Decoding the Profitability of Financial Institutions

Net interest margin (NIM) stands as a critical barometer of a financial institution’s profitability. It reflects the effectiveness of a bank’s lending and investment strategies. Understanding the formula for net interest margin is crucial for investors, analysts, and bank managers alike. This metric reveals how efficiently a bank utilizes its assets to generate income. This article aims to demystify NIM. It will provide a comprehensive understanding of its components and calculation. The formula for net interest margin offers insights into a bank’s ability to manage interest rate risk and optimize its earning potential.

NIM represents the difference between the revenue generated from a bank’s interest-bearing assets and the expenses associated with its interest-bearing liabilities, relative to the amount of its interest-earning assets. In simpler terms, it’s the difference between what a bank earns on its loans and investments and what it pays on deposits and borrowings, expressed as a percentage of its earning assets. A higher NIM generally indicates a more profitable bank, assuming similar risk profiles. Therefore, mastering the formula for net interest margin is essential for gauging a bank’s financial health.

The significance of NIM extends beyond a simple profitability measure. It provides a lens through which to assess a bank’s operational efficiency and risk management practices. A fluctuating NIM can signal changes in a bank’s lending strategy, funding costs, or asset quality. Monitoring the formula for net interest margin over time allows for identification of trends and potential areas of concern. This article will break down the components of NIM. It also explains its calculation, and explores the factors influencing it. It also highlights its importance in comparative bank analysis. Ultimately, a thorough understanding of NIM empowers stakeholders to make informed decisions about a bank’s financial performance and stability. The formula for net interest margin, therefore, is an indispensable tool in the world of finance.

How to Calculate Net Interest Margin: A Step-by-Step Approach

Calculating the net interest margin (NIM) is crucial for understanding a financial institution’s profitability. This section provides a practical, step-by-step guide to computing this vital metric. The formula for net interest margin involves several key components, each derived from the institution’s financial statements. Understanding the formula for net interest margin and its elements is the first step.

First, identify and gather the necessary data. You’ll need the following figures: interest income, interest expense, and average earning assets. Interest income represents the revenue generated from interest-bearing assets, such as loans and investments. Interest expense represents the cost of funds, including interest paid on deposits and borrowings. Average earning assets represent the average value of assets that generate interest income during the period, and is an essential part of the formula for net interest margin. Data should be readily available in the income statement and balance sheet. Ensure the figures are for the same period, typically a quarter or a year, to guarantee accurate calculation of the formula for net interest margin.

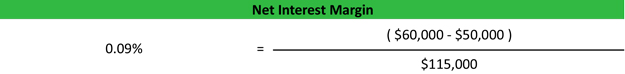

Next, calculate the net interest income (NII). This is simply the difference between interest income and interest expense. The formula is: Net Interest Income = Interest Income – Interest Expense. Once you have the NII, you can calculate the NIM. The formula for net interest margin is: NIM = (Net Interest Income / Average Earning Assets) * 100. The resulting percentage represents the bank’s net interest margin. A higher NIM generally indicates better profitability. The formula for net interest margin can reveal opportunities. This step-by-step approach ensures an accurate understanding of a bank’s financial performance. Remember to analyze trends over time and compare NIM to industry benchmarks. The formula for net interest margin provides valuable insights for investors and managers alike.

Factors Influencing a Bank’s Interest Margin

A bank’s net interest margin (NIM) is not static. Numerous internal and external factors exert influence, leading to fluctuations in profitability. Understanding these factors is crucial for stakeholders to assess a bank’s performance and future prospects. The formula for net interest margin can be affected by multiple factors.

Changes in interest rates are perhaps the most significant external factor. The Federal Reserve’s monetary policy, specifically adjustments to the fed funds rate, directly impacts a bank’s cost of funds and lending rates. When interest rates rise, banks can typically increase their lending rates, potentially expanding their NIM. However, this benefit can be offset if deposit rates also increase. The sensitivity of a bank’s assets and liabilities to interest rate changes, known as the “gap,” plays a critical role. A positive gap (more assets than liabilities repricing) benefits from rising rates, while a negative gap suffers. Economic conditions also affect the formula for net interest margin. During economic expansions, loan demand typically increases, leading to higher interest income. Conversely, during recessions, loan defaults rise, reducing interest income and potentially shrinking the NIM. Furthermore, competition among banks can pressure lending rates, limiting the ability to expand NIM even in a favorable interest rate environment.

Internal factors also play a vital role. The composition of a bank’s loan portfolio significantly influences its NIM. Loans with higher risk, such as credit card debt or subprime mortgages, typically command higher interest rates, boosting NIM. However, these loans also carry a greater risk of default. The bank’s funding costs are another key determinant. Banks with access to low-cost deposits, such as those with a strong retail presence, have a distinct advantage. Efficient asset-liability management is crucial for optimizing the NIM. This involves carefully matching the maturities and interest rate sensitivity of assets and liabilities to minimize interest rate risk. Moreover, controlling operating expenses can indirectly improve NIM by reducing the overall cost base. The effective formula for net interest margin relies on managing these different aspects. Banks should regularly assess and adapt their strategies to optimize NIM in response to evolving economic conditions and competitive pressures. Understanding the formula for net interest margin, therefore, requires a holistic view of both external and internal influences.

Net Interest Margin versus Net Interest Income: Understanding the Difference

Net interest margin (NIM) and net interest income (NII) are crucial metrics for assessing a financial institution’s profitability. However, they represent different aspects of performance. NII is the absolute difference between interest income and interest expense. It is expressed as a dollar amount. NIM, on the other hand, is a ratio. It normalizes NII by dividing it by earning assets. Understanding the distinction is vital for accurate financial analysis.

NII reveals the raw profit a bank generates from its lending and investment activities. A larger NII suggests greater profitability in absolute terms. However, it doesn’t account for the size of the bank’s asset base. A large bank might have a substantial NII. But its NIM could be lower than a smaller, more efficient bank. This is where NIM becomes essential. NIM provides a standardized measure of profitability. It allows for comparisons between banks of different sizes. The formula for net interest margin helps in evaluating how effectively a bank utilizes its assets to generate interest income relative to its interest expenses. The formula for net interest margin essentially levels the playing field. It allows analysts to compare profitability across institutions regardless of their size.

The choice between using NII and NIM depends on the specific analytical goal. NII is useful for tracking a bank’s overall earnings growth over time. It’s also helpful for understanding the direct impact of changes in interest rates or loan volumes on profitability. NIM is more appropriate for comparing a bank’s profitability to its peers. It also assesses its efficiency in managing interest rate risk. Consider a scenario where two banks have similar NII. The bank with a smaller asset base and a higher NIM is likely more efficient in generating profits. The formula for net interest margin helps determine the true performance. While NII offers a snapshot of total earnings, the formula for net interest margin offers a clearer view of efficiency and profitability relative to asset size. The formula for net interest margin considers earning assets and is more useful for comparing different banks.

Analyzing Different Bank’s Yield: A Comparative Assessment

Net interest margin (NIM) serves as a valuable tool for comparing the profitability of different banks. However, a direct comparison without context can be misleading. It is crucial to consider the unique business models, risk profiles, and operational strategies of each institution. For instance, a bank specializing in high-yield, high-risk loans may naturally exhibit a higher NIM compared to a bank focusing on low-risk, low-yield mortgages. Understanding these nuances is vital for accurate interpretation. The formula for net interest margin remains consistent, but the factors influencing it vary considerably across institutions.

When conducting a comparative assessment, examine the composition of each bank’s loan portfolio. A higher concentration of credit card debt, for example, typically results in a greater NIM due to the higher interest rates associated with this type of lending. Conversely, a portfolio dominated by government-backed securities will likely yield a lower NIM because of their inherent safety and lower returns. Consider also the bank’s funding sources. Banks that rely heavily on deposits may have lower funding costs than those that depend on more expensive sources, such as brokered deposits or wholesale funding. This difference in funding costs directly impacts the formula for net interest margin and overall profitability.

Furthermore, establish benchmarks to provide a frame of reference for your analysis. Industry averages for NIM, categorized by bank size and type, can offer valuable insights. Regulatory filings and industry reports often publish these benchmarks. Comparing a bank’s NIM to its peer group average can reveal whether it is outperforming or underperforming its competitors. Remember to adjust for differences in risk appetite and business strategy when interpreting these comparisons. While the formula for net interest margin provides a standardized measure, a thorough analysis requires a holistic view of the bank’s operations and its place within the broader financial landscape. A comprehensive understanding of these variables ensures a more informed and accurate assessment of a bank’s financial health and profitability.

Improving your NIM: Strategies for Enhanced Profitability

Financial institutions continuously seek avenues to bolster their net interest margin (NIM) to achieve enhanced profitability. Optimizing NIM necessitates a multifaceted approach encompassing strategic adjustments across various financial domains. One key strategy involves refining loan pricing models. Financial institutions should meticulously analyze their loan portfolios and implement dynamic pricing strategies that reflect the inherent risks and market conditions. This may involve adjusting interest rates based on credit scores, loan-to-value ratios, and prevailing market rates. Effective loan pricing ensures that institutions are adequately compensated for the risk assumed while remaining competitive in the market. Understanding the formula for net interest margin is key to these pricing decisions.

Diversifying funding sources represents another crucial tactic for improving NIM. Over-reliance on a single funding source can expose institutions to vulnerabilities, particularly during periods of economic instability. By diversifying funding sources, such as attracting retail deposits, accessing wholesale funding markets, and exploring alternative funding mechanisms, institutions can reduce their funding costs and enhance their NIM. Furthermore, efficient asset-liability management (ALM) plays a pivotal role in optimizing NIM. ALM involves strategically managing the institution’s assets and liabilities to mitigate interest rate risk and liquidity risk. This includes carefully matching the maturities and repricing characteristics of assets and liabilities to minimize the impact of interest rate fluctuations on the institution’s earnings. The formula for net interest margin dictates that a better managed balance sheet translates directly into improved profitability.

Reducing operating expenses is a perennial focus for institutions seeking to improve their NIM. Streamlining operations, automating processes, and leveraging technology can significantly reduce overhead costs, thereby boosting profitability. For example, investing in digital banking platforms can reduce the need for physical branches, leading to cost savings in terms of rent, utilities, and personnel expenses. Furthermore, institutions can explore opportunities to outsource non-core functions, such as customer service or IT support, to specialized vendors, further reducing operating expenses. The effective management of operating expenses directly contributes to an improved net interest margin, as the formula for net interest margin demonstrates. By optimizing these strategies, financial institutions can achieve sustainable improvements in their NIM and enhance their overall financial performance.

The impact of Economic Cycles on Financial Institutions Margin

Economic cycles significantly influence a financial institution’s net interest margin (NIM). These cycles, characterized by periods of expansion and contraction, impact interest rates, loan demand, and funding costs, all of which directly affect the formula for net interest margin. Understanding these dynamics is crucial for banks to navigate volatile economic conditions and maintain profitability. During periods of rising interest rates, a bank’s ability to quickly reprice its assets (loans) relative to its liabilities (deposits) determines its NIM performance. Banks with a higher proportion of variable-rate loans tend to benefit more rapidly from rising rates, as their interest income increases. However, deposit rates also tend to rise, increasing interest expenses and partially offsetting the benefit. The formula for net interest margin helps to quantify these changes.

Conversely, during periods of falling interest rates, banks may experience a compression of their NIM. As loan rates decrease, interest income declines. However, the reduction in funding costs (deposit rates) may not keep pace, especially if a significant portion of deposits are already priced at or near zero. Banks can prepare for these economic shifts by carefully managing their asset-liability mix. Strategies include stress-testing their balance sheets under various interest rate scenarios and adjusting their loan and deposit pricing accordingly. Diversifying funding sources can also provide flexibility during economic downturns. For instance, a bank with access to a variety of funding options, such as wholesale funding or government programs, may be less reliant on deposits and better able to manage its funding costs when interest rates decline. The formula for net interest margin acts as a key indicator during these strategic evaluations.

Furthermore, banks must consider the impact of economic cycles on credit quality. During economic downturns, loan losses tend to increase, reducing the overall return on assets and negatively affecting NIM. Banks can mitigate this risk by tightening lending standards, diversifying their loan portfolios, and proactively managing their problem loans. Effective risk management, combined with a deep understanding of the formula for net interest margin, enables financial institutions to navigate economic cycles successfully and sustain profitability. Banks also utilize hedging strategies to mitigate interest rate risk. Interest rate swaps and other derivative instruments can be used to lock in fixed rates on a portion of their assets or liabilities, reducing their exposure to interest rate fluctuations. Successfully navigating economic cycles also involves accurately forecasting economic trends. This is done through continual evaluations that include the formula for net interest margin, and external expertise.

Pitfalls to Avoid When Interpreting Interest Spreads

Interpreting net interest margin (NIM) data requires careful consideration to avoid common pitfalls that can lead to inaccurate conclusions. One frequent mistake is overlooking off-balance sheet activities. While the formula for net interest margin focuses on on-balance sheet items, a bank’s profitability can be significantly affected by activities such as loan securitizations, derivatives trading, and other off-balance sheet exposures. These activities generate income and expenses that are not reflected in the traditional NIM calculation, potentially skewing the true picture of a bank’s financial performance. Therefore, a comprehensive analysis should always consider the impact of these activities on overall profitability.

Another pitfall lies in failing to adequately consider a bank’s risk profile. Banks that engage in higher-risk lending activities, such as providing loans to borrowers with lower credit scores or investing in riskier assets, may exhibit higher NIMs. However, this higher margin comes at the cost of increased credit risk and potential losses. A higher NIM, in this case, might not indicate superior performance but rather a higher level of risk-taking. It is crucial to assess the quality of the assets generating the interest income and the associated risks before drawing conclusions about a bank’s efficiency or profitability based solely on the formula for net interest margin. Comparative analysis must consider the risk-adjusted return rather than the nominal NIM.

Relying solely on NIM without considering other relevant financial metrics represents yet another common mistake. While NIM provides valuable insight into a bank’s interest-earning activities, it does not capture the full scope of its financial health. Other metrics, such as return on assets (ROA), return on equity (ROE), efficiency ratio, and capital adequacy ratios, provide a more holistic view of a bank’s performance. The formula for net interest margin is a useful tool, it should be used in conjunction with these other metrics to gain a complete understanding of a bank’s financial condition. Examining these metrics together can help identify potential issues that might be masked by a seemingly healthy NIM, leading to more informed and accurate assessments of a bank’s overall performance and stability. Indeed, focusing exclusively on the formula for net interest margin presents an incomplete and potentially misleading analysis.