Understanding the Fama French 5 Factors Model

The Fama French 5 factors model is a widely-used asset pricing model in finance that helps investors and researchers understand the behavior of stock market returns. Developed by Eugene Fama and Kenneth French in the 1990s, this model builds upon the Capital Asset Pricing Model (CAPM) by incorporating additional factors that influence stock prices. The Fama French 5 factors model is significant because it provides a more accurate representation of stock market returns, allowing investors to make more informed investment decisions. By understanding the underlying factors that drive stock prices, investors can better navigate the complexities of the stock market and optimize their portfolios. The Fama French 5 factors model has been widely adopted in the finance industry, and its applications continue to grow as researchers and investors seek to improve their understanding of the stock market.

How to Apply the Fama French 5 Factors Model in Portfolio Management

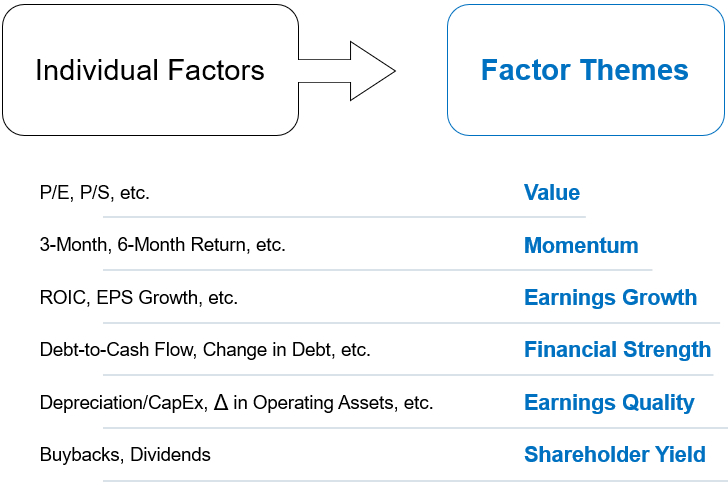

Applying the Fama French 5 factors model in portfolio management involves a step-by-step process that helps investors make informed investment decisions. The first step is to calculate the five factors: market, size, value, profitability, and investment. The market factor represents the overall market return, while the size factor captures the effect of a company’s market capitalization on its stock price. The value factor reflects the ratio of a company’s book value to its market value, and the profitability factor measures a company’s ability to generate earnings. The investment factor represents the company’s investment patterns. Once these factors are calculated, investors can use them to construct a portfolio that balances risk and return. For example, an investor may choose to overweight value stocks and underweight growth stocks based on their factor loadings. By applying the Fama French 5 factors model, investors can create a diversified portfolio that is better equipped to navigate the complexities of the stock market.

The Five Factors Explained: Market, Size, Value, Profitability, and Investment

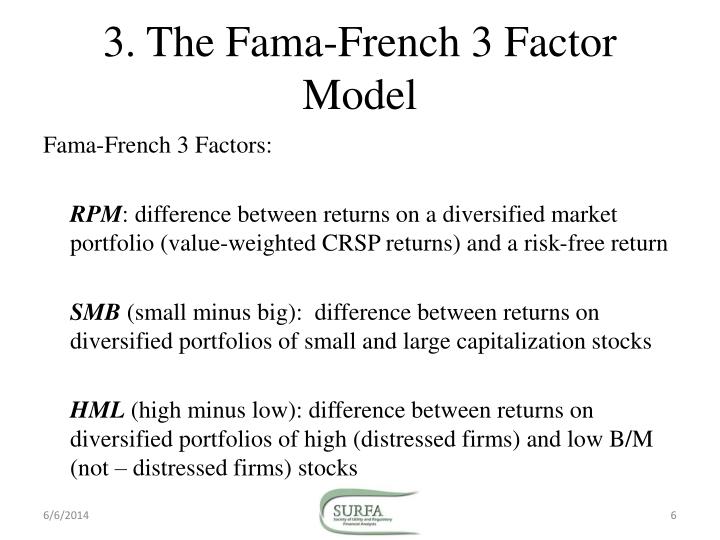

The Fama French 5 factors model is built around five key factors that capture the complexities of stock market returns. The market factor, often represented by the market return, captures the overall performance of the stock market. The size factor, measured by market capitalization, reflects the effect of a company’s size on its stock price. The value factor, calculated as the ratio of a company’s book value to its market value, represents the value of a company’s assets relative to its market price. The profitability factor, measured by metrics such as return on equity (ROE) or return on assets (ROA), captures a company’s ability to generate earnings. Finally, the investment factor, measured by metrics such as asset growth or capital expenditures, represents a company’s investment patterns.

Each of these factors has a unique impact on stock market returns. For example, the market factor captures the overall market trend, while the size factor reflects the effect of a company’s size on its stock price. The value factor is often used to identify undervalued or overvalued stocks, while the profitability factor helps investors identify companies with strong earnings potential. The investment factor provides insights into a company’s growth prospects and capital allocation decisions. By understanding the individual impact of each factor, investors can make more informed investment decisions and construct a portfolio that balances risk and return.

The Fama French 5 factors model provides a more comprehensive understanding of stock market returns by incorporating these five factors. By recognizing the unique contributions of each factor, investors can better navigate the complexities of the stock market and make more informed investment decisions. The model’s ability to capture the nuances of stock market returns has made it a widely-used tool in the finance industry, and its applications continue to grow as researchers and investors seek to improve their understanding of the stock market.

The Advantages of the Fama French 5 Factors Model Over CAPM

The Capital Asset Pricing Model (CAPM) has long been a cornerstone of finance, providing a framework for understanding the relationship between risk and return. However, the CAPM has several limitations, including its reliance on a single factor (market return) to explain stock market returns. In contrast, the Fama French 5 factors model provides a more comprehensive understanding of stock market returns by incorporating five factors: market, size, value, profitability, and investment.

One of the primary advantages of the Fama French 5 factors model is its ability to capture the nuances of stock market returns. By incorporating multiple factors, the model provides a more accurate representation of the complex interactions between different variables that influence stock prices. This is particularly important for investors seeking to construct a diversified portfolio that balances risk and return.

Another advantage of the Fama French 5 factors model is its ability to address the limitations of the CAPM. For example, the CAPM assumes that all investors have the same expectations and preferences, which is not always the case in reality. The Fama French 5 factors model, on the other hand, recognizes that different investors may have different preferences and expectations, and incorporates these differences into its calculations.

Furthermore, the Fama French 5 factors model has been shown to provide a more accurate representation of stock market returns than the CAPM. Studies have consistently demonstrated that the model is able to explain a larger proportion of stock market returns than the CAPM, making it a more reliable tool for investors and financial analysts.

In conclusion, the Fama French 5 factors model offers several advantages over the CAPM, including its ability to capture the nuances of stock market returns, address the limitations of the CAPM, and provide a more accurate representation of stock market returns. As a result, the model has become a widely-used tool in the finance industry, and its applications continue to grow as researchers and investors seek to improve their understanding of the stock market.

Real-World Applications of the Fama French 5 Factors Model

The Fama French 5 factors model has been widely adopted in the finance industry, with numerous investment firms, financial analysts, and individual investors utilizing the model to inform their investment decisions. One notable example is the investment firm, Dimensional Fund Advisors, which has incorporated the Fama French 5 factors model into its investment strategy. By using the model to identify undervalued and overvalued stocks, Dimensional Fund Advisors has been able to deliver strong returns to its clients.

Financial analysts have also found the Fama French 5 factors model to be a valuable tool in their work. For instance, analysts at Goldman Sachs have used the model to identify profitable investment opportunities in the equity market. By analyzing the five factors, analysts can gain a deeper understanding of the underlying drivers of stock market returns, enabling them to make more informed investment recommendations to their clients.

Individual investors have also benefited from the Fama French 5 factors model. By using the model to construct a diversified portfolio, individual investors can reduce their exposure to market volatility and increase their potential returns. For example, an individual investor may use the model to identify undervalued stocks with strong profitability and investment characteristics, and then construct a portfolio that balances these factors with other considerations, such as risk tolerance and investment horizon.

In addition to its applications in investment management, the Fama French 5 factors model has also been used in academic research to study the behavior of stock markets. For instance, researchers have used the model to examine the impact of macroeconomic factors, such as inflation and interest rates, on stock market returns. By using the model to control for the effects of these factors, researchers can gain a deeper understanding of the underlying drivers of stock market returns.

Overall, the Fama French 5 factors model has been widely adopted in the finance industry, with numerous applications in investment management, financial analysis, and academic research. Its ability to provide a more comprehensive understanding of stock market returns has made it a valuable tool for investors and researchers alike.

Criticisms and Limitations of the Fama French 5 Factors Model

While the Fama French 5 factors model has been widely adopted in the finance industry, it is not without its criticisms and limitations. One of the primary concerns is the quality of the data used to estimate the model’s parameters. If the data is incomplete, inaccurate, or biased, the model’s results may be unreliable. Furthermore, the model’s complexity can make it difficult to interpret and apply in practice.

Another limitation of the Fama French 5 factors model is the potential for overfitting. With five factors to estimate, there is a risk that the model may fit the noise in the data rather than the underlying patterns. This can result in poor out-of-sample performance and reduced predictive power. Additionally, the model’s reliance on historical data may not capture changes in market conditions or investor behavior.

Some critics have also argued that the Fama French 5 factors model is too simplistic, failing to capture the complexity of real-world markets. For example, the model assumes that the five factors are independent and identically distributed, which may not be the case in reality. Furthermore, the model does not account for other factors that may influence stock market returns, such as macroeconomic variables or sentiment indicators.

Despite these limitations, the Fama French 5 factors model remains a widely-used and influential tool in the finance industry. Its ability to provide a more comprehensive understanding of stock market returns has made it a valuable resource for investors and researchers alike. However, it is essential to be aware of the model’s limitations and to use it in conjunction with other tools and techniques to gain a more complete understanding of the markets.

Future Directions: Extending the Fama French 5 Factors Model

The Fama French 5 factors model has been a cornerstone of finance research for decades, and its continued relevance in modern finance is a testament to its enduring value. However, as the financial landscape continues to evolve, there are opportunities to extend and improve the model. One potential avenue for future research is the integration of additional factors that can help explain stock market returns.

For example, researchers have explored the role of factors such as momentum, quality, and dividend yield in explaining stock market returns. Incorporating these factors into the Fama French 5 factors model could provide a more comprehensive understanding of the drivers of stock market returns. Additionally, the use of alternative data sources, such as big data or machine learning algorithms, could provide new insights into the behavior of stock markets.

Another potential direction for future research is the application of machine learning techniques to the Fama French 5 factors model. By using machine learning algorithms to analyze large datasets, researchers may be able to identify patterns and relationships that are not apparent through traditional statistical analysis. This could lead to the development of more accurate and robust models of stock market returns.

Furthermore, the Fama French 5 factors model could be extended to other asset classes, such as bonds or commodities, to provide a more comprehensive understanding of the behavior of different markets. This could be particularly useful for investors seeking to diversify their portfolios across multiple asset classes.

Overall, the Fama French 5 factors model remains a powerful tool for understanding stock market returns, and its continued relevance in modern finance is a testament to its enduring value. By extending and improving the model, researchers and investors can gain a deeper understanding of the drivers of stock market returns and make more informed investment decisions.

Conclusion: The Enduring Relevance of the Fama French 5 Factors Model

In conclusion, the Fama French 5 factors model has revolutionized the field of finance by providing a more comprehensive understanding of stock market returns. By incorporating five key factors – market, size, value, profitability, and investment – the model has been able to capture the complexity of stock market behavior in a way that the Capital Asset Pricing Model (CAPM) cannot. The Fama French 5 factors model has been widely adopted in the finance industry, and its applications in portfolio management, risk assessment, and investment decision-making have been invaluable.

Despite its limitations and criticisms, the Fama French 5 factors model remains a powerful tool for understanding stock market returns. Its ability to explain the behavior of different stocks and portfolios has made it an essential component of modern finance. As the financial landscape continues to evolve, the Fama French 5 factors model will likely remain a cornerstone of finance research, providing a foundation for future innovation and development.

Ultimately, the Fama French 5 factors model is a testament to the power of academic research in shaping our understanding of the financial world. By building upon the foundations of the CAPM, Eugene Fama and Kenneth French have created a model that has had a profound impact on the finance industry. As we look to the future, it is clear that the Fama French 5 factors model will continue to play a vital role in shaping our understanding of stock market returns and informing investment decisions.