Why You Need a Reliable Financial Platform

When it comes to making informed investment decisions, having a trustworthy financial platform is crucial. A reliable platform provides access to real-time market data, accurate financial analysis, and user-friendly interfaces, empowering investors to make informed decisions. With the vast amount of financial information available, a reliable platform helps to filter out noise and focus on relevant data. This is particularly important when comparing financial tools, such as Google Finance vs Yahoo Finance, to determine which one best suits your investment needs. By leveraging a reliable financial platform, investors can gain a competitive edge, minimize risks, and maximize returns.

Google Finance vs Yahoo Finance: A Comprehensive Comparison

When it comes to financial platforms, two names stand out: Google Finance and Yahoo Finance. Both have established themselves as leaders in the industry, providing investors with valuable tools and insights to make informed decisions. Google Finance, launched in 2006, has leveraged its parent company’s expertise in search and data analysis to offer a robust platform for investors. Yahoo Finance, on the other hand, has been a staple in the financial industry since 1997, providing a comprehensive suite of tools and resources for investors. With both platforms boasting large user bases and a wide range of features, it’s essential to understand their histories, strengths, and weaknesses to make an informed decision when choosing between Google Finance vs Yahoo Finance.

How to Choose the Right Financial Platform for Your Needs

With numerous financial platforms available, selecting the right one can be a daunting task. When comparing Google Finance vs Yahoo Finance, it’s essential to consider several key factors to ensure you choose a platform that meets your investment needs. Data accuracy is a critical aspect, as it directly impacts the reliability of your investment decisions. Look for platforms that provide real-time market data, accurate financial analysis, and transparent data sources. Charting capabilities are also vital, as they enable you to visualize market trends and make informed decisions. Additionally, consider the platform’s news coverage, mobile accessibility, and user interface. A user-friendly interface can significantly enhance your overall experience, while mobile accessibility ensures you can stay informed on-the-go. By carefully evaluating these factors, you can make an informed decision and choose a financial platform that helps you achieve your investment goals.

Google Finance: A Closer Look at Its Features and Benefits

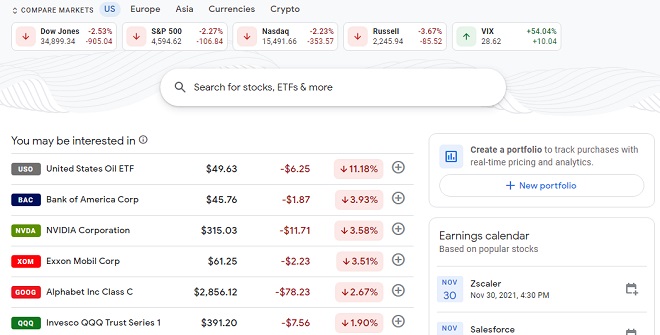

Google Finance is a powerful financial platform that offers a range of features and benefits to help investors make informed decisions. One of its standout features is its real-time market data, which provides users with up-to-the-minute information on stock prices, market trends, and news. Additionally, Google Finance offers customizable charts, allowing users to tailor their analysis to specific needs and preferences. The platform’s integration with other Google services, such as Google Search and Google Alerts, further enhances its functionality and convenience. Furthermore, Google Finance provides a comprehensive portfolio tracking feature, enabling users to monitor their investments and receive personalized alerts. With its user-friendly interface and robust feature set, Google Finance is an attractive option for investors seeking a reliable financial platform. When comparing Google Finance vs Yahoo Finance, it’s essential to consider these benefits and how they align with your investment goals.

Yahoo Finance: Exploring Its Strengths and Weaknesses

Yahoo Finance is a well-established financial platform that offers a range of features and benefits to investors. One of its standout strengths is its comprehensive news coverage, providing users with in-depth analysis and insights from reputable sources. The platform’s interactive charts are also a notable feature, allowing users to visualize market trends and make informed decisions. Additionally, Yahoo Finance boasts a thriving community of users, with active forums and discussion groups where investors can share knowledge and ideas. However, some users have reported issues with the platform’s data accuracy, citing occasional discrepancies in real-time market data. Furthermore, Yahoo Finance’s user interface has been criticized for being cluttered and difficult to navigate. Despite these weaknesses, Yahoo Finance remains a popular choice for investors, particularly those seeking a platform with a strong focus on news and community engagement. When comparing Google Finance vs Yahoo Finance, it’s essential to weigh these strengths and weaknesses against your individual needs and preferences.

A Side-by-Side Comparison of Google Finance and Yahoo Finance

When evaluating Google Finance vs Yahoo Finance, it’s essential to examine the similarities and differences between the two platforms. In terms of data accuracy, both platforms provide reliable and up-to-date information, with Google Finance slightly edging out Yahoo Finance in terms of real-time market data. However, Yahoo Finance excels in its comprehensive news coverage, offering a wider range of sources and in-depth analysis. Both platforms offer customizable charts, but Google Finance’s integration with other Google services, such as Google Sheets, provides a more seamless experience. In terms of user interface, Google Finance is generally considered more user-friendly, with a cleaner and more intuitive design. Yahoo Finance, on the other hand, has a more cluttered interface, but offers a wider range of features and tools. When it comes to mobile accessibility, both platforms offer robust mobile apps, with Google Finance’s app receiving slightly higher ratings. Ultimately, the choice between Google Finance and Yahoo Finance depends on individual needs and preferences. If real-time market data and a user-friendly interface are top priorities, Google Finance may be the better choice. However, if comprehensive news coverage and a wide range of features are more important, Yahoo Finance is worth considering.

Which Financial Platform is Right for You?

When deciding between Google Finance and Yahoo Finance, it’s essential to consider your individual needs and preferences. If you’re a beginner investor, Google Finance’s user-friendly interface and real-time market data may be the better choice. On the other hand, if you’re a more experienced investor seeking comprehensive news coverage and interactive charts, Yahoo Finance may be the way to go. It’s also important to consider your investment goals and strategies. For example, if you’re focused on technical analysis, Google Finance’s customizable charts may be more suitable. However, if you’re looking for a platform with a strong community of investors, Yahoo Finance’s forums and discussion groups may be more appealing. Ultimately, the choice between Google Finance vs Yahoo Finance depends on your unique requirements and investment style. By carefully evaluating your needs and weighing the strengths and weaknesses of each platform, you can make an informed decision and maximize your investment potential.

Maximizing Your Investment Potential with the Right Financial Tools

In today’s fast-paced and ever-changing financial landscape, having a reliable financial platform is crucial for making informed investment decisions. By choosing the right platform, investors can gain access to accurate and timely market data, analyze trends and patterns, and make data-driven decisions. Whether you’re a seasoned investor or just starting out, Google Finance vs Yahoo Finance offers a range of features and benefits that can help you achieve long-term financial success. By carefully evaluating your needs and selecting the platform that best aligns with your investment goals and strategies, you can maximize your investment potential and stay ahead of the curve. Remember, a reliable financial platform is not just a tool, but a key to unlocking your full investment potential. With the right platform, you can make informed decisions, minimize risks, and achieve your financial objectives.