What is Return on Invested Capital and Why Does it Matter?

In the pursuit of profitability, businesses and investors alike rely on various metrics to evaluate performance and inform strategic decisions. One such metric is Return on Invested Capital (ROIC), a powerful tool for assessing a company’s ability to generate profits from its invested capital. But have you ever wondered how to calculate return on invested capital, and why it’s so crucial for long-term success? In essence, ROIC provides a snapshot of a company’s financial health, helping stakeholders identify areas for improvement and optimize resource allocation. By understanding ROIC, businesses can make informed decisions about investments, capital structure, and operational efficiency, ultimately driving growth and profitability.

Understanding the Formula: A Step-by-Step Breakdown

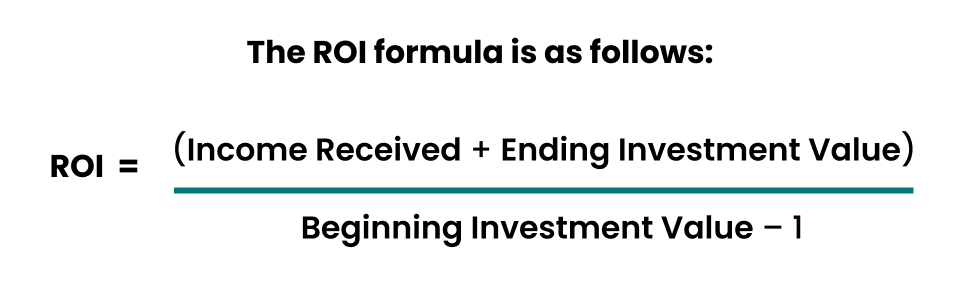

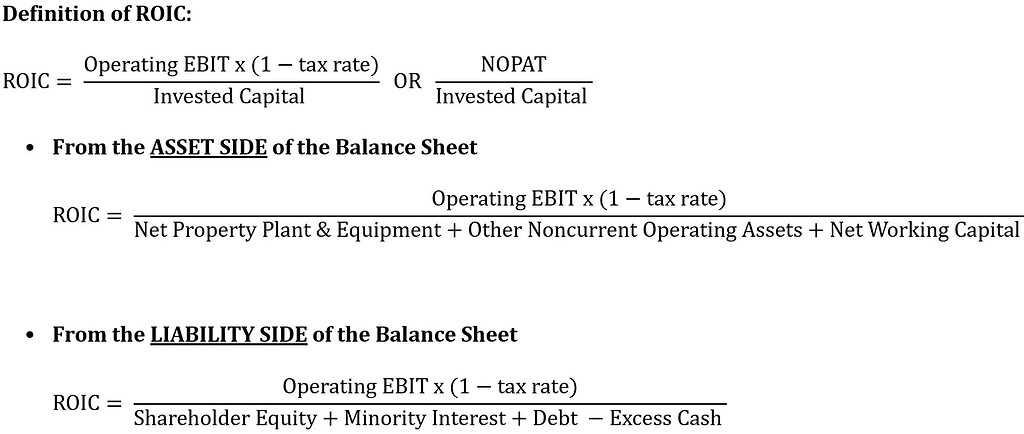

The ROIC formula is a straightforward yet powerful tool for evaluating a company’s profitability. To calculate ROIC, you need to understand its two primary components: net operating profit after taxes (NOPAT) and invested capital. The ROIC formula is as follows: ROIC = NOPAT / Invested Capital. In this section, we’ll delve into the details of each component, providing examples to illustrate the calculation process. By grasping the intricacies of the ROIC formula, you’ll be better equipped to make informed decisions about investments, capital structure, and operational efficiency. So, how do you calculate return on invested capital? Let’s start by examining the NOPAT component.

How to Calculate NOPAT: A Critical Component of ROIC

Net operating profit after taxes (NOPAT) is a crucial component of the ROIC formula, representing a company’s earnings from its core operations. To calculate NOPAT, you need to consider three key elements: operating income, taxes, and non-operating items. The NOPAT formula is as follows: NOPAT = Operating Income x (1 – Tax Rate) + Non-Operating Items. When calculating NOPAT, it’s essential to adjust for non-operating items, such as interest income or expenses, to ensure a accurate representation of a company’s core profitability. For instance, a retail company with significant interest expenses on its debt would need to subtract these expenses from its operating income to arrive at a more accurate NOPAT figure. By understanding how to calculate NOPAT, you’ll be better equipped to evaluate a company’s profitability and make informed decisions about investments and resource allocation. So, how do you calculate return on invested capital? It starts with a thorough understanding of NOPAT.

Invested Capital: The Often-Overlooked Component of ROIC

Invested capital is a critical component of the ROIC formula, representing the total amount of capital invested in a business. It encompasses debt, equity, and other forms of capital, providing a comprehensive picture of a company’s capital structure. To calculate invested capital, you need to consider both the book value and the market value of a company’s assets and liabilities. The invested capital formula is as follows: Invested Capital = Total Debt + Total Equity – Cash and Cash Equivalents. When calculating invested capital, it’s essential to adjust for non-operating assets, such as excess cash or investments, to ensure a accurate representation of a company’s core operations. For instance, a technology company with significant cash reserves would need to subtract these reserves from its total equity to arrive at a more accurate invested capital figure. By understanding how to calculate invested capital, you’ll be better equipped to evaluate a company’s profitability and make informed decisions about investments and resource allocation. When calculating ROIC, it’s crucial to consider both NOPAT and invested capital to gain a comprehensive understanding of a company’s performance. So, how do you calculate return on invested capital? It starts with a thorough understanding of invested capital.

Interpreting ROIC Results: What Do the Numbers Mean?

Once you’ve calculated a company’s ROIC, it’s essential to interpret the results to gain insights into its performance. A high ROIC indicates that a company is generating strong profits from its invested capital, suggesting that it has a competitive advantage and is likely to be a profitable investment. On the other hand, a low ROIC may indicate that a company is struggling to generate profits from its investments, potentially due to inefficient operations or poor capital allocation. When interpreting ROIC results, it’s crucial to consider industry benchmarks and competitor analysis to gain a comprehensive understanding of a company’s performance. For instance, a company with a ROIC of 15% may seem impressive, but if its industry average is 20%, it may indicate that the company is underperforming. By understanding how to interpret ROIC results, investors and business owners can make informed decisions about investments and resource allocation. So, how do you calculate return on invested capital? It’s not just about plugging in numbers; it’s about understanding what those numbers mean for a company’s long-term success.

Common Pitfalls to Avoid When Calculating ROIC

When calculating ROIC, it’s essential to avoid common mistakes that can lead to inaccurate results. One of the most critical errors is incorrectly calculating NOPAT, which can be due to neglecting non-operating items or misclassifying operating income. Another common pitfall is failing to adjust invested capital for non-operating assets, such as excess cash or investments. Additionally, using incorrect or outdated data can lead to inaccurate ROIC calculations. To ensure accurate and reliable ROIC calculations, it’s crucial to carefully review financial statements, consider industry-specific nuances, and avoid making assumptions about a company’s capital structure. By being aware of these common pitfalls, investors and business owners can ensure that their ROIC calculations provide a accurate representation of a company’s performance. Remember, how do you calculate return on invested capital is not just about plugging in numbers, it’s about understanding the underlying components and avoiding common mistakes that can lead to inaccurate results.

Real-World Applications of ROIC: How Companies Use it to Drive Growth

Many successful companies have leveraged ROIC to drive growth and improve profitability. For instance, Amazon’s focus on high-ROIC investments has enabled the company to expand its e-commerce dominance and diversify into new markets. Similarly, companies like Coca-Cola and PepsiCo have used ROIC to optimize their capital allocation and drive shareholder value. By understanding how to calculate return on invested capital, businesses can make informed decisions about investments and resource allocation. ROIC can also inform strategic business decisions, such as identifying areas for cost reduction or opportunities for expansion. For example, a company with a low ROIC may identify opportunities to improve operational efficiency or divest underperforming assets. By applying ROIC analysis, companies can unlock new opportunities for growth and drive long-term success. By understanding how ROIC is used in real-world applications, investors and business owners can gain valuable insights into the power of ROIC in driving business growth and profitability.

Conclusion: Unlocking the Power of ROIC for Long-Term Success

In conclusion, understanding how to calculate return on invested capital is a crucial aspect of evaluating a company’s profitability and performance. By grasping the concepts and formulas discussed in this article, investors and business owners can make informed decisions about investments and resource allocation. ROIC provides a comprehensive picture of a company’s ability to generate profits from its investments, enabling stakeholders to identify areas for improvement and opportunities for growth. By applying ROIC analysis, businesses can unlock new opportunities for long-term success and drive sustainable profitability. Remember, how do you calculate return on invested capital is not just a mathematical exercise, it’s a key to unlocking the secrets of profitability and driving business growth. By mastering the art of ROIC calculation, investors and business owners can gain a competitive edge in today’s fast-paced business landscape.