What Are Fed Fund Futures and How Do They Work?

Fed Fund Futures are a type of financial derivative that allows investors to predict and hedge against future interest rate changes. These futures contracts are based on the expected value of the federal funds rate, which is the interest rate at which banks and other depository institutions lend and borrow money from each other. The federal funds rate is set by the Federal Reserve, the central bank of the United States, and has a profound impact on the overall economy.

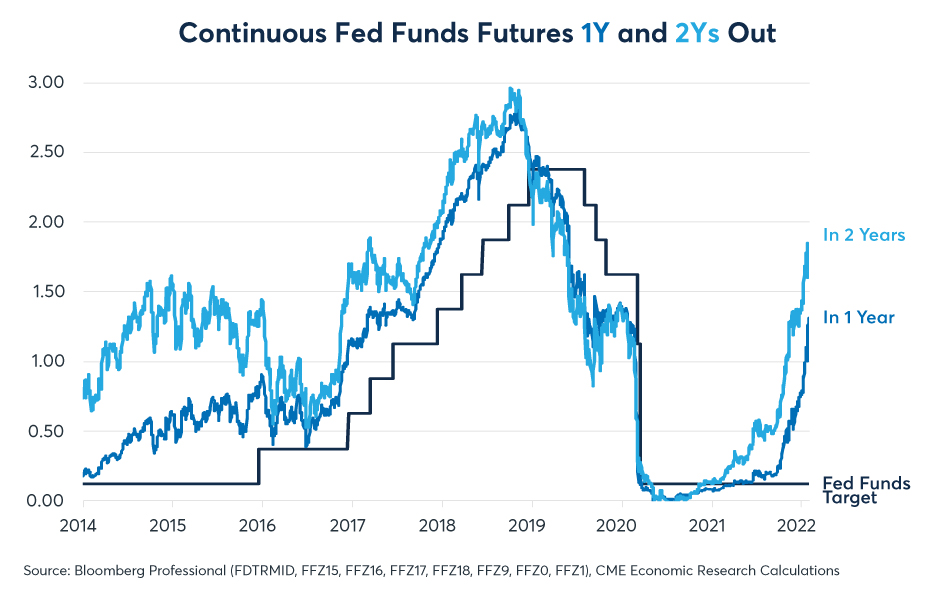

The concept of Fed Fund Futures was introduced in the 1980s as a way for banks and other financial institutions to manage their exposure to interest rate risk. Today, Fed Fund Futures are traded on the Chicago Mercantile Exchange (CME) and are widely used by investors, banks, and corporations to hedge against potential losses or gains from interest rate changes.

The significance of Fed Fund Futures in modern finance cannot be overstated. By providing a window into market expectations of future interest rates, the fed fund futures implied rate has become a key indicator for investors, policymakers, and economists alike. The implied rate is calculated by analyzing the prices of Fed Fund Futures contracts and provides valuable insights into market sentiment and expectations of future monetary policy decisions.

In essence, Fed Fund Futures allow investors to tap into the collective wisdom of the market, providing a unique perspective on future interest rate movements. By understanding how Fed Fund Futures work and the insights they provide, investors can make more informed decisions and navigate the complex landscape of interest rate risk.

Deciphering the Implied Rate: A Key to Unlocking Market Insights

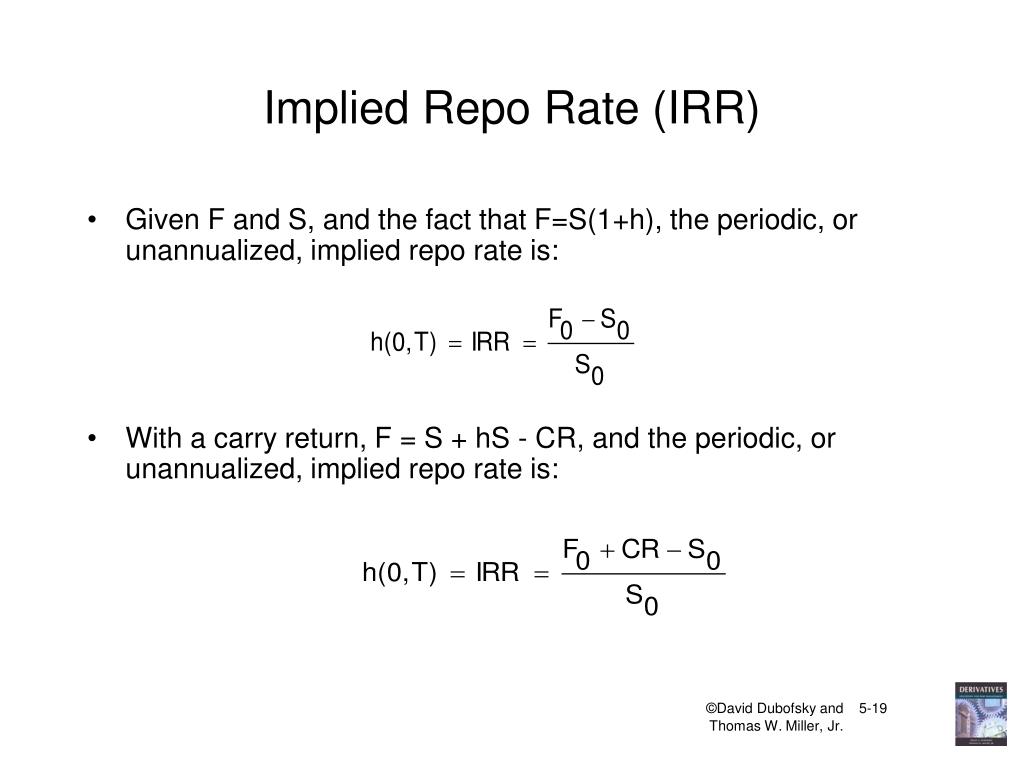

The implied rate is a crucial component of Fed Fund Futures, providing valuable insights into market expectations of future interest rates. Calculated by analyzing the prices of Fed Fund Futures contracts, the implied rate reveals the market’s collective expectation of future monetary policy decisions.

The implied rate is a forward-looking indicator, offering a glimpse into the market’s expectations of future interest rate movements. By understanding the implied rate, investors can gain a better understanding of market sentiment and make more informed investment decisions. The implied rate can be used to identify potential trends, recognize market signals, and anticipate changes in monetary policy.

One of the key benefits of the implied rate is its ability to provide a comprehensive view of market expectations. By analyzing the implied rate, investors can gain insights into the market’s expectations of future interest rate movements, inflation expectations, and economic growth. This information can be used to inform investment decisions, manage risk, and optimize portfolio performance.

Moreover, the implied rate can be used in conjunction with other market indicators, such as the yield curve and inflation expectations, to provide a more comprehensive view of the market. By combining the implied rate with other indicators, investors can gain a deeper understanding of market dynamics and make more informed investment decisions.

In the following sections, we will explore how to analyze the implied rate, including tips on interpreting charts, identifying trends, and recognizing market signals. We will also examine the role of Fed Fund Futures in monetary policy decisions, the connection between market sentiment and the implied rate, and the applications of implied rate analysis in real-world investment scenarios.

How to Analyze Fed Fund Futures Implied Rate for Informed Investment Decisions

Analyzing the fed fund futures implied rate is a crucial step in making informed investment decisions. By understanding how to interpret the implied rate, investors can gain valuable insights into market expectations and make more informed decisions. Here is a step-by-step guide on how to analyze the implied rate:

Step 1: Understand the Implied Rate Calculation

The implied rate is calculated by analyzing the prices of Fed Fund Futures contracts. It is essential to understand the calculation methodology to accurately interpret the implied rate. The implied rate is a forward-looking indicator, providing insights into market expectations of future interest rate movements.

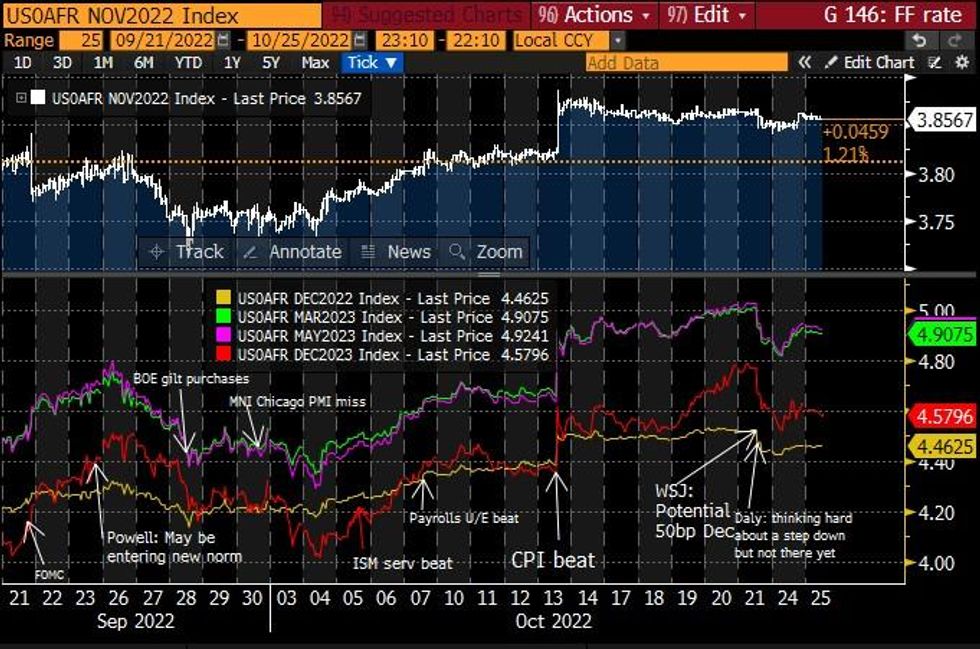

Step 2: Interpret Charts and Identify Trends

Charts are an essential tool in analyzing the implied rate. By examining charts, investors can identify trends, recognize market signals, and anticipate changes in monetary policy. It is essential to understand the different types of charts, including line charts, bar charts, and candlestick charts, to accurately interpret the implied rate.

Step 3: Combine Technical and Fundamental Analysis

A comprehensive analysis of the implied rate requires combining technical and fundamental analysis. Technical analysis involves examining charts and patterns to identify trends and market signals. Fundamental analysis involves examining economic indicators, such as GDP growth and inflation rates, to understand the underlying factors driving market expectations. By combining both approaches, investors can gain a more comprehensive understanding of the implied rate.

Step 4: Recognize Market Signals

The implied rate can provide valuable insights into market expectations, but it is essential to recognize market signals to make informed investment decisions. Market signals can include changes in the implied rate, shifts in market sentiment, and changes in monetary policy. By recognizing these signals, investors can anticipate changes in the market and adjust their investment strategies accordingly.

By following these steps, investors can gain a deeper understanding of the fed fund futures implied rate and make more informed investment decisions. The implied rate is a powerful tool in predicting future interest rate movements, and by combining technical and fundamental analysis, investors can unlock its full potential.

The Role of Fed Fund Futures in Monetary Policy Decisions

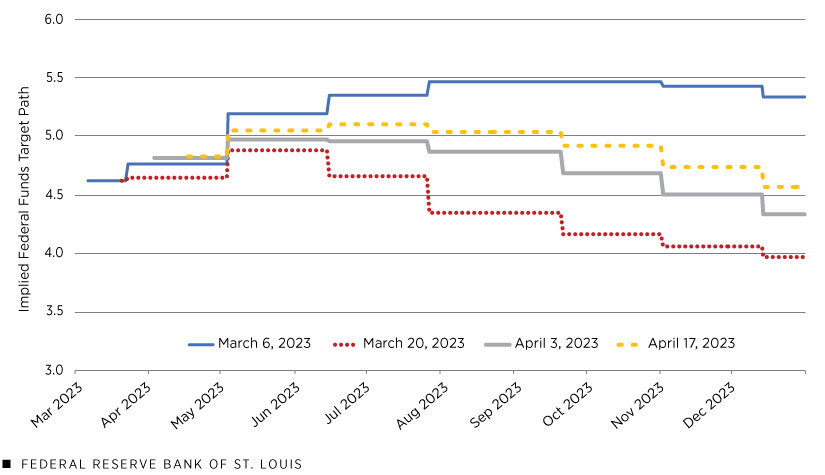

The fed fund futures implied rate plays a crucial role in monetary policy decisions, as it provides valuable insights into market expectations of future interest rate movements. The Federal Reserve, the central bank of the United States, closely monitors the implied rate to inform its monetary policy decisions.

The implied rate influences the Federal Reserve’s actions in several ways. Firstly, it provides a forward-looking indicator of market expectations, allowing the Fed to anticipate changes in interest rates and adjust its policy accordingly. Secondly, the implied rate reflects market sentiment, providing the Fed with insights into the overall health of the economy. Finally, the implied rate can influence the Fed’s decision-making process, as it provides a benchmark for evaluating the effectiveness of monetary policy.

The relationship between the fed fund futures implied rate and monetary policy decisions has significant implications for the broader economy. For instance, when the implied rate suggests that interest rates are likely to rise, the Fed may adjust its policy to mitigate the impact of higher interest rates on the economy. Conversely, when the implied rate suggests that interest rates are likely to fall, the Fed may adopt a more accommodative stance to stimulate economic growth.

The Fed’s use of the implied rate in monetary policy decisions has several benefits. Firstly, it allows the Fed to respond to changes in market expectations, ensuring that monetary policy is aligned with market conditions. Secondly, it provides a transparent and data-driven approach to monetary policy, reducing the risk of policy mistakes. Finally, it allows the Fed to communicate its policy intentions more effectively, reducing uncertainty and volatility in financial markets.

In conclusion, the fed fund futures implied rate plays a vital role in monetary policy decisions, providing valuable insights into market expectations and informing the Federal Reserve’s actions. By understanding the relationship between the implied rate and monetary policy, investors can gain a deeper appreciation of the complex interactions between financial markets and the economy.

Market Sentiment and the Implied Rate: What’s the Connection?

The fed fund futures implied rate is closely tied to market sentiment, with changes in sentiment having a significant impact on the implied rate. In this section, we will explore the connection between market sentiment and the implied rate, discussing how changes in sentiment can impact the implied rate and vice versa.

Market sentiment refers to the overall attitude of investors towards the market, encompassing their emotions, opinions, and biases. When market sentiment is bullish, investors are optimistic about the market’s prospects, leading to increased demand for assets and higher prices. Conversely, when market sentiment is bearish, investors are pessimistic, leading to decreased demand and lower prices.

The implied rate is influenced by market sentiment in several ways. Firstly, changes in sentiment can impact the demand for fed fund futures contracts, leading to changes in the implied rate. For instance, when market sentiment is bullish, investors may be more likely to buy fed fund futures contracts, driving up the implied rate. Secondly, market sentiment can influence the Federal Reserve’s monetary policy decisions, which in turn affect the implied rate. When market sentiment is bearish, the Fed may adopt a more accommodative stance, leading to lower interest rates and a lower implied rate.

The connection between market sentiment and the implied rate has significant implications for investment strategies. By understanding the relationship between the two, investors can better anticipate changes in the implied rate and adjust their investment decisions accordingly. For instance, when market sentiment is bullish, investors may want to consider taking a more aggressive stance, investing in assets that are likely to benefit from rising interest rates. Conversely, when market sentiment is bearish, investors may want to adopt a more defensive stance, investing in assets that are less sensitive to interest rate changes.

In addition, the implied rate can also influence market sentiment. When the implied rate suggests that interest rates are likely to rise, investors may become more cautious, leading to a decrease in market sentiment. Conversely, when the implied rate suggests that interest rates are likely to fall, investors may become more optimistic, leading to an increase in market sentiment.

In conclusion, the connection between market sentiment and the fed fund futures implied rate is complex and multifaceted. By understanding this relationship, investors can gain a deeper appreciation of the market’s dynamics and make more informed investment decisions.

Fed Fund Futures Implied Rate vs. Other Market Indicators: A Comparative Analysis

In the world of finance, market indicators play a crucial role in helping investors make informed decisions. The fed fund futures implied rate is one such indicator, providing valuable insights into market expectations of future interest rates. However, it is essential to understand how the implied rate compares to other market indicators, such as the yield curve and inflation expectations.

The yield curve, which plots the interest rates of bonds with different maturities, is a widely followed market indicator. While the yield curve provides a snapshot of current interest rates, the fed fund futures implied rate offers a forward-looking perspective, revealing market expectations of future interest rates. The implied rate can be used in conjunction with the yield curve to gain a more comprehensive understanding of the interest rate landscape.

Inflation expectations, which are often measured through surveys or market-based indicators, are another important market indicator. The implied rate can be influenced by inflation expectations, as higher inflation expectations can lead to higher interest rates. Conversely, the implied rate can also influence inflation expectations, as changes in the implied rate can impact the overall economic outlook.

A comparative analysis of the implied rate with other market indicators reveals both strengths and limitations. The implied rate is particularly useful in providing a forward-looking perspective on interest rates, whereas the yield curve and inflation expectations offer a more current snapshot of market conditions. By combining these indicators, investors can gain a more nuanced understanding of the market, identifying potential opportunities and risks.

For instance, if the implied rate suggests that interest rates are likely to rise, while the yield curve indicates a flat or inverted curve, investors may want to consider adjusting their investment strategy to account for potential changes in interest rates. Similarly, if inflation expectations are rising, while the implied rate remains stable, investors may want to consider investing in assets that are less sensitive to inflation.

In conclusion, the fed fund futures implied rate is a valuable market indicator that provides unique insights into market expectations of future interest rates. By comparing the implied rate with other market indicators, such as the yield curve and inflation expectations, investors can gain a more comprehensive understanding of the market, making more informed investment decisions.

Real-World Applications of Fed Fund Futures Implied Rate Analysis

In the world of finance, theoretical concepts are only as valuable as their practical applications. The fed fund futures implied rate is no exception, with its insights into market expectations of future interest rates being used in a variety of real-world investment decisions. In this section, we’ll explore several case studies that demonstrate the power of implied rate analysis in navigating the complexities of the market.

Case Study 1: Anticipating Rate Hikes

In 2015, the fed fund futures implied rate suggested that the Federal Reserve was likely to raise interest rates in the near future. A hedge fund, anticipating this move, adjusted its portfolio by reducing its exposure to long-term bonds and increasing its holdings of short-term commercial paper. As a result, the fund was able to avoid significant losses when the Fed did indeed raise rates.

Case Study 2: Identifying Market Opportunities

In 2019, the implied rate indicated that market expectations of future interest rates were lower than the current rate. A savvy investor, recognizing this disconnect, invested in a diversified portfolio of stocks and bonds, taking advantage of the relatively low interest rate environment. As the market adjusted to the new reality, the investor was able to capitalize on the resulting price movements.

Challenges and Limitations

While the fed fund futures implied rate can be a powerful tool, it is not without its limitations. Market conditions can change rapidly, rendering previous analysis obsolete. Moreover, the implied rate is only as good as the data that underlies it, and errors in calculation or interpretation can have significant consequences.

Adapting to Changing Market Conditions

In today’s fast-paced market environment, investors must be able to adapt quickly to changing conditions. The fed fund futures implied rate can be a valuable tool in this regard, providing insights into market expectations and helping investors adjust their strategies accordingly. By combining implied rate analysis with other forms of technical and fundamental analysis, investors can stay ahead of the curve and make more informed investment decisions.

In conclusion, the fed fund futures implied rate is not just a theoretical concept, but a practical tool that can be used to inform real-world investment decisions. By understanding how to apply implied rate analysis in a variety of market scenarios, investors can gain a competitive edge and achieve their financial goals.

Staying Ahead of the Curve: The Future of Fed Fund Futures Implied Rate Analysis

The fed fund futures implied rate has come a long way since its inception, and its significance in modern finance is undeniable. As the market continues to evolve, it’s essential to stay ahead of the curve and anticipate the future of implied rate analysis. In this section, we’ll explore emerging trends and potential developments that will shape the future of fed fund futures implied rate analysis.

Machine Learning and Artificial Intelligence

The integration of machine learning and artificial intelligence (AI) is poised to revolutionize the field of implied rate analysis. By leveraging these technologies, investors can analyze vast amounts of data, identify patterns, and make more accurate predictions. AI-powered models can also help identify potential biases in implied rate calculations, leading to more reliable insights.

Big Data and Alternative Data Sources

The increasing availability of big data and alternative data sources is expected to play a significant role in the future of implied rate analysis. By incorporating these data sources, investors can gain a more comprehensive understanding of market expectations and make more informed investment decisions.

Increased Focus on Risk Management

As market volatility continues to rise, investors are becoming increasingly focused on risk management. The fed fund futures implied rate will play a critical role in this effort, providing insights into potential risks and opportunities. By combining implied rate analysis with other risk management tools, investors can develop more effective strategies for navigating uncertain markets.

Enhanced Transparency and Regulation

The future of implied rate analysis will also be shaped by enhanced transparency and regulation. As regulators continue to scrutinize the financial industry, investors can expect greater transparency in implied rate calculations and more stringent regulations governing their use.

Staying Ahead of the Curve

In an ever-changing market landscape, it’s essential to stay ahead of the curve. By understanding the emerging trends and potential developments in fed fund futures implied rate analysis, investors can position themselves for success. By combining innovative technologies, alternative data sources, and a focus on risk management, investors can unlock the full potential of the fed fund futures implied rate and make more informed investment decisions.