Understanding the Distinctions Between Finance and Economics

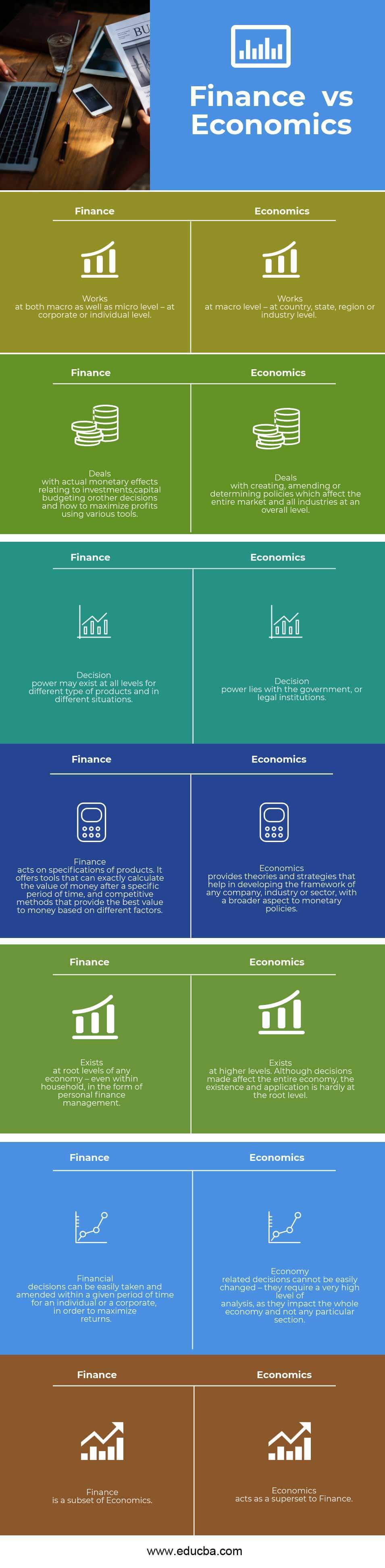

When considering a degree in finance or economics, it’s crucial to recognize the distinct differences between these two fields. While both disciplines deal with the management of resources, they have unique focuses, skill sets, and career paths. A finance degree vs economics degree is not just a matter of semantics; it’s a choice that can significantly impact future career prospects. Finance degrees tend to focus on the management of money and investments, preparing students for careers in investment banking, financial analysis, and portfolio management. On the other hand, economics degrees delve into the study of economic systems, policy development, and market research, leading to careers in government, non-profit organizations, and private industry. By grasping the distinctions between these two fields, individuals can make an informed decision about which degree aligns with their interests, skills, and career aspirations.

What Can You Do with a Finance Degree?

Holders of a finance degree can pursue a wide range of exciting and rewarding career opportunities. With a strong foundation in financial concepts, theories, and practices, finance graduates can excel in various roles, including investment banking, financial analysis, and portfolio management. In investment banking, finance professionals advise clients on mergers and acquisitions, initial public offerings, and other complex financial transactions. As financial analysts, they analyze financial data to identify trends, risks, and opportunities, providing valuable insights to businesses and organizations. In portfolio management, finance experts develop and implement investment strategies to maximize returns and minimize risk. Additionally, finance degree holders can explore careers in asset management, risk management, and financial planning, among others. With a finance degree, the possibilities are endless, and the career paths are diverse and rewarding.

How to Leverage an Economics Degree for a Successful Career

Economics degree holders possess a unique combination of analytical, problem-solving, and critical thinking skills, making them highly sought after in a wide range of industries. With a strong foundation in economic theory, data analysis, and policy development, economics graduates can excel in various roles. In data analysis, economics professionals collect and interpret complex data to inform business decisions, policy development, and market research. In policy development, they work with government agencies, non-profit organizations, and private companies to design and implement policies that promote economic growth and stability. Additionally, economics degree holders can pursue careers in market research, international trade, and economic consulting, among others. The versatility of an economics degree allows graduates to adapt to changing market conditions and pursue opportunities in various sectors, from finance and government to healthcare and education. By leveraging their skills and knowledge, economics degree holders can unlock a successful and fulfilling career.

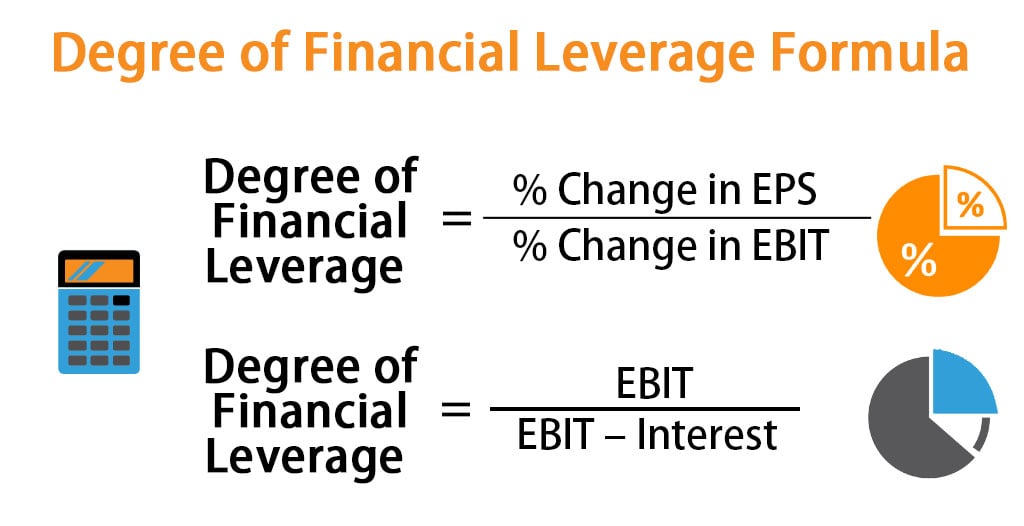

Key Skills and Knowledge: Finance vs Economics

When considering a finance degree vs economics degree, it’s essential to understand the distinct skills and knowledge each field provides. Finance degrees focus on developing expertise in financial modeling, investment analysis, and portfolio management, preparing students for careers in investment banking, financial analysis, and asset management. In contrast, economics degrees emphasize the study of economic systems, policy development, and data analysis, leading to careers in government, non-profit organizations, and private industry. While both fields require strong analytical and problem-solving skills, finance degrees tend to focus on the application of financial concepts to real-world problems, whereas economics degrees delve deeper into the underlying economic theories and principles. Additionally, finance degrees often require proficiency in financial software and tools, such as Excel, Bloomberg, and Matlab, whereas economics degrees place a greater emphasis on econometrics, statistical analysis, and data visualization. By understanding the unique skills and knowledge acquired through each degree, individuals can make an informed decision about which path aligns with their interests, skills, and career aspirations.

Which Degree is Right for You: A Personalized Approach

When deciding between a finance degree vs economics degree, it’s essential to consider individual interests, skills, and career aspirations. To make an informed decision, ask yourself: What are your strengths and weaknesses? Are you more interested in the practical application of financial concepts or the theoretical foundations of economic systems? What are your career goals, and which degree is more likely to help you achieve them? By reflecting on these questions, individuals can identify which degree aligns with their unique profile. For instance, those with a passion for data analysis and a strong mathematical background may find an economics degree more suitable. On the other hand, individuals with a keen interest in financial markets and a talent for financial modeling may thrive in a finance program. By taking a personalized approach, individuals can choose the degree that best fits their skills, interests, and career aspirations, setting themselves up for success in the competitive job market.

The Job Market Outlook: Finance vs Economics

The job market outlook for finance and economics degree holders is highly competitive, with both fields offering promising career prospects. According to recent data, finance degree holders can expect a median salary range of $60,000 to $80,000, with growth opportunities in fields such as investment banking, financial analysis, and portfolio management. In contrast, economics degree holders can expect a median salary range of $50,000 to $70,000, with growth opportunities in fields such as data analysis, policy development, and market research. While both fields offer strong job prospects, the finance industry is expected to experience faster growth, driven by increasing demand for financial services and investment products. However, economics degree holders are in high demand in government and non-profit organizations, where their analytical skills and knowledge of economic systems are highly valued. When choosing between a finance degree vs economics degree, it’s essential to consider the job market outlook and salary expectations, as well as individual interests and skills. By doing so, individuals can make an informed decision that aligns with their career aspirations and goals.

Real-World Applications: Case Studies in Finance and Economics

To illustrate the practical applications of finance and economics degrees, let’s consider several case studies. In the finance industry, a finance degree holder might work as a financial analyst for a investment bank, analyzing market trends and developing financial models to inform investment decisions. In contrast, an economics degree holder might work as a policy analyst for a government agency, using econometric techniques to evaluate the impact of policy interventions on economic outcomes. In the non-profit sector, a finance degree holder might work as a portfolio manager for a charitable foundation, managing investments to maximize returns and support philanthropic goals. Meanwhile, an economics degree holder might work as a research economist for a think tank, conducting studies on the economic impact of social programs and policy interventions. These case studies demonstrate the diverse range of career paths available to finance and economics degree holders, and highlight the importance of considering individual interests and skills when choosing between a finance degree vs economics degree.

Conclusion: Making an Informed Decision

In conclusion, choosing between a finance degree vs economics degree requires careful consideration of individual interests, skills, and career aspirations. By understanding the unique skills and knowledge each field provides, as well as the diverse range of career opportunities available, individuals can make an informed decision that aligns with their goals. Whether pursuing a career in investment banking, financial analysis, or policy development, a finance or economics degree can provide a strong foundation for success. By weighing the job market outlook, salary expectations, and growth opportunities, individuals can make a well-informed decision that sets them up for long-term success. Ultimately, the key to unlocking career potential lies in choosing a degree that aligns with individual strengths and interests, and leveraging the skills and knowledge acquired to achieve career goals.