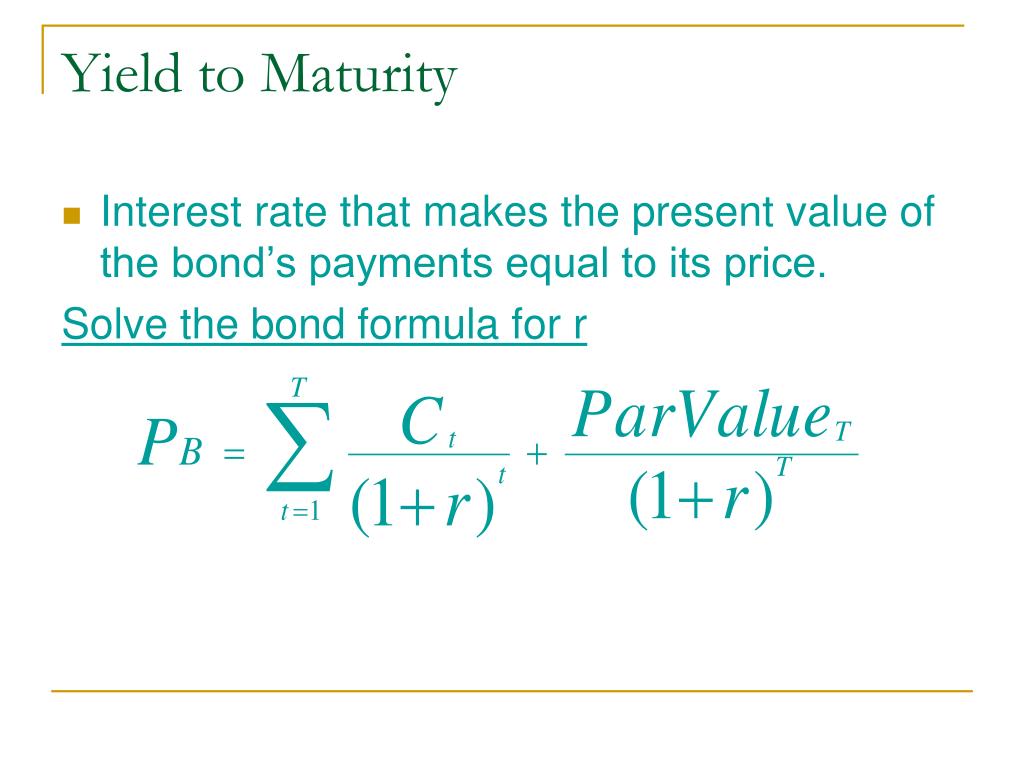

The Role of Yield to Maturity in Bond Valuation

Yield to maturity (YTM) is a critical concept in bond valuation, as it represents the total return an investor can expect to earn from a bond if they hold it until maturity. YTM takes into account the bond’s coupon rate, face value, and time to maturity, as well as the market interest rate. To calculate YTM, investors can use the following formula: YTM = (Coupon Payment + (Face Value – Present Value) / Time to Maturity) / Present Value. For instance, if an investor wants to know how do you calculate the market value of a bond with a face value of $1,000, a coupon rate of 5%, and a time to maturity of 10 years, they would first need to calculate the YTM using the above formula. The YTM would then be used to calculate the present value of the bond’s cash flows, which would ultimately give the bond’s market value. Understanding YTM is essential in bond valuation, as it helps investors determine the bond’s market value and make informed investment decisions.

Using Bond Pricing Models: An Overview of Popular Methods

Bond pricing models are essential tools for investors seeking to calculate the market value of a bond. There are several popular models that can be used, each with its own strengths and weaknesses. The present value model, for instance, is a widely used method that discounts the bond’s cash flows to their present value using a discount rate. This model is useful for calculating the market value of a bond with a fixed coupon rate and maturity date. Another popular model is the arbitrage-free model, which takes into account the bond’s credit risk and liquidity risk in addition to the discount rate. This model is more complex but provides a more accurate estimate of the bond’s market value. Other models, such as the binomial model and the finite difference model, can also be used to calculate the market value of a bond. By understanding how to apply these models, investors can accurately calculate the market value of a bond and make informed investment decisions. For example, if an investor wants to know how do you calculate the market value of a bond using the present value model, they would first need to determine the bond’s cash flows, including the coupon payments and face value. They would then discount these cash flows to their present value using a discount rate, such as the yield to maturity. The resulting present value would represent the bond’s market value.

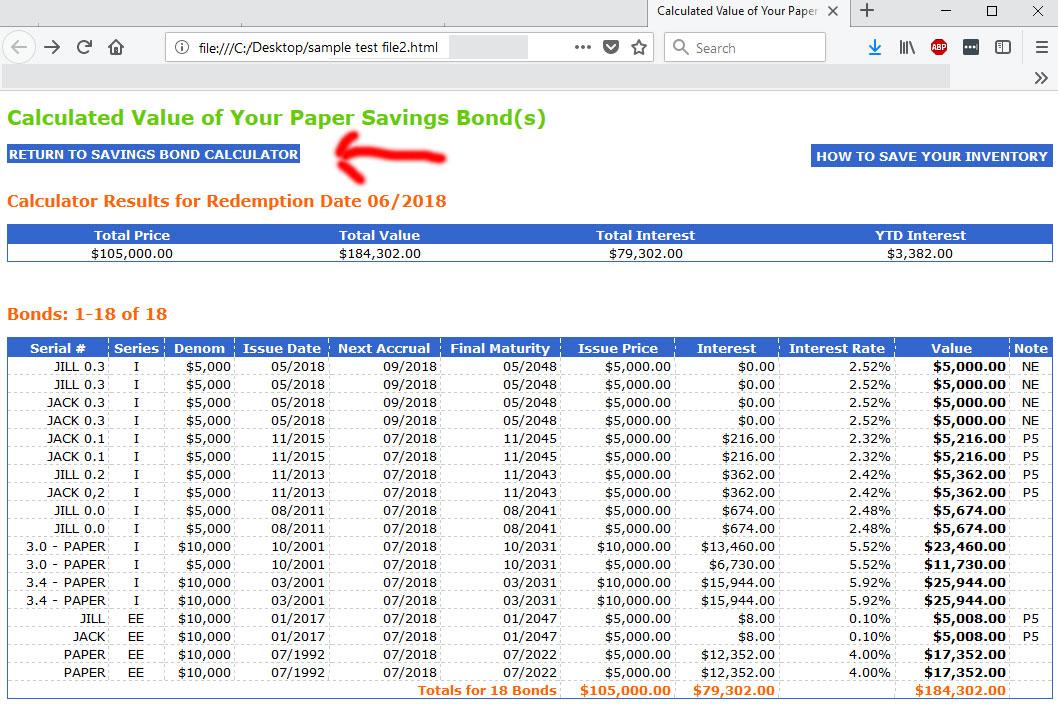

Real-World Examples: Calculating Bond Market Value in Practice

To illustrate the practical application of bond valuation, let’s consider a few real-world examples. Suppose an investor is considering purchasing a 10-year bond with a face value of $1,000 and a coupon rate of 4%. The bond is issued by a company with a credit rating of A-, and the current market interest rate is 3.5%. To calculate the market value of this bond, the investor would need to determine the present value of the bond’s cash flows, including the coupon payments and face value. Using a financial calculator or spreadsheet, the investor can calculate the present value of the bond’s cash flows and determine that the market value of the bond is approximately $960. This means that the investor would need to pay $960 to purchase the bond. Another example is a 5-year bond with a face value of $500 and a coupon rate of 3%. The bond is issued by a company with a credit rating of BBB, and the current market interest rate is 2.5%. In this case, the investor would need to calculate the present value of the bond’s cash flows using a discount rate that takes into account the bond’s credit risk and liquidity risk. By doing so, the investor can determine that the market value of the bond is approximately $480. These examples demonstrate how to calculate the market value of a bond in practice, highlighting the importance of considering the bond’s cash flows, credit rating, and market conditions. By understanding how to apply bond valuation techniques in real-world scenarios, investors can make informed investment decisions and maximize their returns. For instance, if an investor wants to know how do you calculate the market value of a bond, they can use the examples above as a guide and apply the same principles to calculate the market value of a bond with different characteristics.

Common Mistakes to Avoid in Bond Valuation

When calculating the market value of a bond, it’s essential to avoid common mistakes that can lead to inaccurate valuations. One of the most common errors is using an incorrect discount rate, which can result in a mispriced bond. Another mistake is failing to consider the bond’s credit risk and liquidity risk, which can lead to an inaccurate assessment of the bond’s market value. Additionally, investors should avoid using outdated or irrelevant data, such as historical interest rates or credit ratings, which can lead to inaccurate valuations. Furthermore, investors should be cautious when using bond pricing models, as incorrect inputs or assumptions can lead to inaccurate results. For instance, if an investor wants to know how do you calculate the market value of a bond using the present value model, they should ensure that they are using the correct discount rate and cash flows. By being aware of these common mistakes, investors can avoid pitfalls and ensure accurate bond valuations. Some other common mistakes to avoid include ignoring the bond’s callability or putability features, failing to consider the tax implications of the bond, and using an incorrect bond valuation formula. By being mindful of these potential errors, investors can ensure that their bond valuations are accurate and reliable, and make informed investment decisions as a result.

Conclusion: Mastering Bond Valuation for Informed Investment Decisions

Accurate bond valuation is crucial for making informed investment decisions. By understanding the factors that influence bond market value, such as interest rates, credit ratings, and market conditions, investors can make more informed decisions about their investments. Additionally, mastering the bond valuation process, including the use of popular bond pricing models, can help investors to calculate the market value of a bond with confidence. It is essential to avoid common mistakes, such as using an incorrect discount rate or failing to consider credit risk, to ensure accurate valuations. By applying the knowledge and techniques outlined in this article, investors can determine the true worth of their investments and make informed decisions about their portfolios. Whether an investor is looking to buy, sell, or hold a bond, understanding how to calculate the market value of a bond is essential for achieving their investment goals. By following the steps outlined in this article, investors can gain a deeper understanding of bond valuation and make more informed investment decisions. Remember, accurate bond valuation is key to unlocking the full potential of your investments, so take the time to master the techniques and make informed decisions about your investments.