What is Net Interest Margin and Why Does it Matter?

Net interest margin, often referred to as net interest spread, is a crucial indicator of a financial institution’s profitability. It represents the difference between the interest income a financial institution receives from its assets (like loans and investments) and the interest expense it pays on its liabilities (like deposits and borrowed funds), expressed as a percentage of average earning assets. Understanding this metric is vital for investors seeking to assess the financial health and potential returns of a bank or other financial institution. For management, the formula for net interest margin serves as a key performance indicator (KPI), highlighting the efficiency of their interest-earning activities and guiding strategic decisions. Customers, too, benefit from a healthy net interest margin, as it contributes to the financial stability of their bank and ultimately, the security of their deposits. Unlike metrics such as return on assets (ROA) or return on equity (ROE), which consider a broader range of factors impacting profitability, the net interest margin provides a focused measure of a financial institution’s core interest-based earnings power. The formula for net interest margin helps provide insights into core operational profitability independent of non-interest income or expenses. A strong net interest margin signals efficient asset management and effective interest rate risk management, while a weakening margin might suggest potential vulnerabilities. The formula for net interest margin thus provides valuable information for all stakeholders.

Analyzing the net interest margin involves careful consideration of the interest rate environment, the institution’s lending practices, and the cost of its funding. A higher net interest margin is generally preferred, indicating greater profitability, although the optimal level will vary depending on the specific institution’s business model and market conditions. The formula for net interest margin helps to determine how well the institution is managing the difference between its interest income and expenses, offering valuable insights into the overall effectiveness of its operations. For investors, a consistent and growing net interest margin can be a sign of a well-managed and potentially profitable institution. The formula for net interest margin is a critical tool for understanding the core earnings power of a bank or other financial institution. A thorough understanding of this metric provides a critical foundation for evaluating the financial health and performance of the institution.

Understanding the formula for net interest margin is essential for making informed decisions related to investing in, managing, or interacting with financial institutions. The formula itself is relatively straightforward, but its implications are far-reaching. It offers a concise yet powerful way to gauge the success of a financial institution in generating profit from its core operations, and its significance transcends the simple arithmetic of the calculation. By comprehending the underlying components and factors influencing the formula for net interest margin, stakeholders can gain valuable insights into the overall financial health and future prospects of the institution. Therefore, a grasp of the formula for net interest margin is invaluable for navigating the complexities of the financial world.

Breaking Down the Components: Interest Income and Interest Expense

The net interest spread, a crucial element in the formula for net interest margin, is determined by two primary components: interest income and interest expense. Interest income represents the revenue generated from a financial institution’s lending activities. This includes income earned from various sources such as interest on loans (personal, commercial, mortgages), returns on investments in securities, and interest earned on deposits held at other financial institutions. The higher the volume of loans and investments, and the higher the interest rates charged, the greater the interest income generated. Conversely, interest expense encompasses the cost of funds for the financial institution. This includes payments made on deposits (checking, savings, certificates of deposit), borrowed funds from other banks or financial markets, and any other interest-bearing liabilities. The more a bank borrows and the higher the interest rates paid on these borrowings, the greater the interest expense. Understanding these components is vital to grasping the formula for net interest margin and a bank’s overall profitability, as the difference between them directly impacts the net interest spread.

The relationship between interest income and interest expense is intrinsically linked to a bank’s core business model. Banks act as intermediaries, borrowing funds at lower rates and lending them out at higher rates. The difference between these rates, effectively captured in the formula for net interest margin, is the foundation of their profitability. A bank’s success in managing the balance between attracting low-cost deposits and generating high-yield loans is critical for maximizing the net interest spread. For instance, a bank with a highly efficient deposit-gathering system and a portfolio of high-yielding loans will typically enjoy a larger net interest spread. Conversely, a bank facing high competition for deposits and lending into lower-yielding markets will likely experience a smaller spread. Effective asset-liability management plays a pivotal role in this dynamic, ensuring a healthy balance sheet and optimizing interest income relative to interest expense – a key consideration when applying the formula for net interest margin.

Analyzing the composition of both interest income and interest expense offers valuable insights into a financial institution’s strategy and performance. A diversified loan portfolio, for example, can mitigate risk and potentially enhance interest income. Similarly, effectively managing deposit costs through strategic pricing and product offerings can significantly impact interest expense, thus affecting the net interest margin as calculated by the formula for net interest margin. By meticulously examining these constituent parts, stakeholders gain a more comprehensive understanding of the bank’s financial health and its capacity for future profitability. The formula for net interest margin, therefore, isn’t just a simple calculation; it’s a window into the intricacies of a financial institution’s operations and strategic decisions.

The Simple Formula: How to Determine Net Interest Spread

The core calculation for net interest spread, which is often used interchangeably with net interest margin, is straightforward. It involves finding the difference between a financial institution’s total interest income and its total interest expense. The formula for net interest margin is expressed as: Net Interest Spread = Total Interest Income – Total Interest Expense. Interest income represents the revenue earned from interest-bearing assets, such as loans to customers or investments in securities. Interest expense, on the other hand, reflects the costs associated with funding these assets, typically including interest paid on deposits, borrowed funds, or bonds issued. The net interest spread shows how efficiently an institution is using its interest-generating activities to earn profit; a higher net interest spread indicates stronger profitability from its core operations. To understand this, consider a hypothetical scenario: if a bank generates $5 million in interest income and incurs $2 million in interest expense, its net interest spread would be $3 million. This value gives a basic understanding of the net income generated from lending and borrowing activities.

This initial calculation of the net interest spread provides a foundational understanding of an institution’s profitability, though it doesn’t account for the scale of assets that generate the income. The formula for net interest margin shows the relationship between revenues and expenses directly related to interest-based financial activities. The higher the difference between interest income and expenses, the more profitable, in theory, the financial operations are. A simple example of this might be a credit union that earns $200,000 from mortgage loans (interest income) but has to pay $50,000 in interest on its members’ savings accounts (interest expense). The resulting net interest spread would be $150,000. While informative, this simple approach is often supplemented with more complex methods to provide a deeper insight. In subsequent sections, a more refined approach using average earning assets will be introduced to provide a more accurate depiction of a financial institution’s profitability.

Beyond the Basics: Exploring Average Earning Assets

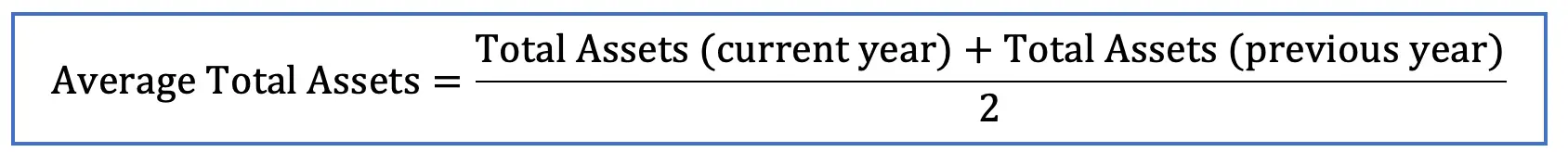

While the basic formula for net interest margin provides a foundational understanding, incorporating “average earning assets” offers a more nuanced perspective. This concept moves beyond simply comparing total interest income and expense to considering the scale of assets that generate that income. Average earning assets represent the average value of a financial institution’s assets that produce income during a specific period, typically a quarter or a year. This isn’t simply the total value of all assets. Instead, it focuses on those assets that are directly used to generate revenue, such as loans, securities investments, and other interest-bearing assets. For example, cash held in a vault or equipment used by the institution would not be considered earning assets for the purpose of calculating the formula for net interest margin. By using the average value, we account for fluctuations in the asset base over the period, providing a more representative picture of how efficiently a financial institution is using its resources to generate interest income. This adjustment is particularly important for institutions that experience significant changes in their asset portfolio during the reporting period.

The inclusion of average earning assets in the calculation of the formula for net interest margin helps to normalize the metric, making it more accurate and comparable across different financial institutions and across different periods of time for the same institution. Without factoring in the volume of earning assets, a large bank with a huge loan portfolio may falsely seem more profitable than it actually is simply due to the magnitude of its operations when compared to a smaller institution. A financial institution might have a large interest income, but if that income was generated by an equally large asset base, then its profitability may be lower than it would initially appear. By using the average earning assets, the formula for net interest margin provides a ratio that better reflects the actual profitability on a per-asset basis. This helps in more accurately measuring how well the institution is performing at converting its assets into interest income compared to its interest expenses. This allows for a more appropriate and fair comparison between different types of financial institutions which may have very different sized portfolios.

Furthermore, earning assets typically comprise the bulk of a financial institution’s portfolio and can include items like mortgages, car loans, corporate loans, government bonds, and other securities. It is important to differentiate these revenue generating assets from non-earning assets, such as premises and equipment, which do not directly generate interest income. The use of average earning assets is an essential refinement of the basic formula for net interest margin, enhancing the accuracy and comparability of this key financial indicator. This more advanced approach allows stakeholders to gain a deeper insight into a financial institution’s profitability, going beyond just the raw figures of interest income and expense to reflect how efficiently those assets are being used in reality. The formula for net interest margin that includes average earning assets thus becomes a more precise and useful measure of a financial institution’s performance.

Calculating the Margin: A More Precise Method

While simply comparing interest income to interest expense provides a basic understanding, a more precise approach to calculating net interest margin involves incorporating average earning assets. This refinement offers a more accurate depiction of a financial institution’s profitability relative to the assets it utilizes to generate income. Instead of just looking at the absolute difference, this method considers how effectively a bank is using its assets. The concept of average earning assets represents the average value of assets that generate interest income over a specific period. These assets typically include loans, investment securities, and other interest-bearing instruments. Using the average value helps smooth out fluctuations that might occur during the reporting period, giving a clearer picture of performance. The refined formula for net interest margin is calculated as: (Interest Income – Interest Expense) / Average Earning Assets. This formula for net interest margin provides a percentage that expresses the net interest income as a proportion of the total assets generating that income, providing a better standard for comparison among institutions of different sizes and over different periods.

To illustrate, consider a bank that earns $10 million in interest income and incurs $6 million in interest expenses during a year. If the bank’s average earning assets for the same period are $200 million, the formula for net interest margin calculation would be: ($10,000,000 – $6,000,000) / $200,000,000 = 0.02 or 2%. This 2% net interest margin provides a clearer insight into the bank’s profitability than simply considering the $4 million difference between income and expenses. The use of average earning assets brings more accuracy since it relates the profit to the actual value of the assets that generated it. This approach for calculating net interest margin is particularly important for comparing banks of different sizes, or for monitoring a bank’s performance over time when the total value of their assets is variable. It gives a more realistic and stable measure of efficiency. This slightly more accurate approach also helps highlight how effectively the bank is using its assets to generate revenue beyond the raw numbers of income and expenses.

Factors Influencing Net Interest Spread: Market Dynamics

External market conditions significantly impact a financial institution’s net interest spread, influencing its profitability. Changes in interest rates are a primary driver. When central banks raise benchmark rates, the cost of funds for institutions typically increases, impacting interest expense. Conversely, the yield curve, which illustrates interest rates across different maturities, also plays a crucial role. A steep yield curve, where long-term rates are significantly higher than short-term rates, can provide opportunities for banks to earn a higher net interest spread by borrowing at lower short-term rates and lending at higher long-term rates. Conversely, a flattened or inverted yield curve can compress this spread. Competitive pressures within the financial sector also exert considerable influence. If many institutions offer similar products and services, they are often forced to lower lending rates to attract customers, squeezing their interest income. This dynamic of competition directly affects the spread between income and expenses, emphasizing the importance of strategic pricing and cost management. Understanding these market forces is critical for financial institutions, as they form the basis for effective risk management and strategic planning, influencing their long-term performance and profitability.

The volatility of interest rates directly affects the formula for net interest margin. Rising rates often increase interest expense for financial institutions before a corresponding increase in interest income from loans and investments. This creates a timing challenge, particularly with fixed-rate assets, where revenue adjustments lag behind the increased costs of funds. Similarly, a declining interest rate environment can shrink the net interest margin, with income reducing faster than expenses, leading to reduced profitability. The formula for net interest margin is therefore highly susceptible to these rate movements. The competitive landscape also has a significant impact on net interest spread. When multiple institutions aggressively compete for business, it can lead to interest rates being depressed, thereby reducing the margins and overall profit. This environment puts pressure on the institutions to optimize their cost structures and strategically manage their assets and liabilities to maintain profitability. Furthermore, economic fluctuations, affecting loan demand and default rates, can influence the interest rates that financial institutions can charge, thereby affecting the net interest margin.

Therefore, the external dynamics such as the prevailing interest rate environment, the shape of the yield curve, and the intensity of competition, are critical factors that are consistently monitored when calculating the formula for net interest margin. These market forces not only impact an institution’s income and expenses but also require a proactive approach to risk management and pricing strategies. Institutions must constantly adapt their operations and portfolios to navigate these shifts, optimizing their balance sheet structure to reduce sensitivity to interest rate changes and to capitalize on opportunities that enhance profitability. This includes diversification, strategic pricing, and robust risk management processes to maintain a sustainable net interest spread in the face of market variability. The ability to understand and respond to these market dynamics can greatly differentiate one institution from another, and influences their long-term financial sustainability.

How to Improve Your Net Interest Spread: Strategies for Success

Improving the net interest spread, a crucial metric for financial institutions, requires a multi-faceted approach focused on optimizing both interest income and interest expense. One primary strategy involves carefully managing funding costs. Institutions should seek to diversify their funding sources, exploring options beyond traditional deposits, such as accessing wholesale funding markets or issuing debt instruments at favorable rates. This proactive management of liabilities can directly reduce interest expenses, thereby widening the net interest spread. Another effective approach is diversifying loan portfolios. By strategically allocating loans across various sectors and risk profiles, financial institutions can potentially achieve higher yields while managing credit risk. This can involve expanding into higher-yielding loan products or focusing on specific market niches where margins are more robust. Effective asset-liability management is also paramount. This entails aligning the maturity and interest rate sensitivity of assets and liabilities to minimize the impact of interest rate fluctuations. By carefully matching assets and liabilities, institutions can mitigate risks associated with changes in interest rates and secure a more stable and predictable net interest spread. The ultimate goal is to maximize the difference between interest earned on assets and interest paid on liabilities, contributing to overall profitability. These strategies play a significant role in managing the formula for net interest margin.

Further, a financial institution should employ strategies focused on enhancing the quality of its loan portfolio. This can involve rigorous credit risk assessments, ensuring that lending decisions are made responsibly and that the institution is adequately compensated for the risk it assumes. Regularly monitoring the loan portfolio’s performance and proactively addressing any potential delinquencies or defaults can help minimize credit losses. Improving operational efficiency also impacts the bottom line, as reduced expenses enhance profitability, even if indirectly linked to interest rates. The institution should also focus on pricing strategies for loans and other credit products, ensuring they align with market conditions and the risk appetite of the institution, while still maximizing profitability. These strategies contribute to a healthier and more profitable operation, ultimately positively impacting the net interest spread. Furthermore, technology can help streamline operations and enhance efficiency, contributing to improved financial performance and making the institution more competitive in the market. The effective implementation of these strategies directly impacts the formula for net interest margin.

Finally, continuous analysis and adaptation to market conditions are essential. Institutions should regularly assess their competitive landscape, monitor interest rate movements, and adjust their strategies accordingly. This may involve refining loan pricing, modifying funding strategies, or exploring new opportunities in different market segments. The key to sustainable success lies in the flexibility and agility to respond to external factors and constantly seek opportunities for improvement. Furthermore, strengthening customer relationships can also contribute to improving the net interest spread. By enhancing customer loyalty, the institution can retain existing deposits and attract new ones, thus potentially reducing funding costs. This commitment to service and customer satisfaction can translate into a more stable and profitable operation, positively influencing the overall net interest spread. These proactive strategies play a major role in the ongoing management of the formula for net interest margin, ensuring a financial institution remains competitive and profitable.

Analyzing Trends: Using Net Interest Spread for Financial Insights

Net interest spread, often used synonymously with net interest margin, serves as a powerful tool for analyzing the financial health and performance of financial institutions. By tracking this metric over time, stakeholders can discern significant trends, identify areas of strength and weakness, and make well-informed decisions. For investors, a consistently growing net interest spread signals effective management and potentially higher returns, while a declining spread might indicate increasing risks or inefficiencies. Comparing the net interest spread across different institutions provides a valuable benchmark for relative performance, allowing for a more nuanced understanding of which organizations are generating more profit from their core lending and borrowing activities. Understanding how this metric evolves is key to strategic planning. This analysis allows stakeholders to identify the impact of changes in the business or market.

The application of the formula for net interest margin becomes particularly useful when assessing the impact of strategic decisions. For instance, if a financial institution alters its loan portfolio by shifting towards riskier, but higher-yielding assets, or lowers interest rates offered for deposits to optimize funding costs, analyzing the resulting change in the net interest margin will reveal whether the strategy is achieving its intended effect on profitability. Similarly, trends in net interest spread can uncover the impact of changes in external economic conditions, such as shifts in the yield curve or competitive pressures. A declining spread might suggest that the institution is facing challenges in maintaining profitability amidst these fluctuations, highlighting the need for adaptive strategies. The formula for net interest margin is a crucial financial assessment metric for identifying business risks, opportunities and long-term trends.

Furthermore, the net interest spread provides critical insight for the internal management of financial institutions. By meticulously monitoring this metric, management can evaluate the effectiveness of their asset-liability strategies, identify areas where adjustments need to be made, and make sure that their institution is operating at peak efficiency. A favorable net interest spread suggests that a financial institution’s pricing and management strategies are effective at generating higher income from lending and investments than the cost of funds acquired by deposits and other liabilities. When monitored closely, the net interest margin becomes a key indicator of the institution’s overall financial health, serving as a tool that enables sound strategic planning, risk assessment, and long-term financial sustainability. Regular monitoring of the formula for net interest margin allows financial institutions to better manage their financials.