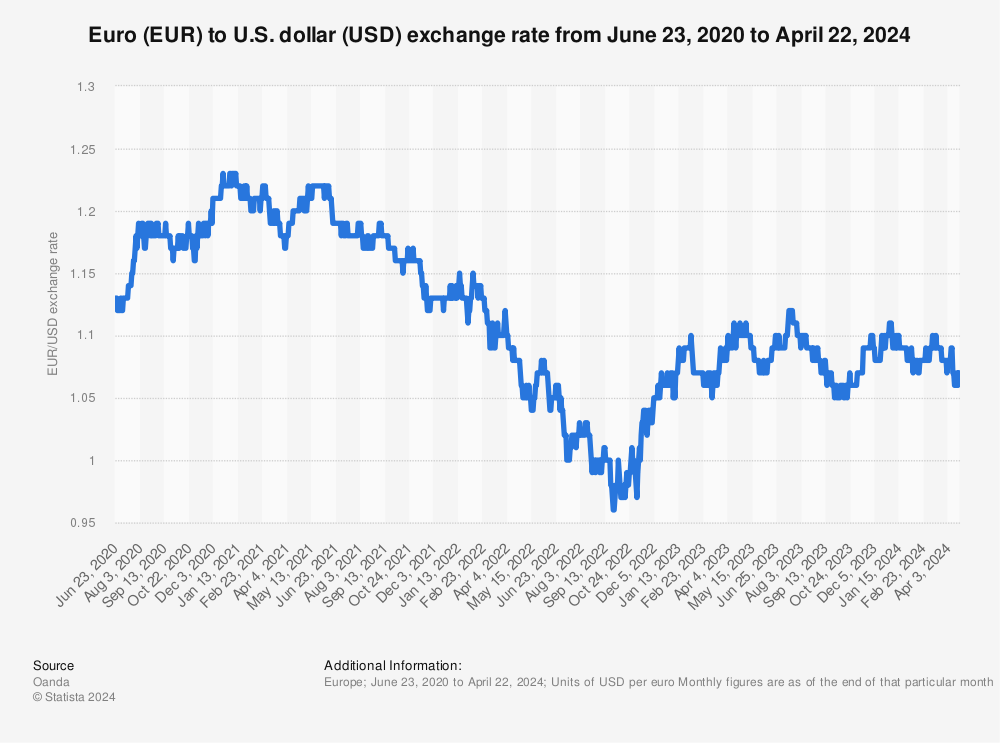

What Drives the Value of the Euro Against the US Dollar?

The EUR/USD spot exchange rate is a complex and dynamic entity, influenced by a multitude of factors. At its core, the exchange rate is a reflection of the relative value of the euro and the US dollar, which is shaped by a delicate balance of economic indicators, geopolitical events, and central bank policies. Economic indicators, such as GDP growth rates, inflation, and unemployment rates, play a significant role in shaping the EUR/USD exchange rate. A strong economy in the Eurozone, for instance, may lead to an appreciation of the euro against the US dollar, while a sluggish economy in the United States may cause the dollar to weaken. Geopolitical events, such as trade tensions, elections, and conflicts, can also impact the exchange rate, as they influence market sentiment and investor confidence. Central banks, including the European Central Bank and the Federal Reserve, also play a crucial role in shaping the EUR/USD exchange rate through their monetary policies, including interest rates and quantitative easing. By understanding these factors, individuals can better navigate the complexities of the foreign exchange market and make informed decisions about their investments and currency transactions. The EUR/USD spot exchange rate is a critical component of international trade and investment, and its fluctuations can have far-reaching consequences for businesses, investors, and individuals alike.

How to Read and Interpret Live Exchange Rate Data

Accessing and analyzing live EUR/USD exchange rate data is a crucial step in making informed investment decisions and managing currency risk. With the advent of digital technology, obtaining real-time exchange rate data has become easier than ever. There are several reliable sources that provide live EUR/USD exchange rate data, including financial news websites, currency exchange platforms, and economic data providers. To access live exchange rate data, individuals can visit these websites, create an account, and set up customized alerts to receive notifications when the exchange rate reaches a certain level. Once access to live exchange rate data is obtained, the next step is to analyze it effectively. This involves identifying trends and patterns, such as upward or downward trends, and understanding the underlying factors driving these movements. For instance, a sudden increase in the EUR/USD exchange rate may be driven by a positive economic indicator, such as a strong GDP growth rate in the Eurozone. By analyzing live exchange rate data, individuals can gain valuable insights into market sentiment and make informed decisions about their investments and currency transactions. Furthermore, understanding how to read and interpret live exchange rate data can help individuals optimize their currency transactions, minimize losses, and maximize gains. In the context of the EUR/USD spot exchange rate, being able to analyze live exchange rate data is essential for businesses and investors seeking to navigate the complexities of the foreign exchange market.

The Role of Market Forces in Shaping the EUR/USD Spot Rate

The EUR/USD spot exchange rate is heavily influenced by market forces, which play a crucial role in shaping its value. At its core, the exchange rate is determined by the forces of supply and demand in the foreign exchange market. When demand for the euro increases, its value appreciates against the US dollar, and conversely, when demand for the US dollar increases, its value appreciates against the euro. Market sentiment, speculation, and hedging are key factors that influence the supply and demand dynamics of the EUR/USD exchange rate. Market sentiment, for instance, can drive the exchange rate up or down, depending on whether investors are optimistic or pessimistic about the economy. Speculation, on the other hand, can lead to sudden and significant fluctuations in the exchange rate, as investors seek to profit from anticipated price movements. Hedging, a strategy used to mitigate currency risk, can also impact the exchange rate, as businesses and investors seek to lock in exchange rates to minimize potential losses. Understanding the role of market forces in shaping the EUR/USD spot exchange rate is essential for businesses and investors seeking to navigate the complexities of the foreign exchange market and make informed investment decisions. By recognizing the impact of supply and demand, market sentiment, speculation, and hedging, individuals can better anticipate and respond to changes in the EUR/USD exchange rate, ultimately optimizing their currency transactions and managing risk more effectively.

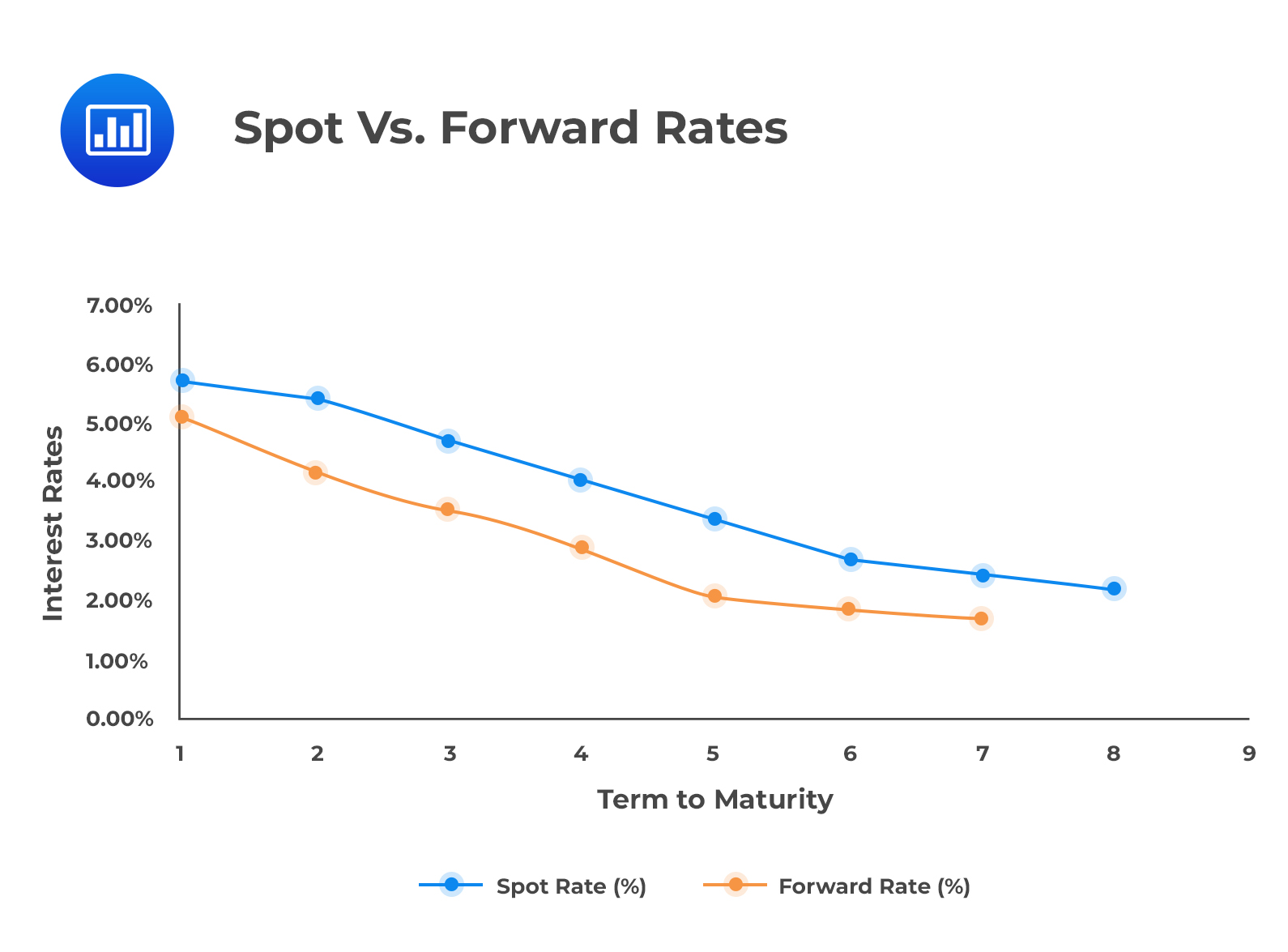

Understanding the Difference Between Spot and Forward Exchange Rates

In the foreign exchange market, there are two primary types of exchange rates: spot exchange rates and forward exchange rates. Understanding the distinction between these two rates is crucial for businesses and investors seeking to navigate the complexities of currency exchange. The EUR/USD spot exchange rate, for instance, represents the current market price of the euro in terms of the US dollar, with settlement typically occurring within two business days. In contrast, forward exchange rates are agreements to exchange currencies at a fixed rate on a specific date in the future, often used to hedge against currency risk. Forward exchange rates are typically used by businesses and investors to lock in exchange rates for future transactions, providing certainty and stability in an otherwise volatile market. The key implications of spot and forward exchange rates for businesses and investors lie in their ability to manage risk and optimize currency transactions. By understanding the differences between spot and forward exchange rates, individuals can make informed decisions about their currency transactions, minimize losses, and maximize gains. In the context of the EUR/USD spot exchange rate, recognizing the distinction between spot and forward exchange rates is essential for businesses and investors seeking to navigate the complexities of the foreign exchange market and make informed investment decisions.

How to Make Informed Decisions with Real-Time Exchange Rate Data

Access to real-time EUR/USD exchange rate data is essential for businesses and investors seeking to make informed investment decisions, manage risk, and optimize currency transactions. With the ability to track exchange rate movements in real-time, individuals can respond quickly to changes in the market, capitalizing on opportunities and mitigating potential losses. To make the most of real-time exchange rate data, it is crucial to understand how to analyze and interpret the data effectively. This involves identifying trends and patterns, recognizing key levels of support and resistance, and staying informed about market news and events. By combining real-time exchange rate data with technical and fundamental analysis, businesses and investors can develop a comprehensive understanding of the EUR/USD spot exchange rate, enabling them to make informed decisions about their currency transactions. Additionally, real-time exchange rate data can be used to monitor and adjust hedging strategies, ensuring that currency risk is managed effectively. By leveraging the power of real-time exchange rate data, businesses and investors can gain a competitive edge in the foreign exchange market, optimizing their currency transactions and maximizing their returns.

The Impact of Economic Indicators on the EUR/USD Exchange Rate

The EUR/USD spot exchange rate is heavily influenced by a range of economic indicators, which provide valuable insights into the health and performance of the European and US economies. Key indicators such as GDP, inflation, and unemployment rates play a crucial role in shaping the EUR/USD exchange rate, as they reflect the underlying strength and stability of the economies. For instance, a strong GDP growth rate in the US can lead to an appreciation of the US dollar against the euro, causing the EUR/USD spot exchange rate to decline. Conversely, a rise in European inflation can lead to an increase in the EUR/USD exchange rate, as investors seek higher returns in the eurozone. Unemployment rates also have a significant impact, with low unemployment rates in the US often leading to a stronger US dollar. By analyzing these economic indicators, businesses and investors can gain a deeper understanding of the factors driving the EUR/USD exchange rate, enabling them to make informed investment decisions and manage risk more effectively. Furthermore, staying up-to-date with the latest economic indicators can help individuals anticipate potential changes in the EUR/USD spot exchange rate, allowing them to adjust their strategies accordingly. By recognizing the importance of economic indicators in shaping the EUR/USD exchange rate, businesses and investors can optimize their currency transactions and maximize their returns in the foreign exchange market.

Managing Currency Risk in a Volatile Market

In today’s volatile foreign exchange market, managing currency risk is crucial for businesses and investors seeking to protect their investments and optimize their returns. The EUR/USD spot exchange rate is particularly susceptible to fluctuations, making it essential to develop effective strategies for mitigating currency risk. One key approach is hedging, which involves taking positions in the market to offset potential losses. For example, a business importing goods from the eurozone may hedge against a potential decline in the EUR/USD exchange rate by taking a short position in the euro. Diversification is another effective strategy, involving the spread of investments across different currencies and asset classes to minimize exposure to any one market. Currency forecasting is also a valuable tool, enabling businesses and investors to anticipate potential changes in the EUR/USD exchange rate and adjust their strategies accordingly. By combining these strategies, businesses and investors can effectively manage currency risk and optimize their returns in the foreign exchange market. Furthermore, staying informed about market trends and developments is essential for making informed decisions and staying ahead of the curve. By leveraging the power of real-time EUR/USD exchange rate data and expert analysis, businesses and investors can navigate the complexities of the foreign exchange market with confidence, minimizing their exposure to currency risk and maximizing their returns.

Staying Ahead of the Curve with EUR/USD Exchange Rate Forecasts

In the fast-paced world of foreign exchange, staying informed about EUR/USD exchange rate forecasts and trends is crucial for businesses and investors seeking to optimize their returns and manage risk. By accessing reliable sources of expert analysis and staying up-to-date with the latest market developments, individuals can gain a valuable edge in the market. One key approach is to follow reputable sources of EUR/USD exchange rate forecasts, such as central banks, financial institutions, and leading economists. These sources provide valuable insights into market trends and developments, enabling businesses and investors to anticipate potential changes in the EUR/USD spot exchange rate and adjust their strategies accordingly. Additionally, analyzing expert opinions and market commentary can provide valuable insights into the factors driving the EUR/USD exchange rate, such as economic indicators, geopolitical events, and central bank policies. By combining these approaches, businesses and investors can stay ahead of the curve and make informed decisions in the foreign exchange market. Furthermore, leveraging the power of real-time EUR/USD exchange rate data and expert analysis can help individuals identify opportunities and mitigate risks, ultimately optimizing their returns in the foreign exchange market.