What is a Forward Rate and Why Does it Matter?

In the realm of currency exchange, forward rates play a vital role in facilitating international trade and investment. A forward rate is an exchange rate agreed upon today for a transaction that will take place at a future date. This differs from a spot rate, which is the current exchange rate for a currency pair. Forward rates are essential for businesses and investors, as they enable them to manage foreign exchange risk and make informed decisions about future transactions.

The significance of forward rates lies in their ability to provide certainty in an uncertain market. By locking in a fixed exchange rate for a future transaction, businesses can mitigate the risk of currency fluctuations and ensure that their profits are not eroded by adverse exchange rate movements. This is particularly important for companies that engage in international trade, as small changes in exchange rates can have a significant impact on their bottom line.

In the context of the forward rate euro to dollar, this concept is crucial for businesses and investors operating in the global market. The euro and dollar are two of the most widely traded currencies in the world, and their exchange rate has a significant impact on global trade and investment. By understanding forward rates, businesses and investors can better navigate the complexities of currency exchange and make informed decisions that drive growth and profitability.

Understanding the Euro to Dollar Forward Rate

The euro to dollar forward rate is a crucial component of international trade and investment, particularly for businesses and investors operating in the global market. As one of the most widely traded currency pairs, the euro to dollar exchange rate has a significant impact on global trade and investment. The forward rate euro to dollar, in particular, plays a vital role in managing foreign exchange risk and making informed investment decisions.

The euro to dollar forward rate is influenced by a range of factors, including interest rates, inflation, and economic indicators. For instance, changes in interest rates set by the European Central Bank and the Federal Reserve can impact the forward rate euro to dollar, as can shifts in inflation expectations and economic growth. Understanding these factors is essential for businesses and investors seeking to navigate the complexities of currency exchange and make informed decisions about future transactions.

In global markets, the forward rate euro to dollar is used to hedge against potential losses and lock in profits. For example, a European company exporting goods to the United States may use a forward rate euro to dollar to fix the exchange rate for a future transaction, thereby mitigating the risk of adverse exchange rate movements. Similarly, an investor seeking to invest in European assets may use the forward rate euro to dollar to inform their investment decisions and manage foreign exchange risk.

How to Calculate Forward Rates: A Step-by-Step Guide

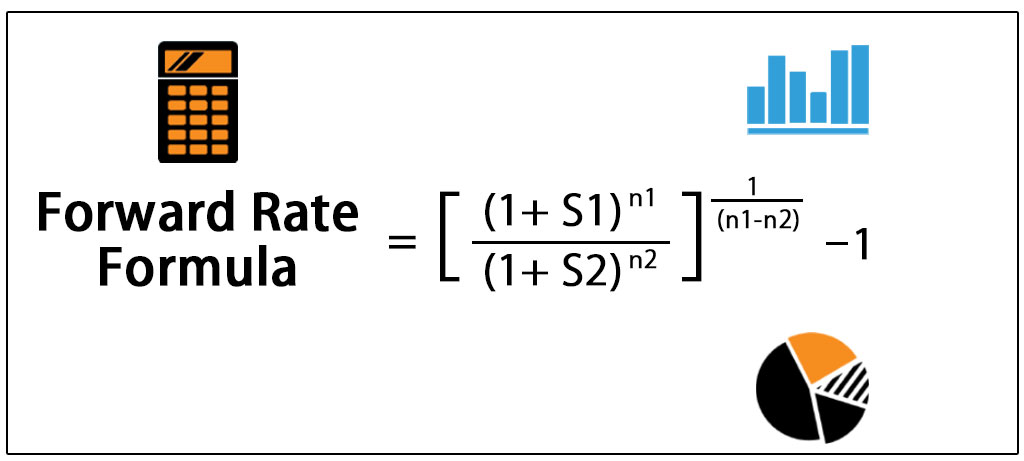

Calculating forward rates is a crucial step in managing foreign exchange risk and making informed investment decisions. The forward rate euro to dollar, in particular, is a widely used metric in global markets. In this section, we will provide a detailed explanation of how to calculate forward rates, including the formulas and variables involved, and offer examples to illustrate the process.

The formula to calculate a forward rate is as follows:

F = S x (1 + r1) / (1 + r2)

Where:

F = Forward rate

S = Spot rate

r1 = Interest rate of the base currency (e.g. euro)

r2 = Interest rate of the quote currency (e.g. dollar)

For example, let’s say the spot rate euro to dollar is 1.1000, and the interest rate in the eurozone is 2% per annum, while the interest rate in the United States is 3% per annum. To calculate the 1-year forward rate euro to dollar, we would plug in the following values:

F = 1.1000 x (1 + 0.02) / (1 + 0.03) = 1.1334

This means that the 1-year forward rate euro to dollar is 1.1334, indicating that one euro can be exchanged for 1.1334 dollars in one year’s time.

By understanding how to calculate forward rates, businesses and investors can better navigate the complexities of currency exchange and make informed decisions about future transactions. The forward rate euro to dollar, in particular, is a critical metric in global markets, and its accurate calculation is essential for managing foreign exchange risk and maximizing profits.

The Role of Forward Rates in Risk Management

Forward rates, particularly the forward rate euro to dollar, play a crucial role in managing foreign exchange risk. In international trade and investment, exchange rate fluctuations can have a significant impact on profits and losses. Forward rates provide a way to hedge against potential losses and lock in profits by fixing the exchange rate for a future transaction.

One of the primary ways forward rates are used in risk management is through forward contracts. A forward contract is an agreement between two parties to exchange a certain amount of currency at a fixed rate on a specific date in the future. By entering into a forward contract, businesses and investors can ensure that they receive a fixed exchange rate, regardless of future market fluctuations.

For example, let’s say a European company exports goods to the United States and expects to receive $1 million in six months’ time. To hedge against potential losses due to exchange rate fluctuations, the company can enter into a forward contract to sell $1 million at a fixed forward rate euro to dollar of 1.1500. This means that regardless of the spot rate in six months’ time, the company will receive $1 million at an exchange rate of 1.1500.

Forward rates can also be used to speculate on future exchange rate movements. By entering into a forward contract at a rate that is expected to be favorable, businesses and investors can potentially lock in profits. However, this approach also carries risks, as exchange rate movements can be unpredictable.

In addition to forward contracts, forward rates are also used in other risk management strategies, such as options and swaps. These instruments provide businesses and investors with flexibility and customization options to manage their foreign exchange risk.

In conclusion, forward rates, including the forward rate euro to dollar, are a critical component of risk management in international trade and investment. By understanding how to use forward rates effectively, businesses and investors can better navigate the complexities of currency exchange and minimize their exposure to foreign exchange risk.

Factors Affecting the Euro to Dollar Forward Rate

The forward rate euro to dollar is influenced by a complex array of factors, including interest rates, inflation, and economic indicators. Understanding these factors is crucial for businesses and investors seeking to navigate the complexities of currency exchange and make informed decisions.

Interest rates play a significant role in determining the forward rate euro to dollar. When interest rates in the eurozone are higher than those in the United States, the forward rate euro to dollar tends to increase, as investors are incentivized to hold euros rather than dollars. Conversely, when interest rates in the United States are higher, the forward rate euro to dollar tends to decrease.

Inflation is another key factor affecting the forward rate euro to dollar. When inflation is high in the eurozone, the value of the euro tends to decrease, causing the forward rate euro to dollar to increase. Similarly, when inflation is high in the United States, the value of the dollar tends to decrease, causing the forward rate euro to dollar to decrease.

Economic indicators, such as GDP growth rates and unemployment rates, also influence the forward rate euro to dollar. Strong economic growth in the eurozone, for example, can lead to an increase in the forward rate euro to dollar, as investors become more confident in the euro’s value. Conversely, weak economic growth in the United States can lead to a decrease in the forward rate euro to dollar.

Other factors, such as political instability, trade policies, and commodity prices, can also impact the forward rate euro to dollar. For example, a trade war between the European Union and the United States could lead to a decrease in the forward rate euro to dollar, as investors become more risk-averse.

By understanding the complex array of factors affecting the forward rate euro to dollar, businesses and investors can better navigate the complexities of currency exchange and make informed decisions about their investments and transactions.

Using Forward Rates in Investment Decisions

Forward rates, particularly the forward rate euro to dollar, play a crucial role in informing investment decisions. By understanding the forward rate euro to dollar, investors can gain valuable insights into the future direction of currency exchange rates, enabling them to make more informed investment decisions.

One of the primary benefits of using forward rates in investment decisions is that they provide a snapshot of market expectations. By analyzing the forward rate euro to dollar, investors can gain a sense of whether the market expects the euro to appreciate or depreciate against the dollar in the future. This information can be used to inform investment decisions, such as whether to invest in euro-denominated assets or dollar-denominated assets.

Forward rates can also be used to identify potential investment opportunities. For example, if the forward rate euro to dollar indicates that the euro is expected to appreciate against the dollar in the future, investors may consider investing in euro-denominated assets, such as European stocks or bonds. Conversely, if the forward rate euro to dollar indicates that the dollar is expected to appreciate against the euro, investors may consider investing in dollar-denominated assets, such as US stocks or bonds.

However, it’s essential to note that forward rates are not without their limitations. They are based on market expectations, which can be influenced by a range of factors, including economic indicators, geopolitical events, and market sentiment. As such, forward rates should be used in conjunction with other investment tools and strategies to ensure a well-diversified portfolio.

In addition, forward rates can be used to manage risk in investment portfolios. By hedging against potential losses using forward contracts, investors can reduce their exposure to foreign exchange risk and lock in profits. This can be particularly useful for investors with international investments, such as multinational corporations or individual investors with assets in multiple currencies.

In conclusion, the forward rate euro to dollar is a valuable tool for investors seeking to inform their investment decisions. By understanding the forward rate euro to dollar, investors can gain valuable insights into the future direction of currency exchange rates, enabling them to make more informed investment decisions and manage risk in their portfolios.

Real-World Applications of Forward Rates

Forward rates, particularly the forward rate euro to dollar, have a wide range of real-world applications in various industries and sectors. Understanding how forward rates are used in practice can help individuals and businesses navigate the complexities of currency exchange and make informed decisions.

In international trade, forward rates are used to manage foreign exchange risk. For example, a European company exporting goods to the United States may use forward rates to hedge against potential losses due to exchange rate fluctuations. By locking in a forward rate euro to dollar, the company can ensure a fixed exchange rate for its exports, reducing the risk of losses due to currency fluctuations.

In tourism, forward rates are used to manage currency risk associated with international travel. Travel agencies and tour operators may use forward rates to hedge against potential losses due to exchange rate fluctuations, ensuring that their customers receive a fixed exchange rate for their travel expenses.

In business operations, forward rates are used to manage foreign exchange risk associated with international transactions. Multinational corporations may use forward rates to hedge against potential losses due to exchange rate fluctuations, ensuring that their international transactions are conducted at a fixed exchange rate.

For example, a US-based company with operations in Europe may use forward rates to hedge against potential losses due to exchange rate fluctuations. By locking in a forward rate euro to dollar, the company can ensure a fixed exchange rate for its international transactions, reducing the risk of losses due to currency fluctuations.

In addition, forward rates are used in investment decisions, such as in portfolio management and asset allocation. Investors may use forward rates to inform their investment decisions, taking into account the expected future direction of currency exchange rates.

By understanding how forward rates are used in real-world scenarios, individuals and businesses can better appreciate the importance of forward rates in managing foreign exchange risk and making informed investment decisions. The forward rate euro to dollar, in particular, plays a critical role in global markets, and understanding its applications can help individuals and businesses navigate the complexities of currency exchange.

Conclusion: Mastering the Forward Rate Euro to Dollar

In conclusion, understanding forward rates, particularly the forward rate euro to dollar, is crucial for individuals and businesses operating in the complex world of currency exchange. By grasping the concepts of forward rates, including how they differ from spot rates, their significance in international trade and investment, and their role in risk management, investors and businesses can make informed decisions and navigate the complexities of currency exchange.

The forward rate euro to dollar, in particular, plays a critical role in global markets, and understanding its importance, calculation, and applications can help individuals and businesses mitigate foreign exchange risk and maximize profits. Whether in international trade, tourism, or business operations, forward rates are an essential tool for managing currency risk and making informed investment decisions.

By mastering the forward rate euro to dollar, individuals and businesses can gain a competitive edge in the global market, making informed decisions that take into account the expected future direction of currency exchange rates. With a deep understanding of forward rates, investors and businesses can navigate the complexities of currency exchange with confidence, unlocking new opportunities for growth and profitability.

In today’s interconnected world, understanding forward rates is no longer a luxury, but a necessity. By grasping the concepts and applications of forward rates, individuals and businesses can stay ahead of the curve, making informed decisions that drive success in the complex world of currency exchange.