What is Ex-Dividend Date and Why Does it Matter?

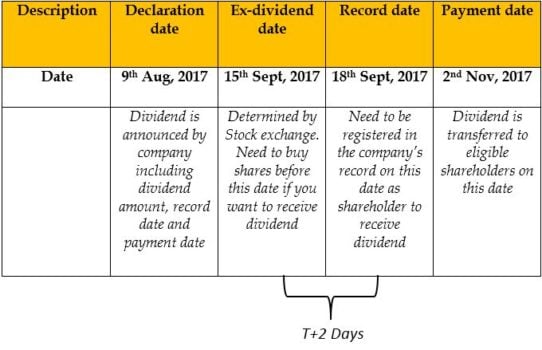

In the realm of dividend investing, understanding the ex-dividend date is crucial for maximizing returns. The ex-dividend date, also known as the ex-date, is the first trading day after the stock’s dividend record date, when the stock begins trading without the right to receive the upcoming dividend payment. This date is significant because it affects the stock’s price and the dividend yield, making it essential for investors to grasp its implications.

For EPD stock, in particular, the ex-dividend date has a direct impact on the stock’s price and dividend yield. As a dividend-paying stock, EPD’s ex-dividend date is a critical event that can influence investor decisions. By understanding the ex-dividend date, investors can make informed decisions about buying or selling EPD stock, ultimately affecting their overall investment strategy.

A brief overview of EPD stock reveals a consistent dividend payer with a strong track record of distributing dividends to its shareholders. With a history of paying quarterly dividends, EPD stock is attractive to income-focused investors seeking regular dividend payments. However, to fully capitalize on EPD stock’s dividend potential, investors must comprehend the ex-dividend date and its implications.

How to Identify the Ex-Dividend Date for EPD Stock

Identifying the ex-dividend date for EPD stock is crucial for investors seeking to maximize their dividend returns. To find the ex-dividend date, investors can follow these steps:

1. Check the EPD stock’s website: Investors can visit EPD’s official website to find information on upcoming dividend payments, including the ex-dividend date.

2. Use financial websites: Websites such as Yahoo Finance, Google Finance, or Bloomberg provide information on EPD stock’s dividend history, including the ex-dividend date.

3. Set up dividend alerts: Investors can set up alerts on financial websites or through their brokerage accounts to notify them of upcoming dividend payments and ex-dividend dates.

Staying informed about dividend announcements and payment dates is essential for investors. By knowing the ex-dividend date, investors can make informed decisions about buying or selling EPD stock, ultimately affecting their overall investment strategy. It’s also important to understand that the ex-dividend date is typically set one business day before the record date, which is the date by which shareholders must be on the company’s records to receive the dividend payment.

Investors should prioritize staying up-to-date on EPD stock’s ex-dividend date to avoid missing out on potential dividend payments. By doing so, investors can optimize their dividend-focused investment strategy and maximize their returns.

Understanding the Impact of Ex-Dividend Date on EPD Stock Price

The ex-dividend date has a significant impact on EPD stock’s price, and understanding this relationship is crucial for dividend investors. When EPD stock goes ex-dividend, its price typically drops by the amount of the dividend payment. This is because the dividend payment is no longer included in the stock’s price, making it less attractive to investors seeking immediate returns.

For example, if EPD stock is trading at $50 and declares a $1 dividend, the stock’s price may drop to $49 on the ex-dividend date. This price fluctuation can create buying opportunities for investors seeking to capitalize on the dividend payment. However, it’s essential to consider the dividend yield, which may also change on the ex-dividend date.

Historically, EPD stock’s dividend payments have had a significant impact on its stock price. For instance, in 2020, EPD stock’s dividend payment of $0.875 per share led to a 2% decline in stock price on the ex-dividend date. Similarly, in 2019, a dividend payment of $0.825 per share resulted in a 1.5% decline in stock price.

By analyzing EPD stock’s past dividend payments and their impact on the stock price, investors can better understand the relationship between the ex-dividend date and stock price fluctuations. This knowledge can help investors make informed decisions about buying or selling EPD stock, ultimately affecting their overall investment strategy.

It’s also important to note that the ex-dividend date can affect EPD stock’s dividend yield, which is the ratio of the annual dividend payment to the stock’s current price. When the stock price drops on the ex-dividend date, the dividend yield may increase, making the stock more attractive to income-focused investors.

EPD Stock’s Dividend History: A Review of Past Payments

EPD stock has a long history of paying consistent dividends to its shareholders. Since 1996, the company has increased its dividend payout 22 times, with an average annual dividend growth rate of 5.5%. This commitment to dividend payments has made EPD stock an attractive option for income-focused investors.

A review of EPD stock’s dividend history reveals a pattern of consistent quarterly dividend payments, with the company typically announcing its dividend payments in January, April, July, and October. The dividend payment dates are usually set for the following month, with the ex-dividend date occurring one business day before the record date.

In recent years, EPD stock’s dividend payments have been as follows:

2020: $0.875 per share (quarterly), with a dividend yield of 5.2%

2019: $0.825 per share (quarterly), with a dividend yield of 5.5%

2018: $0.775 per share (quarterly), with a dividend yield of 5.8%

2017: $0.725 per share (quarterly), with a dividend yield of 6.1%

This review of EPD stock’s dividend history highlights the company’s commitment to providing consistent income to its shareholders. By understanding the pattern of dividend payments and the ex-dividend date, investors can make informed decisions about investing in EPD stock and maximizing their returns through dividend investing.

Notably, EPD stock’s dividend yield has remained relatively stable over the years, ranging from 5.2% to 6.1%. This stability makes EPD stock an attractive option for income-focused investors seeking predictable returns.

What to Expect from EPD Stock’s Future Dividend Payments

EPD stock’s future dividend payments are expected to continue its trend of consistent quarterly payments. The company’s dividend policy is centered around providing a stable income stream to its shareholders, and it has a history of increasing its dividend payout over time.

Based on EPD stock’s past dividend payments, investors can expect the company to announce its dividend payments in January, April, July, and October, with the ex-dividend date typically occurring one business day before the record date. The dividend payment amounts may fluctuate, but the company’s commitment to providing a consistent income stream remains unchanged.

One potential change to EPD stock’s future dividend payments is the possibility of a dividend increase. The company has a history of increasing its dividend payout over time, and investors may expect this trend to continue. However, the timing and amount of any potential dividend increase are uncertain and will depend on various factors, including the company’s financial performance and industry trends.

EPD stock’s dividend policy is designed to provide a stable income stream to its shareholders, and the company’s commitment to this policy is reflected in its consistent dividend payments. By understanding the company’s dividend policy and its impact on EPD stock, investors can make informed decisions about investing in the stock and maximizing their returns through dividend investing.

Investors should also be aware of the potential risks associated with EPD stock’s future dividend payments. Changes in the company’s financial performance or industry trends could impact the dividend payment amount or schedule, and investors should be prepared to adapt their investment strategy accordingly. By staying informed about EPD stock’s dividend payments and policy, investors can make informed decisions and maximize their returns.

Investing in EPD Stock: A Dividend-Focused Strategy

A dividend-focused investment strategy for EPD stock involves maximizing returns through consistent dividend payments and long-term capital appreciation. To achieve this, investors should adopt a long-term perspective and diversify their portfolio to minimize risk.

One key aspect of a dividend-focused strategy is to understand the ex-dividend date and its impact on EPD stock price. By knowing when the ex-dividend date occurs, investors can make informed decisions about buying or selling the stock to maximize their returns. Additionally, investors should stay informed about EPD stock’s dividend history and future dividend payments to adjust their investment strategy accordingly.

To maximize returns through dividend investing, investors should consider the following tips:

– Invest for the long term: EPD stock’s dividend payments are designed to provide a stable income stream over the long term. By adopting a long-term perspective, investors can ride out market fluctuations and benefit from the company’s consistent dividend payments.

– Diversify your portfolio: Spreading investments across different asset classes and industries can minimize risk and maximize returns. By diversifying their portfolio, investors can reduce their exposure to market volatility and ensure a steady income stream.

– Monitor EPD stock’s dividend yield: The dividend yield is a key metric for dividend investors, as it indicates the return on investment. By monitoring EPD stock’s dividend yield, investors can adjust their investment strategy to maximize their returns.

– Consider dividend reinvestment: Dividend reinvestment plans allow investors to reinvest their dividend payments in additional shares of EPD stock. This can be an effective way to maximize returns over the long term, as it takes advantage of the power of compounding.

By adopting a dividend-focused investment strategy and following these tips, investors can maximize their returns from EPD stock and achieve their long-term investment goals.

Common Mistakes to Avoid When Investing in EPD Stock

When investing in EPD stock, it’s essential to avoid common mistakes that can impact returns. One of the most critical mistakes is misunderstanding the ex-dividend date and its impact on EPD stock price. Failing to understand the ex-dividend date can result in buying or selling the stock at the wrong time, leading to reduced returns or even losses.

Another common mistake is ignoring the dividend yield and its changes over time. EPD stock’s dividend yield is a critical metric for dividend investors, as it indicates the return on investment. Failing to monitor the dividend yield can result in missed opportunities or poor investment decisions.

Additionally, investors should avoid making emotional decisions based on short-term market fluctuations. EPD stock’s price can be volatile in the short term, but its dividend payments are designed to provide a stable income stream over the long term. By adopting a long-term perspective, investors can ride out market fluctuations and benefit from the company’s consistent dividend payments.

Investors should also avoid over-concentrating their portfolio in EPD stock or any other single stock. Diversification is key to minimizing risk and maximizing returns. By spreading investments across different asset classes and industries, investors can reduce their exposure to market volatility and ensure a steady income stream.

To avoid these common mistakes, investors should:

– Stay informed about EPD stock’s ex-dividend date and dividend payments.

– Monitor the dividend yield and adjust their investment strategy accordingly.

– Adopt a long-term perspective and avoid making emotional decisions based on short-term market fluctuations.

– Diversify their portfolio to minimize risk and maximize returns.

By avoiding these common mistakes, investors can make informed investment decisions and maximize their returns from EPD stock.

Conclusion: Mastering EPD Stock’s Ex-Dividend Date for Dividend Success

In conclusion, understanding the ex-dividend date is crucial for dividend investors seeking to maximize returns from EPD stock. By grasping the concept of ex-dividend date and its impact on EPD stock price, investors can make informed decisions about buying or selling the stock. Additionally, staying informed about EPD stock’s dividend history, future dividend payments, and dividend yield changes can help investors adapt their investment strategy and avoid common mistakes.

By following the tips and strategies outlined in this article, investors can master EPD stock’s ex-dividend date and achieve dividend success. Remember to stay informed, adopt a long-term perspective, and diversify your portfolio to minimize risk and maximize returns. With a deep understanding of EPD stock’s ex-dividend date and its impact on the stock, investors can unlock the full potential of dividend investing and achieve their long-term investment goals.

As EPD stock continues to be a popular choice for dividend investors, it’s essential to stay up-to-date with the latest dividend announcements and payment dates. By doing so, investors can capitalize on the stock’s consistent dividend payments and maximize their returns. Don’t let misunderstandings about ex-dividend date hold you back from achieving dividend success – stay informed, adapt your strategy, and reap the rewards of EPD stock’s dividend payments.