What Are Credit Spreads and Why Do They Matter?

Credit spreads serve as a vital instrument for assessing risk within the realm of fixed income securities. They essentially quantify the incremental yield an investor anticipates receiving for assuming credit risk, as opposed to investing in a risk-free benchmark. This benchmark is typically a government bond, such as a Treasury security. The magnitude of the credit spread directly reflects the market’s perception of the issuer’s creditworthiness; a wider spread suggests a higher risk of default, while a narrower spread indicates a lower perceived risk.

Understanding credit spreads is crucial for fixed income investors because they facilitate the comparison of relative value among different bonds. By analyzing the spread, investors can determine whether a particular bond is priced attractively relative to its risk profile and comparable securities. This comparative analysis aids in identifying potential investment opportunities and managing portfolio risk effectively. Factors influencing credit spreads include the issuer’s financial health, industry outlook, prevailing economic conditions, and overall market sentiment. Fluctuations in these factors can significantly impact credit spreads, underscoring the need for continuous monitoring and analysis.

The concept of “g spread vs z spread” becomes relevant when analyzing credit spreads more deeply. While the basic credit spread provides a general overview of risk compensation, more sophisticated measures like the G-Spread and Z-Spread offer a more nuanced understanding. These advanced calculations adjust for factors like the shape of the yield curve and the timing of cash flows, providing a more precise assessment of relative value. Understanding the differences between these spreads, particularly “g spread vs z spread,” is essential for making informed investment decisions and optimizing fixed income portfolio performance, ultimately leading to better risk-adjusted returns. Sophisticated investors often use the “g spread vs z spread” to fine-tune their fixed income strategies.

Navigating the Landscape: Treasury Yield Curves and Benchmarking

The Treasury yield curve is a critical benchmark for pricing fixed-income securities. It represents the yields of Treasury securities across various maturities, from short-term bills to long-term bonds. This curve reflects the market’s expectations for future interest rates and economic growth. Because Treasury securities are considered virtually risk-free, the Treasury yield curve serves as the foundation for calculating spreads on other fixed-income investments.

Understanding the Treasury yield curve is essential for fixed-income analysis. The shape of the curve can indicate the overall health of the economy. A normal yield curve slopes upward, meaning that longer-term bonds have higher yields than shorter-term bonds. This typically reflects expectations for future economic growth and inflation. An inverted yield curve, where short-term yields are higher than long-term yields, can signal a potential economic slowdown or recession. A flat yield curve suggests uncertainty in the economic outlook.

The Treasury yield curve acts as a benchmark against which other fixed-income securities are measured. To assess the relative value of a corporate bond, for example, investors compare its yield to that of a Treasury security with a similar maturity. The difference between these yields is known as a spread. This spread represents the compensation investors demand for taking on the additional risk associated with the corporate bond, such as credit risk and liquidity risk. When analyzing fixed income securities, understanding the g spread vs z spread is crucial to proper evaluation. While both are relative value measures, they derive from the treasury yield curve. The g spread vs z spread are key tools for investment decisions. It is important to analyze and consider the g spread vs z spread when comparing fixed income opportunities, which can lead to potentially more profitable outcomes. The g spread vs z spread methodologies provide different perspectives. The g spread vs z spread calculations allow for a deeper dive.

Unlocking Investment Value: What is the “Nominal Spread”?

The Nominal Spread represents the difference in yield between a corporate bond and a comparable maturity Treasury security. It quantifies the extra return an investor anticipates for bearing the credit risk associated with the corporate bond. This spread is usually quoted in basis points (bps), where 100 bps equals 1%. Understanding nominal spreads is crucial for fixed income analysis. It helps investors assess the relative value of different bonds.

To calculate the Nominal Spread, simply subtract the yield-to-maturity (YTM) of the benchmark Treasury security from the YTM of the corporate bond. For example, imagine a corporate bond with a YTM of 5.00%. The Treasury bond with a similar maturity has a YTM of 3.00%. The Nominal Spread would be 2.00% or 200 bps (5.00% – 3.00% = 2.00%). This indicates the corporate bond offers an additional 2.00% yield above the risk-free Treasury bond. Investors often consider other spreads to achieve better performance, like the g spread vs z spread.

While the Nominal Spread offers a quick assessment of relative value, it’s essential to recognize its limitations. It does not account for the shape of the yield curve. It only considers a single point on the Treasury curve. For a more precise evaluation, especially when comparing bonds across different maturities or when the yield curve is not flat, the G-Spread and Z-Spread are better measures. The g spread vs z spread are helpful tools for fixed income, because they provide a more detailed view of the risk and return. Understanding the differences between the g spread vs z spread, the nominal spread, and other spread measurements empowers investors to make well-informed decisions in the fixed income market.

How to Calculate the G-Spread: A Practical Guide to Fixed Income Analysis

The G-Spread is a crucial metric in fixed income analysis, representing the yield advantage a corporate bond offers over a similar-maturity government bond. This difference, expressed in basis points (bps), provides a straightforward assessment of the credit risk premium associated with the corporate bond. Understanding how to calculate the G-Spread is essential for investors seeking to evaluate relative value and make informed investment decisions. The concept of the G spread vs z spread becomes relevant when comparing the simplicity of the G-Spread to the more complex Z-Spread.

To calculate the G-Spread, one needs the yield-to-maturity (YTM) of the corporate bond and the YTM of a government bond with a comparable maturity. The government bond is typically a Treasury bond in the United States. The calculation is a simple subtraction: G-Spread = Corporate Bond YTM – Government Bond YTM. For instance, imagine a corporate bond with a YTM of 4.5% and a Treasury bond with a matching maturity yielding 3.0%. The G-Spread would be 1.5% or 150 bps (4.5% – 3.0% = 1.5%). This 150 bps spread represents the additional compensation investors receive for the potential credit risk associated with the corporate bond. When analyzing fixed income securities, the G spread vs z spread consideration helps investors decide which spread best suits their analysis needs. Let’s consider a slightly different example, if the Corporate Bond YTM is 6.0% and the Government Bond YTM is 4.2%, then the G-Spread will be 1.8% or 180 bps.

While seemingly straightforward, the G-Spread offers a valuable snapshot of relative value. A higher G-Spread generally indicates a higher perceived credit risk or potentially an undervalued corporate bond. Conversely, a lower G-Spread might suggest lower credit risk or an overvalued bond. However, it’s vital to remember the G-Spread’s limitations. It relies on a single point on the Treasury yield curve and doesn’t account for the curve’s shape. This is where understanding the G spread vs z spread distinction becomes critical, as the Z-Spread addresses this limitation by considering the entire yield curve. The G-Spread is a useful tool for quick comparisons, but a more nuanced analysis, especially for bonds with complex cash flows, often requires the Z-Spread. Investors use the G-Spread as a starting point, then complement it with other metrics and qualitative factors to make well-rounded investment decisions.

Delving Deeper: Understanding the Z-Spread and its Nuances

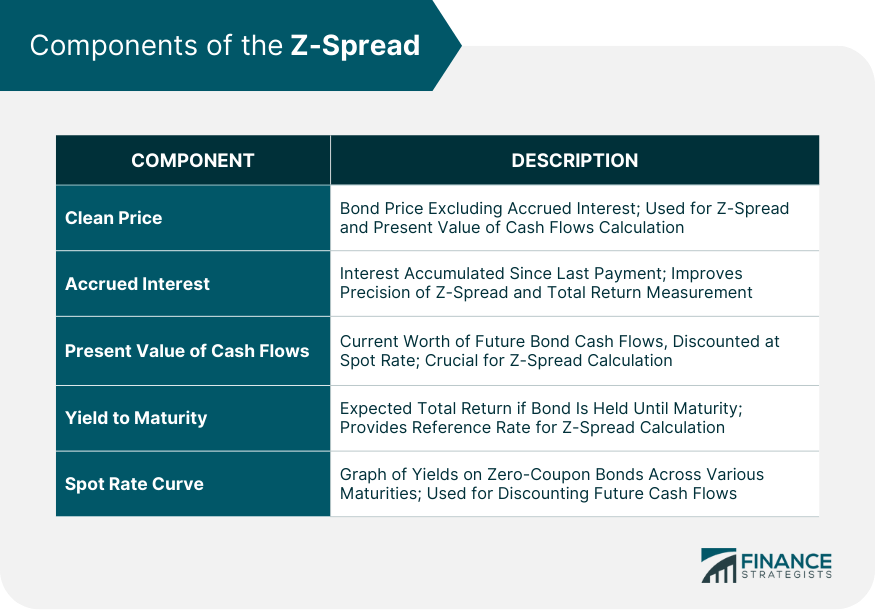

The Z-Spread (zero-volatility spread) represents a more refined measurement compared to the G-Spread. It quantifies the constant spread that, when added to each spot rate on the Treasury yield curve, makes the present value of a bond’s cash flows equal to its current market price. In essence, the Z-Spread captures the credit risk premium while accounting for the time value of money at each point in the bond’s life.

Unlike the G-Spread, which relies on a single point on the Treasury yield curve for comparison, the Z-Spread considers the entire curve. This is particularly important when the yield curve is not flat. The Z-Spread calculation involves an iterative process. It finds the spread that, when added to each spot rate, discounts the bond’s cash flows back to its market price. Because it accounts for the shape of the yield curve, the Z-Spread offers a more accurate representation of the bond’s relative value, especially for bonds with longer maturities or those exhibiting significant cash flow variations. The difference between the g spread vs z spread is very important.

To illustrate, imagine two bonds with identical maturities but different coupon payment schedules. The G-Spread might suggest they offer similar value. However, if the Treasury yield curve is upward sloping, the bond with higher cash flows in later years will be more sensitive to the higher discount rates at those maturities. The Z-Spread will reflect this sensitivity, potentially revealing a more accurate picture of the relative value between the two bonds. Therefore, understanding the nuances between the g spread vs z spread is essential for fixed income analysis. When evaluating bonds, remember that the g spread vs z spread provide different perspectives on risk and return. Choosing the appropriate spread measure depends on the specific characteristics of the bond and the shape of the prevailing yield curve. Accurately interpreting the g spread vs z spread can help make informed investment decisions.

G Spread vs Z Spread: Key Differences and When to Use Each

The G-Spread and the Z-Spread are both valuable tools for analyzing fixed-income securities, but they approach the assessment of credit risk from different angles. Understanding the nuances of each spread, including the key differences, is crucial for making informed investment decisions. The most significant distinction between the G spread vs z spread lies in how they utilize the Treasury yield curve. The G-Spread relies on a single point on the curve, specifically the yield-to-maturity of a Treasury bond with a maturity similar to the corporate bond being evaluated. In contrast, the Z-Spread considers the entire Treasury yield curve.

This difference in methodology has important implications. The G-Spread is a simpler calculation, making it easier to compute and understand. However, its simplicity comes at the cost of accuracy, especially when the Treasury yield curve is not flat. The G spread vs z spread comparison highlights this limitation. The G-Spread assumes that all cash flows from the corporate bond are discounted at the same rate, which is the yield of the comparable Treasury bond. This assumption is valid only if the yield curve is flat. When the yield curve is upward sloping (steeper), the G-Spread will underestimate the true spread because it doesn’t account for the higher discount rates applicable to later cash flows. Conversely, when the yield curve is downward sloping (inverted), the G-Spread will overestimate the spread. The Z-Spread, also known as the zero-volatility spread, addresses this limitation by incorporating the present value of each cash flow discounted at a specific zero-coupon rate derived from the Treasury yield curve. Therefore, Z-Spread provides a more accurate measure of the credit spread because it accounts for the time value of money for each individual cash flow.

Choosing between the G spread vs z spread depends on the specific situation and the desired level of accuracy. The G-Spread may be sufficient for quick comparisons of bonds with similar maturities, particularly when the yield curve is relatively flat. It’s also useful for tracking changes in credit spreads over time. However, when dealing with bonds that have complex cash flows, such as mortgage-backed securities or callable bonds, or when the yield curve is significantly sloped or curved, the Z-Spread is the preferred measure. The more sophisticated calculation of the Z-Spread provides a more precise assessment of the bond’s credit risk. Ultimately, understanding the strengths and weaknesses of both the G spread vs z spread enables investors to make more informed decisions and manage their fixed-income portfolios more effectively. For instance, if two bonds appear to have similar spreads based on the G-Spread, but one has a significantly higher Z-Spread, it may indicate that the latter bond is riskier due to its cash flow structure or the shape of the yield curve. Therefore, understanding the difference between the spreads leads to a better investment decision.

Limitations of Spreads: Factors to Consider Beyond the Numbers

While G-Spreads and Z-Spreads offer valuable insights into relative value, relying solely on these metrics for investment decisions can be misleading. Several factors beyond the numbers can significantly impact the actual performance of fixed-income securities. One crucial aspect is liquidity. A bond with a seemingly attractive spread may be difficult to sell quickly without incurring a substantial price concession, effectively eroding the anticipated yield advantage. The g spread vs z spread analysis should not be the only factor to consider.

Embedded options, such as callability, also complicate spread analysis. A callable bond may offer a higher spread than a non-callable bond from the same issuer. However, the issuer retains the right to redeem the bond before maturity, especially if interest rates decline. This limits the investor’s potential upside and introduces reinvestment risk. Credit rating changes represent another important consideration. A downgrade can widen the spread of a bond, reflecting increased credit risk. Conversely, an upgrade can narrow the spread. It’s essential to monitor credit ratings and assess the potential for future changes. Macroeconomic conditions exert a powerful influence on fixed-income markets. Factors such as inflation, economic growth, and monetary policy can impact interest rates and credit spreads across the board. A seemingly attractive spread may be unsustainable if the broader economic environment deteriorates. Investors must carefully consider the macroeconomic outlook and its potential impact on their fixed-income investments. The relationship of g spread vs z spread must be understood in the context of all factors involved.

Furthermore, regulatory changes and geopolitical events can introduce unexpected risks and opportunities in the fixed-income market. These events can trigger significant price movements and volatility, potentially affecting the performance of bonds regardless of their initial spreads. Therefore, thorough due diligence is paramount. Investors should conduct independent research, analyze financial statements, and assess the issuer’s creditworthiness. It is also important to evaluate the bond’s indenture, which outlines the terms and conditions of the issue, including any covenants or restrictions. Remember, spreads are just one piece of the puzzle. A comprehensive investment strategy involves considering a wide range of factors and conducting rigorous analysis to make informed decisions. Understanding g spread vs z spread nuances is vital, but a holistic perspective ensures better risk management and potential for long-term success. Investors need to assess multiple factors beyond spread for a balanced view.

Applications in Investment Strategy: Using Spreads to Identify Opportunities

Investors employ G-Spreads and Z-Spreads to pinpoint potential investment opportunities and effectively manage risk within fixed-income portfolios. These spreads are crucial for strategies like spread trading and relative value analysis. By analyzing the nuances between the G spread vs z spread, investors can better assess the impact of interest rate fluctuations on portfolio performance. For example, consider two corporate bonds with similar maturities and credit ratings. Bond A has a higher G-Spread than Bond B, but Bond B exhibits a higher Z-Spread. This discrepancy might indicate that Bond B’s cash flows are more heavily weighted towards the later part of the yield curve, making it more sensitive to changes in long-term interest rates. An investor expecting interest rates to remain stable might favor Bond A, while an investor anticipating a flattening of the yield curve might find Bond B more attractive.

Spread trading involves capitalizing on anticipated changes in the difference between two related fixed-income securities. Investors examine the G spread vs z spread to gauge relative value. If the spread between a corporate bond and a Treasury bond is perceived to be unusually wide compared to its historical range, an investor might buy the corporate bond and sell the Treasury bond, expecting the spread to narrow as the market corrects. This strategy profits from the convergence of the spread towards its perceived fair value. Relative value analysis utilizes spreads to compare the attractiveness of different bonds within the same asset class or across different asset classes. Analyzing the G spread vs z spread allows investors to identify bonds that are undervalued relative to their peers, potentially generating higher returns.

Understanding the nuances between the G spread vs z spread is critical for making informed investment decisions. The G-Spread offers a quick snapshot of the yield advantage of a corporate bond over a comparable Treasury. However, it does not capture the complexities of the yield curve. The Z-Spread, on the other hand, provides a more accurate measure of the spread by considering the entire yield curve. This is particularly important when analyzing bonds with complex cash flows or during periods of significant yield curve shifts. Imagine an investor comparing two bonds, one with a bullet maturity and the other with a sinking fund provision. While the G-Spread might appear similar, the Z-Spread would likely reveal a significant difference due to the differing cash flow patterns and their sensitivity to various points on the yield curve. Understanding the distinction between the G spread vs z spread empowers investors to make more informed decisions. This ultimately refines risk management and potentially improves portfolio performance in the dynamic world of fixed income investing.

:max_bytes(150000):strip_icc()/yieldspread.asp_final-0bcbecedb4624d85bcc4fb61c6729e85.png)