Understanding Spot Prices: The Here and Now

The spot price represents the current market value of an asset for immediate delivery. It’s the price you’d pay today to buy gold, crude oil, or a specific stock. For example, if the spot price of gold is $1,900 per ounce, that’s the price a buyer would pay for immediate delivery. Similarly, the EUR/USD spot exchange rate reflects the current value of one euro in US dollars. Spot transactions involve immediate exchange of the asset for cash. This immediacy is crucial for traders needing to execute trades quickly to capitalize on short-term market fluctuations. Businesses rely on spot prices for immediate procurement of raw materials or foreign currency needed for day-to-day operations. The relationship between futures price vs spot price is a key consideration for all market participants. Understanding this dynamic allows for informed decisions regarding timing and pricing, regardless of whether one is dealing in commodities or financial instruments. Spot prices, by their very nature, are highly dynamic and react in real time to market news and events; this is fundamentally different from the futures markets.

Spot prices are essential across various asset classes. In commodity markets, spot prices dictate the immediate cost of goods like crude oil or agricultural products. The spot price of crude oil, for instance, directly impacts gasoline prices at the pump. In currency markets, spot rates are critical for international trade and investment. A company importing goods from Europe will use the current EUR/USD spot rate to calculate the cost of the import. The futures price vs spot price is also a factor in how businesses manage risk associated with currency fluctuations. Stock markets also rely on spot prices, which represent the current market value of a share at any given time. These prices constantly fluctuate based on supply and demand, company news, and broader market trends. The speed at which spot prices adjust makes them a powerful indicator of immediate market sentiment and a crucial metric to monitor for both short-term and long-term investment strategies. This differs significantly from the more forward-looking nature of futures price vs spot price analysis.

The immediacy of spot transactions contrasts sharply with futures contracts. While spot prices reflect current market conditions, understanding how those conditions may evolve helps inform trading and investment strategies. The difference between futures price vs spot price frequently provides insight into market expectations and helps traders and investors manage risk and potential profit opportunities. Understanding the dynamics between spot and futures prices is crucial for effective market participation across various asset classes and trading strategies. Accurate forecasting, even for short periods, relies heavily on understanding both spot and future price fluctuations. The relationship between these two prices can provide crucial insights into investor sentiment and likely future price movements, helping to manage exposure to risk and enhance potential returns.

Futures Prices: A Glimpse into the Future

Futures contracts are agreements to buy or sell an asset at a predetermined price on a specific future date. These contracts are standardized and traded on exchanges, offering a mechanism for hedging risk and speculation. A futures price represents the agreed-upon price for the asset at that future date. Understanding the relationship between futures price vs spot price is crucial for market participants. The futures price reflects market expectations about the asset’s future value, incorporating factors like anticipated supply and demand, interest rates, and storage costs. Unlike spot transactions, which involve immediate delivery, futures contracts allow participants to lock in a price for a future transaction, mitigating price volatility. This is a key differentiator in futures price vs spot price analysis.

The time element is the fundamental distinction between spot and futures transactions. Spot transactions involve immediate exchange of the asset and payment. Futures transactions, conversely, involve a commitment to exchange the asset at a future date. This time lag introduces various factors that influence the futures price, often resulting in a difference between the futures price and the current spot price. For example, a futures contract for oil delivery in three months might trade at a different price than the current spot price for immediate delivery. This difference accounts for storage, interest, and other carrying costs until the future delivery date. The futures price vs spot price reflects the market’s collective forecast of these costs plus an additional premium or discount depending on market conditions.

Hedging and speculation are two primary uses of futures contracts. Hedgers use futures to mitigate price risk. For instance, an airline might buy fuel futures to protect against rising fuel costs. Speculators, on the other hand, aim to profit from price movements. They might buy futures contracts if they anticipate price increases and sell them if they expect price declines. In both cases, a keen understanding of the interplay between futures price vs spot price is essential for effective decision-making. Analyzing the dynamics of futures price vs spot price provides valuable insights into market sentiment and future price expectations. This understanding is pivotal for both hedgers mitigating their risks and speculators seeking to capitalize on market movements. The relationship between the futures price and the spot price reveals crucial information about market expectations and the overall market environment.

Factors Influencing the Gap Between Spot and Futures Prices

Several key factors contribute to the divergence between spot and futures prices. Storage costs significantly impact commodity futures price vs spot price. For instance, storing oil requires specialized tanks and incurs expenses. These costs are factored into the futures price, pushing it higher than the spot price. The longer the time until delivery, the greater the cumulative storage costs, widening the futures price vs spot price gap. Interest rates play a crucial role, particularly in financial markets. The opportunity cost of tying up capital in an asset until the futures contract’s delivery date influences the futures price. Higher interest rates increase this opportunity cost, making the futures price relatively lower compared to the spot price. This relationship is evident in currency futures, where interest rate differentials between countries affect the futures price vs spot price.

Convenience yield is another factor impacting the futures price vs spot price dynamic, particularly for commodities. This represents the value of having immediate access to the physical asset. For instance, a refinery needs immediate access to crude oil to maintain operations; they may pay a premium for spot oil compared to waiting for delivery through a futures contract. This demand for immediate access increases the spot price, relative to the futures price. Market expectations regarding future supply and demand also influence the futures price vs spot price. If the market anticipates future scarcity (e.g., due to a production disruption), the futures price will likely be higher than the spot price. Conversely, if an oversupply is anticipated, futures prices might fall below spot prices. Analyzing market sentiment and anticipated supply-demand dynamics is key to understanding the futures price vs spot price spread. Accurate forecasting involves considering geopolitical events, weather patterns (for agricultural commodities), and technological advancements influencing production.

Furthermore, the interplay between these factors can create complex dynamics. For example, high storage costs combined with low interest rates can lead to a situation where the futures price is still higher than the spot price, despite the relatively low cost of capital. Understanding how these factors interact is crucial for accurately interpreting the futures price vs spot price relationship and making informed trading decisions. This analysis helps understand potential market risks and opportunities, particularly in identifying periods of contango or backwardation. Consideration of these factors provides a valuable tool for market participants to manage risk and to profit from price fluctuations.

Contango and Backwardation: Understanding Market Dynamics

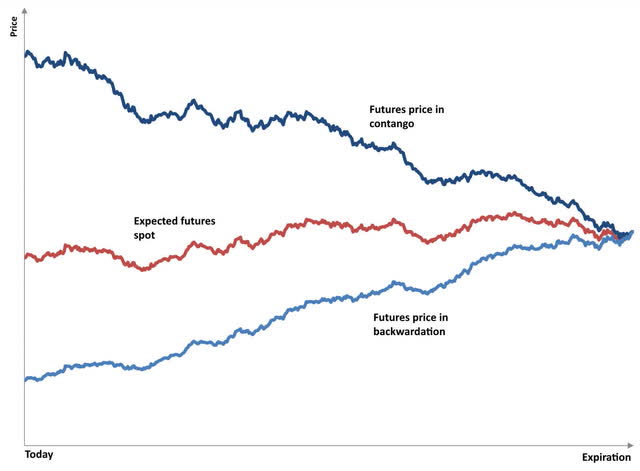

Contango and backwardation are two crucial concepts in understanding futures price vs spot price dynamics. Contango describes a market condition where the futures price of a commodity or asset is higher than its spot price. This typically occurs when there’s ample supply in the present, but expectations for future supply are lower or storage costs are high. For instance, if the spot price of crude oil is $70 per barrel, but the futures contract for delivery in six months is priced at $75, this reflects contango. Investors are willing to pay a premium to secure oil at a future date, reflecting anticipated supply constraints or storage costs. The futures price incorporates the cost of carrying the asset over time. This price differential compensates holders for storage, insurance, and financing costs associated with holding the physical commodity until the future delivery date. Analyzing the futures price vs spot price in a contango market can help investors assess storage costs and market expectations about future supply and demand. The size of the contango reflects the market’s view of future price changes and the cost of carrying the asset. A large contango suggests a significant expected increase in price or substantial storage costs.

Backwardation, conversely, represents the opposite scenario: the futures price is lower than the spot price. This is often indicative of anticipated scarcity or strong current demand exceeding available supply. For example, if the spot price of wheat is $10 per bushel, but the futures contract for delivery in three months trades at $9, this illustrates backwardation. Buyers are willing to accept a lower price in the future to secure the wheat now, reflecting concerns about potential future shortages or strong current demand. This futures price vs spot price relationship is particularly prevalent during times of significant supply disruptions or exceptionally high demand. The degree of backwardation reveals the market’s anticipation of future price volatility. A pronounced backwardation reflects significant anxieties about immediate supply shortages. In commodity markets, backwardation is common in times of tight supply or expected supply shocks. This is particularly the case for goods that cannot be easily stored or have low storage costs. Understanding whether a market is in contango or backwardation is crucial for making informed trading and hedging decisions. The futures price vs spot price spread provides valuable insights into market expectations and dynamics.

Analyzing the futures price vs spot price relationship within the context of contango and backwardation helps traders and investors to identify potential trading opportunities and assess risk. In a contango market, for example, a long-term investor may choose to purchase the futures contract for later delivery, rather than buying the spot asset, to lock in a certain price. Conversely, in backwardation, an investor might consider selling the futures contract, potentially profiting from the price difference if the spot price falls toward the futures price. Market participants need to carefully consider factors like storage costs and convenience yield, in addition to the spread between futures and spot prices when devising their trading strategies. The interplay of contango and backwardation illustrates the complex relationship between the current market valuation and future expectations, shaping the dynamics of futures price vs spot price and providing valuable insights for effective market participation. By diligently monitoring these patterns, market participants can gain a deeper understanding of the intricate dynamics of price formation and risk management in various asset classes.

How to Analyze Spot and Futures Price Relationships

Analyzing the relationship between spot and futures price requires a systematic approach. Begin by gathering historical data for both spot and futures prices of the asset you’re interested in. Reliable data sources include financial news websites and brokerage platforms. Visualizing this data using charts is crucial. Line charts effectively show price movements over time, allowing for the easy identification of trends in both spot and futures price. Observe the price difference between the spot and futures contracts at various points in time. Is the futures price trading at a premium (contango) or a discount (backwardation) to the spot price? The magnitude of this difference offers insights into market sentiment and expectations. For instance, a widening contango might suggest expectations of future supply surpluses. Conversely, a deepening backwardation could indicate anticipated future scarcity. Pay close attention to the evolution of this spread, as changes signal shifts in market dynamics. The futures price vs spot price relationship is dynamic and requires ongoing monitoring. Effective analysis involves considering the specific characteristics of the underlying asset. Commodities, for example, are heavily influenced by factors like storage costs and convenience yields. Understanding these influences is paramount to interpreting the price relationship accurately. Technical analysis tools, such as moving averages and relative strength index (RSI), can supplement this analysis by identifying potential trends and momentum changes. These indicators help to gauge the overall market sentiment and the potential for price reversals in the futures price vs spot price relationship.

A key aspect of this analysis involves identifying patterns and correlations. Are there consistent relationships between specific market events (like economic announcements or geopolitical developments) and shifts in the futures price vs spot price spread? Identifying these relationships allows for better forecasting. Furthermore, comparing the observed price relationship with historical data helps assess whether the current spread is within a typical range or signals an unusual market condition. This context is essential in evaluating potential trading or hedging opportunities. Remember that external factors always impact the relationship between spot and futures price. Interest rate changes, for example, can affect the cost of carrying inventory, influencing futures prices. Similarly, shifts in supply and demand forecasts influence both spot and futures markets. By acknowledging these external influences, analysts can better contextualize the relationship and improve the reliability of their analysis. Consistent and disciplined monitoring of the futures price vs spot price is key to identifying profitable opportunities and mitigating risks. Successful analysis combines quantitative data with qualitative assessments of market conditions. This holistic view is crucial for effective decision-making.

Effective use of charting software is invaluable. Most platforms allow for overlaying spot and futures price charts, making comparison straightforward. This visual representation highlights the price spread and its evolution over time. Analyzing the volatility of both spot and futures prices provides insights into market uncertainty and potential risks. High volatility might indicate increased uncertainty, influencing trading strategies. The relationship between spot and futures price is a dynamic interplay of numerous market factors. The ability to recognize these factors and interpret their influence is crucial for successful market participation. Understanding the nuances of the futures price vs spot price relationship enables sophisticated trading strategies and robust risk management. For example, hedgers can use futures contracts to lock in prices, mitigating price fluctuations. Speculators, conversely, may use this relationship to identify potential arbitrage opportunities, capitalizing on price discrepancies. By leveraging this understanding, market participants can make more informed and successful investment decisions.

Spot vs. Futures Price Relationship: Implications for Market Participants

The relationship between futures price vs spot price significantly impacts various market participants. Producers, for instance, often use futures contracts to hedge against price fluctuations. Understanding the futures price allows them to lock in a selling price for their goods, mitigating the risk of price drops before harvest or delivery. This strategy protects their profit margins. Conversely, consumers might utilize futures contracts to secure a fixed price for essential commodities, safeguarding against price increases in the future. Analyzing the futures price vs spot price helps them plan their budgets effectively and ensures supply stability. The spread between these prices gives insights into market sentiment and anticipated supply and demand. Accurate analysis of this relationship is key to effective risk management.

Speculators, on the other hand, actively participate in the futures market, aiming to profit from price movements. They analyze the futures price vs spot price to identify potential opportunities. A widening gap between these prices could signal an impending market shift. Speculators then use this information to bet on the future direction of the asset’s price. They may enter long positions if they expect the futures price to rise or short positions if they anticipate a decline. Effective speculation requires a deep understanding of market dynamics and the interplay between futures and spot prices. This involves sophisticated technical and fundamental analysis to predict price trends accurately. The futures price serves as an important indicator in this process.

Hedgers, including producers and consumers, use futures contracts to reduce their exposure to price risks. They carefully analyze the futures price vs spot price to determine the optimal hedging strategy. For example, an airline hedging against rising fuel costs would purchase fuel futures contracts. This strategy locks in a predictable fuel price for future operations, protecting their profit margins from volatile fuel markets. The difference between the futures price and the spot price determines the cost of this protection, affecting the profitability of the hedge. Understanding this dynamic is critical for successful risk management, showcasing the importance of a keen understanding of futures price vs spot price relationships.

Case Studies: Real-World Examples of Spot and Futures Price Dynamics

The 2008 oil price spike offers a compelling illustration of futures price vs spot price dynamics. Crude oil spot prices surged dramatically due to a combination of factors, including geopolitical instability and increasing global demand. Simultaneously, futures prices reflected market anxieties about future supply constraints, resulting in a significant contango. This wide gap between spot and futures prices impacted various market players. Producers, facing high spot prices, benefited immediately from increased revenues. However, consumers faced immediate price increases at the pump. Hedgers, who had locked in futures contracts, experienced varying outcomes depending on their position and timing. Some hedged against future price increases successfully, while others saw their hedges become less effective due to the unexpected volatility.

Another example lies in the foreign exchange market. Consider the EUR/USD exchange rate. Suppose escalating interest rate hikes in the US lead to increased demand for the US dollar. The spot price of the USD might strengthen immediately. However, futures contracts might reflect market expectations of continued interest rate differentials, pushing the futures price of the USD even higher than the current spot price. This scenario creates a contango, potentially beneficial for speculators anticipating further USD appreciation. Importantly, businesses involved in international trade would carefully analyze the futures price vs spot price to manage currency risk and make informed decisions about hedging strategies. A company expecting to receive Euros in the future might use futures contracts to lock in a favorable exchange rate, mitigating potential losses from future fluctuations. Analyzing the relationship between spot and futures prices allowed them to anticipate and mitigate potential risks.

The agricultural commodities market also presents insightful case studies for futures price vs spot price analysis. Consider a situation where an unexpectedly poor harvest season is predicted for a specific crop. The spot price might initially reflect limited immediate supply concerns. However, the futures price would likely reflect anticipated scarcity in the coming months, leading to a significant backwardation where futures prices fall below spot prices. This would provide invaluable information for agricultural producers, helping them to adjust their planting strategies and possibly benefit from higher future prices. Similarly, consumers and food processors could use this information to make more informed purchasing and inventory management decisions, potentially mitigating future price increases. Understanding the interplay between spot and futures prices is therefore crucial for successful decision-making in the agricultural sector.

Conclusion: Harnessing the Power of Spot and Futures Price Information

Understanding the intricacies of futures price vs spot price is crucial for navigating the complexities of various markets. This analysis reveals that differences between these prices stem from several key factors. Storage costs, interest rates, convenience yield, and market expectations regarding future supply and demand all play significant roles in shaping the futures price vs spot price relationship. The concepts of contango and backwardation highlight the dynamic interplay between these factors, reflecting market sentiment and anticipating future trends. Analyzing the relationship between spot and futures prices, using tools like charts and technical indicators, provides valuable insights for informed decision-making. Traders, producers, consumers, and hedgers all employ this information differently, tailoring their strategies to optimize their positions within the market.

The impact of futures price vs spot price dynamics is profound and far-reaching. Producers can use futures contracts to hedge against price fluctuations, locking in prices for their output and mitigating risk. Consumers, conversely, might utilize futures to secure future supplies at a predetermined price, thus protecting themselves from potential price increases. Speculators, on the other hand, leverage the price differential to profit from anticipated market movements. This detailed analysis of futures price vs spot price dynamics provides a robust framework for understanding market behavior. It underscores the importance of considering time horizons, anticipated supply and demand imbalances, and the inherent risks and rewards associated with various market positions.

Ultimately, mastering the analysis of futures price vs spot price relationships empowers market participants to make more informed decisions. By carefully considering the interplay of factors driving the price differential and interpreting market signals effectively, investors can enhance their risk management strategies and increase their chances of success in dynamic and often unpredictable markets. The ongoing relevance of this analysis cannot be overstated, given the inherent volatility and interconnectedness of modern financial markets. Continuous monitoring and analysis of futures price vs spot price dynamics remains essential for navigating the complexities of today’s global economy. A keen understanding of these dynamics is therefore a valuable asset for any market participant.