What are M1 and M2: Unraveling the Mystery

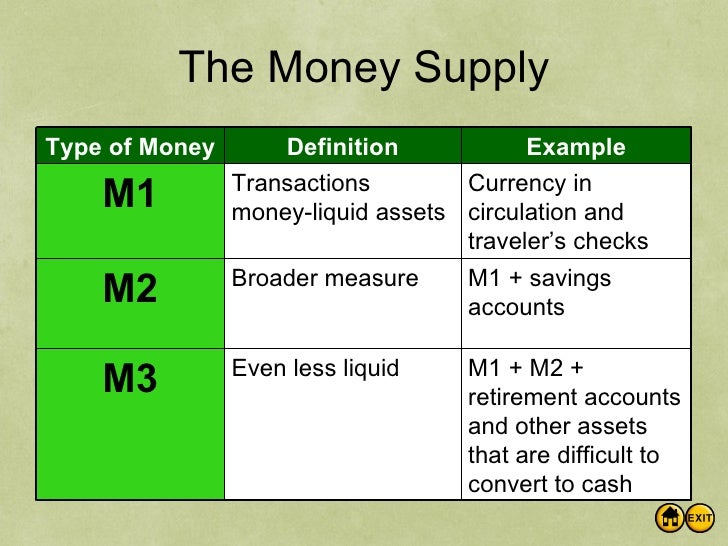

Monetary policy is a crucial component of a country’s economic framework, as it enables central banks to regulate the money supply and maintain economic stability. At the core of monetary policy lies the concept of money supply, which is measured through two key aggregates: M1 and M2. Understanding the difference between these two measures is vital in grasping the dynamics of the economy. M1, also known as the narrow money supply, encompasses physical currency, checking accounts, and other liquid assets that are readily available for spending. On the other hand, M2, or the broad money supply, includes savings accounts, money market funds, and other near-money assets that are less liquid but still contribute to the overall money supply. Examples of M1 and M2 are essential in understanding the money supply, and their significance cannot be overstated. In this article, we will delve into the world of M1 and M2, exploring their significance, measurement, and impact on the economy.

How to Measure Money Supply: The Role of M1 and M2

Measuring the money supply is a crucial aspect of monetary policy, as it enables central banks to regulate the economy and maintain stability. The two primary aggregates used to measure the money supply are M1 and M2. M1, also known as the narrow money supply, is calculated by adding up the total value of physical currency, checking accounts, and other liquid assets that are readily available for spending. On the other hand, M2, or the broad money supply, is calculated by including savings accounts, money market funds, and other near-money assets that are less liquid but still contribute to the overall money supply. Understanding how these measures are calculated is essential in grasping the significance of M1 and M2 in economic decision-making. For instance, examples of M1 and M2 can help policymakers identify trends in the money supply and make informed decisions about monetary policy. By examining the components of M1 and M2, central banks can better understand the dynamics of the economy and implement effective monetary policies to promote economic growth and stability.

Examples of M1: Understanding the Narrow Money Supply

The narrow money supply, also known as M1, consists of highly liquid assets that are readily available for spending. Examples of M1 include physical currency, such as coins and banknotes, as well as checking accounts and other demand deposits. These components are considered liquid because they can be easily converted into cash or used to make payments. Other examples of M1 include traveler’s checks, money orders, and other negotiable instruments. The significance of M1 lies in its ability to facilitate transactions and support economic activity. By understanding the components of M1, policymakers can better grasp the dynamics of the money supply and make informed decisions about monetary policy. For instance, examples of M1 and M2 can help central banks identify trends in the money supply and adjust their policies accordingly. By examining the narrow money supply, policymakers can gain valuable insights into the economy and implement effective policies to promote economic growth and stability.

Examples of M2: The Broader Money Supply Explained

The broader money supply, also known as M2, includes not only the liquid assets found in M1 but also other near-money assets that are less liquid but still contribute to the overall money supply. Examples of M2 include savings accounts, money market funds, and other near-money assets that can be easily converted into cash or used to make payments. Other examples of M2 include commercial paper, treasury bills, and certificates of deposit. These components are considered near-money because they are not as liquid as those found in M1, but they can still be used to support economic activity. By understanding the components of M2, policymakers can gain a more comprehensive understanding of the money supply and make informed decisions about monetary policy. For instance, examples of M1 and M2 can help central banks identify trends in the money supply and adjust their policies accordingly. By examining the broader money supply, policymakers can gain valuable insights into the economy and implement effective policies to promote economic growth and stability.

The Impact of M1 and M2 on the Economy

Changes in M1 and M2 can have significant effects on the economy, influencing key macroeconomic variables such as inflation, interest rates, and economic growth. An increase in M1, for instance, can lead to an increase in aggregate demand, as more liquid assets become available for spending. This, in turn, can drive up prices and lead to inflation. On the other hand, a decrease in M1 can lead to a decrease in aggregate demand, resulting in deflation or disinflation. Similarly, changes in M2 can affect interest rates, as an increase in M2 can lead to an increase in the money supply, putting downward pressure on interest rates. Conversely, a decrease in M2 can lead to an increase in interest rates. Furthermore, the ratio of M1 to M2 can also provide insights into the economy’s liquidity and credit conditions. By understanding the impact of M1 and M2 on the economy, policymakers can make informed decisions about monetary policy, using examples of M1 and M2 to guide their decisions. For instance, during times of economic downturn, central banks may increase the money supply by injecting liquidity into the system, thereby increasing M1 and M2. Conversely, during times of high inflation, central banks may reduce the money supply by selling securities, thereby decreasing M1 and M2.

Central Banks and Monetary Policy: The Role of M1 and M2

Central banks play a crucial role in implementing monetary policy, and M1 and M2 are essential components of this process. By understanding the dynamics of M1 and M2, central banks can make informed decisions about monetary policy, using examples of M1 and M2 to guide their actions. One way central banks use M1 and M2 is through open market operations, where they buy or sell government securities to increase or decrease the money supply. For instance, if a central bank wants to increase the money supply, it can buy government securities from banks, thereby increasing M1 and M2. Conversely, if it wants to decrease the money supply, it can sell government securities to banks, thereby decreasing M1 and M2. Central banks also use reserve requirements to influence the money supply. By setting reserve requirements, central banks can determine the amount of money that banks must hold in reserve, rather than lending it out. This, in turn, affects the money supply, as banks with higher reserve requirements may have less money to lend, thereby decreasing M1 and M2. By understanding the relationship between M1, M2, and monetary policy, central banks can effectively manage the economy, promoting economic growth and stability.

Real-World Applications of M1 and M2: Case Studies

The concepts of M1 and M2 are not just theoretical; they have real-world applications in economic decision-making. Central banks and financial institutions use examples of M1 and M2 to inform their monetary policy decisions and navigate the complexities of the economy. For instance, during the 2008 financial crisis, the Federal Reserve used open market operations to increase the money supply, thereby increasing M1 and M2. This injection of liquidity helped to stabilize the financial system and stimulate economic growth. Similarly, the European Central Bank has used negative interest rates to encourage banks to lend, thereby increasing M1 and M2. In another example, the Bank of Japan has used quantitative easing to increase the money supply, thereby increasing M1 and M2. These case studies demonstrate the importance of understanding M1 and M2 in implementing effective monetary policy. By analyzing examples of M1 and M2, policymakers can develop targeted strategies to address economic challenges and promote sustainable growth. Furthermore, financial institutions can use M1 and M2 to inform their investment decisions, managing risk and maximizing returns in a rapidly changing economic environment. By examining real-world applications of M1 and M2, we can gain a deeper understanding of the complex relationships between monetary policy, the money supply, and the economy.

Conclusion: The Importance of Understanding M1 and M2

In conclusion, M1 and M2 are crucial components of monetary policy, providing insights into the money supply and its impact on the economy. By understanding the differences between M1 and M2, policymakers and financial institutions can make informed decisions about monetary policy, interest rates, and economic growth. The examples of M1 and M2 provided in this article demonstrate the significance of these aggregates in measuring the money supply and informing economic decision-making. Furthermore, the real-world applications of M1 and M2, including case studies of central banks and financial institutions, highlight the importance of these concepts in navigating the complexities of the economy. As the global economy continues to evolve, understanding M1 and M2 will remain essential for policymakers, financial institutions, and individuals seeking to navigate the intricacies of monetary policy and its impact on the economy. By grasping the concepts of M1 and M2, we can better appreciate the role of monetary policy in shaping the economy and promoting sustainable growth.