What is Spread and Why is it Important?

In the world of finance, understanding the concept of spread is crucial for making informed trading decisions. Spread refers to the difference between the bid price and the ask price of a security, and it plays a significant role in determining the profitability of a trade. When asking “how do you calculate spread,” it’s essential to recognize that spread is not just a simple mathematical calculation, but rather a complex concept that affects the entire trading process.

There are various types of spreads, including bid-ask spread, margin spread, and option spread, each with its unique characteristics and implications for traders. The bid-ask spread, for instance, represents the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. This spread has a direct impact on the trader’s profit margin, making it a critical component of trading strategy.

Understanding the significance of spread is vital for traders, as it can greatly influence their trading decisions. A thorough comprehension of spread enables traders to make more accurate predictions, manage risk more effectively, and ultimately, increase their chances of success in the markets. By grasping the concept of spread, traders can gain a competitive edge in the markets and make more informed decisions.

Understanding the Factors that Influence Spread

When it comes to calculating spread, understanding the factors that influence it is crucial. Market volatility, liquidity, and supply and demand are just a few of the key factors that can impact spread. For instance, in times of high market volatility, spreads tend to widen as market makers and traders become more risk-averse. This is because they require a higher return to compensate for the increased uncertainty.

Liquidity also plays a significant role in determining spread. In markets with low liquidity, spreads tend to be wider due to the lack of buyers and sellers. This is because market makers and traders have to work harder to find counterparties, resulting in higher costs. On the other hand, in markets with high liquidity, spreads tend to be narrower as there are more buyers and sellers, making it easier to execute trades.

Supply and demand imbalances can also impact spread. When there is a high demand for a particular security and a limited supply, spreads tend to widen as buyers are willing to pay a premium to get their hands on the security. Conversely, when there is a high supply and low demand, spreads tend to narrow as sellers are willing to accept a lower price to offload their securities.

Understanding how these factors interact and impact spread is essential for traders. By recognizing how market conditions can affect spread, traders can make more informed decisions and adjust their strategies accordingly. For example, in times of high volatility, traders may want to consider widening their spreads to compensate for the increased risk. By doing so, they can ensure that they are adequately compensated for taking on that risk.

The Formula for Calculating Spread

When it comes to calculating spread, having a solid understanding of the formula is essential. The formula for calculating spread is relatively simple: Spread = Ask Price – Bid Price. This formula is applicable to various financial instruments, including stocks, options, and forex.

To apply this formula, traders need to know the bid price and ask price of a security. The bid price is the highest price a buyer is willing to pay for a security, while the ask price is the lowest price a seller is willing to accept. By subtracting the bid price from the ask price, traders can calculate the spread.

For example, let’s say the bid price of a stock is $50 and the ask price is $55. To calculate the spread, traders would subtract the bid price from the ask price: Spread = $55 – $50 = $5. This means that the spread is $5, which represents the difference between the price at which buyers are willing to buy and sellers are willing to sell.

Understanding how to calculate spread is crucial for traders, as it can greatly impact their trading decisions. By knowing how to calculate spread, traders can determine the cost of buying and selling a security, which can help them make more informed investment decisions. Additionally, accurate spread calculation can help traders identify profitable trading opportunities and manage risk more effectively.

So, how do you calculate spread? By using the simple formula above and having a solid understanding of the bid and ask prices, traders can accurately calculate spread and make more informed trading decisions. Remember, accurate spread calculation is critical in today’s fast-paced markets, and mastering this concept can give traders a competitive edge.

How to Calculate Spread in Different Markets

Calculating spread is not a one-size-fits-all approach. Different markets have unique characteristics that affect spread calculation. In this section, we’ll explore how to calculate spread in various markets, including forex, stocks, and options.

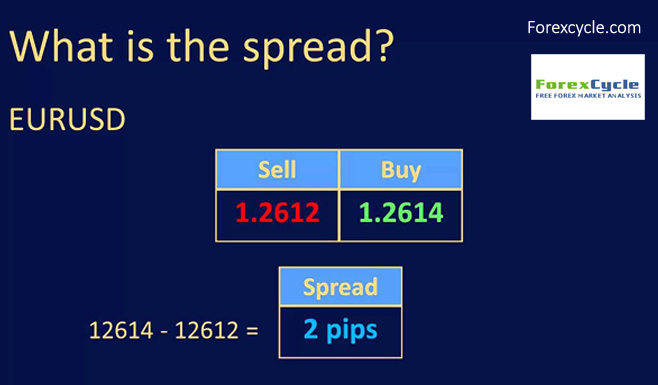

In the forex market, calculating spread is crucial due to the high liquidity and volatility. Forex spreads are typically quoted in pips, which represent the smallest unit of price movement. To calculate the spread in forex, traders need to know the bid and ask prices of a currency pair. For example, if the bid price of EUR/USD is 1.1000 and the ask price is 1.1020, the spread would be 20 pips.

In the stock market, calculating spread is essential for investors and traders. Stock spreads are typically quoted in cents or dollars and are affected by factors such as market volatility and liquidity. To calculate the spread in stocks, traders need to know the bid and ask prices of a stock. For example, if the bid price of a stock is $50 and the ask price is $55, the spread would be $5.

In the options market, calculating spread is critical due to the complexity of options pricing. Options spreads are typically quoted in cents or dollars and are affected by factors such as volatility, time to expiration, and interest rates. To calculate the spread in options, traders need to know the bid and ask prices of an option contract. For example, if the bid price of a call option is $2 and the ask price is $3, the spread would be $1.

So, how do you calculate spread in different markets? By understanding the unique characteristics of each market and applying the formula for calculating spread, traders can accurately calculate spread and make more informed trading decisions. Whether you’re trading forex, stocks, or options, mastering spread calculation is essential for success in today’s fast-paced markets.

Common Mistakes to Avoid When Calculating Spread

Calculating spread is a crucial aspect of trading, but it’s not immune to errors. Traders must be aware of common mistakes that can lead to inaccurate spread calculations, which can ultimately affect trading decisions. In this section, we’ll identify common errors to avoid when calculating spread.

One of the most common mistakes traders make is ignoring market conditions. Market volatility, liquidity, and supply and demand can all impact spread. Failing to consider these factors can lead to inaccurate calculations. For example, if a trader is calculating spread during a period of high market volatility, they must take into account the increased uncertainty and adjust their calculations accordingly.

Another mistake traders make is using incorrect data. This can include outdated or inaccurate bid and ask prices, which can lead to incorrect spread calculations. To avoid this mistake, traders must ensure they are using reliable and up-to-date data sources.

Additionally, traders may make mistakes when applying the formula for calculating spread. This can include incorrect calculations or misunderstandings of the bid and ask prices. To avoid this mistake, traders must have a solid understanding of the formula and how to apply it in different scenarios.

So, how do you calculate spread accurately? By avoiding common mistakes, such as ignoring market conditions and using incorrect data, traders can ensure accurate spread calculations. This, in turn, can lead to more informed trading decisions and improved trading outcomes.

By being aware of these common mistakes, traders can take steps to avoid them and ensure accurate spread calculations. This includes staying up-to-date with market conditions, using reliable data sources, and having a solid understanding of the formula for calculating spread. By following these best practices, traders can master the art of spread calculation and improve their trading performance.

The Role of Technology in Spread Calculation

Technology has revolutionized the way traders calculate spread. With the advent of advanced trading platforms, algorithms, and other tools, traders can now calculate spread with greater accuracy and efficiency. In this section, we’ll explore the role of technology in spread calculation and how it can improve trading outcomes.

Trading platforms, such as MetaTrader and TradingView, provide traders with real-time data and advanced calculators to calculate spread. These platforms also offer automated trading features, which can execute trades based on pre-set spread calculations. This can help traders save time and reduce errors.

Algorithms, such as those used in high-frequency trading, can also be used to calculate spread. These algorithms can analyze large amounts of data in real-time, providing traders with accurate and up-to-date spread calculations. This can be particularly useful in fast-paced markets, where spread can change rapidly.

Other tools, such as spread calculators and financial software, can also be used to calculate spread. These tools can provide traders with a range of features, including real-time data, charting tools, and automated calculations. This can help traders to quickly and accurately calculate spread, even in complex market conditions.

So, how do you calculate spread using technology? By leveraging advanced trading platforms, algorithms, and other tools, traders can improve the accuracy and efficiency of spread calculation. This can help traders to make more informed trading decisions and improve their overall trading performance.

In addition, technology can also help traders to avoid common mistakes when calculating spread. For example, automated calculators can reduce the risk of human error, while real-time data can ensure that traders are using the most up-to-date information. By combining technology with a solid understanding of spread calculation, traders can master the art of spread calculation and achieve greater success in the markets.

Real-World Applications of Spread Calculation

Spread calculation is a crucial aspect of trading, and its applications are diverse and far-reaching. In this section, we’ll explore how spread calculation is used in real-world trading scenarios, and highlight the importance of accurate spread calculation in these scenarios.

One of the most critical applications of spread calculation is in risk management. Traders use spread calculation to assess the potential risks and rewards of a trade, and to determine the optimal position size. By accurately calculating spread, traders can minimize their exposure to market volatility and maximize their potential profits.

Another important application of spread calculation is in profit calculation. Traders use spread calculation to determine the profit or loss of a trade, and to adjust their trading strategies accordingly. By accurately calculating spread, traders can ensure that they are maximizing their profits and minimizing their losses.

Spread calculation is also used in trade execution, where it plays a critical role in determining the timing and pricing of trades. By accurately calculating spread, traders can ensure that they are executing trades at the best possible prices, and minimizing their transaction costs.

In addition, spread calculation is used in a range of other trading scenarios, including hedging, arbitrage, and market making. In each of these scenarios, accurate spread calculation is critical to achieving success.

So, how do you calculate spread in these real-world scenarios? By mastering the art of spread calculation, traders can gain a competitive edge in the markets and achieve greater success. Whether it’s in risk management, profit calculation, or trade execution, accurate spread calculation is essential to making informed trading decisions.

In the next section, we’ll discuss best practices for traders to ensure accurate spread calculation, and summarize the key takeaways from this article.

Best Practices for Accurate Spread Calculation

To ensure accurate spread calculation, traders must follow best practices that prioritize attention to detail, ongoing education, and regular market analysis. By adopting these practices, traders can minimize errors, maximize profits, and gain a competitive edge in the markets.

First and foremost, traders must conduct regular market analysis to stay up-to-date with market conditions and trends. This involves monitoring news, economic indicators, and technical analysis to understand how they impact spread. By doing so, traders can adjust their spread calculations accordingly and make informed trading decisions.

Secondly, traders must verify the accuracy of their data to ensure that it is reliable and up-to-date. This involves cross-checking data sources, using multiple platforms, and avoiding outdated information. By doing so, traders can minimize errors and ensure that their spread calculations are accurate.

Thirdly, traders must prioritize ongoing education and training to stay ahead of the curve. This involves staying up-to-date with market developments, learning new strategies, and refining their skills. By doing so, traders can improve their spread calculation skills and adapt to changing market conditions.

Finally, traders must avoid common mistakes that can lead to inaccurate spread calculations. This includes ignoring market conditions, using incorrect data, and failing to account for fees and commissions. By being aware of these mistakes, traders can take steps to avoid them and ensure accurate spread calculations.

So, how do you calculate spread accurately? By following these best practices, traders can ensure that their spread calculations are accurate, reliable, and effective. Whether it’s in risk management, profit calculation, or trade execution, accurate spread calculation is critical to achieving success in the markets.

In conclusion, mastering the art of spread calculation is critical to achieving success in the markets. By understanding the concept of spread, the factors that influence it, and how to calculate it accurately, traders can gain a competitive edge and maximize their profits. Remember, accurate spread calculation is key to making informed trading decisions and achieving long-term success in the markets.