Understanding the History of the French Franc

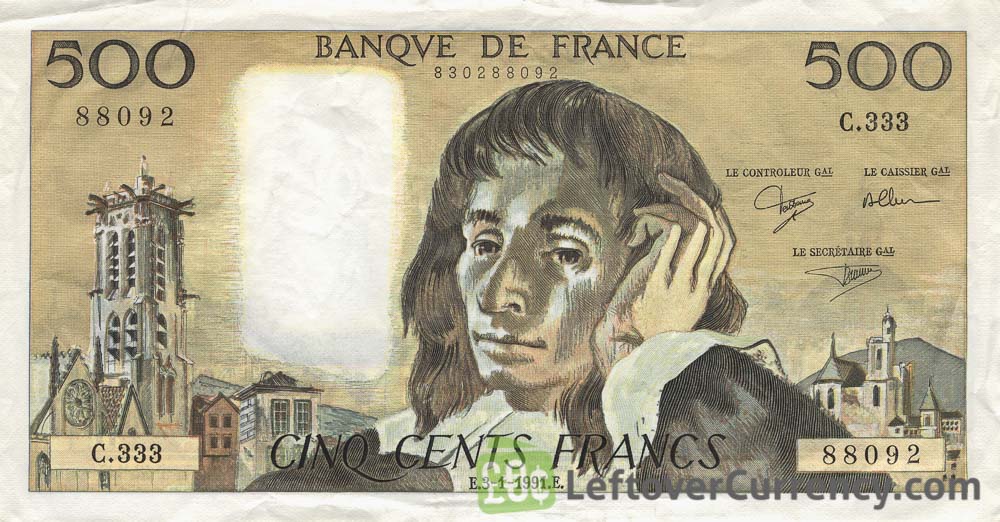

The French Franc, once a symbol of French economic power, has a rich history dating back to the 14th century. Initially introduced as a gold coin, the Franc evolved over the centuries, with various denominations and designs being introduced. In the mid-20th century, the French Franc became a key currency in the European Economic Community, paving the way for the eventual introduction of the Euro in 1999. Today, although the French Franc is no longer an official currency, its legacy lives on, and understanding its history is essential for grasping the complexities of currency exchange rates, including the French Franc to US Dollar exchange rate. This historical context sets the stage for understanding the importance of converting French Francs to US Dollars, a crucial aspect of international trade and commerce.

How to Convert French Francs to US Dollars

Converting French Francs to US Dollars can seem daunting, but with the right guidance, it’s a straightforward process. To convert French Francs to US Dollars, you’ll need to know the current exchange rate, which can fluctuate frequently. As of [current date], the exchange rate is approximately 1 French Franc = 0.18 US Dollars. Keep in mind that exchange rates may vary depending on the provider and any applicable fees or charges. When converting French Francs to US Dollars, it’s essential

The Impact of Exchange Rates on International Trade

Exchange rates play a crucial role in international trade, as they directly affect the prices of imports and exports. A fluctuation in the French Franc to US Dollar exchange rate can significantly impact the profitability of businesses engaged in international trade. For instance, a depreciation of the French Franc against the US Dollar can make French exports cheaper and more competitive in the US market, while a appreciation of the French Franc can make US exports more expensive and less competitive in France. This, in turn, can influence trade balances, economic growth, and even employment rates. Understanding the dynamics of exchange rates is essential for businesses and individuals involved in international trade, as it enables them to make informed decisions about investments, pricing, and risk management. In the context of French Franc to US Dollar exchange rates, a thorough understanding of exchange rate fluctuations can help businesses navigate the complexities of international trade and stay competitive in the global market.

Factors Affecting the French Franc to US Dollar Exchange Rate

The exchange rate between the French Franc and US Dollar is influenced by a complex array of factors, including economic indicators, political stability, and supply and demand. Economic indicators such as inflation rates, interest rates, and GDP growth rates can significantly impact the exchange rate. For instance, a country with high inflation rates may see its currency depreciate against the US Dollar, making French Franc to US Dollar exchange rates more favorable for importers. Political stability also plays a crucial role, as a country with a stable political environment is more likely to attract foreign investment, which can strengthen its currency. Supply and demand imbalances can also affect the exchange rate, as changes in trade patterns or investment flows can influence the demand for a particular currency. Additionally, market sentiment, speculation, and central bank interventions can also impact the French Franc to US Dollar exchange rate. Understanding these factors is essential for individuals and businesses involved in international trade, as it enables them to make informed decisions about investments, pricing, and risk management. By grasping the complexities of currency exchange, individuals can navigate the fluctuations in French Franc to US Dollar exchange rates and make the most of their international transactions.

Using Currency Exchange Services: What You Need to Know

When converting French Francs to US Dollars, individuals and businesses have a range of currency exchange services to choose from. Banks, online exchange platforms, and currency brokers are the most common options, each with their own benefits and drawbacks. Banks, for instance, offer a secure and reliable way to exchange currencies, but may charge higher fees and have less competitive exchange rates. Online exchange platforms, on the other hand, provide a convenient and often cheaper way to exchange currencies, but may lack the personal service and security of a bank. Currency brokers, specializing in large-volume transactions, can offer more competitive exchange rates and personalized service, but may require a minimum transaction amount. When selecting a currency exchange service, it is essential to compare exchange rates, fees, and services to find the best option for your specific needs. Additionally, understanding the fees and charges associated with each service can help individuals and businesses avoid hidden costs and make the most of their French Franc to US Dollar exchange. By choosing the right currency exchange service, individuals can ensure a smooth and cost-effective conversion process.

Avoiding Hidden Fees When Converting French Francs to US Dollars

When converting French Francs to US Dollars, it’s essential to be aware of the fees and charges associated with the transaction. Hidden fees can quickly add up, eating into the value of your exchange. To avoid these unwanted surprises, it’s crucial to compare exchange rates and fees across different providers. Start by researching the current French Franc to US Dollar exchange rate to get an idea of the going rate. Then, compare the rates offered by banks, online exchange platforms, and currency brokers. Be sure to factor in any additional fees, such as transfer fees, commission fees, and margin fees. Some providers may also charge higher fees for smaller transactions or cash exchanges. By taking the time to research and compare, individuals can avoid hidden fees and ensure they get the best possible rate for their French Franc to US Dollar exchange. Additionally, consider using online tools and calculators to get an estimate of the fees and exchange rates before making a transaction. With a little planning and research, individuals can save money and make the most of their French Franc to US Dollar exchange.

The Future of Currency Exchange: Trends and Predictions

The world of currency exchange is rapidly evolving, driven by technological advancements, shifting global economic trends, and the rise of digital currencies. As the French Franc to US Dollar exchange rate continues to fluctuate, it’s essential to stay ahead of the curve and understand the trends shaping the future of currency exchange. One of the most significant developments is the increasing adoption of digital currencies, such as Bitcoin and Ethereum, which are decentralized and operate independently of traditional financial systems. Blockchain technology, the underlying infrastructure of digital currencies, is also being explored for its potential to increase the speed, security, and transparency of cross-border transactions. Furthermore, the growth of online exchange platforms and mobile payment systems is making it easier and more convenient for individuals and businesses to convert French Francs to US Dollars. Looking ahead, it’s likely that we’ll see even more innovative solutions emerge, such as the use of artificial intelligence and machine learning to optimize exchange rates and predict market fluctuations. As the global economy continues to evolve, understanding the trends and predictions shaping the future of currency exchange will be crucial for individuals and businesses looking to navigate the complex world of French Franc to US Dollar exchange rates.

Conclusion: Mastering French Franc to US Dollar Exchange Rates

In conclusion, understanding the intricacies of French Franc to US Dollar exchange rates is crucial for individuals and businesses alike. By grasping the history of the French Franc, learning how to convert French Francs to US Dollars, and appreciating the impact of exchange rates on international trade, individuals can navigate the complex world of currency exchange with confidence. Additionally, recognizing the factors that influence the French Franc to US Dollar exchange rate, utilizing currency exchange services effectively, and avoiding hidden fees can help individuals and businesses optimize their exchange transactions. As the future of currency exchange continues to evolve, staying informed about trends and predictions will be essential for mastering French Franc to US Dollar exchange rates. By following the guidelines and tips outlined in this article, individuals can ensure they get the best possible rate for their French Franc to US Dollar exchange, ultimately saving time and money. With a deep understanding of French Franc to US Dollar exchange rates, individuals can take control of their international transactions and achieve their financial goals with ease.