Understanding the Coupon Rate: Your Fixed Income Payment

A bond’s coupon rate is the annual interest rate the issuer pays the bondholder. Think of it like the interest you earn on a savings account, but specifically for bonds. The coupon rate is a fixed percentage of the bond’s face value, also known as its par value. This face value represents the amount the issuer will repay at maturity. For what is the coupon rate used to compute the periodic interest payments? It’s the key figure in calculating these payments. The coupon rate determines the amount of interest income a bondholder receives each period until the bond matures. Understanding this rate is fundamental for any bond investor. It’s a crucial factor in assessing the potential return of a bond investment, helping investors evaluate the profitability of the investment. The bond’s face value multiplied by the coupon rate provides the total annual interest payment. This annual interest is further divided by the number of payment periods per year, usually semi-annually, to find the periodic payment. This simple calculation provides a clear understanding of the regular income a bond will generate. For what is the coupon rate used to compute these consistent, periodic payments? It’s the foundational element in the process.

Analogies help illustrate the concept. Imagine a savings account offering a 3% annual interest rate. The interest earned is similar to a bond’s coupon payment. The principal amount in your savings account mirrors the bond’s face value. The annual interest you receive is equivalent to the annual coupon payment. The frequency of interest payments (monthly, quarterly, annually) matches the payment frequency for bonds (usually semi-annually). In both cases, a higher interest rate or coupon rate means a higher return. However, unlike savings accounts which typically offer variable interest, a bond’s coupon rate remains fixed throughout its life. This fixed nature provides predictability to bondholders. This fixed nature is a significant advantage for investors seeking stable income streams, particularly for long-term financial planning. For what is the coupon rate used to compute the expected return for an investor? It forms the base of this calculation, alongside the face value and maturity date.

The coupon rate is a crucial component for what is the coupon rate used to compute the bond’s periodic interest payment. It’s expressed as a percentage. It’s applied to the bond’s face value to determine the payment amount. The resulting figure is then divided by the number of payment periods per year to determine the payment amount for each period. This clear and simple calculation is at the heart of bond investment analysis. This periodic payment forms a key part of the overall return an investor expects from holding the bond until maturity. Understanding this calculation empowers investors to assess and compare potential bond investments. The computation helps investors to align their investment choices with their long-term financial strategies. Investors can thus assess the suitability of different bonds for their diverse investment objectives.

How Coupon Payments are Calculated: A Step-by-Step Guide

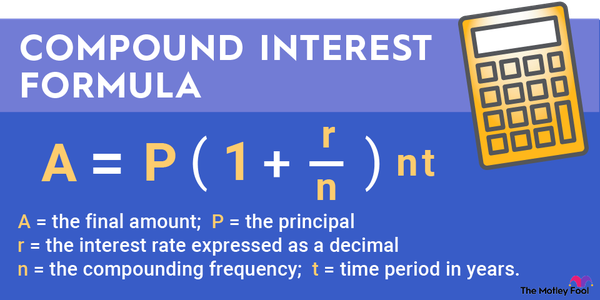

Understanding how coupon payments are calculated is crucial for any bond investor. The coupon rate is the annual interest rate a bond issuer promises to pay. It’s expressed as a percentage of the bond’s face value (also known as par value). For what is the coupon rate used to compute? The coupon rate is used to compute the periodic interest payment. This payment is typically made semi-annually, meaning twice a year. To determine the amount of each payment, one simply multiplies the coupon rate by the face value, then divides the result by the number of payment periods in a year.

Let’s illustrate with an example. Suppose an investor buys a bond with a face value of $1,000 and a coupon rate of 5%. For what is the coupon rate used to compute the semi-annual payment? The coupon rate is used to compute the semi-annual payment. Since the payments are semi-annual, there are two payment periods per year. The calculation is as follows: (0.05 * $1,000) / 2 = $25. The investor will receive $25 every six months. This straightforward calculation demonstrates how easily one can determine the periodic interest payment from a bond using the coupon rate and face value. This periodic payment remains consistent until the bond matures, providing a steady stream of income for the bondholder. Remember, this calculation is fundamental to understanding the return on a bond investment.

It’s important to note that the coupon rate is a fixed percentage. It remains constant throughout the bond’s life. However, the market value of the bond itself can fluctuate, based on changes in prevailing interest rates. If market interest rates rise, the bond’s market price will generally fall. Conversely, if market interest rates fall, the bond’s market price will likely rise. This is because investors will demand a higher yield when interest rates are high. This is why understanding the interplay between coupon rate, market interest rates, and bond pricing is vital for making informed investment decisions. For what is the coupon rate used to compute the total return over the life of the bond? While the coupon rate shows the periodic payment, other factors such as the purchase price and prevailing market rates influence the total return, often represented by the Yield to Maturity (YTM).

The Impact of Coupon Rate on Bond Pricing: Understanding Market Value

A bond’s market price has an inverse relationship with prevailing market interest rates. This means that when market interest rates rise, the market price of a bond with a fixed coupon rate typically falls. Conversely, when market interest rates decline, the market price of a bond generally increases. This fluctuation occurs because investors always seek the highest return for their investment. A bond with a coupon rate higher than current market rates offers a more attractive return, driving up its demand and price. This is what is referred to as a premium bond. The coupon rate is used to compute the periodic interest payments. Conversely, a bond with a coupon rate lower than current market rates becomes less appealing, reducing demand and thus its market price; this is a discount bond. Understanding this dynamic is crucial for what is the coupon rate used to compute, investors’ decisions.

The difference between a bond’s coupon rate and the current market interest rate significantly impacts its price. If a bond offers a higher coupon rate compared to newly issued bonds with similar risk profiles, it will trade at a premium. Investors are willing to pay more than the face value to secure the higher yield. The opposite is true for a bond with a lower coupon rate; it will trade at a discount. For what is the coupon rate used to compute, the periodic interest payment, it influences the bond’s attractiveness relative to other investment opportunities. This dynamic underscores the importance of considering market conditions when analyzing bond investments. This is vital in determining a bond’s potential for capital appreciation or loss.

Investors use the coupon rate, alongside yield to maturity (YTM) and other factors, to assess the overall value and risk associated with a bond. While the coupon rate provides a fixed income stream, the market price fluctuations reflect the prevailing interest rate environment. The coupon rate for what is the coupon rate used to compute the attractiveness of a bond in the marketplace, determines whether the bond is trading at a premium or discount to its face value. Analyzing the interplay between the coupon rate, market interest rates, and the bond’s maturity date is essential for making informed investment choices. A comprehensive understanding of these elements facilitates successful bond portfolio management.

Coupon Rate vs. Yield to Maturity (YTM): What’s the Difference?

The coupon rate and yield to maturity (YTM) are distinct yet related concepts crucial for understanding bond investments. The coupon rate, a fixed percentage, represents the annual interest payment relative to the bond’s face value. For what is the coupon rate used to compute the periodic interest payments? It’s a simple calculation: (Coupon Rate * Face Value) / Number of Payment Periods per Year. This fixed percentage remains constant throughout the bond’s life. Investors use the coupon rate to quickly assess the bond’s potential for income generation. The coupon rate itself doesn’t account for market fluctuations or the price at which the bond is bought or sold.

Yield to maturity (YTM), conversely, reflects the total return an investor anticipates if they hold the bond until its maturity date. Unlike the coupon rate, YTM considers the bond’s purchase price, all future interest payments (for what is the coupon rate used to compute these payments?), and the difference between the purchase price and the face value at maturity. It provides a more comprehensive measure of a bond’s return, incorporating market dynamics and the investor’s initial investment. YTM is expressed as an annual percentage and is influenced by market interest rates and the time until maturity. A bond purchased at a discount will have a YTM higher than its coupon rate, while a premium bond will have a lower YTM. For what is the coupon rate used to compute the initial estimate of the bond’s value? It provides a baseline, but the YTM gives a more complete picture.

Understanding the difference between the coupon rate and YTM is essential for making informed investment choices. While the coupon rate provides a clear picture of the periodic interest payments, the YTM offers a more holistic view of the potential return, accounting for price fluctuations and the bond’s overall lifespan. Investors use both figures in conjunction with other metrics to effectively assess the risks and potential rewards associated with various bond opportunities. Comparing bonds based solely on coupon rate can be misleading. YTM provides a more accurate reflection of the investment’s true return, considering both the initial cost and the time value of money. Therefore, using both the coupon rate and YTM is crucial when assessing different bond investments and making informed decisions.

Using the Coupon Rate to Compare Bonds: A Crucial Investment Tool

Investors use the coupon rate, alongside yield to maturity (YTM) and other crucial metrics, to compare bonds effectively. The coupon rate provides a straightforward measure of the periodic interest income a bond generates. Understanding for what is the coupon rate used to compute this income is fundamental. It allows investors to quickly assess the potential cash flow from different bonds. For example, a bond with a higher coupon rate will generate more interest income than a bond with a lower coupon rate, assuming the same face value. However, solely relying on the coupon rate for comparison is insufficient. Investors must consider the bond’s maturity date, credit rating of the issuer, and prevailing market interest rates for a complete picture. A high coupon rate might be offset by higher risk, meaning the potential for capital loss outweighs the higher interest payment.

When comparing bonds, the coupon rate helps investors understand the immediate return potential. It’s particularly useful when comparing bonds with similar maturities and credit ratings. In such cases, the bond with the higher coupon rate often appears more attractive, all else being equal. However, for what is the coupon rate used to compute the overall return is usually not the sole determinant. Investors must also account for the bond’s purchase price and its potential price fluctuations in the market. A higher coupon rate might not guarantee a higher overall return if the bond’s market price falls significantly. The YTM offers a more holistic measure of return, incorporating both coupon payments and the difference between the purchase price and the face value. Analyzing both the coupon rate and YTM enables investors to make more informed decisions, balancing risk and return more effectively.

Ultimately, the coupon rate is a key piece of information, but it’s just one part of a larger puzzle. Investors should not focus solely on the coupon rate when choosing bonds. It is important to consider the broader investment strategy and risk tolerance. Understanding for what is the coupon rate used to compute is only one component of effective bond analysis. Diversification across different bonds with varying coupon rates and maturities is a standard practice to reduce overall investment risk. Investors should always conduct thorough research and potentially seek professional financial advice before making investment decisions.

Analyzing Bond Investments: Putting the Coupon Rate into Perspective

Let’s analyze two hypothetical bonds to illustrate how the coupon rate, for what is the coupon rate used to compute periodic interest payments, influences investment decisions. Bond A has a face value of $1,000, a 5% coupon rate, and matures in 5 years. Bond B also has a face value of $1,000 but offers a 7% coupon rate and matures in 10 years. Both bonds are issued by companies with similar credit ratings. The higher coupon rate of Bond B immediately suggests greater periodic interest payments. However, the longer maturity period introduces more risk. Investors considering these bonds need to assess their risk tolerance and investment timeline. For what is the coupon rate used to compute, in this case, is the annual interest payment. A shorter-term bond like Bond A provides lower returns but involves less interest rate risk than Bond B. The investor must decide which aspects—higher return or lower risk—are prioritized.

Calculating the annual coupon payments clarifies the immediate financial impact of the coupon rate. For Bond A, the annual coupon payment is ($1,000 * 0.05) = $50. For Bond B, it’s ($1,000 * 0.07) = $70. This demonstrates that a higher coupon rate directly translates to higher annual interest income. However, this is just one factor in the decision-making process. The yield to maturity (YTM) provides a more comprehensive picture of the return on investment, considering the purchase price and the time value of money. For what is the coupon rate used to compute the annual return, one should also consider the YTM, which accounts for the bond’s purchase price and the present value of future cash flows. This provides a more complete picture of the bond’s overall return compared to just considering the coupon rate.

To make an informed decision, investors should carefully consider all relevant factors. The coupon rate, while vital for determining periodic interest payments, is only one piece of the puzzle. Factors such as the bond’s credit rating, its maturity date, prevailing market interest rates, and the investor’s individual financial goals and risk tolerance all play a significant role in the investment decision. For what is the coupon rate used to compute the total return, it’s important to incorporate the YTM and carefully assess the bond’s risk profile. A thorough analysis ensures that the chosen bond aligns with the investor’s specific requirements and financial objectives.

Beyond the Basics: Factors Influencing Coupon Rates

Several key factors influence a bond’s coupon rate. The creditworthiness of the issuer plays a crucial role. Higher-rated issuers, perceived as less risky, typically offer lower coupon rates. Conversely, lower-rated issuers need to offer higher rates to attract investors willing to accept the increased risk. For what is the coupon rate used to compute the periodic interest payments, this risk premium is reflected in the coupon rate. Prevailing market interest rates also significantly impact coupon rates. When market rates rise, newly issued bonds need to offer higher coupon rates to be competitive. Conversely, falling market rates allow for lower coupon rates. The bond’s maturity date is another factor. Longer-term bonds generally carry higher coupon rates to compensate investors for the increased risk associated with tying up their capital for a longer period. For what is the coupon rate used to compute, understanding the interplay of these factors is crucial. The overall economic environment also affects coupon rates. During periods of economic expansion, rates tend to be higher, while during recessions, they may fall.

Inflation expectations also influence coupon rates. Investors demand higher coupon rates to protect against the erosion of purchasing power due to inflation. The supply and demand for bonds in the market also play a role. High demand for bonds can drive coupon rates down, while low demand can push them higher. The type of bond also matters. Municipal bonds, for instance, often have lower coupon rates than corporate bonds due to their tax-exempt status. For what is the coupon rate used to compute, remember it is a fundamental component of a bond’s overall attractiveness to investors. Investors carefully consider the coupon rate alongside other factors, such as the bond’s maturity and credit rating. The interaction of these various factors ultimately determines the coupon rate offered by a bond issuer.

Understanding these influences provides a more comprehensive view of the coupon rate. It is not simply an arbitrary number, but rather a reflection of several interconnected market forces and issuer-specific characteristics. For what is the coupon rate used to compute, the periodic interest payments, this understanding is key. By grasping these dynamics, investors can better evaluate bond opportunities and make more informed decisions. Analyzing the coupon rate within this broader context helps investors assess the risk and reward potential of different bond offerings and manage their portfolios effectively. The coupon rate, therefore, acts as a critical indicator of a bond’s attractiveness and overall investment potential.

Investing Wisely: Maximizing Your Returns with Coupon Rate Understanding

Understanding the coupon rate is fundamental to successful bond investing. It directly impacts your periodic income stream. The coupon rate, for what is the coupon rate used to compute periodic interest payments, is a fixed percentage of the bond’s face value. Investors use this information to project potential returns and compare different investment options. A higher coupon rate generally means larger interest payments, but this doesn’t always equate to the best investment. Market interest rates and the bond’s maturity date also significantly influence overall returns. Therefore, a comprehensive understanding of the interplay between the coupon rate and these other factors is crucial for making informed decisions. For what is the coupon rate used to compute, remember its role in calculating your regular interest income. Consider the coupon rate in conjunction with the yield to maturity (YTM) for a more holistic view of potential returns.

The coupon rate, for what is the coupon rate used to compute the return on your investment, allows investors to assess the immediate income generated by a bond. However, it’s vital to consider the bond’s price relative to its face value. Bonds trading at a premium (above face value) will have a lower yield than their coupon rate, while discount bonds (below face value) offer a higher yield. Analyzing these elements allows investors to compare bonds effectively and identify opportunities aligned with their risk tolerance. This process of comparing coupon rates helps investors to construct a diversified portfolio that balances income and capital appreciation. Investors should carefully consider factors such as the creditworthiness of the issuer and the prevailing economic conditions to mitigate risk.

In conclusion, mastering the concept of the coupon rate empowers investors to make smarter decisions in the bond market. By understanding how the coupon rate works, along with other crucial factors, investors can navigate the complexities of fixed-income investments more effectively. This knowledge enables them to choose bonds that provide the optimal balance of risk and return, maximizing their overall investment performance. Remember that the coupon rate is only one piece of the puzzle; a comprehensive approach that incorporates broader market analysis is essential for successful bond investing. For what is the coupon rate used to compute, remember its role in providing a stream of income from your bond holdings.