Understanding the History of the French Franc

The French Franc, once the official currency of France, has a rich history that dates back to the 5th century. Introduced by the Frankish King Clovis, the Franc was initially a gold coin used for trade and commerce. Over the centuries, the Franc underwent numerous transformations, with its value and design changing to reflect the country’s economic and political landscape. In 1960, the French government introduced the new Franc, which replaced the old Franc at a rate of 1 new Franc to 100 old Francs. This move was aimed at stabilizing the economy and combating inflation.

In 1999, the French Franc was officially replaced by the Euro, marking a significant shift in the country’s monetary policy. The Eurozone, comprising 19 of the 27 European Union member states, adopted the Euro as their official currency. This change had a profound impact on currency conversion, including the French Franc to dollar conversion. Today, while the French Franc is no longer an official currency, its legacy continues to influence currency exchange rates and conversion practices. Understanding the history of the French Franc is essential for grasping the complexities of French Franc to dollar conversion, as it affects the exchange rate and conversion fees.

How to Convert French Francs to US Dollars

Converting French Francs to US Dollars requires an understanding of the current exchange rate and any relevant conversion fees. To perform a French Franc to dollar conversion, follow these steps:

1. Determine the current exchange rate: Check the current exchange rate between the French Franc and the US Dollar. You can find this information on currency conversion websites, such as XE.com or Oanda, or through a financial institution.

2. Calculate the conversion amount: Multiply the amount of French Francs you want to convert by the current exchange rate. This will give you the equivalent amount in US Dollars.

3. Consider conversion fees: Be aware of any conversion fees associated with the transaction. These fees can vary depending on the conversion method and institution used.

For example, if you want to convert 1,000 French Francs to US Dollars and the current exchange rate is 1 French Franc = 0.18 US Dollars, the calculation would be:

1,000 French Francs x 0.18 US Dollars/French Franc = 180 US Dollars

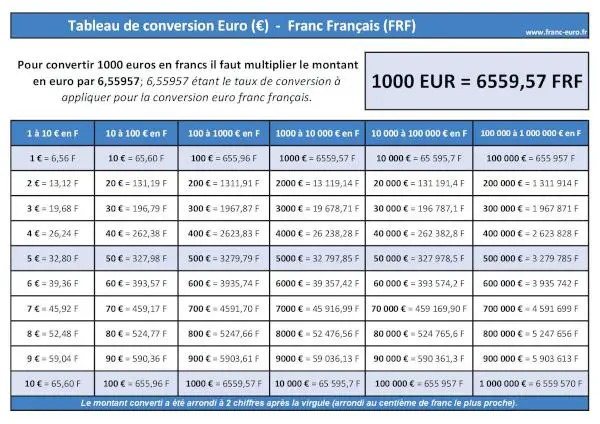

Keep in mind that the French Franc is no longer an official currency, so you may need to convert it to Euros or another currency before converting it to US Dollars. Understanding the French Franc to dollar conversion process is crucial for individuals and businesses involved in international transactions.

By following these steps and considering the current exchange rate and conversion fees, you can accurately perform a French Franc to dollar conversion and make informed decisions about your international transactions.

The Impact of Exchange Rates on Conversion

Exchange rates play a crucial role in French Franc to dollar conversion, as they determine the value of one currency in terms of another. Understanding the factors that influence exchange rates is essential for individuals and businesses involved in international transactions.

Economic indicators, such as inflation rates, interest rates, and GDP growth, significantly impact exchange rates. A country with a strong economy and low inflation rate is likely to have a stronger currency, resulting in a higher exchange rate. On the other hand, a country with a weak economy and high inflation rate may experience a depreciation of its currency, leading to a lower exchange rate.

Political stability is another key factor that affects exchange rates. A country with a stable political environment is more likely to attract foreign investment, leading to an appreciation of its currency. Conversely, a country with political unrest or instability may experience a depreciation of its currency.

Market trends, such as supply and demand, also influence exchange rates. If there is a high demand for a particular currency, its value is likely to increase, resulting in a higher exchange rate. Conversely, if there is a low demand for a currency, its value may decrease, leading to a lower exchange rate.

In the context of French Franc to dollar conversion, these factors can significantly impact the exchange rate. For example, if the US economy is experiencing a period of growth, the value of the US Dollar may appreciate, resulting in a higher exchange rate for French Franc to dollar conversions. On the other hand, if the French economy is experiencing a period of instability, the value of the Euro (and subsequently the French Franc) may depreciate, leading to a lower exchange rate.

Understanding the factors that influence exchange rates is crucial for individuals and businesses involved in French Franc to dollar conversions. By staying informed about economic indicators, political stability, and market trends, individuals and businesses can make informed decisions about their international transactions and minimize the risks associated with exchange rate fluctuations.

Using Currency Conversion Tools and Services

When it comes to French Franc to dollar conversion, using online currency conversion tools and services can simplify the process and provide accurate results. There are several options available, each with their own features and fees.

XE.com is a popular online currency conversion tool that provides up-to-date exchange rates and allows users to convert French Francs to US Dollars. The website also offers a range of other features, including historical exchange rate data, currency charts, and a currency converter app.

Oanda is another well-known online currency conversion service that provides accurate exchange rates and allows users to convert French Francs to US Dollars. Oanda also offers a range of other features, including a currency converter API, exchange rate data, and a currency converter app.

Other online currency conversion tools and services include CurrencyFair, TransferWise, and WorldRemit. Each of these services offers a range of features and fees, so it’s essential to compare them before making a decision.

When choosing a currency conversion tool or service, it’s essential to consider the fees associated with the conversion. Some services may charge a flat fee, while others may charge a percentage of the conversion amount. Additionally, some services may offer better exchange rates than others, so it’s essential to compare rates before making a decision.

In addition to online currency conversion tools and services, individuals and businesses can also use banks and financial institutions to convert French Francs to US Dollars. However, these institutions may charge higher fees and offer less competitive exchange rates than online services.

By using online currency conversion tools and services, individuals and businesses can simplify the French Franc to dollar conversion process and minimize the risks associated with exchange rate fluctuations. Whether you’re traveling, conducting international business, or investing, using a reliable currency conversion tool or service can help you achieve your goals.

Common Conversion Scenarios: Travel, Business, and Investment

French Franc to dollar conversion is a necessary step for individuals and businesses involved in international transactions. There are several common scenarios where this conversion is necessary, including travel, international business, and investment.

Travelers, for instance, may need to convert French Francs to US Dollars when visiting the United States or conducting transactions with US-based businesses. In this scenario, it’s essential to understand the current exchange rate and any relevant conversion fees to avoid unnecessary charges. Using a reliable currency conversion tool or service, such as XE.com or Oanda, can help travelers get the best possible exchange rate.

International businesses may also require French Franc to dollar conversion when conducting transactions with US-based clients or suppliers. In this scenario, it’s essential to understand the implications of exchange rate fluctuations on the business’s bottom line. By using a currency conversion tool or service, businesses can minimize the risks associated with exchange rate fluctuations and ensure accurate conversions.

Investors may also need to convert French Francs to US Dollars when investing in US-based assets or conducting transactions with US-based financial institutions. In this scenario, it’s essential to understand the current exchange rate and any relevant conversion fees to maximize returns on investment. Using a reliable currency conversion tool or service can help investors make informed decisions and avoid unnecessary charges.

In each of these scenarios, it’s essential to understand the French Franc to dollar conversion process and the factors that influence exchange rates. By doing so, individuals and businesses can minimize the risks associated with exchange rate fluctuations and ensure accurate conversions. Additionally, using a reliable currency conversion tool or service can help simplify the conversion process and provide the best possible exchange rate.

Whether you’re a traveler, international business, or investor, understanding the French Franc to dollar conversion process is crucial for success in today’s global economy. By staying informed about exchange rates, conversion fees, and currency conversion tools and services, individuals and businesses can navigate the complexities of international transactions with confidence.

Avoiding Conversion Fees and Charges

When conducting French Franc to dollar conversions, it’s essential to be aware of the potential fees and charges associated with the process. These fees can eat into the value of the conversion, reducing the amount of US Dollars received. Fortunately, there are several strategies for minimizing or avoiding conversion fees and charges.

One effective strategy is to use credit cards or debit cards that do not charge foreign transaction fees. These cards can help individuals and businesses avoid conversion fees and charges, ensuring that they receive the full value of their French Franc to dollar conversion.

Another strategy is to use specialized currency conversion services that offer competitive exchange rates and low or no fees. These services, such as TransferWise or WorldRemit, can help individuals and businesses save money on French Franc to dollar conversions.

Additionally, individuals and businesses can avoid conversion fees and charges by using online currency conversion tools and services that offer competitive exchange rates and low or no fees. These tools and services, such as XE.com or Oanda, can help simplify the French Franc to dollar conversion process and reduce the costs associated with it.

It’s also essential to be aware of the exchange rates offered by different currency conversion services and tools. Some services may offer more competitive exchange rates than others, which can help individuals and businesses save money on French Franc to dollar conversions.

By understanding the fees and charges associated with French Franc to dollar conversions and using strategies to minimize or avoid them, individuals and businesses can ensure that they receive the best possible value for their conversions. Whether you’re a traveler, international business, or investor, avoiding conversion fees and charges is crucial for success in today’s global economy.

By staying informed about the fees and charges associated with French Franc to dollar conversions and using the right strategies, individuals and businesses can navigate the complexities of international transactions with confidence and maximize their returns.

Understanding the Difference Between Fixed and Floating Exchange Rates

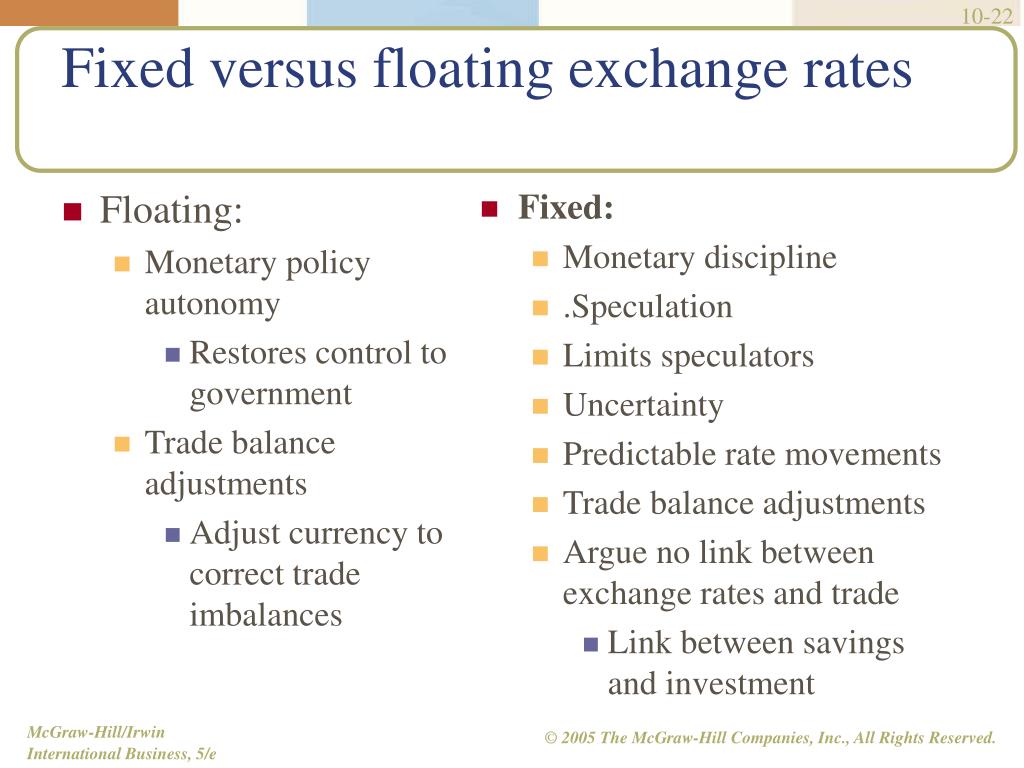

In the context of French Franc to dollar conversion, understanding the difference between fixed and floating exchange rates is crucial. Exchange rates can be classified into two main categories: fixed and floating. Each type of exchange rate has its own implications for individuals and businesses conducting French Franc to dollar conversions.

A fixed exchange rate is a rate that is set and maintained by a government or central bank. This type of exchange rate is often used in countries with a fixed currency regime. In a fixed exchange rate system, the value of the currency is pegged to a stable currency, such as the US Dollar. This means that the exchange rate remains constant, and French Franc to dollar conversions are not affected by market fluctuations.

On the other hand, a floating exchange rate is a rate that is determined by market forces, such as supply and demand. This type of exchange rate is often used in countries with a floating currency regime. In a floating exchange rate system, the value of the currency fluctuates constantly, and French Franc to dollar conversions are affected by market trends and economic indicators.

The implications of fixed and floating exchange rates on French Franc to dollar conversions are significant. With a fixed exchange rate, individuals and businesses can predict the exchange rate with certainty, which can help with budgeting and financial planning. However, a fixed exchange rate can also limit the flexibility of monetary policy, as the government or central bank has limited ability to adjust the exchange rate in response to changing economic conditions.

With a floating exchange rate, individuals and businesses must be prepared for exchange rate fluctuations, which can affect the value of their French Franc to dollar conversions. However, a floating exchange rate also allows for greater flexibility in monetary policy, as the government or central bank can adjust the exchange rate in response to changing economic conditions.

Understanding the difference between fixed and floating exchange rates is essential for individuals and businesses conducting French Franc to dollar conversions. By recognizing the implications of each type of exchange rate, individuals and businesses can make informed decisions about their currency conversions and minimize the risks associated with exchange rate fluctuations.

In today’s global economy, exchange rates play a critical role in international transactions. By understanding the difference between fixed and floating exchange rates, individuals and businesses can navigate the complexities of French Franc to dollar conversions with confidence and maximize their returns.

Staying Up-to-Date with Currency Conversion News and Trends

Staying informed about currency conversion news, trends, and updates is crucial for individuals and businesses conducting French Franc to dollar conversions. With the ever-changing global economy, exchange rates can fluctuate rapidly, affecting the value of French Franc to dollar conversions.

To stay ahead of the curve, individuals and businesses can utilize various resources to stay informed about currency conversion news and trends. Online news sources, such as Bloomberg or Reuters, provide up-to-date information on exchange rates, economic indicators, and market trends. Additionally, currency conversion websites, such as XE.com or Oanda, offer real-time exchange rates, currency charts, and market analysis.

Subscribing to currency conversion newsletters or following reputable currency experts on social media can also provide valuable insights and updates on French Franc to dollar conversions. Furthermore, setting up price alerts or exchange rate notifications can help individuals and businesses stay informed about changes in the French Franc to dollar conversion rate.

Staying informed about currency conversion news and trends can help individuals and businesses make informed decisions about their French Franc to dollar conversions. By understanding the factors that influence exchange rates, individuals and businesses can anticipate changes in the French Franc to dollar conversion rate and adjust their strategies accordingly.

Moreover, staying up-to-date with currency conversion news and trends can help individuals and businesses identify opportunities for cost savings and optimization. For instance, if the French Franc to dollar conversion rate is favorable, individuals and businesses may want to consider converting their French Francs to US Dollars to take advantage of the exchange rate.

In conclusion, staying informed about currency conversion news and trends is essential for individuals and businesses conducting French Franc to dollar conversions. By utilizing various resources and staying up-to-date with the latest developments, individuals and businesses can make informed decisions, optimize their conversions, and maximize their returns.