Understanding the Relationship Between Monetary Policy and Bond Prices

The Federal Reserve’s monetary policy exerts a considerable influence on the bond market. The cornerstone of this influence is the Fed Funds Rate, a benchmark interest rate that serves as a primary tool for managing inflation and promoting economic stability. The fed funds rate vs 2 year treasury relationship is critical for understanding market dynamics. Changes to the Fed Funds Rate directly impact borrowing costs for banks, which in turn, ripples through the broader economy, affecting interest rates on various financial products, including bonds. The fed funds rate vs 2 year treasury is a key indicator.

When the Federal Reserve lowers the Fed Funds Rate, it effectively reduces the cost of borrowing. This encourages businesses and consumers to take out loans, invest, and spend, thereby stimulating economic activity. In such a scenario, bond prices typically rise because newly issued bonds with lower interest rates become less attractive compared to older bonds with higher rates. Conversely, when the Federal Reserve raises the Fed Funds Rate, borrowing costs increase, potentially slowing down economic growth. In this case, bond prices tend to fall as new, higher-yielding bonds enter the market, making existing bonds less appealing. The fed funds rate vs 2 year treasury relationship reflects these economic shifts.

The impact of the Fed Funds Rate extends beyond short-term borrowing. It also shapes expectations about future inflation and economic growth, which in turn influences longer-term interest rates and bond yields. Market participants closely monitor the Federal Reserve’s policy statements and actions to anticipate future rate movements and adjust their investment strategies accordingly. Understanding the interplay between the Fed Funds Rate and the bond market is crucial for investors, economists, and policymakers alike. The fed funds rate vs 2 year treasury dynamic provides valuable insights into the overall health and direction of the economy.

Treasury Notes: A Primer on the Two-Year Maturity

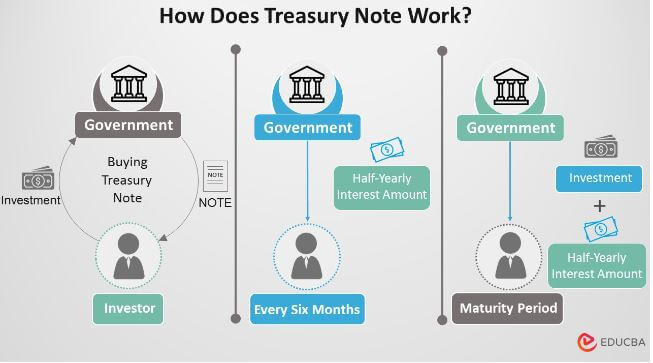

The two-year Treasury note is a debt security issued by the U.S. Department of the Treasury. It matures in two years from its issue date. These notes are a crucial component of the fixed-income market. They serve as a benchmark for short-term interest rates. Investors closely monitor the yield on the two-year Treasury note. This is because it reflects market expectations about the near-term path of interest rates and the overall health of the economy. The interplay between the fed funds rate vs 2 year treasury yield offers valuable insights into market sentiment and economic forecasts.

Two-year Treasury notes are popular among a wide range of investors. These include individuals, institutions, and foreign governments. Their appeal lies in their relative safety, liquidity, and predictable returns. As obligations of the U.S. government, they are considered virtually risk-free in terms of credit risk. The active trading market for these notes ensures high liquidity. This allows investors to easily buy and sell them without significantly impacting their price. This contrasts with less liquid investments. The yield on the two-year Treasury is influenced by many factors. These factors include the current fed funds rate, inflation expectations, and economic growth prospects. These factors all contribute to the dynamic relationship between the fed funds rate vs 2 year treasury.

The two-year Treasury yield is a key indicator that market participants use to gauge the expected trajectory of the fed funds rate. The fed funds rate is the target rate set by the Federal Reserve for overnight lending between banks. The market prices in anticipated future Fed decisions into the two-year Treasury yield. This makes it a forward-looking indicator of monetary policy. For example, if the market expects the Fed to raise rates, the two-year Treasury yield will likely increase in anticipation. Conversely, if the market anticipates rate cuts, the yield will likely decrease. Analyzing the spread between the fed funds rate vs 2 year treasury yield provides valuable clues. These clues help decipher market sentiment and potential shifts in monetary policy. Moreover, economic data releases such as inflation reports and GDP figures can significantly impact both the fed funds rate and the two-year Treasury yield, further highlighting the interconnectedness of these two key rates. Understanding the nuanced relationship between the fed funds rate vs 2 year treasury is essential for informed investment decisions and economic analysis.

How To Interpret Signals from Yield Curve Dynamics

The relationship between the fed funds rate vs 2 year treasury yield offers crucial insights into market expectations. The 2-year Treasury yield reflects the market’s predicted path of future short-term interest rates, heavily influenced by anticipated Fed Funds Rate adjustments. Investors constantly assess the probability of future rate hikes or cuts. This assessment directly impacts the 2-year Treasury yield. A rising yield suggests expectations of higher future Fed Funds Rates, possibly due to anticipated inflation or strong economic growth. Conversely, a falling yield indicates expectations of lower future Fed Funds Rates, perhaps reflecting concerns about economic slowdown or deflationary pressures. Understanding this dynamic is key to interpreting the fed funds rate vs 2 year treasury interplay.

Analyzing the yield curve’s shape provides further context. The yield curve plots Treasury yields across different maturities. A steepening yield curve indicates a widening gap between short-term and long-term yields, suggesting investors anticipate stronger future economic growth and higher inflation. This typically happens when the Fed is expected to raise rates aggressively. A flattening yield curve shows a narrowing gap, signaling a potential slowdown in economic growth or a belief that the Fed’s tightening cycle is nearing its end. An inverted yield curve, where short-term yields exceed long-term yields, is considered a strong recessionary predictor. It suggests that investors anticipate future rate cuts, potentially as a response to an economic downturn. The fed funds rate vs 2 year treasury relationship is central to interpreting these yield curve shifts.

Market participants actively analyze the fed funds rate vs 2 year treasury spread to gauge expectations for future monetary policy. Discrepancies between the two can reveal important market dynamics. For example, a situation where the Fed raises the Fed Funds Rate but the 2-year Treasury yield falls might signal a “flight to safety,” where investors seek the perceived security of Treasury bonds despite higher interest rates. Conversely, if economic data unexpectedly strengthens, the 2-year Treasury yield may rise even if the Fed maintains its current rate. This signals increased confidence in future growth and potentially higher inflation. Careful observation of the fed funds rate vs 2 year treasury dynamic provides valuable insight into evolving market sentiment and future economic prospects.

Divergence and Convergence: Analyzing Key Market Patterns

It’s crucial to analyze instances where the fed funds rate vs 2 year treasury yield exhibit divergence. This means they move in opposite directions. These movements can signal underlying economic shifts. Sometimes, the 2-Year Treasury yield decreases. This can occur even as the Federal Reserve tightens monetary policy by raising the fed funds rate. This divergence often reflects a “flight to safety.” Investors seek the security of U.S. Treasury bonds amidst global economic uncertainty. This increased demand drives Treasury prices up, pushing yields down, irrespective of the Fed’s actions on the fed funds rate.

Conversely, strong economic data releases can cause the 2-Year Treasury yield to increase. This happens even if the Fed maintains a steady fed funds rate. Positive reports on GDP growth, employment, or inflation can boost investor confidence. This leads to a sell-off in Treasury bonds. Investors move towards riskier assets with potentially higher returns. The resulting increase in Treasury supply pushes yields higher, demonstrating how market sentiment can sometimes overshadow the immediate impact of the fed funds rate. The fed funds rate vs 2 year treasury relationship is fluid. It is subject to many different market forces.

Furthermore, the spread between the fed funds rate vs 2 year treasury yield itself is a key indicator. A widening spread suggests the market anticipates future Fed rate hikes. A narrowing spread could signal expectations for future rate cuts or a slowing economy. Analyzing these patterns of divergence and convergence provides valuable insights. Investors and analysts can better understand market expectations and the interplay of various economic forces. These forces ultimately shape the trajectory of both the fed funds rate and the 2-Year Treasury yield. Understanding the dynamics of the fed funds rate vs 2 year treasury yield is essential for making informed investment decisions. Especially during times of economic uncertainty or policy shifts.

The Economic Factors Influencing Bond Yields

A multitude of economic factors exert influence over both the fed funds rate vs 2 year treasury. These factors form a complex web that shapes market expectations and ultimately dictates monetary policy decisions. Inflation, a persistent rise in the general price level, is a primary concern for central banks. High inflation erodes purchasing power and can destabilize the economy. To combat inflation, the Federal Reserve may raise the fed funds rate, making borrowing more expensive and cooling down economic activity. This action often leads to an increase in the 2-Year Treasury yield as investors anticipate higher returns in a rising rate environment.

Gross Domestic Product (GDP) growth, a measure of the economy’s overall output, also plays a significant role. Strong GDP growth typically signals a healthy economy, which can lead to increased demand for credit and potentially higher inflation. In such scenarios, the Federal Reserve might raise the fed funds rate to prevent the economy from overheating. Conversely, weak GDP growth could prompt the Fed to lower rates to stimulate borrowing and investment. The unemployment rate, another key economic indicator, reflects the percentage of the labor force that is unemployed. A low unemployment rate generally indicates a tight labor market, which can contribute to wage inflation. This can pressure the Federal Reserve to tighten monetary policy, impacting the fed funds rate vs 2 year treasury. Global economic conditions also exert influence. Economic slowdowns in major trading partners can dampen demand for U.S. exports, potentially impacting GDP growth and inflation. Geopolitical events and shifts in global trade policies can also create uncertainty and volatility in financial markets, affecting both the fed funds rate and Treasury yields.

These economic factors are interconnected and constantly evolving. Understanding how they interact is essential for interpreting the signals from the bond market. For example, a combination of high inflation and strong GDP growth might lead investors to anticipate aggressive rate hikes by the Federal Reserve, resulting in a significant increase in the 2-Year Treasury yield relative to the fed funds rate. Alternatively, concerns about a potential recession could lead to a “flight to safety,” driving investors to purchase Treasury securities, pushing yields down even if the Fed is maintaining a steady fed funds rate. The interplay between the fed funds rate vs 2 year treasury offers valuable insights into the market’s assessment of the economic outlook and the likely path of monetary policy. Analyzing these relationships helps investors and policymakers alike make informed decisions in a complex and ever-changing economic landscape.

Using Bond Yields to Gauge Market Sentiment

Investors and analysts closely monitor the relationship between the fed funds rate vs 2 year treasury yield to decipher market sentiment and assess risk appetite. This relationship serves as a barometer for gauging investor confidence and anticipating potential economic shifts. A stable and predictable spread between the fed funds rate vs 2 year treasury typically indicates a healthy and functioning market, reflecting a consensus view on economic prospects and monetary policy. However, significant deviations or erratic movements in this relationship can signal underlying anxieties or heightened uncertainty.

When the 2-Year Treasury yield rises sharply above the fed funds rate, it often suggests that investors anticipate future interest rate hikes by the Federal Reserve due to strong economic growth or rising inflation. Conversely, if the 2-Year Treasury yield falls below the fed funds rate, it may indicate concerns about a potential economic slowdown or recession, leading investors to seek the safety of short-term government bonds. This phenomenon is known as an inverted yield curve and is widely regarded as a potential leading indicator of economic downturns. The fed funds rate vs 2 year treasury dynamic is therefore a critical tool for understanding market expectations about future monetary policy and economic conditions. Furthermore, increased volatility in the bond market, as reflected in wider swings in the 2-Year Treasury yield, often coincides with periods of heightened uncertainty and risk aversion, prompting investors to re-evaluate their investment strategies and potentially shift towards safer assets.

Changes in the relationship between the fed funds rate vs 2 year treasury can also reflect shifts in investor confidence and potential economic turning points. For instance, a sudden widening of the spread between the two rates might suggest that investors are becoming more optimistic about economic growth prospects, even if the Federal Reserve is maintaining a cautious stance on monetary policy. Similarly, a narrowing of the spread could signal growing concerns about the sustainability of the economic expansion, prompting investors to brace for a potential slowdown. By carefully analyzing these movements and considering the underlying economic factors, investors and analysts can gain valuable insights into market sentiment and make more informed investment decisions. Analyzing the fed funds rate vs 2 year treasury helps to understand the risk appetite present in the market at any given moment, aiding more qualified investments.

Strategies for Investors in a Changing Rate Environment

Navigating a fluctuating interest rate landscape requires a strategic approach, especially when considering the interplay between the fed funds rate vs 2 year treasury yield. Investors can employ various strategies to mitigate risk and potentially enhance returns. Portfolio allocation should be carefully considered. This involves diversifying investments across different asset classes, such as stocks, bonds, and real estate. The proportion allocated to each asset class should align with the investor’s risk tolerance and investment goals. When the fed funds rate vs 2 year treasury spread widens, indicating potentially higher future rates, investors might consider reducing their exposure to long-duration bonds.

Duration management is another crucial aspect. Duration measures a bond’s sensitivity to interest rate changes. Shorter-duration bonds are less sensitive to rate hikes than longer-duration bonds. Investors can shorten the duration of their fixed-income portfolio by investing in shorter-term bonds or bond funds. Floating-rate notes, whose interest rates adjust periodically based on a benchmark rate, offer another avenue for managing interest rate risk. When evaluating fed funds rate vs 2 year treasury movements, investors should consider the impact on different sectors. For example, rising rates can negatively impact interest-rate-sensitive sectors such as utilities and real estate. Conversely, sectors like financials may benefit from higher rates. Active management of bond portfolios involves adjusting holdings based on anticipated rate movements. This could include selling bonds expected to decline in value and purchasing those expected to perform well.

Interest rate risk mitigation is paramount. Strategies include using interest rate swaps or options to hedge against potential losses from rising rates. Laddering bond maturities involves holding bonds with staggered maturity dates. This strategy provides a steady stream of income and reduces the risk of reinvesting at unfavorable rates. Furthermore, staying informed about economic indicators and Federal Reserve policy announcements is crucial for making informed investment decisions. Analyzing the fed funds rate vs 2 year treasury relationship in conjunction with economic data can provide valuable insights into future rate movements. Investors can use these insights to adjust their portfolios accordingly. Seeking advice from a qualified financial advisor is essential for developing a personalized investment strategy that aligns with individual circumstances and risk tolerance. Remember that no strategy guarantees profits, and all investments involve risk. The key is to understand the risks involved and implement strategies that mitigate those risks while pursuing investment objectives. Understanding the dynamics of the fed funds rate vs 2 year treasury is integral to successful navigation of the bond market.

Future Outlook for Bond Markets and Monetary Policy

The future direction of the fed funds rate vs 2 year treasury yield hinges on a complex interplay of economic forces and Federal Reserve policy. Predicting these movements requires a careful assessment of inflation trends, economic growth prospects, and the Fed’s reaction function. Current expectations suggest a period of continued vigilance from the Federal Reserve, focused on maintaining price stability while supporting sustainable economic activity.

Several factors could influence the trajectory of the fed funds rate vs 2 year treasury relationship. Persistent inflationary pressures may compel the Fed to maintain or even increase the fed funds rate, potentially leading to an upward movement in the 2-Year Treasury yield as the market prices in future rate hikes. Conversely, a significant slowdown in economic growth could prompt the Fed to ease monetary policy, potentially causing both the fed funds rate vs 2 year treasury to decline. Geopolitical risks and unexpected global events could also trigger shifts in investor sentiment, leading to fluctuations in Treasury yields as investors seek safe-haven assets. The relationship between the fed funds rate vs 2 year treasury is also affected by quantitative tightening. As the Fed reduces its balance sheet, this action could put upward pressure on bond yields. Monitoring key economic indicators, such as the Consumer Price Index (CPI), GDP growth, and employment figures, will be crucial for anticipating future movements in the fed funds rate vs 2 year treasury.

Investors should remain adaptable and prepared to adjust their strategies in response to evolving market conditions. Understanding the drivers of the fed funds rate vs 2 year treasury, and their potential impact on investment portfolios, is essential for navigating the complexities of the bond market. Scenario planning, stress testing portfolios, and diversifying across asset classes can help mitigate risk and capitalize on opportunities in a changing rate environment. The interplay between the fed funds rate vs 2 year treasury will continue to be a key indicator of market sentiment and a crucial factor for investors to consider.