What is Yield to Maturity and Why is it Important?

In the world of finance, bonds are a popular investment instrument, offering a relatively stable source of income. However, to make informed investment decisions, it’s essential to understand the bond’s yield to maturity. Yield to maturity is the total return on investment, considering the bond’s coupon rate, face value, and market price. It’s a critical metric in bond valuation, as it helps investors determine the bond’s potential return and make comparisons with other investment opportunities. In contrast, current yield only considers the bond’s coupon rate and face value, neglecting the market price. This distinction is crucial, as current yield may not accurately reflect the bond’s true return. The Excel yield to maturity function is a powerful tool in calculating this metric, allowing users to make accurate and informed investment decisions.

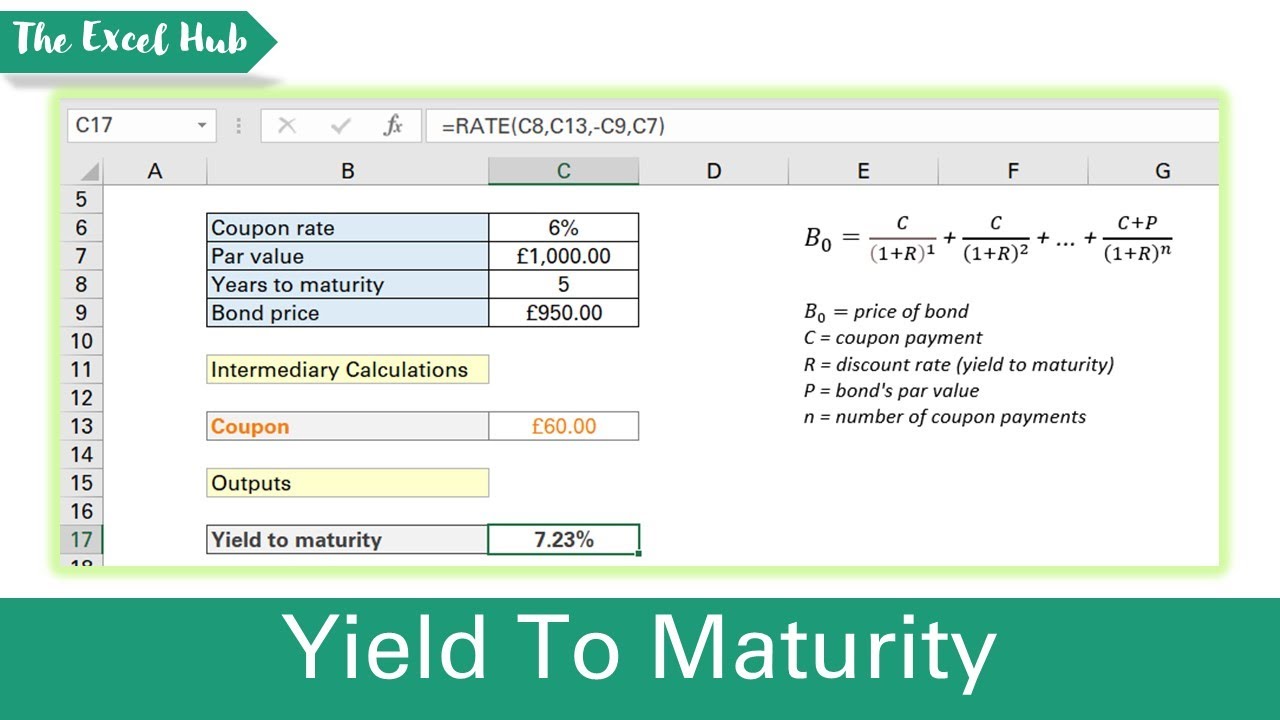

How to Calculate Yield to Maturity in Excel

To calculate yield to maturity in Excel, you can use the YIELD function, which is a built-in formula that simplifies the process. The syntax for the YIELD function is YIELD(settlement, maturity, rate, pr, redemption, frequency, basis). To use this function, follow these steps:

Step 1: Enter the required inputs, including the settlement date, maturity date, coupon rate, bond price, redemption value, frequency of payments, and basis (day count convention).

Step 2: Enter the formula =YIELD(A1, B1, C1, D1, E1, F1, G1), assuming the inputs are in cells A1 to G1.

Step 3: Press Enter to calculate the yield to maturity.

For example, suppose you want to calculate the yield to maturity for a bond with a settlement date of 01/01/2022, maturity date of 01/01/2032, coupon rate of 5%, bond price of $1,050, redemption value of $1,000, semi-annual payments, and a 30/360 day count convention. The formula would be =YIELD(A1, B1, 0.05, 1050, 1000, 2, 0), where A1 and B1 contain the settlement and maturity dates, respectively.

The Excel yield to maturity function will return the yield to maturity, which can be used to make informed investment decisions. By following these steps and using the YIELD function, you can easily calculate the yield to maturity in Excel and gain a better understanding of your bond investments.

Understanding the YIELD Function Syntax and Arguments

The Excel YIELD function is a powerful tool for calculating yield to maturity, but it’s essential to understand its syntax and arguments to use it correctly. The YIELD function syntax is YIELD(settlement, maturity, rate, pr, redemption, frequency, basis), where each argument plays a critical role in the calculation.

The settlement argument represents the bond’s settlement date, which is the date when the bond is traded. The maturity argument is the bond’s maturity date, when the bond expires. The rate argument is the bond’s coupon rate, expressed as a decimal. The pr argument is the bond’s current price, and the redemption argument is the bond’s redemption value.

The frequency argument specifies how often the bond makes interest payments, with 1 representing annual payments, 2 representing semi-annual payments, and 4 representing quarterly payments. The basis argument determines the day count convention used, with 0 representing the 30/360 convention, 1 representing the actual/actual convention, and 2 representing the actual/360 convention.

Common mistakes to avoid when using the YIELD function include incorrect input values, such as using percentages instead of decimals for the coupon rate, or using the wrong day count convention. It’s also essential to ensure that the settlement and maturity dates are in the correct format, as the function is sensitive to date formats.

By understanding the YIELD function syntax and arguments, you can accurately calculate yield to maturity in Excel and make informed investment decisions. Remember to double-check your inputs and formulas to avoid errors and ensure accurate results. With the Excel yield to maturity function, you can easily calculate this critical metric and gain a deeper understanding of your bond investments.

Real-World Applications of Yield to Maturity in Excel

Calculating yield to maturity in Excel is an essential skill for finance professionals, investors, and analysts. The Excel yield to maturity function has numerous practical applications in various fields, including bond portfolio management, investment analysis, and financial modeling.

In bond portfolio management, calculating yield to maturity helps investors evaluate the performance of their bond holdings and make informed decisions about buying or selling bonds. By using the YIELD function in Excel, investors can quickly calculate the yield to maturity for each bond in their portfolio and compare their returns.

In investment analysis, yield to maturity is a critical metric for evaluating the attractiveness of a bond investment. Analysts can use the YIELD function to calculate the yield to maturity for different bonds and compare their returns to determine which bonds offer the best value.

In financial modeling, yield to maturity is used to estimate the expected returns on bond investments and to build complex financial models. By using the YIELD function in Excel, financial modelers can create detailed models that accurately reflect the performance of bond investments.

For example, suppose an investor wants to calculate the yield to maturity for a bond with a settlement date of 01/01/2022, maturity date of 01/01/2032, coupon rate of 5%, bond price of $1,050, redemption value of $1,000, semi-annual payments, and a 30/360 day count convention. Using the YIELD function in Excel, the investor can quickly calculate the yield to maturity and use this information to make informed investment decisions.

By applying the YIELD function in these contexts, finance professionals, investors, and analysts can make more accurate and informed decisions about bond investments and optimize their portfolios for better returns.

Troubleshooting Common Errors with the YIELD Function

When using the Excel YIELD function to calculate yield to maturity, it’s essential to avoid common errors that can lead to inaccurate results. In this section, we’ll identify and resolve common errors that may occur when using the YIELD function, providing troubleshooting tips and best practices to ensure accurate calculations.

One common error is incorrect input values, such as using percentages instead of decimals for the coupon rate or redemption value. To avoid this, ensure that all input values are in the correct format and units. For example, the coupon rate should be expressed as a decimal, such as 0.05 for a 5% coupon rate.

Another common error is formula mistakes, such as incorrect syntax or missing arguments. To troubleshoot this, check the formula syntax and ensure that all required arguments are included. The YIELD function syntax is YIELD(settlement, maturity, rate, pr, redemption, frequency, basis), so ensure that all these arguments are included in the correct order.

Version compatibility issues can also occur when using the YIELD function, particularly when working with older versions of Excel. To resolve this, ensure that you’re using a compatible version of Excel and that the YIELD function is supported in your version.

To avoid errors, it’s essential to follow best practices when using the YIELD function. These include:

- Double-checking input values and formulas for accuracy

- Using consistent formatting and units for input values

- Testing the YIELD function with sample data to ensure accurate results

- Documenting formulas and assumptions to ensure transparency and reproducibility

By following these troubleshooting tips and best practices, you can ensure accurate and reliable yield to maturity calculations using the Excel YIELD function. Remember to always double-check your inputs and formulas, and to test the function with sample data to ensure accurate results.

Advanced Yield to Maturity Calculations in Excel

In addition to calculating yield to maturity for standard bonds, Excel’s YIELD function can also be used to handle more complex scenarios. In this section, we’ll explore advanced yield to maturity calculations in Excel, including bonds with sinking funds, amortizing bonds, and bonds with embedded options.

Bonds with sinking funds, for example, require a more nuanced approach to yield to maturity calculations. A sinking fund is a provision that allows the issuer to retire a portion of the bond’s principal amount before maturity. To calculate the yield to maturity for a bond with a sinking fund, you’ll need to adjust the redemption value and frequency arguments in the YIELD function. For instance, if the bond has a sinking fund that retires 20% of the principal amount annually, you’ll need to adjust the redemption value accordingly.

Amortizing bonds, on the other hand, involve a gradual reduction of the bond’s principal amount over time. To calculate the yield to maturity for an amortizing bond, you’ll need to use a combination of the YIELD function and Excel’s amortization schedules. By creating an amortization schedule that outlines the bond’s principal balance and interest payments over time, you can then use the YIELD function to calculate the yield to maturity based on the bond’s cash flows.

Bonds with embedded options, such as callable or putable bonds, require even more advanced calculations. These bonds give the issuer or investor the option to redeem the bond at a specific price or date, which can affect the yield to maturity. To calculate the yield to maturity for a bond with an embedded option, you’ll need to use a combination of the YIELD function and option pricing models, such as the Black-Scholes model.

By using Excel’s YIELD function in conjunction with other financial functions and formulas, you can handle even the most complex yield to maturity calculations with ease. Whether you’re working with bonds with sinking funds, amortizing bonds, or bonds with embedded options, Excel provides a powerful platform for advanced yield to maturity calculations.

For example, suppose you want to calculate the yield to maturity for a bond with a sinking fund that retires 20% of the principal amount annually. Using the YIELD function, you can adjust the redemption value and frequency arguments to reflect the sinking fund provision. The formula might look like this: =YIELD(settlement, maturity, rate, pr, redemption*0.8, frequency, basis). By adjusting the redemption value to reflect the sinking fund, you can accurately calculate the yield to maturity for this complex bond scenario.

Comparing Yield to Maturity with Other Bond Valuation Metrics

When evaluating bonds, investors and analysts often rely on a range of metrics to assess their value and potential returns. Yield to maturity, calculated using the Excel YIELD function, is a key metric in this regard. However, it’s essential to understand how yield to maturity compares to other bond valuation metrics, such as duration, convexity, and yield curve analysis.

Duration, for instance, measures a bond’s sensitivity to changes in interest rates. While yield to maturity provides a snapshot of a bond’s total return, duration offers a more nuanced view of a bond’s risk profile. By combining yield to maturity calculations with duration analysis, investors can better understand a bond’s potential volatility and adjust their portfolios accordingly.

Convexity, another important metric, measures the curvature of a bond’s yield curve. This metric is particularly useful for bonds with complex cash flow structures, such as mortgage-backed securities or callable bonds. By incorporating convexity analysis into their yield to maturity calculations, investors can gain a more comprehensive understanding of a bond’s value and potential returns.

Yield curve analysis, meanwhile, involves examining the relationship between bond yields and maturities. This metric provides a broader perspective on the bond market, allowing investors to identify trends and opportunities. By combining yield to maturity calculations with yield curve analysis, investors can develop a more informed investment strategy that takes into account the broader market context.

In Excel, investors can easily incorporate these metrics into their yield to maturity calculations using a range of built-in functions and formulas. For example, the DURATION function can be used to calculate a bond’s duration, while the CONVEXITY function can be used to calculate its convexity. By combining these metrics with the YIELD function, investors can develop a more comprehensive understanding of a bond’s value and potential returns.

By understanding the differences between yield to maturity and other bond valuation metrics, investors can make more informed investment decisions and develop a more effective bond portfolio management strategy. Whether you’re a seasoned investor or just starting out, Excel’s built-in functions and formulas provide a powerful platform for bond valuation and analysis.

Best Practices for Yield to Maturity Calculations in Excel

When calculating yield to maturity in Excel, accuracy and precision are crucial. To ensure reliable results, it’s essential to follow best practices for data organization, formula consistency, and error checking. By adopting these expert tips, investors and analysts can streamline their bond valuation processes and make more informed investment decisions.

First and foremost, organize your data in a clear and concise manner. This includes using separate columns for settlement dates, maturity dates, coupon rates, and other relevant inputs. By doing so, you can easily reference these values in your YIELD function formulas and reduce the risk of errors.

Consistency is key when it comes to formula writing. Use a standardized format for your YIELD function formulas, and avoid using hardcoded values whenever possible. Instead, reference cell values or named ranges to make your formulas more flexible and easier to maintain.

Error checking is also critical when calculating yield to maturity in Excel. Use Excel’s built-in error handling functions, such as IFERROR or IFBLANK, to catch and resolve errors as they occur. This includes checking for invalid input values, formula mistakes, or version compatibility issues.

In addition, consider using Excel’s auditing tools to identify and resolve errors. The Formula Auditing feature, for example, can help you trace errors back to their source and correct them quickly.

Finally, consider using Excel templates or add-ins to streamline your yield to maturity calculations. These tools can provide pre-built formulas and functions that simplify the calculation process and reduce the risk of errors.

By following these best practices, investors and analysts can ensure accurate and reliable yield to maturity calculations in Excel. Whether you’re managing a bond portfolio, conducting investment analysis, or building financial models, these expert tips can help you get the most out of the Excel YIELD function and make more informed investment decisions.

Remember, the Excel YIELD function is a powerful tool for calculating yield to maturity, but it’s only as good as the data and formulas that drive it. By adopting these best practices, you can unlock the full potential of the YIELD function and take your bond valuation skills to the next level.