Understanding the Concept of Future Value in Annuities

In the world of finance, understanding the concept of future value is crucial for making informed investment decisions. When it comes to annuities, future value plays a vital role in determining the potential growth of an investment over time. In essence, future value represents the amount of money an investment is expected to be worth at a future date, taking into account factors such as interest rates, compounding, and time. This concept is particularly important when considering a growing annuity, as it allows individuals to project the potential returns on their investment and make informed decisions about their financial future. By grasping the concept of future value, individuals can better navigate the complexities of annuity planning and make more informed decisions about their financial future. A future value growing annuity calculator can be a valuable tool in this process, providing accurate and reliable results to inform investment decisions.

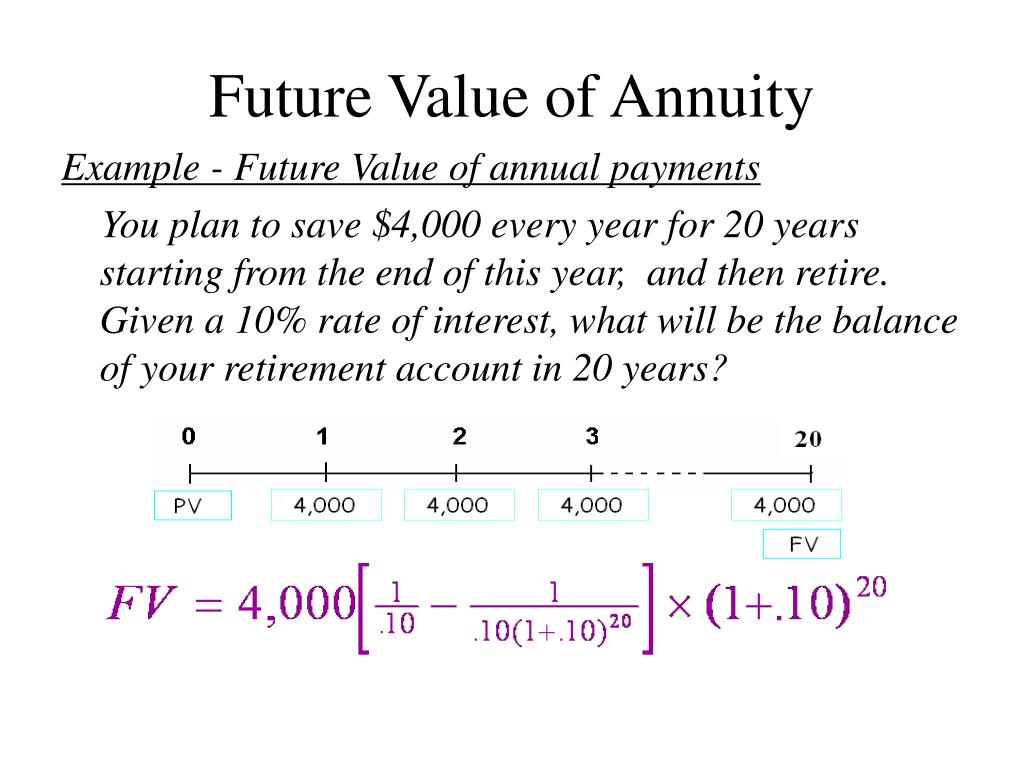

How to Calculate Future Value of a Growing Annuity

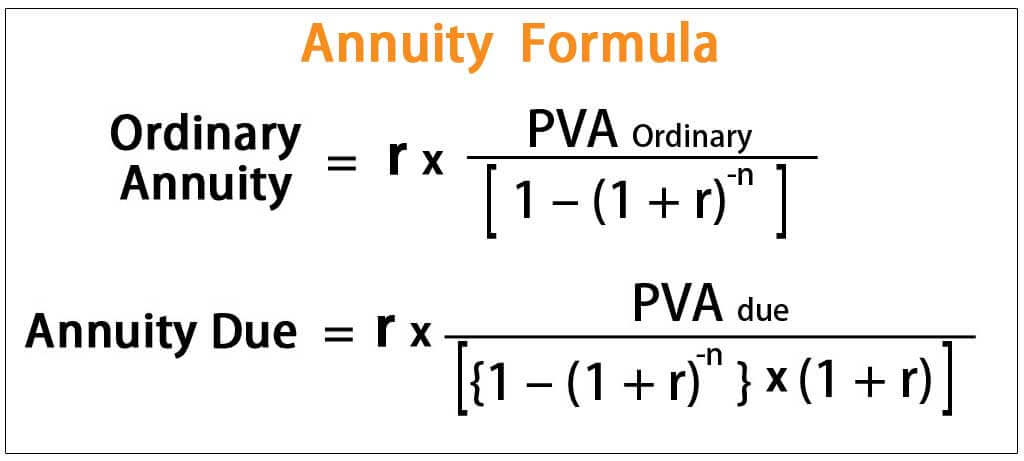

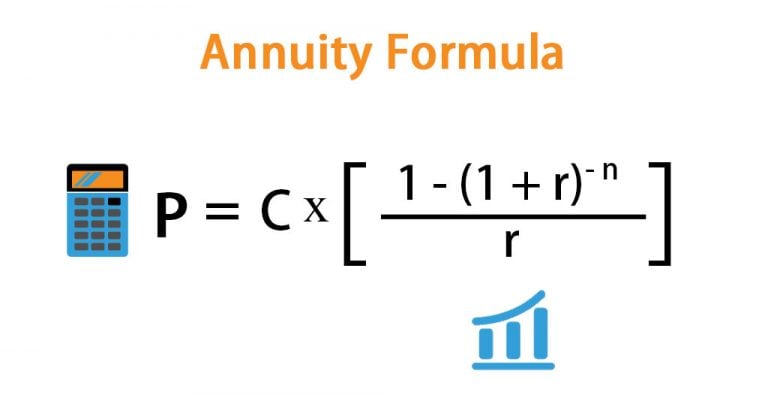

The calculation of future value is a crucial step in understanding the potential growth of a growing annuity. The formula for calculating the future value of a growing annuity is as follows: FV = PV x (1 + r)^n, where FV represents the future value, PV represents the present value, r represents the interest rate, and n represents the number of years. To apply this formula, individuals must first determine the present value of their investment, which is the initial amount invested. Next, they must determine the interest rate, which is the rate at which the investment grows over time. Finally, they must determine the number of years the investment will be held, which affects the compounding of interest. By plugging these variables into the formula, individuals can calculate the future value of their growing annuity and gain a better understanding of its potential growth. For example, if an individual invests $10,000 at an interest rate of 5% per year for 10 years, the future value of their investment would be approximately $16,289. A future value growing annuity calculator can simplify this process, providing accurate and reliable results to inform investment decisions.

The Role of Interest Rates and Compounding in Growing Annuities

Interest rates and compounding play a crucial role in determining the future value of a growing annuity. The interest rate, which is the rate at which the investment grows over time, has a direct impact on the annuity’s growth. A higher interest rate can result in a significantly higher future value, while a lower interest rate can lead to slower growth. Compounding, which is the process of earning interest on both the principal amount and any accrued interest, can also have a profound impact on the annuity’s growth. By compounding interest over time, individuals can potentially earn a significant amount of interest, leading to a higher future value. For example, if an individual invests $10,000 at an interest rate of 5% per year, compounded annually, the future value of their investment would be approximately $16,289 after 10 years. However, if the interest rate were to increase to 7% per year, the future value would jump to approximately $23,965. A future value growing annuity calculator can help individuals understand the impact of interest rates and compounding on their investment, providing a clear picture of their annuity’s potential growth.

Using a Future Value Growing Annuity Calculator for Accurate Results

A future value growing annuity calculator is a powerful tool that can simplify the process of calculating the future value of a growing annuity. By using a calculator, individuals can avoid the complexity of manual calculations and ensure accurate results. A future value growing annuity calculator can also help individuals to quickly compare different investment scenarios, allowing them to make informed decisions about their financial planning. For example, an individual can use a calculator to determine the impact of different interest rates or compounding frequencies on the future value of their annuity. This can help them to identify the most beneficial investment strategy and maximize their returns. Additionally, a future value growing annuity calculator can provide a clear and concise picture of the annuity’s potential growth, allowing individuals to plan for their financial future with confidence. To use a future value growing annuity calculator effectively, individuals should ensure that they have a clear understanding of the variables involved, including the present value, interest rate, and compounding frequency. By doing so, they can make the most of this valuable tool and achieve their long-term financial goals.

Real-World Applications of Growing Annuities in Financial Planning

Growing annuities have a wide range of practical applications in financial planning, making them a valuable tool for individuals seeking to achieve specific financial goals. One of the most common uses of growing annuities is in retirement planning, where they can provide a steady income stream for retirees. By investing in a growing annuity, individuals can ensure that they have a reliable source of income in their golden years, allowing them to maintain their standard of living. Growing annuities can also be used for wealth accumulation, providing a tax-deferred growth opportunity that can help individuals build wealth over time. Additionally, growing annuities can be used in estate planning, allowing individuals to transfer wealth to their beneficiaries in a tax-efficient manner. For example, an individual may use a growing annuity to provide a legacy for their children or grandchildren, ensuring that they have a secure financial future. By understanding the real-world applications of growing annuities, individuals can make informed decisions about their financial planning and achieve their long-term goals.

Common Mistakes to Avoid When Calculating Future Value

When calculating the future value of a growing annuity, it’s essential to avoid common mistakes that can lead to inaccurate results. One of the most common errors is incorrect assumptions about interest rates or compounding frequencies. For instance, assuming a fixed interest rate when the actual rate is variable can significantly impact the future value of the annuity. Another mistake is formula mistakes, such as incorrectly applying the formula for calculating future value or neglecting to account for compounding. To avoid these mistakes, it’s crucial to carefully review the calculation process and ensure that all variables are accurately accounted for. Additionally, using a future value growing annuity calculator can help to simplify the calculation process and reduce the risk of errors. By being aware of these common mistakes and taking steps to avoid them, individuals can ensure that their calculations are accurate and reliable, allowing them to make informed decisions about their financial planning.

Comparing Growing Annuities with Other Investment Options

When considering a growing annuity as an investment option, it’s essential to compare it with other alternatives to determine which one best suits individual financial goals. Two common investment options that are often compared with growing annuities are fixed annuities and mutual funds. Fixed annuities, unlike growing annuities, provide a fixed rate of return and a guaranteed income stream. While they offer more predictability, they may not provide the same level of growth potential as a growing annuity. Mutual funds, on the other hand, offer a diversified investment portfolio, but they often come with higher fees and market volatility. Growing annuities, by contrast, offer a unique combination of tax-deferred growth, compounding interest, and a guaranteed income stream. When used in conjunction with other investment options, growing annuities can provide a balanced investment portfolio that meets individual financial goals. For instance, an individual may use a growing annuity to provide a steady income stream in retirement, while investing in mutual funds to achieve long-term growth. By understanding the pros and cons of each investment option, individuals can make informed decisions about their financial planning and maximize their returns. Additionally, using a future value growing annuity calculator can help individuals determine the potential growth of their investment and make informed decisions about their financial planning.

Maximizing the Benefits of a Growing Annuity

To maximize the benefits of a growing annuity, it’s essential to optimize interest rates, compounding, and tax implications. One strategy is to shop around for the best interest rates, as even a small difference in rates can significantly impact the future value of the annuity. Additionally, considering the compounding frequency can also impact the growth of the annuity. For instance, daily compounding can result in a higher future value compared to annual compounding. Furthermore, understanding the tax implications of a growing annuity can help individuals minimize their tax liability and maximize their returns. For example, using a tax-deferred growing annuity can help individuals reduce their tax burden and increase their savings. By using a future value growing annuity calculator, individuals can determine the potential growth of their investment and make informed decisions about their financial planning. By combining these strategies, individuals can maximize the benefits of a growing annuity and achieve their long-term financial goals. By considering the future value of a growing annuity, individuals can make informed decisions about their financial planning and create a secure financial future.