Understanding the Federal Funds Rate

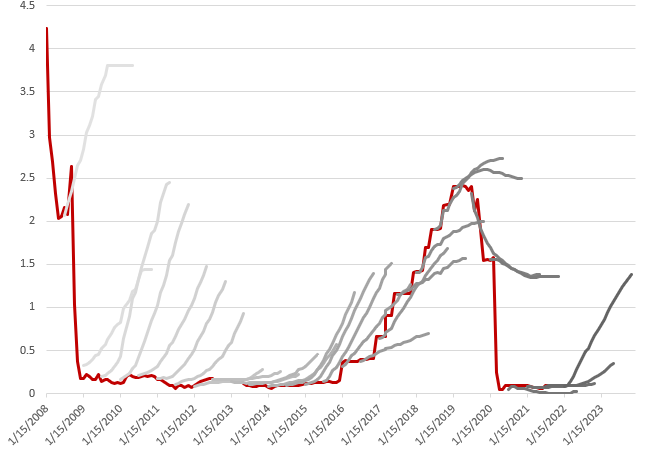

The federal funds rate is the target rate that the Federal Reserve (also known as the Fed) wants banks to charge each other for overnight loans. This key interest rate plays a vital role in the US economy. Changes to the federal funds rate directly impact borrowing costs for businesses and consumers. When the Fed lowers the rate, borrowing becomes cheaper, potentially stimulating economic growth. Conversely, raising the rate makes borrowing more expensive, aiming to curb inflation. The Federal Open Market Committee (FOMC) sets the federal funds rate. The FOMC meets several times a year to assess economic conditions and decide on the appropriate rate. Understanding this rate is crucial for comprehending the fed funds rate forward curve, a tool used to predict future interest rate movements. The fed funds rate forward curve helps investors, businesses, and economists anticipate potential changes in monetary policy and their broader economic consequences. Its implications extend far beyond the immediate impact of the current federal funds rate, offering a glimpse into the likely trajectory of interest rates over time. This understanding provides valuable insights for decision-making across various sectors, from investment strategies to personal financial planning. The relationship between the current federal funds rate and the predicted future rates, as shown in the fed funds rate forward curve, illuminates market expectations and provides context for analyzing future economic scenarios.

The Fed’s decisions regarding the federal funds rate are influenced by a multitude of factors. These include inflation levels, employment data, and overall economic growth. The goal is to maintain a stable and healthy economy. A stable economy benefits consumers, businesses, and the financial markets. The Fed aims for an economy that experiences sustainable growth with low inflation. By carefully managing the federal funds rate, the central bank attempts to balance these sometimes competing objectives. The impact of the federal funds rate isn’t confined to banks. It ripples throughout the financial system, influencing mortgage rates, credit card interest, and various other borrowing costs. This pervasive influence highlights the importance of understanding how the federal funds rate functions within the broader economic landscape. Grasping the federal funds rate is foundational to comprehending the more advanced concept of the fed funds rate forward curve.

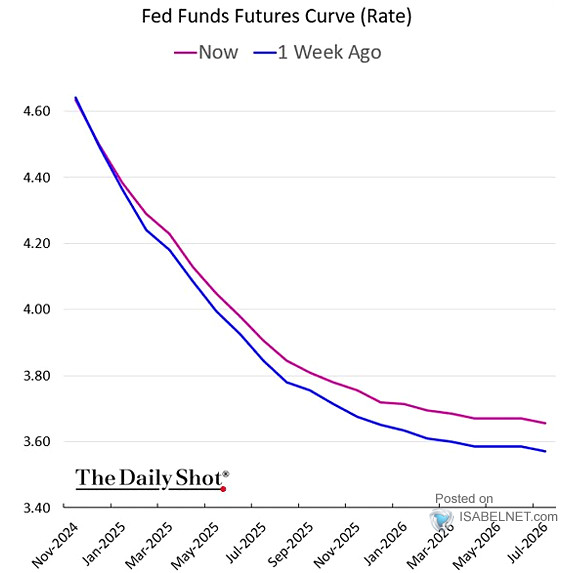

Analyzing the fed funds rate forward curve requires understanding its relationship to the federal funds rate itself. The forward curve essentially projects the market’s expectation of future federal funds rates. It provides a visual representation of these expectations, illustrating the anticipated path of interest rates over a given timeframe. Changes in this curve reflect shifts in market sentiment and expectations regarding future monetary policy. This information is valuable to various stakeholders, including investors, policymakers, and businesses. The curve’s shape can be interpreted to provide insights into market confidence and potential economic developments. A steeply upward-sloping curve, for example, generally suggests expectations of rising interest rates, implying an anticipated tightening of monetary policy. Conversely, a downward-sloping curve might indicate expectations of rate cuts. The fed funds rate forward curve, therefore, provides a powerful forecasting tool, albeit with inherent limitations. Its accuracy depends on the precision of market expectations, which are constantly influenced by new economic information and unforeseen events.

What is a Forward Curve?

Imagine trying to predict tomorrow’s weather. Meteorologists use various data points to create forecasts. Similarly, the fed funds rate forward curve provides a prediction of future interest rates. It’s a graphical representation showing market expectations for the federal funds rate at different points in time. This curve isn’t a guarantee, but rather a snapshot of collective market sentiment. Understanding the fed funds rate forward curve allows investors and economists to anticipate potential shifts in monetary policy and their economic consequences. The curve’s shape reflects the market’s collective wisdom, offering insights into potential future interest rate movements and economic scenarios. Analyzing the fed funds rate forward curve is crucial for strategic decision-making across various financial sectors.

The fed funds rate forward curve essentially plots the implied interest rates for various future dates. Each point on the curve represents the market’s expectation for the federal funds rate at a specific future time. For example, one point might show the predicted rate three months from now, another six months, and so on. The curve’s shape itself is significant, revealing market expectations for future economic conditions. A steeply upward-sloping curve might suggest expectations of rising inflation and subsequent interest rate hikes by the Federal Reserve. Conversely, a downward-sloping curve could indicate predictions of economic slowdown and potential rate cuts. Analyzing the fed funds rate forward curve requires careful consideration of its nuances, offering valuable insights into the economy and potential investment opportunities.

Think of it like predicting stock prices. No one can say for sure what a stock will do tomorrow, but analysts use various models and indicators to make informed guesses. The fed funds rate forward curve serves a similar purpose for interest rates. It’s a powerful tool for understanding market expectations, but it’s crucial to remember that it’s just a prediction based on current information and market sentiment. Unexpected events could easily change the actual path of interest rates. The fed funds rate forward curve, therefore, should be considered alongside other economic indicators and analyses to develop a comprehensive perspective on the future of interest rates and their implications for financial planning and investment strategies.

Interpreting the Forward Curve: Shapes and Signals

The shape of the fed funds rate forward curve offers valuable insights into market expectations regarding future interest rate adjustments. A steeply upward-sloping curve suggests the market anticipates rising interest rates. This typically reflects expectations of robust economic growth and potentially higher inflation. Investors might interpret this as a signal to favor investments that benefit from rising rates, such as certain types of bonds. Conversely, a downward-sloping curve indicates that the market anticipates interest rate cuts. This might be due to concerns about economic slowdown or deflationary pressures. Such a curve may lead investors to seek assets that perform well in low-interest-rate environments.

A relatively flat fed funds rate forward curve implies that the market anticipates little change in interest rates over the forecast period. This scenario often reflects a state of economic stability, with neither significant inflationary nor deflationary pressures. Investors might see this as a time for careful consideration of various asset classes, since the potential for significant gains from rate changes is limited. A humped curve, characterized by an initial upward slope followed by a downward slope, suggests that the market initially expects rate hikes, but anticipates future rate cuts. This could reflect expectations of a temporary economic surge followed by a period of slower growth or an attempt by the central bank to manage inflation. The interpretation of a humped fed funds rate forward curve requires careful analysis to understand the underlying economic factors.

Understanding these different shapes of the fed funds rate forward curve is crucial for interpreting market sentiment. The curve acts as a barometer of market expectations, reflecting the collective wisdom of numerous investors and traders. While the fed funds rate forward curve provides valuable information, it is essential to remember that it is merely a prediction based on current market conditions. Unforeseen economic events or changes in central bank policy can significantly alter the actual path of interest rates. Therefore, a comprehensive understanding of the underlying economic conditions is crucial for effectively using the forward curve for making informed financial decisions. Analyzing the fed funds rate forward curve alongside other economic indicators provides a more holistic view of future interest rate trends and their potential impact on various investment strategies.

How to Read and Analyze a Federal Funds Rate Forward Curve

The fed funds rate forward curve is a graphical representation of market expectations for future short-term interest rates. It plots the expected federal funds rate for various future dates. Understanding this curve requires examining its shape and key features. The current federal funds rate is the starting point, usually found on the left side of the chart. This represents the rate currently in effect. The curve then shows the market’s prediction for the rate at future points in time. A steeply upward-sloping curve suggests expectations of rising interest rates, implying a tightening monetary policy or robust economic growth. Conversely, a downward-sloping curve indicates anticipated rate cuts, often reflecting concerns about economic slowdown or disinflation. Analyzing the fed funds rate forward curve involves carefully interpreting its slope and overall shape to glean insights into market sentiment and future interest rate movements.

Interpreting the slope of the fed funds rate forward curve is crucial. An upward-sloping curve signals expectations of higher future interest rates. This could reflect expectations of increased inflation, stronger economic growth, or a more hawkish central bank stance. A downward-sloping curve, however, suggests anticipated interest rate cuts. This might indicate concerns about a weakening economy, lower inflation, or a more dovish monetary policy. A flat curve implies stable interest rate expectations. It is important to remember that the fed funds rate forward curve is not a precise predictor of the future. It reflects market sentiment and expectations, which are subject to change based on new information and evolving economic conditions. Analyzing the curve requires considering various economic indicators and events that can influence market sentiment. Using the curve requires careful interpretation; unforeseen events can greatly impact actual rates.

Visual examples can greatly enhance understanding. An upward-sloping fed funds rate forward curve typically looks like an ascending line, while a downward-sloping curve descends. A humped curve starts with an upward slope, then plateaus or even declines. Each shape reflects a unique economic outlook. Examining these visual representations alongside the underlying economic data provides a more holistic understanding of the market’s expectations for the future path of interest rates. The fed funds rate forward curve provides valuable insights, but should be used in conjunction with other economic indicators and analyses. It’s a dynamic tool reflecting ever-changing market expectations for the federal funds rate. Remember, this is just one piece of the puzzle when making investment decisions or forecasting future economic conditions. The fed funds rate forward curve offers a valuable perspective on market sentiment and future interest rate expectations.

Factors Influencing the Fed Funds Rate Forward Curve

The fed funds rate forward curve, a crucial tool for understanding future interest rate expectations, is shaped by a complex interplay of economic factors. Market participants constantly assess these factors to form their predictions, which collectively determine the curve’s shape. Inflation data plays a pivotal role. High inflation generally leads to expectations of future interest rate hikes by the Federal Reserve, resulting in an upward-sloping curve. Conversely, low inflation might suggest a flatter or even downward-sloping curve, reflecting expectations of lower rates or even potential rate cuts. Economic growth forecasts are equally important. Robust growth often implies increased inflationary pressures, prompting expectations of higher future rates. Conversely, weak growth may lead to predictions of lower rates to stimulate the economy. The relationship between the fed funds rate forward curve and economic growth is dynamic and crucial to understand.

Unemployment figures also significantly influence the fed funds rate forward curve. Low unemployment often indicates a tight labor market, potentially fueling wage growth and inflation. This scenario may lead to expectations of higher future interest rates, reflected in an upward-sloping curve. High unemployment, conversely, might suggest lower inflationary pressures and potential rate cuts, potentially resulting in a downward-sloping curve. Central bank pronouncements, particularly statements from the Federal Open Market Committee (FOMC), carry immense weight. These announcements provide insights into the central bank’s assessment of the economy and its likely policy response, directly shaping market expectations and thus influencing the fed funds rate forward curve. Understanding these statements is critical for interpreting the curve’s shape and the implied future interest rate path. The market carefully analyzes these pronouncements for clues about future monetary policy decisions.

Beyond these core factors, other variables also subtly influence the fed funds rate forward curve. Geopolitical events, shifts in global economic conditions, and unexpected shocks to the financial system can all affect market sentiment and, consequently, the shape of the curve. Therefore, while the curve offers valuable insights, it’s crucial to acknowledge its limitations. It represents a collective market prediction, subject to inherent uncertainties and potential revisions as new information emerges. Investors should carefully consider all relevant economic indicators and factors to make well-informed investment decisions, using the forward curve as one piece of the puzzle rather than the sole determinant. The fed funds rate forward curve provides a dynamic snapshot of market expectations, influenced by a complex interplay of economic forces and central bank policy.

Using the Fed Funds Rate Forward Curve for Investment Decisions

The fed funds rate forward curve serves as a valuable tool for various investment strategies. For bond traders, understanding the curve’s shape helps anticipate future interest rate movements. An upward-sloping curve, for instance, suggests expectations of rising interest rates, potentially impacting bond prices. Traders can adjust their portfolios accordingly, perhaps favoring shorter-term bonds to mitigate potential losses from falling prices in longer-term bonds. Conversely, a downward-sloping curve might signal an opportunity to invest in longer-term bonds with higher yields. The fed funds rate forward curve is not a crystal ball, however, so diversification remains crucial.

In loan pricing, businesses and financial institutions use the fed funds rate forward curve to forecast future borrowing costs. This allows them to set interest rates on loans more accurately, minimizing exposure to unexpected changes in the cost of funds. The curve aids in predicting future cash flows, enabling better risk management and improved profitability. Businesses can factor the expected trajectory of interest rates, as reflected in the fed funds rate forward curve, into their long-term financial planning. This allows for more informed decisions regarding debt financing and capital investments. Accurate forecasting using the fed funds rate forward curve can contribute significantly to the bottom line.

Beyond bond trading and loan pricing, the fed funds rate forward curve provides valuable information for a range of investment decisions. For example, it can inform decisions related to hedging strategies, where investors seek to protect their portfolios from interest rate risk. By studying the curve’s shape and the implied expectations for future interest rate changes, investors can develop more effective hedging strategies tailored to their individual risk tolerance and investment goals. However, it’s vital to remember that the fed funds rate forward curve is just one piece of the puzzle. Investors should consider other factors, such as macroeconomic conditions, company-specific fundamentals, and geopolitical events, before making investment decisions. Successful investing requires a holistic approach that goes beyond interpreting the fed funds rate forward curve alone. Using the fed funds rate forward curve effectively requires careful analysis and a nuanced understanding of market dynamics.

Limitations of the Fed Funds Rate Forward Curve

The fed funds rate forward curve, while a valuable tool, presents inherent limitations. It’s crucial to remember that the curve reflects market expectations, not certainties. These expectations are based on currently available data and market sentiment. Unexpected events, such as geopolitical crises, significant shifts in consumer behavior, or unforeseen technological disruptions, can dramatically alter the actual path of interest rates. The fed funds rate forward curve cannot predict these “black swan” events. Therefore, relying solely on the curve for investment decisions is unwise.

Another limitation lies in the inherent difficulty of accurately forecasting economic variables. Inflation, economic growth, and unemployment are complex phenomena influenced by numerous interacting factors. The fed funds rate forward curve incorporates forecasts of these variables, but these forecasts themselves are subject to considerable uncertainty. Errors in forecasting these fundamental economic indicators will directly impact the accuracy of the fed funds rate forward curve. Moreover, the curve’s accuracy depends on the quality and timeliness of the data used in its construction. Inaccurate or delayed data will lead to a less reliable fed funds rate forward curve. Regularly reviewing and updating the analysis is therefore vital.

Finally, the fed funds rate forward curve should not be interpreted in isolation. It provides valuable insights into market expectations, but it’s only one piece of the puzzle. A comprehensive investment strategy requires consideration of other economic indicators, fundamental analysis of individual assets, and a thorough understanding of the overall market context. Investors should treat the fed funds rate forward curve as a helpful guide, but not a definitive predictor. Using it alongside other analytical tools and risk management strategies yields a more robust and informed approach to investment decision-making. Remember, the fed funds rate forward curve is a tool for understanding market sentiment, not a crystal ball predicting the future with certainty.

The Forward Curve and Your Financial Planning

Understanding the fed funds rate forward curve offers significant benefits, even for those not directly involved in financial markets. By grasping how market participants predict future interest rates, individuals gain valuable insights into the broader economic climate. This knowledge empowers better financial planning. For example, anticipating potential interest rate hikes allows for proactive adjustments to debt management strategies. It also helps in making informed decisions about savings accounts, mortgages and other interest-bearing instruments. The fed funds rate forward curve provides a powerful lens through which to view the economic landscape, enabling more strategic personal finance choices.

While you won’t directly trade based on the fed funds rate forward curve, its implications are far-reaching. Changes in the curve often precede shifts in borrowing costs for consumers. Businesses, too, use this tool. They plan investments and pricing accordingly. Therefore, understanding the curve’s implications allows you to anticipate potential impacts on your personal finances, enabling informed decisions related to debt, investments, and long-term financial goals. Observing the shape and movements of the fed funds rate forward curve offers a valuable, indirect way to stay ahead of changes in the financial world.

In summary, the fed funds rate forward curve, though seemingly complex, offers a valuable window into future economic conditions. Even without direct involvement in financial markets, grasping the basics helps individuals become more financially savvy. By understanding market expectations reflected in the curve, one can better position themselves for the financial challenges and opportunities that lie ahead. The curve is a vital tool for many, indirectly impacting all through its influence on overall economic trends.

:max_bytes(150000):strip_icc()/FederalFundsRate-8064baabc82d47bf81b735e57a5c4557.jpg)