Understanding the Role of Brokers in Trading

In the complex world of trading, brokers play a vital role in facilitating transactions and providing access to markets. They act as intermediaries between buyers and sellers, enabling individuals and institutions to participate in the global financial markets. With the rise of online trading, the importance of brokers has only increased, as they provide the necessary infrastructure and support for traders to execute their trades efficiently. There are different types of brokers, each with their unique roles and services. Two of the most common types of brokers are executing brokers and prime brokers. Understanding the differences between these two types of brokers is crucial for making an informed decision when choosing a broker. The executing broker vs prime broker dilemma is a common challenge faced by traders, and it is essential to understand the benefits and drawbacks of each before making a decision.

What is an Executing Broker?

An executing broker is a type of broker that plays a crucial role in executing trades on behalf of clients. They act as an intermediary between buyers and sellers, facilitating transactions and providing access to various markets. One of the primary benefits of working with an executing broker is access to multiple markets, allowing traders to diversify their portfolios and capitalize on opportunities across different asset classes. Additionally, executing brokers often offer competitive pricing, which can help traders minimize their trading costs and maximize their returns. By leveraging the expertise and resources of an executing broker, traders can focus on their investment strategies, confident that their trades are being executed efficiently and effectively. When considering an executing broker vs prime broker, it is essential to understand the unique benefits and services offered by each.

The Advantages of Working with a Prime Broker

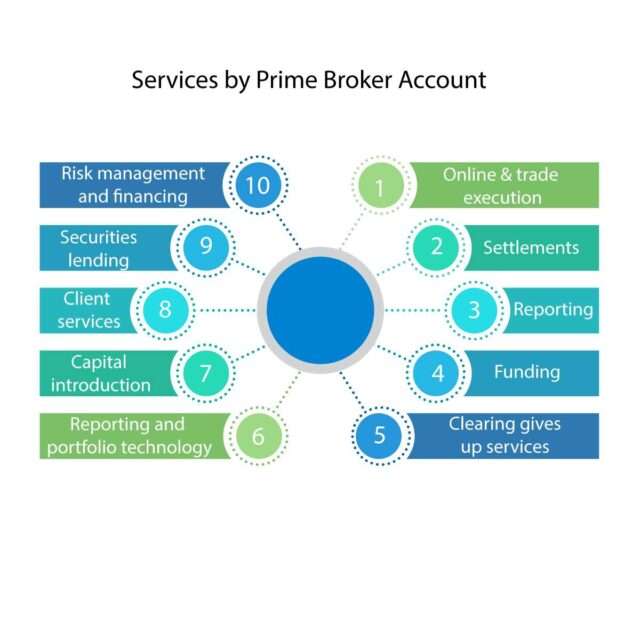

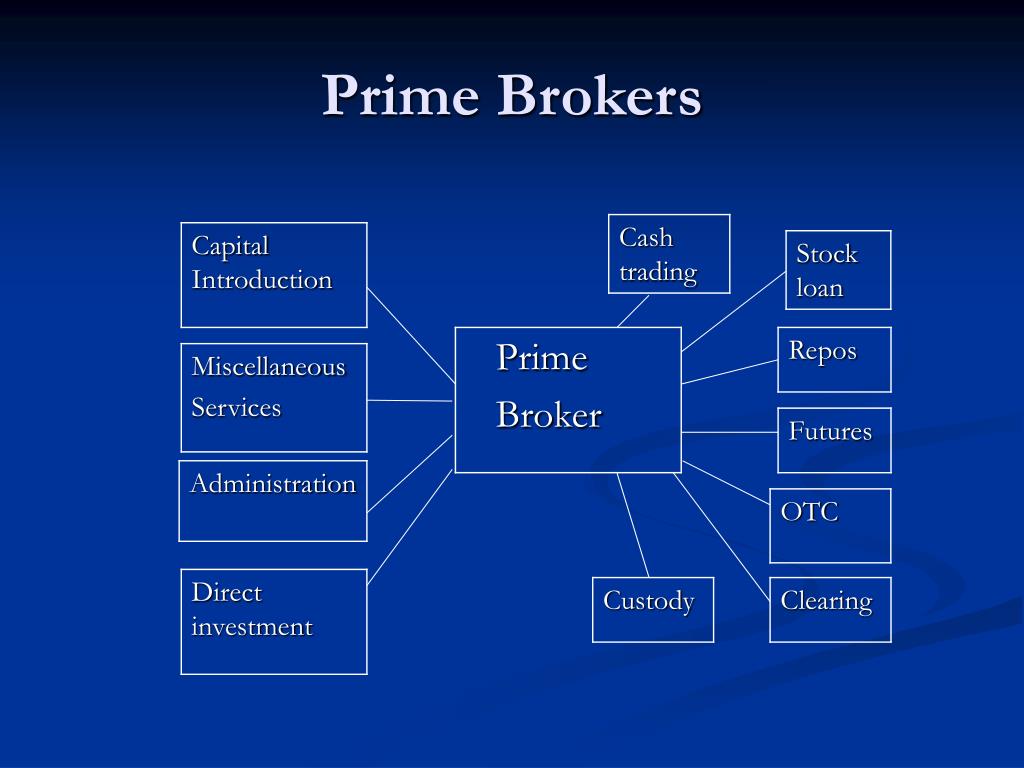

A prime broker is a type of broker that provides a range of services, including execution, clearing, and custody. They act as a one-stop-shop for traders, offering a comprehensive suite of services that cater to their diverse needs. One of the primary benefits of working with a prime broker is increased leverage, which enables traders to amplify their trading positions and potentially increase their returns. Additionally, prime brokers often provide access to advanced trading tools, such as sophisticated analytics and risk management systems, which can help traders refine their investment strategies and minimize their risk exposure. Furthermore, prime brokers typically offer a high level of customization, allowing traders to tailor their trading experience to their specific needs and preferences. When considering an executing broker vs prime broker, it is essential to weigh the benefits of each and determine which type of broker best aligns with individual trading goals and objectives.

Key Differences Between Executing Brokers and Prime Brokers

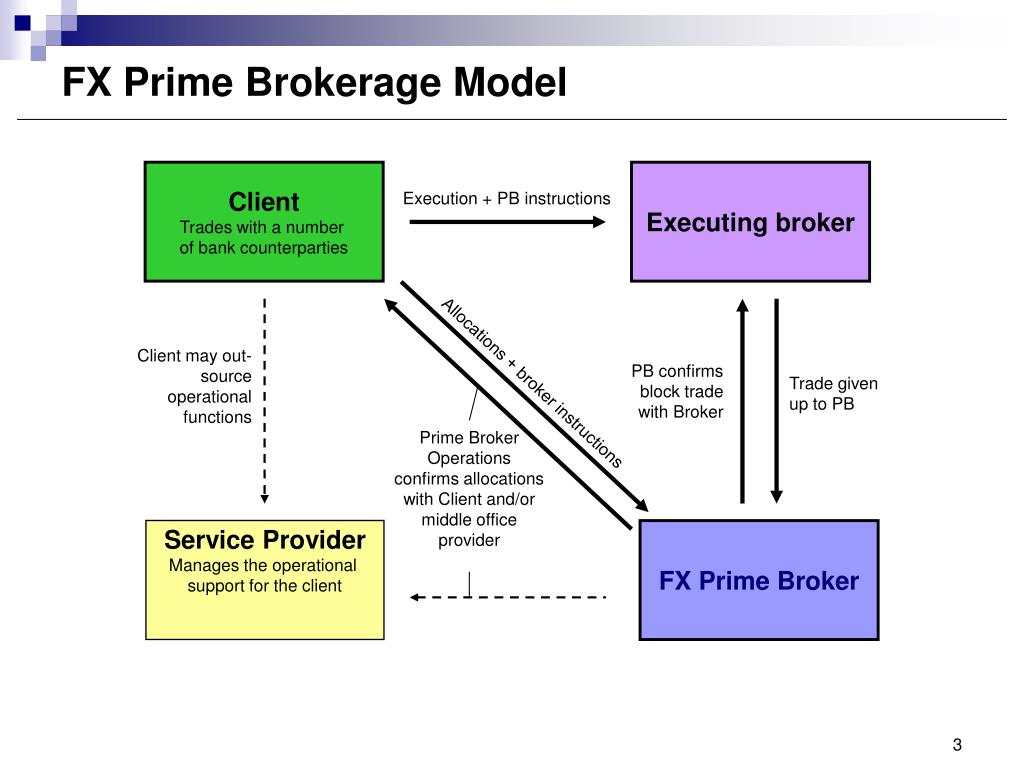

When it comes to navigating the complex world of brokerage services, understanding the key differences between executing brokers and prime brokers is crucial. While both types of brokers play a vital role in facilitating trades and providing access to markets, they differ significantly in their roles, services, and benefits. Executing brokers, as discussed earlier, specialize in executing trades on behalf of clients, offering access to multiple markets and competitive pricing. In contrast, prime brokers provide a comprehensive suite of services, including execution, clearing, and custody, along with increased leverage and access to advanced trading tools. When deciding between an executing broker vs prime broker, traders must consider their individual trading needs and goals. For instance, traders who require a high level of customization and advanced trading tools may benefit from working with a prime broker, while those who prioritize competitive pricing and access to multiple markets may prefer an executing broker. By understanding the key differences between these two types of brokers, traders can make informed decisions and optimize their trading performance.

How to Choose the Right Broker for Your Trading Needs

Selecting the right broker is a crucial decision that can significantly impact trading performance. With numerous brokers offering a range of services, it can be overwhelming to navigate the complex world of brokerage services. When choosing between an executing broker vs prime broker, traders must consider several key factors. Firstly, fees and commissions play a significant role in determining the overall cost of trading. Traders should research and compare the fees and commissions charged by different brokers to ensure they are getting the best deal. Additionally, the trading platform offered by the broker is critical, as it can affect the speed and efficiency of trade execution. Traders should look for brokers that offer advanced trading tools, such as technical analysis software and risk management strategies, to help them make informed trading decisions. Furthermore, the level of customer support and market analysis provided by the broker can also impact trading performance. By carefully considering these factors and researching different brokers, traders can make an informed decision and choose the right broker for their individual trading needs.

The Importance of Regulatory Compliance in Broker Selection

When selecting a broker, regulatory compliance is a critical factor to consider. A broker’s regulatory status can significantly impact the safety and security of traders’ funds and personal information. To ensure that a broker is reputable and trustworthy, traders should verify their regulatory status with relevant authorities, such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA). Additionally, traders should research the broker’s history of compliance, including any disciplinary actions or fines imposed by regulatory bodies. By choosing a broker that is committed to regulatory compliance, traders can minimize the risk of fraud and ensure that their trading activities are conducted in a fair and transparent manner. Furthermore, regulatory compliance can also impact the quality of services offered by the broker, including the execution of trades and the provision of market analysis and risk management strategies. By prioritizing regulatory compliance, traders can make an informed decision and choose a broker that meets their individual trading needs, whether they opt for an executing broker vs prime broker.

Maximizing Trading Performance with the Right Broker

Selecting the right broker can significantly impact trading performance. A broker that provides access to advanced trading tools, market analysis, and risk management strategies can help traders make informed decisions and maximize their returns. For instance, a prime broker may offer advanced trading platforms that provide real-time market data, technical analysis tools, and automated trading strategies. Additionally, a prime broker may also offer risk management strategies, such as stop-loss orders and position sizing, to help traders minimize their losses. On the other hand, an executing broker may offer competitive pricing and fast execution speeds, which can be beneficial for traders who require quick entry and exit from trades. By choosing a broker that aligns with their individual trading needs, traders can optimize their trading performance and achieve their financial goals. Whether traders opt for an executing broker vs prime broker, the right broker can provide the necessary tools and support to help them succeed in the markets.

Conclusion: Navigating the Complex World of Brokerage Services

In conclusion, navigating the complex world of brokerage services requires a thorough understanding of the different types of brokers, including executing brokers and prime brokers. By recognizing the key differences between these two types of brokers, traders can make informed decisions about which broker to choose based on their individual trading needs. Whether traders require access to multiple markets and competitive pricing or increased leverage and advanced trading tools, the right broker can help maximize trading performance. By considering factors such as fees, commissions, and regulatory compliance, traders can select a broker that aligns with their trading goals and objectives. Ultimately, understanding the executing broker vs prime broker distinction is crucial for traders seeking to optimize their trading performance and achieve success in the markets.