Navigating the Difference Between Immediate and Future Asset Values

The financial world distinguishes between the spot price and the futures price of an asset. The spot price represents the current market value for immediate delivery. Conversely, the futures price reflects the agreed-upon price for delivery at a specified future date. This distinction is critical for various market participants. Traders use these price differences to identify potential profit opportunities. Investors leverage them for hedging and portfolio management. Businesses rely on them for forecasting and managing price risk. Understanding the dynamics between the futures price vs spot price is paramount for informed decision-making. This article provides a comprehensive guide to these differences and their implications in the market. The interplay between the futures price vs spot price reveals expectations about future market conditions.

The difference between the futures price vs spot price is not arbitrary. Several factors contribute to this disparity. Interest rates, storage costs, and convenience yields all play a role. Expectations regarding future supply and demand heavily influence both prices. For example, if a commodity is expected to be scarce in the future, its futures price will likely be higher than its spot price. Similarly, anticipated increases in interest rates can push futures prices upward. Understanding these influencing factors allows market participants to make educated predictions. This can lead to the opportunity to capitalize on price movements. The futures price vs spot price relationship provides valuable insights into market sentiment and future expectations.

The core purpose of this article is to provide a comprehensive understanding of the futures price vs spot price relationship. It aims to explain the underlying factors that drive these prices. We delve into the implications for traders, investors, and businesses. By exploring the nuances of spot and futures markets, this guide equips readers with the knowledge to navigate these complexities. Whether you are a seasoned professional or a newcomer to the financial markets, this resource offers valuable insights. It enhances your understanding of the futures price vs spot price dynamic. This understanding is crucial for effective risk management, investment strategies, and overall financial success. Mastering the futures price vs spot price difference is a key component of financial literacy.

How to Calculate the Fair Value of a Futures Contract

Determining the fair value of a futures contract is essential for identifying potential arbitrage opportunities. This calculation represents the theoretical equilibrium price, reflecting the underlying asset’s spot price adjusted for factors like interest rates, storage costs, and dividends or convenience yields. Understanding how to compute this fair value allows traders to assess whether a futures price vs spot price is overvalued or undervalued in the market. The core principle is that the futures price vs spot price should reflect the cost of carrying the underlying asset until the futures contract’s expiration date.

The formula for calculating the theoretical fair value of a futures contract is: Futures Price = Spot Price * (1 + Interest Rate) + Storage Costs – Convenience Yield (or Dividends). Let’s break down each component. The spot price is the current market price of the asset for immediate delivery. The interest rate represents the cost of financing the purchase of the asset until the futures contract expires. Storage costs are applicable primarily to commodities and represent the expenses associated with storing the physical asset. Dividends (for equities) or convenience yields (for commodities) represent income or benefits derived from holding the physical asset rather than the futures contract. These factors reduce the futures price vs spot price.

The significance of this fair value calculation lies in its ability to highlight potential arbitrage opportunities. If the actual market futures price vs spot price deviates significantly from the calculated fair value, arbitrageurs may step in to exploit the discrepancy. For instance, if the futures price is higher than the fair value, a cash-and-carry arbitrage strategy might be employed: buying the asset at the spot price, storing it, and simultaneously selling the futures contract. Conversely, if the futures price is lower than the fair value, a reverse cash-and-carry arbitrage strategy could be implemented: selling the asset short, buying the futures contract, and taking delivery of the asset upon expiration. Accurate calculation of the fair value is therefore critical for informed decision-making and successful trading in futures markets, enabling participants to profit from discrepancies between the futures price vs spot price and contributing to market efficiency. Mispriced futures provide opportunities, but also risks, that traders need to consider.

The Role of Interest Rates in Shaping Forward Agreements

Interest rates are a critical determinant of the relationship between futures price vs spot price. They significantly shape forward agreements. The “cost of carry” concept explains this influence. Cost of carry includes the expenses associated with holding an asset. These expenses include storage, insurance, and financing costs. Higher interest rates generally increase the cost of carry. Consequently, this leads to higher futures price vs spot price. This is particularly true for commodities and assets that incur storage costs. The futures price reflects the spot price plus the cost of carrying the asset to the delivery date. The formula is often simplified to: Futures Price = Spot Price * (1 + Interest Rate).

The cost of carry model assumes a positive relationship between interest rates and futures price vs spot price. However, markets can sometimes exhibit an inverse relationship. This occurs in what’s known as an “inverted market.” An inverted market, or negative carry, happens when the futures price is lower than the spot price. This situation typically arises when there’s a high demand for immediate delivery of the asset. This high demand outweighs the costs associated with storage and financing. For example, if there is an immediate shortage of a commodity, buyers may be willing to pay a premium for immediate access. This drives up the spot price relative to the futures price. Understanding the interplay between interest rates and the forces of supply and demand is vital. It is essential for accurately interpreting the futures price vs spot price dynamics. Negative carry scenarios are more common in commodities markets that are subject to supply disruptions or seasonal demand spikes.

Variations in interest rates have a direct impact on arbitrage opportunities between the futures price vs spot price. If the futures price deviates significantly from the fair value suggested by the cost of carry model, arbitrageurs may step in. They will buy the cheaper asset and sell the more expensive one. This action helps to bring the futures price vs spot price back into alignment. Central bank policies and macroeconomic conditions can also have an indirect influence. They influence the expectations of future interest rate movements. These expectations can further impact the shape of the futures curve. Therefore, analyzing interest rate trends and understanding their implications are essential. This understanding is essential for anyone participating in futures markets. It allows the trader to anticipate potential price movements and manage risk effectively.

Examining Storage and Convenience Yield in Commodities Markets

The futures price vs spot price of storable commodities is significantly influenced by storage costs. When holding physical commodities, these costs, including warehousing, insurance, and potential spoilage, directly impact the futures price. Higher storage costs typically translate to a wider gap between the spot price (the price for immediate delivery) and the futures price (the price for delivery at a later date). This reflects the cost of carrying the physical commodity over time until the futures contract’s delivery date. Investors and traders must carefully consider these costs when evaluating the fair value of a futures contract, as neglecting them can lead to inaccurate pricing assessments and missed arbitrage opportunities. The relationship between futures price vs spot price is a key consideration.

Another crucial element in commodities markets is the “convenience yield.” This represents the benefit of holding the physical commodity rather than the futures contract. The convenience yield becomes particularly relevant in times of potential scarcity or supply disruptions. For example, a manufacturer might be willing to pay a premium for immediate access to a raw material to ensure uninterrupted production, even if the futures price is lower. This premium reflects the value of avoiding potential production delays or lost sales. The convenience yield effectively reduces the futures price vs spot price spread, as buyers are willing to pay more for the immediate availability of the commodity. Understanding the interplay between storage costs and convenience yield is vital for accurately predicting futures price vs spot price movements in commodity markets.

Furthermore, accurately assessing both storage costs and convenience yields allows market participants to make informed decisions regarding hedging and speculation. For instance, a producer facing high storage costs might choose to hedge their future production by selling futures contracts, effectively locking in a price that offsets these costs. Conversely, a consumer anticipating a supply shortage might be willing to pay a premium for physical inventory, reflecting a high convenience yield. Failing to account for these factors when analyzing futures price vs spot price dynamics can lead to suboptimal trading strategies and increased risk exposure. Therefore, a thorough understanding of these elements is essential for navigating the complexities of commodity markets and maximizing profitability.

Deciphering Contango and Backwardation: Market Dynamics Explained

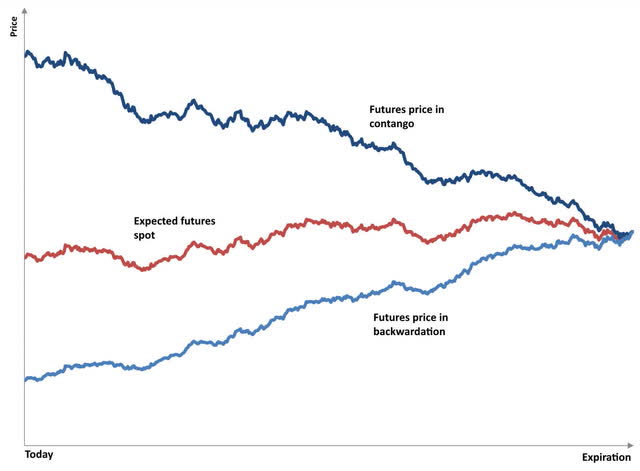

Contango and backwardation are two fundamental concepts in futures markets that describe the relationship between the futures price vs spot price of an asset. Contango occurs when the futures price vs spot price is higher than the expected future spot price, resulting in an upward-sloping futures curve. This typically happens when there are significant storage costs, high interest rates, or expectations of increasing future prices. Market participants are willing to pay a premium for future delivery to avoid the costs and complexities of storing the underlying asset. Conversely, backwardation arises when the futures price vs spot price is lower than the expected future spot price, leading to a downward-sloping futures curve. This often signals a current supply shortage or strong immediate demand, where buyers are willing to pay more for immediate delivery than for future delivery.

Consider the oil market as an example. If oil inventories are high and storage capacity is strained, the market may be in contango. Traders are willing to pay more for oil delivered in the future because they anticipate lower storage costs or a potential increase in demand later on. On the other hand, a sudden geopolitical event that disrupts oil production can trigger backwardation. With immediate supply concerns, the spot price of oil spikes, exceeding the futures price vs spot price as buyers scramble to secure available barrels. Similarly, natural gas markets often exhibit seasonal patterns of contango and backwardation. During periods of low demand, such as the shoulder seasons (spring and fall), natural gas may trade in contango due to ample supply and storage capacity. However, during peak demand seasons (winter and summer), when heating or cooling needs surge, the market can shift into backwardation as concerns about immediate supply adequacy drive up the spot price.

Understanding contango and backwardation is crucial for investors and businesses that utilize futures contracts for hedging or speculation. These market conditions reflect prevailing expectations about future supply and demand dynamics, influencing the profitability of various trading strategies. For instance, a company needing to purchase a commodity in the future might prefer to buy futures contracts when the market is in contango, locking in a known price even if it’s slightly higher than the current spot price. Conversely, a producer of that commodity might choose to hedge their future production by selling futures contracts when the market is in backwardation, securing a price higher than what they might receive in the spot market at the time of production. Analyzing the shape of the futures curve, whether it’s upward-sloping (contango) or downward-sloping (backwardation), provides valuable insights into the market’s expectations and potential opportunities related to the futures price vs spot price.

Strategies for Trading the Spread Between Cash and Forward Values

Several trading strategies are designed to exploit the price differences between spot and futures prices, offering opportunities for profit while managing risk. These strategies, predicated on understanding the dynamics of futures price vs spot price, include cash-and-carry arbitrage, reverse cash-and-carry arbitrage, and calendar spreads. Each strategy possesses unique risk-reward profiles, requiring careful consideration and market analysis.

Cash-and-carry arbitrage involves simultaneously buying an asset in the spot market and selling a corresponding futures contract. This strategy is typically employed when the futures price vs spot price is higher than the cost of carry (storage, insurance, and financing). The arbitrageur profits by delivering the purchased asset at the futures contract’s maturity, effectively locking in a risk-free profit. Conversely, reverse cash-and-carry arbitrage is used when the futures price vs spot price is lower than the cost of carry. In this scenario, the arbitrageur sells the asset in the spot market and buys a futures contract, intending to repurchase the asset at a later date to fulfill the futures obligation. This strategy can be more complex, especially if the asset is difficult to borrow.

Calendar spreads, also known as time spreads, involve simultaneously buying and selling futures contracts on the same underlying asset but with different expiration dates. This strategy aims to profit from changes in the shape of the futures curve. For example, a trader might buy a near-term futures contract and sell a further-dated contract, anticipating that the spread between the two will widen. Understanding the nuances of futures price vs spot price relationships, cost of carry, and market expectations is crucial for successfully implementing these strategies. External factors such as changes in interest rates, storage costs, or supply and demand dynamics can significantly impact the profitability of these trades. Careful risk management, including monitoring market volatility and position sizing, is essential to mitigate potential losses. The effectiveness of each strategy hinges on accurately assessing the relationship between the futures price vs spot price and anticipating future market movements.

Factors That Influence Discrepancies Between Spot and Forward Rates

External factors can significantly influence the deviations observed between spot and futures prices. These discrepancies, impacting the futures price vs spot price relationship, arise from a complex interplay of events and sentiments. Geopolitical events, for instance, can introduce volatility and uncertainty, leading to sudden shifts in both spot and forward markets. Unforeseen supply disruptions, such as natural disasters affecting agricultural yields or political instability impacting oil production, can also create temporary imbalances and affect the futures price vs spot price parity. Understanding these influences is critical for accurately interpreting market signals.

Changes in government regulations represent another layer of complexity that can affect the futures price vs spot price dynamic. New policies related to trade, tariffs, or environmental standards can alter the supply and demand landscape, creating ripple effects across the market. Shifts in investor sentiment, often driven by macroeconomic data releases or changes in risk appetite, can also lead to divergences between spot and forward rates. A sudden increase in risk aversion, for example, might prompt investors to flock to safe-haven assets, pushing down spot prices while simultaneously affecting futures contracts. Monitoring these factors and assessing their potential impact on the futures price vs spot price relationship is essential for informed decision-making.

The interplay of these factors emphasizes the need for continuous monitoring and dynamic risk assessment. Staying informed about geopolitical developments, regulatory changes, and shifts in investor sentiment provides a more holistic understanding of the forces shaping the futures markets. By analyzing these external influences in conjunction with traditional factors like interest rates and storage costs, businesses and investors can develop more robust strategies for navigating market volatility and managing their exposure to price fluctuations. This comprehensive approach enables a more nuanced interpretation of the futures price vs spot price spread, facilitating better-informed trading and hedging decisions. Recognizing these external factors is crucial when analyzing the futures price vs spot price for effective market participation.

Applying Spot-Forward Analysis for Risk Management and Hedging

Businesses and investors can leverage the dynamics of futures price vs spot price for robust risk management and hedging strategies. Understanding the relationship between the futures price vs spot price is crucial for mitigating financial exposures. Producers, aiming to safeguard their future revenues, can utilize futures contracts to lock in selling prices for their commodities. This shields them from potential price declines. Conversely, consumers can hedge against price increases by using futures contracts to secure the future purchase price of raw materials or energy. These strategies are essential in volatile markets. A deep understanding of futures price vs spot price allows for more informed decisions. By carefully analyzing the futures price vs spot price, companies can protect their profit margins and maintain stability in their operations.

Consider an airline seeking to manage jet fuel price volatility. By purchasing heating oil futures, the airline effectively fixes a future price for a significant portion of its fuel consumption. This protects them from unexpected spikes in fuel costs that could negatively impact profitability. Similarly, a gold mining company can hedge its future gold production by selling gold futures contracts. This assures them a certain revenue stream, regardless of any fluctuations in the spot market. These examples demonstrate the practical application of understanding the futures price vs spot price relationship in mitigating risk. Effective hedging strategies, grounded in spot-forward analysis, enhance financial predictability and allow businesses to focus on core operations.

Spot-forward analysis facilitates more than just hedging. It allows for strategic decision-making regarding inventory management and investment timing. For example, a manufacturer might choose to increase raw material inventory when the futures price vs spot price differential suggests an impending price increase. Or, an investor may decide to postpone a commodity purchase if the futures market indicates an expected price decline. Effective employment of futures price vs spot price insights empowers proactive risk management. It also enables informed investment choices. Monitoring the futures price vs spot price provides a valuable tool for navigating complex financial markets and enhancing long-term financial performance. It enables businesses and investors to make informed decisions and optimize their financial strategies within the context of market dynamics.