Unlocking the Power of Effective Interest Rate Calculations

In the world of finance, understanding the concept of effective interest rate is crucial for making informed decisions. The effective interest rate formula in Excel is a powerful tool that helps financial professionals and individuals alike to calculate the true rate of interest on a loan or investment. This formula takes into account the compounding of interest, providing a more accurate representation of the interest rate. By mastering the effective interest rate formula in Excel, users can gain a deeper understanding of their financial situations and make more informed decisions. In this article, we will explore the significance of effective interest rate calculations in Excel, and provide a step-by-step guide on how to calculate it with ease.

How to Calculate Effective Interest Rate in Excel: A Simplified Approach

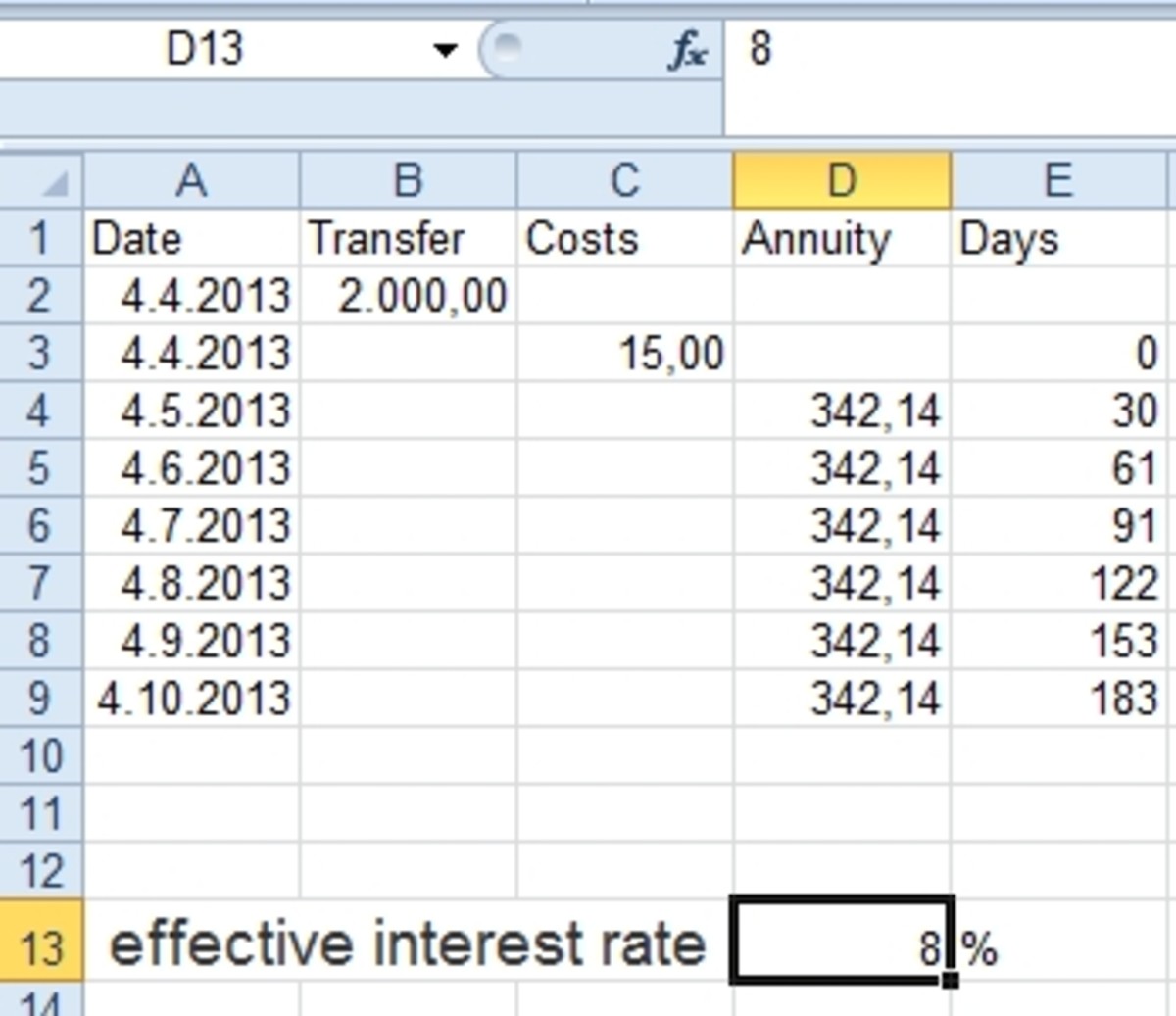

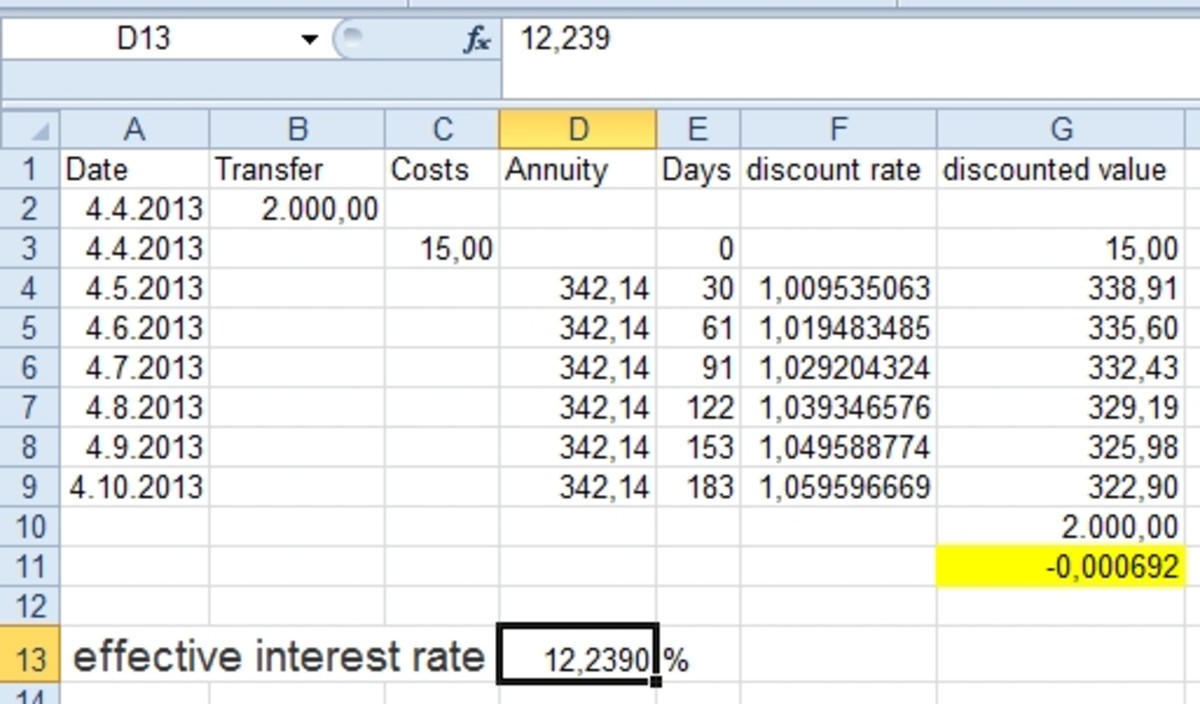

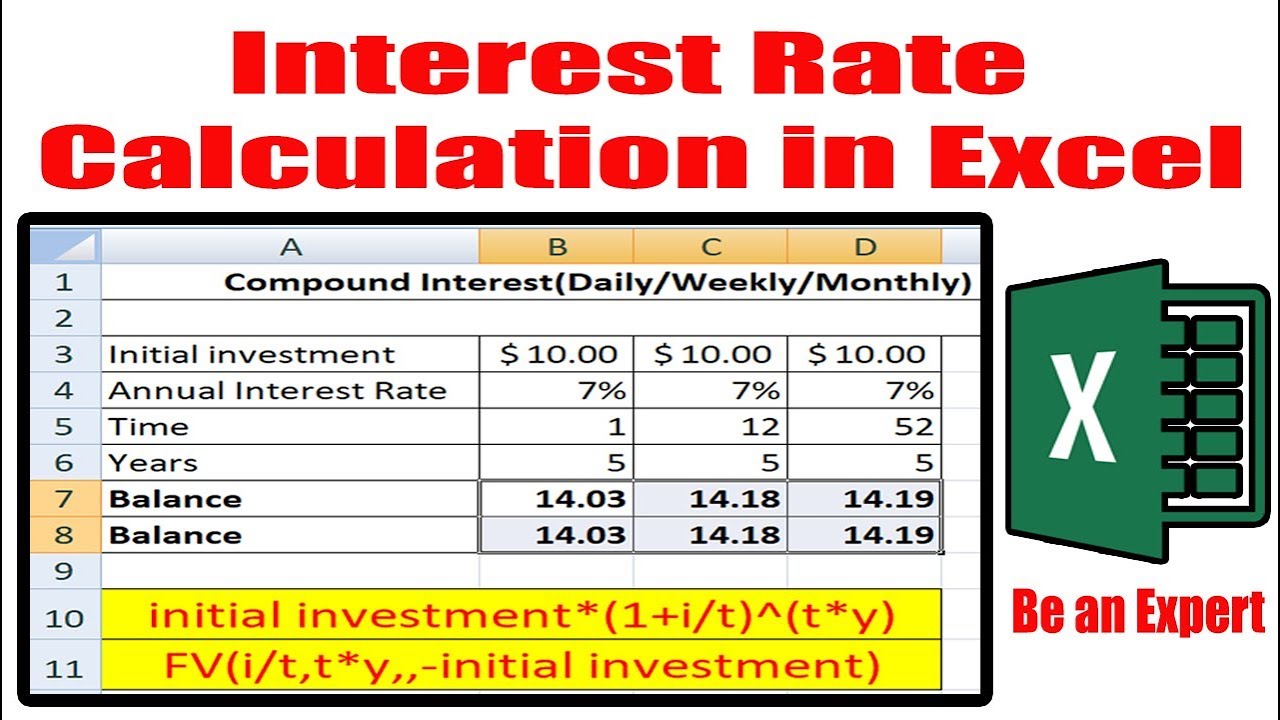

To calculate the effective interest rate in Excel, you can use the formula: (1 + (nominal interest rate / number of compounding periods))^number of compounding periods – 1. This formula takes into account the compounding of interest, providing a more accurate representation of the interest rate. To input the data, follow these steps:

Step 1: Enter the nominal interest rate in a cell, for example, A1.

Step 2: Enter the number of compounding periods in a cell, for example, A2.

Step 3: Enter the formula =(1 + (A1 / A2))^A2 – 1 in a new cell, for example, A3.

Step 4: Press Enter to calculate the effective interest rate.

For example, if the nominal interest rate is 10% per annum, compounded quarterly, the effective interest rate would be approximately 10.38%. This means that the true rate of interest on a loan or investment is 10.38%, rather than the nominal rate of 10%.

By using the effective interest rate formula in Excel, you can easily calculate the true rate of interest on a loan or investment, and make more informed financial decisions.

Understanding the Difference Between Nominal and Effective Interest Rates

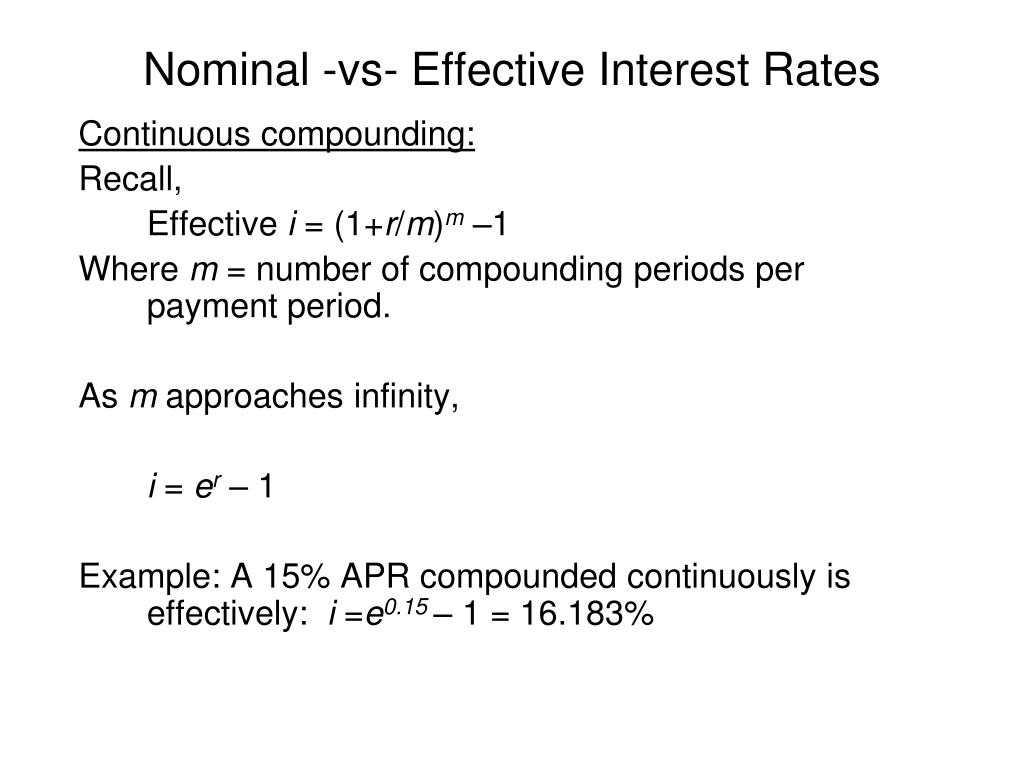

In financial analysis, it’s essential to understand the distinction between nominal and effective interest rates. The nominal interest rate is the rate of interest charged on a loan or investment, expressed as a percentage per annum. However, this rate does not take into account the compounding of interest, which can significantly impact the true rate of interest.

The effective interest rate, on the other hand, is the rate of interest that takes into account the compounding of interest. This rate is calculated using the effective interest rate formula in Excel, which provides a more accurate representation of the interest rate. The effective interest rate is typically higher than the nominal interest rate, as it reflects the true cost of borrowing or the true return on investment.

In different financial scenarios, nominal and effective interest rates are used in distinct ways. For example, in loan evaluations, the nominal interest rate is often used to calculate the monthly payments, while the effective interest rate is used to determine the total cost of the loan. In investment analysis, the effective interest rate is used to calculate the true return on investment, taking into account the compounding of interest.

To apply the effective interest rate formula in Excel, it’s essential to understand the components of the formula, including the nominal interest rate and the number of compounding periods. By using the effective interest rate formula in Excel, financial professionals and individuals can make more informed decisions, as they can accurately calculate the true rate of interest on a loan or investment.

Real-World Applications of Effective Interest Rate Calculations in Excel

Effective interest rate calculations in Excel have numerous practical applications in various financial scenarios. By accurately calculating the effective interest rate, financial professionals and individuals can make informed decisions and optimize their financial strategies.

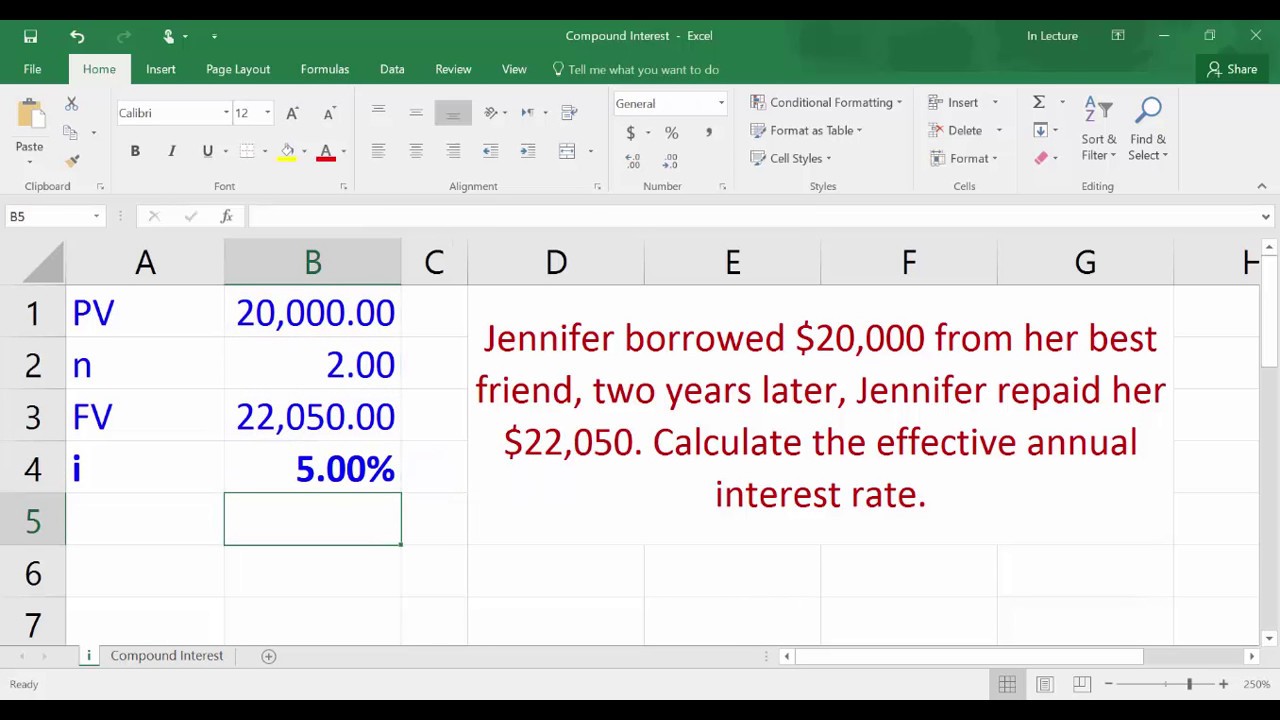

In investment analysis, the effective interest rate formula in Excel is used to calculate the true return on investment, taking into account the compounding of interest. This enables investors to compare different investment opportunities and make informed decisions about their investments.

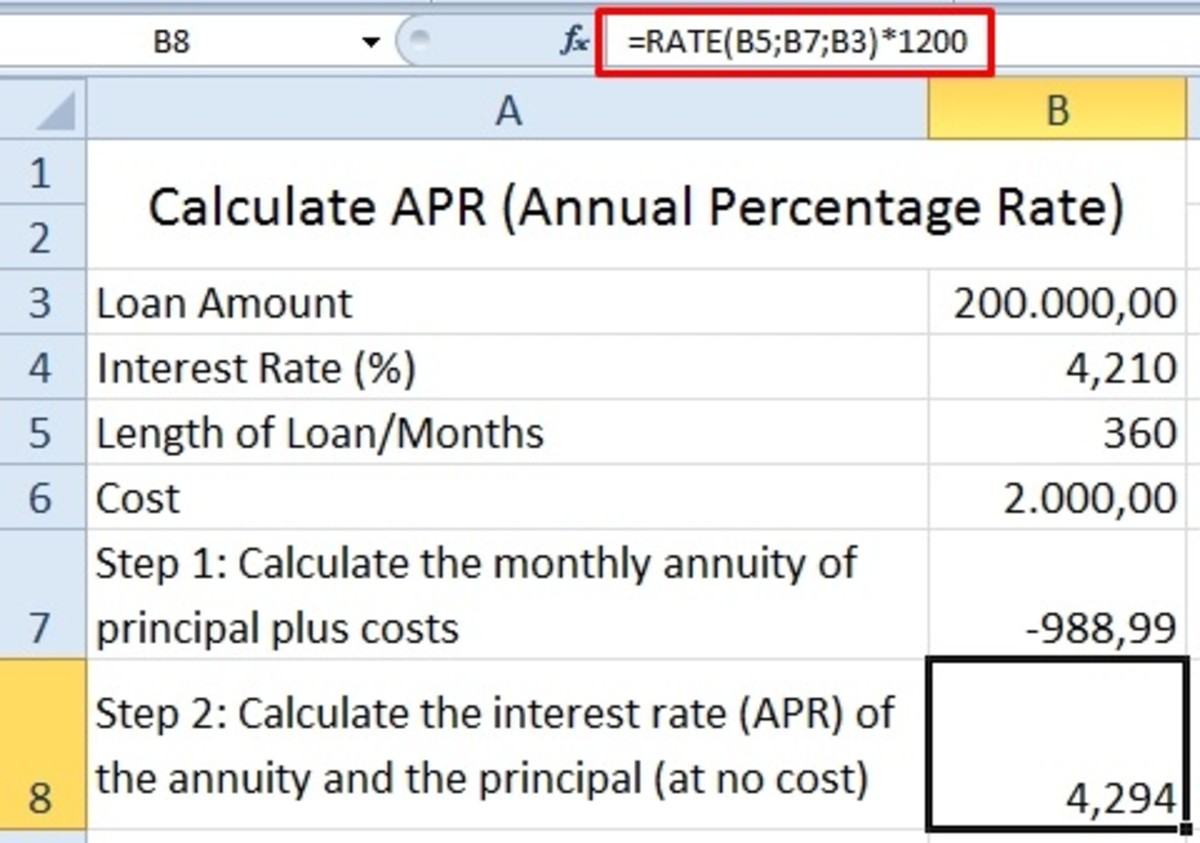

In loan evaluations, the effective interest rate is used to determine the total cost of the loan, including the interest paid over the loan term. This helps borrowers to understand the true cost of borrowing and make informed decisions about their loan options.

In credit risk assessments, the effective interest rate is used to evaluate the creditworthiness of borrowers. By calculating the effective interest rate, lenders can assess the borrower’s ability to repay the loan and make informed decisions about lending.

Additionally, effective interest rate calculations in Excel are used in other financial scenarios, such as capital budgeting, financial modeling, and portfolio management. By accurately calculating the effective interest rate, financial professionals and individuals can optimize their financial strategies and achieve their financial goals.

For example, a financial analyst may use the effective interest rate formula in Excel to evaluate the profitability of a new investment opportunity. By calculating the effective interest rate, the analyst can determine the true return on investment and make an informed decision about whether to invest.

In another example, a loan officer may use the effective interest rate formula in Excel to determine the total cost of a loan for a borrower. By calculating the effective interest rate, the loan officer can provide the borrower with a clear understanding of the true cost of borrowing and help them make an informed decision about their loan options.

Common Errors to Avoid When Calculating Effective Interest Rate in Excel

When calculating the effective interest rate in Excel, it’s essential to avoid common mistakes that can lead to inaccurate results. By understanding these errors, financial professionals and individuals can ensure accurate calculations and make informed decisions.

One common error is incorrect data input. When using the effective interest rate formula in Excel, it’s crucial to input the correct nominal interest rate, compounding frequency, and time period. A small mistake in data input can lead to significant errors in the calculated effective interest rate.

Another common error is misunderstanding the compounding frequency. The compounding frequency affects the calculated effective interest rate, and incorrect assumptions can lead to inaccurate results. For example, if the compounding frequency is monthly, the effective interest rate will be higher than if the compounding frequency is annually.

Additionally, incorrect formula construction can lead to errors. The effective interest rate formula in Excel requires careful construction to ensure accurate results. A small mistake in the formula can lead to significant errors in the calculated effective interest rate.

To avoid these errors, it’s essential to follow best practices when calculating the effective interest rate in Excel. This includes double-checking data input, understanding the compounding frequency, and carefully constructing the formula. By following these best practices, financial professionals and individuals can ensure accurate calculations and make informed decisions.

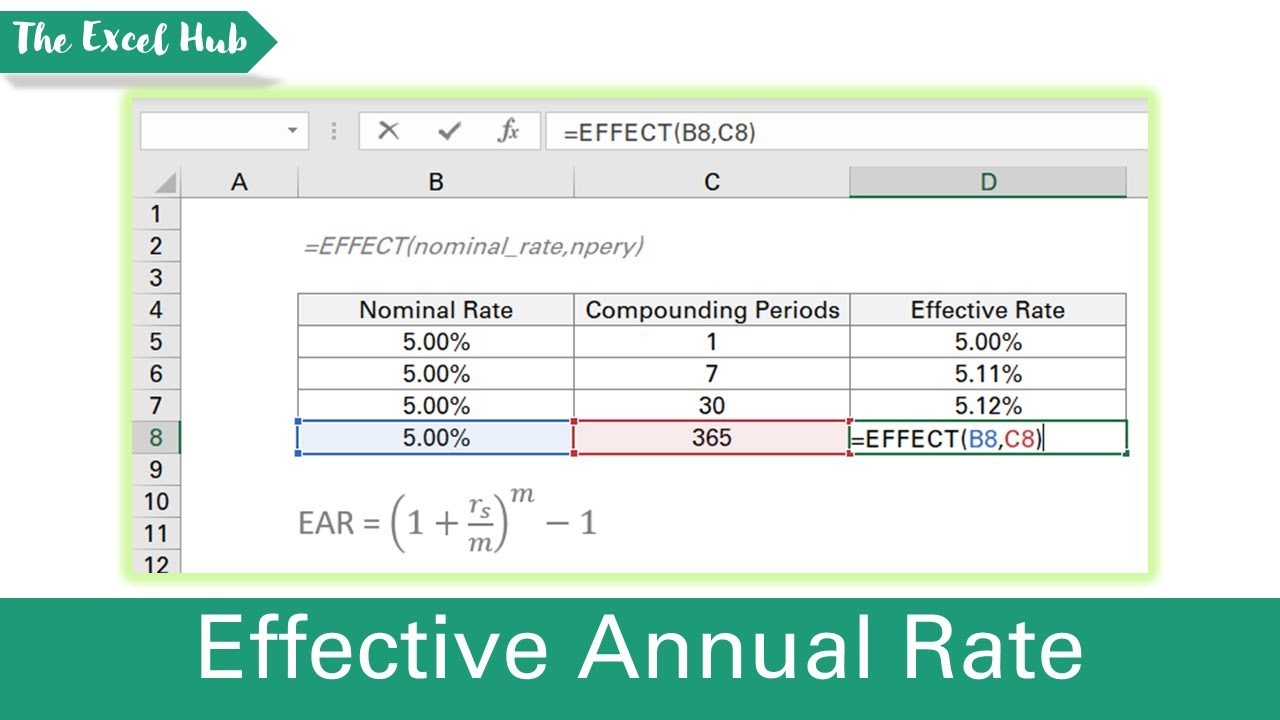

For example, when using the EFFECT function in Excel, it’s essential to input the correct arguments, including the nominal interest rate and compounding frequency. By following the correct syntax and inputting the correct data, users can ensure accurate calculations and avoid common errors.

By understanding common errors and following best practices, financial professionals and individuals can ensure accurate calculations of the effective interest rate in Excel. This enables them to make informed decisions and optimize their financial strategies.

Effective Interest Rate Formula in Excel: A Deeper Dive

The effective interest rate formula in Excel is a powerful tool for financial analysis, but it’s essential to understand the underlying mathematical concepts to apply it correctly. In this section, we’ll delve deeper into the formula and explore how it’s used in Excel.

The effective interest rate formula in Excel is based on the concept of compounding, which is the process of earning interest on both the principal amount and any accrued interest. The formula takes into account the nominal interest rate, compounding frequency, and time period to calculate the effective interest rate.

The mathematical formula for the effective interest rate is:

(1 + (nominal interest rate / number of compounding periods))^number of compounding periods – 1

This formula can be applied in Excel using the EFFECT function, which simplifies the calculation and reduces the risk of errors. The EFFECT function takes three arguments: the nominal interest rate, the compounding frequency, and the time period.

For example, if the nominal interest rate is 10%, the compounding frequency is monthly, and the time period is 1 year, the effective interest rate can be calculated using the following formula in Excel:

=EFFECT(10%/12,12,1)

This formula returns the effective interest rate, which can be used in financial analysis and decision-making.

By understanding the underlying mathematical concepts of the effective interest rate formula in Excel, financial professionals and individuals can apply it correctly and make informed decisions. The formula is a powerful tool for financial analysis, and its correct application can have a significant impact on financial outcomes.

In the next section, we’ll explore how to use Excel functions to simplify effective interest rate calculations and improve efficiency.

Using Excel Functions to Simplify Effective Interest Rate Calculations

When it comes to calculating the effective interest rate in Excel, using built-in functions can significantly simplify the process and reduce the risk of errors. One such function is the EFFECT function, which is specifically designed to calculate the effective interest rate.

The EFFECT function takes three arguments: the nominal interest rate, the compounding frequency, and the time period. By using this function, users can avoid the complexity of the effective interest rate formula and focus on interpreting the results.

The syntax for the EFFECT function is:

=EFFECT(nominal_interest_rate, compounding_frequency, time_period)

For example, if the nominal interest rate is 10%, the compounding frequency is monthly, and the time period is 1 year, the EFFECT function can be used as follows:

=EFFECT(10%/12,12,1)

This formula returns the effective interest rate, which can be used in financial analysis and decision-making.

In addition to the EFFECT function, Excel also provides other functions that can be used to simplify effective interest rate calculations. For instance, the NOMINAL function can be used to calculate the nominal interest rate from the effective interest rate, and the XNPV function can be used to calculate the present value of a series of cash flows.

By leveraging these Excel functions, financial professionals and individuals can streamline their effective interest rate calculations and focus on higher-level analysis and decision-making. This can lead to more accurate results, improved efficiency, and better financial outcomes.

In the next section, we’ll explore best practices for effective interest rate calculations in Excel, including tips on data organization, formula construction, and result interpretation.

Best Practices for Effective Interest Rate Calculations in Excel

When it comes to calculating the effective interest rate in Excel, following best practices is crucial to ensure accurate results and efficient calculations. In this section, we’ll provide tips on data organization, formula construction, and result interpretation to help you master effective interest rate calculations in Excel.

Data Organization: To ensure accurate calculations, it’s essential to organize your data correctly. Make sure to input the nominal interest rate, compounding frequency, and time period correctly, and use clear and concise labels for each variable.

Formula Construction: When constructing the effective interest rate formula in Excel, use the correct syntax and formatting to avoid errors. Use the EFFECT function or the effective interest rate formula, and make sure to input the correct arguments and values.

Result Interpretation: Once you’ve calculated the effective interest rate, it’s essential to interpret the results correctly. Understand the implications of the effective interest rate on your financial analysis and decision-making, and use the results to inform your investment, loan, or credit risk assessments.

Additional Tips: To further improve your effective interest rate calculations in Excel, consider the following tips:

- Use consistent units for the nominal interest rate, compounding frequency, and time period.

- Verify your calculations by using multiple methods or formulas.

- Document your calculations and assumptions for future reference.

- Use Excel’s built-in functions and formulas to simplify your calculations.

By following these best practices, you can ensure accurate and efficient effective interest rate calculations in Excel, and make informed financial decisions with confidence.