Understanding Corporate Bond Quotes: A Foundation for Investment

Corporate bonds represent a significant portion of the fixed-income market, offering investors a way to lend money to corporations in exchange for regular interest payments and the eventual return of principal. Understanding how are corporate bonds quoted is crucial for navigating this market effectively. Bond quotes, at their core, provide a snapshot of a bond’s current market value. This value is influenced by a variety of factors, most notably the bond’s par value (also known as face value), coupon rate, and maturity date. The par value is the amount the issuer will repay at maturity. The coupon rate determines the periodic interest payments, expressed as a percentage of the par value. Finally, the maturity date specifies when the principal is repaid. These three elements, along with market forces, directly impact how are corporate bonds quoted and ultimately determine a bond’s price.

The question of how are corporate bonds quoted often leads investors to explore the mechanics of bond pricing. Bonds are typically quoted as a percentage of their par value. For instance, a bond with a par value of $1,000 quoted at 98 would mean its current market price is $980. This pricing mechanism reflects the interplay of supply and demand in the bond market. Factors such as a company’s creditworthiness, prevailing interest rates, and overall market sentiment significantly influence investor demand and thus the bond’s price. Understanding this dynamic is essential to answering how are corporate bonds quoted, especially considering the impact of various economic conditions and credit ratings on bond valuations. It is important to note that bond prices typically move inversely to interest rates; when interest rates rise, bond prices tend to fall, and vice versa, as investors seek higher returns in the current market environment.

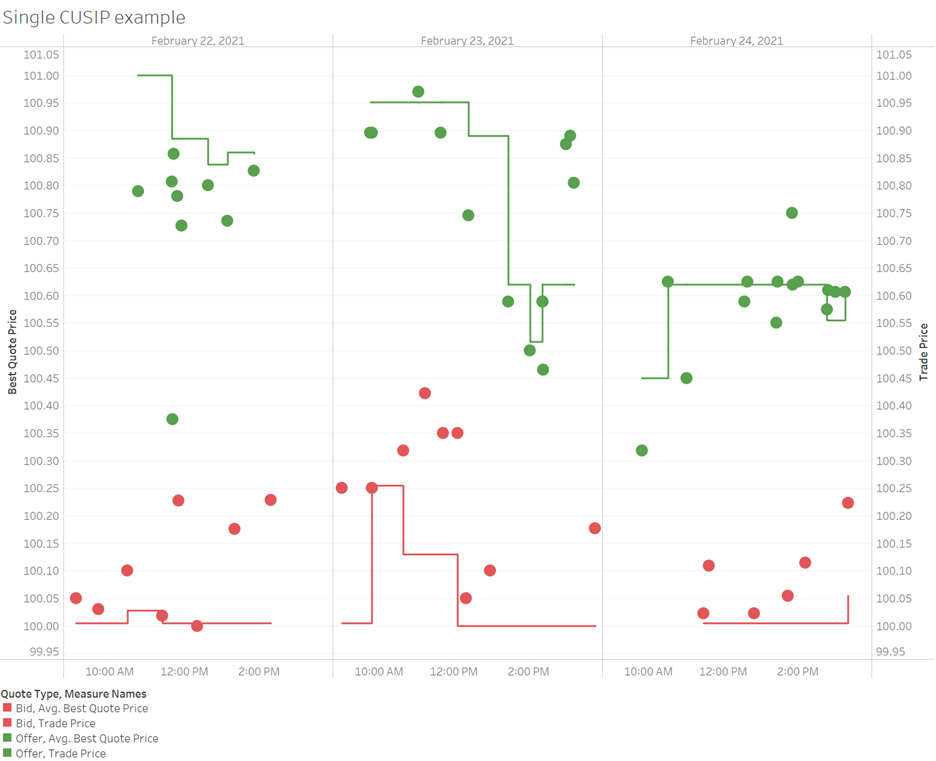

Investors need to comprehend how are corporate bonds quoted to make informed decisions. A bond’s quoted price is rarely the only information available. Bid and ask prices, representing the highest price a buyer is willing to pay and the lowest price a seller is willing to accept, respectively, provide a range within which transactions occur. Furthermore, yield figures, such as yield to maturity (YTM), reflect the total return an investor can expect if the bond is held until maturity. YTM considers the bond’s current price, coupon rate, and time to maturity, providing a more comprehensive picture than the coupon rate alone. Therefore, understanding how are corporate bonds quoted involves not only interpreting the price itself but also analyzing these additional data points to assess the overall investment opportunity. How are corporate bonds quoted? Through a combination of these factors, offering investors the information needed to make sound investment decisions.

How to Interpret the Numbers in a Corporate Bond Quote

Corporate bonds, unlike stocks, are typically quoted as a percentage of their face value or par value, usually $1,000. Understanding how are corporate bonds quoted is crucial for investors. For instance, a quote of “98” signifies that the bond is trading at 98% of its par value, meaning a price of $980. This percentage reflects the current market price, influenced by factors like interest rates and the issuer’s creditworthiness. The quote will also include the yield, representing the return an investor can expect, given the current price and the bond’s characteristics. It’s important to note that bond prices fluctuate inversely with interest rates: when interest rates rise, bond prices generally fall, and vice-versa. This inverse relationship is a fundamental principle in understanding how are corporate bonds quoted and priced.

Most bond quotes display both a bid and an ask price. The bid price represents the highest price a buyer is willing to pay, while the ask price represents the lowest price a seller is willing to accept. The difference between these two prices is called the spread, which reflects the dealer’s profit margin and represents how are corporate bonds quoted and reflects market liquidity. A narrow spread indicates high liquidity (easier to buy or sell), while a wide spread signals lower liquidity. Along with the bid and ask prices, the quote typically shows the yield to maturity (YTM), a crucial metric indicating the total return an investor can expect if they hold the bond until maturity. The YTM considers the current bond price, the coupon rate (the periodic interest payment), and the time remaining until the bond matures. How are corporate bonds quoted regarding yields? Yields are usually expressed as a percentage and are often crucial when comparing different bond options.

To further illustrate how are corporate bonds quoted, consider this example: a bond with a par value of $1,000 is quoted at 102. This means its current market price is $1,020 ($1,000 x 1.02). If the bid price is 101.5 and the ask price is 102, it implies that buyers are offering $1,015, and sellers are asking for $1,020. The corresponding YTM will also be displayed, allowing investors to compare the potential returns with other available bonds. By understanding the different components of a corporate bond quote, investors can make informed decisions based on their risk tolerance and investment goals. Remember that, consistently understanding how are corporate bonds quoted is an ongoing process of learning and interpreting the market dynamics.

The Interplay of Supply and Demand in Corporate Bond Pricing

Understanding how are corporate bonds quoted requires grasping the fundamental principle of supply and demand. Like any other asset, the price of a corporate bond is determined by the interaction of buyers and sellers in the market. When demand for a particular bond is high – perhaps due to investor confidence in the issuing company’s financial strength or a general flight to safety in the market – the price will tend to rise. Conversely, when supply exceeds demand, perhaps because investors are selling off bonds due to rising interest rates or concerns about the issuer’s creditworthiness, the price will fall. This dynamic relationship is constantly at play, affecting how are corporate bonds quoted on a daily basis. The quoted price reflects the equilibrium point where the quantity of bonds offered for sale matches the quantity demanded by investors at a given moment. Several factors influence this equilibrium, creating the ever-shifting landscape of bond pricing.

Changes in investor sentiment significantly impact how are corporate bonds quoted. Positive news about a company, such as exceeding earnings expectations or announcing a strategic acquisition, can boost demand and drive prices upward. Conversely, negative news, like a credit downgrade or a missed interest payment, can trigger selling pressure and lead to lower prices. Interest rate fluctuations also play a crucial role. When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower coupon rates less attractive. This causes the prices of outstanding bonds to fall to compensate for the lower yield relative to new issues. Conversely, falling interest rates increase the relative attractiveness of existing bonds, leading to higher prices. The relationship between interest rates and bond prices is inversely proportional – when one goes up, the other typically goes down. Understanding this dynamic is critical to interpreting bond quotes and predicting potential price movements. How are corporate bonds quoted in relation to interest rates is a core element for prospective investors.

Creditworthiness is another pivotal factor influencing how are corporate bonds quoted. Bonds issued by companies with strong credit ratings (like those from Moody’s, S&P, or Fitch) are generally considered less risky and therefore command higher prices and lower yields. This is because investors are confident in the issuer’s ability to repay the principal and interest payments. Conversely, bonds from companies with weaker credit ratings are perceived as riskier, leading to lower prices and higher yields to compensate investors for the increased risk of default. Investors often use credit ratings as a crucial factor in evaluating the relative value of different bonds, directly influencing how they interpret how are corporate bonds quoted and consequently their investment decisions. The credit rating of the bond issuer fundamentally alters the risk profile and subsequently the price. This interplay of supply, demand, interest rates, and creditworthiness creates a complex and dynamic market where how are corporate bonds quoted represents a snapshot of constantly shifting market forces.

Factors That Influence Corporate Bond Valuation

Several key factors influence how are corporate bonds quoted and ultimately determine their value. Credit risk, a measure of the likelihood a company will default on its debt obligations, is paramount. Credit rating agencies, such as Moody’s, Standard & Poor’s, and Fitch, assess the creditworthiness of corporations, assigning ratings that reflect this risk. Higher credit ratings, indicating lower default risk, generally lead to higher bond prices and lower yields, as investors perceive less risk. Conversely, bonds issued by companies with lower credit ratings command lower prices and higher yields to compensate investors for the increased risk of default. Understanding how are corporate bonds quoted requires analyzing these credit ratings meticulously. Investors should research these ratings before making investment decisions to gauge the risk associated with different corporate bonds.

Time to maturity, or the length of time until the bond’s principal is repaid, significantly impacts bond pricing and how are corporate bonds quoted. Bonds with longer maturities are generally more sensitive to interest rate changes than those with shorter maturities. If interest rates rise after a bond is issued, the price of a long-term bond will fall more sharply than that of a short-term bond because the investor is locked into a lower interest rate for a longer period. Conversely, if interest rates fall, the price of a long-term bond will rise more substantially. This relationship between time to maturity and interest rate sensitivity is a crucial factor in understanding bond valuation and how are corporate bonds quoted, influencing investment strategies and risk management.

The prevailing economic environment also plays a crucial role in shaping corporate bond prices and how are corporate bonds quoted. During periods of economic expansion, investor confidence tends to be high, leading to increased demand for bonds and subsequently higher prices and lower yields. Conversely, during economic downturns or periods of uncertainty, investors may shift towards safer assets, decreasing demand for corporate bonds and potentially driving prices down and yields up. Inflation also affects bond prices; higher inflation erodes the purchasing power of future interest payments and principal repayments, causing bond prices to fall. Understanding how these macroeconomic factors influence investor sentiment and market dynamics is essential to comprehending how are corporate bonds quoted and making informed investment decisions. Careful consideration of these economic conditions and their impact on bond pricing provides a robust understanding of the complexities of the corporate bond market.

Yield to Maturity: Calculating Return on Investment

Yield to maturity (YTM) is a crucial concept for understanding how are corporate bonds quoted and assessing the potential return on a bond investment. Unlike the coupon rate, which represents the annual interest payment relative to the bond’s face value, YTM considers the current market price of the bond, the time remaining until maturity, and the bond’s face value to calculate the total return an investor can expect if they hold the bond until it matures. YTM provides a more comprehensive picture of a bond’s potential return than the coupon rate alone, especially since bond prices fluctuate in the market. A bond purchased at a discount (below its face value) will have a YTM higher than its coupon rate, while a bond purchased at a premium (above its face value) will have a YTM lower than its coupon rate. This is because the difference between the purchase price and the face value contributes to the overall return. How are corporate bonds quoted to reflect this crucial YTM calculation?

Calculating YTM involves a complex formula that accounts for several factors. It’s not a simple calculation that can be done manually without specialized financial calculators or software. However, understanding the underlying principles is vital. The formula essentially solves for the discount rate that equates the present value of all future cash flows (coupon payments and face value) to the current market price of the bond. Software and online calculators readily provide YTM calculations, requiring only inputs such as the bond’s current price, coupon rate, face value, and time to maturity. Investors should readily find YTM displayed alongside other quote information when learning how are corporate bonds quoted. Understanding YTM is vital for comparing the potential returns of different bonds, allowing investors to make informed decisions about their portfolios. Investors should note that YTM is a forward-looking measure; it represents an expected return based on current market conditions and assumptions about future interest rates, which can change over time.

The importance of YTM in understanding how are corporate bonds quoted cannot be overstated. It provides a standardized measure of return that allows investors to compare bonds with different maturities, coupon rates, and prices. By comparing the YTM of various bonds, investors can identify those offering the most attractive returns relative to their risk profiles. YTM, therefore, acts as a critical tool for evaluating the potential profitability of a bond investment, supplementing other factors considered when analyzing a bond’s value and price. The process of determining how are corporate bonds quoted is incomplete without a clear understanding of YTM and its role in evaluating the investment’s total return. Furthermore, understanding YTM helps investors make well-informed decisions when considering their investment strategy. Therefore, understanding how YTM is calculated and interpreted is vital for any investor seeking to effectively navigate the corporate bond market.

Where to Find Corporate Bond Quotes

Locating accurate and up-to-date corporate bond quotes is crucial for informed investment decisions. Several reliable sources provide this information, each with its own strengths and weaknesses. Brokerage platforms, often used for stock trading, usually offer access to bond quotes as part of their comprehensive investment services. These platforms typically display real-time quotes, alongside detailed information about the specific bond, making it easy to compare different options. Understanding how are corporate bonds quoted on these platforms is essential; they usually show the bid and ask prices, yield to maturity, and other relevant details. However, access to these platforms often requires an account, and fees may apply depending on the brokerage.

Financial news websites and dedicated financial data providers represent another avenue for accessing corporate bond quotes. Sites like Bloomberg, Yahoo Finance, and others often include bond quote sections in their market data offerings. These sources usually provide a broader overview of the market, including historical data and analysis alongside real-time quotes. While these resources are often free to access, the information might not be as detailed as what brokerage platforms provide. One should also be mindful that the methods on how are corporate bonds quoted can differ slightly between sources; always cross-reference data from multiple providers to ensure accuracy and get a complete picture of the current market situation.

Directly contacting bond dealers or investment banks is another option for obtaining corporate bond quotes, particularly for less liquid or complex bonds. These specialized entities have access to a wider range of bonds and often provide customized quotes. However, this approach may not be suitable for all investors due to the potential need for large transaction sizes or the specialized knowledge required to navigate this space. Remember that the process of how are corporate bonds quoted by these institutions can vary significantly, so careful consideration of the quotes and the provider’s reputation is essential. Comparing quotes from multiple sources remains crucial to verify pricing and identify the most favorable terms for any potential investment. This practice ensures investors have the most comprehensive information possible before making a decision on which corporate bonds to purchase. Using multiple resources ensures a holistic view of the market and contributes to better informed investment choices.

Navigating the Bond Market: Tips for Beginners

Entering the corporate bond market can be a significant step for new investors. It’s crucial to approach this market with a blend of caution and informed decision-making. One of the first steps involves rigorous due diligence. This means thoroughly researching the companies that issue bonds, paying close attention to their financial health. A company’s financial stability directly influences its ability to repay its debt, which is a critical factor when considering how are corporate bonds quoted in relation to their perceived risk. Analyzing financial statements, including balance sheets, income statements, and cash flow statements, can provide insights into the issuer’s overall financial strength. Credit ratings, provided by agencies like Standard & Poor’s, Moody’s, and Fitch, offer an independent assessment of a bond’s creditworthiness; the higher the rating, the lower the perceived credit risk. Understand that higher credit ratings typically translate to lower yields, while lower ratings usually come with higher yields to compensate investors for the increased risk. Before investing, it’s prudent to investigate the company’s sector, its market position, and its management’s track record. This detailed background research is vital to understanding the potential safety and reliability of the bond you are considering.

Moreover, understanding how are corporate bonds quoted also means recognizing the importance of diversification within an investment portfolio. Spreading investments across various bond issuers and sectors helps mitigate risk, avoiding concentration in a single company or industry, which can amplify losses if that company or sector faces difficulties. Newcomers to the bond market should also be aware of the risks inherent in bond investing, including interest rate risk, inflation risk, and credit risk. Interest rate risk refers to the potential for bond values to decline as interest rates rise, and vice versa, a fundamental aspect of how bond prices and yields move inversely. Inflation risk stems from the possibility that the real value of bond returns may be eroded by increasing inflation. Credit risk, as previously mentioned, refers to the chance that a bond issuer might default on its payment obligations. It’s vital to recognize that all these risks are always present when analyzing any bond quote. Instead of diving head first into the market, beginners are encouraged to start with smaller investments, gaining experience and understanding of market dynamics before committing larger sums. It’s also beneficial to consult with a financial advisor to develop a comprehensive investment strategy that aligns with individual risk tolerance and financial goals. By being well-informed, patient, and cautious, beginners can navigate the corporate bond market effectively and work towards achieving their financial goals.

Understanding the Different Types of Bond Quotes

Beyond the basic bid and ask prices, investors may encounter other nuances in bond quotes. One important distinction is between clean and dirty prices. The clean price of a bond is the price of the bond itself, without accounting for any accrued interest. The dirty price, on the other hand, includes the accrued interest since the last coupon payment date. This accrued interest represents the amount the bond buyer owes the seller for holding the bond during that period. When bonds trade between coupon dates, the seller has effectively earned interest up to that point. Consequently, the buyer pays this accrued interest which is why the dirty price is always higher than the clean price of the bond, unless the bond has just made a coupon payment. Calculating accrued interest is straightforward; it’s the proportion of the coupon payment that corresponds to the holding period since the last payment, expressed as a percentage of the coupon rate. Understanding these two different price mechanisms and how they are different is a must for anyone learning how are corporate bonds quoted.

Furthermore, certain less frequent but important factors can influence corporate bond quotes and how they are interpreted. Call provisions, for example, grant the issuer the right to redeem the bonds before their maturity date at a predetermined price, impacting the potential return for an investor if this right is exercised by the issuer. Sinking funds, another provision, require the issuer to periodically retire a portion of the outstanding bonds, reducing risk for remaining bondholders but also potentially reducing the return. How are corporate bonds quoted may also depend on whether or not a bond is convertible, meaning that the bond can be exchanged for a fixed number of shares of the issuing company’s stock. Convertible bonds tend to have lower yields but can provide investors with the benefit of potential equity upside. While not always present in every bond quote, these provisions contribute to the overall complexity and therefore can impact how are corporate bonds quoted. It is essential for beginners to learn what these bond quote differences are so they can make informed decisions.

By understanding the difference between clean and dirty prices, the impact of accrued interest and call/sinking fund provisions, investors can better navigate the intricacies of corporate bond quotes. When making investment decisions, always make sure to understand all the factors behind how are corporate bonds quoted and any potential effect they may have on your return.