Decoding E-Mini Futures: A Trader’s Guide

E-mini S&P 500 futures contracts represent a pivotal instrument in today’s financial markets, providing a cost-effective avenue for traders and investors to participate in the performance of the Standard & Poor’s 500 Index. Understanding these contracts is crucial for anyone seeking exposure to the U.S. equity market. A futures contract is an agreement to buy or sell an asset at a predetermined price on a specified future date. The S&P 500 index, a capitalization-weighted index, represents the performance of 500 of the largest publicly traded companies in the United States, making it a benchmark for the overall health of the U.S. stock market. The e-mini s&p 500 futures price allows traders to speculate on the direction of this index without directly owning the underlying stocks.

E-mini S&P 500 futures are actively traded by a diverse group of participants, including institutional investors, hedge funds, professional traders, and individual investors. These contracts serve various purposes, from hedging existing equity portfolios to speculating on short-term market movements. One key aspect of trading e-mini s&p 500 futures price is the concept of margin. Margin is the amount of money required to open and maintain a futures position. It is not a down payment but rather a performance bond, ensuring that traders can meet their financial obligations. Because futures are leveraged instruments, a relatively small margin deposit can control a much larger contract value, amplifying both potential gains and losses. The e-mini s&p 500 futures price offers a liquid and efficient way to gain exposure to the broad U.S. equity market.

For traders and investors aiming to capitalize on the e-mini s&p 500 futures price, a thorough grasp of their mechanics and role is essential. These contracts provide a dynamic tool for managing risk, generating returns, and expressing market views. The availability of e-mini s&p 500 futures has democratized access to the S&P 500, enabling a wider range of participants to engage with this important market benchmark. Before trading, understanding the specifications of the e-mini S&P 500 futures contract, such as the contract size, tick value, and trading hours, is very important. Furthermore, traders should be aware of the potential risks involved and implement appropriate risk management strategies. The e-mini s&p 500 futures price is influenced by various factors, and understanding these drivers is key to successful trading.

Factors Influencing the Price of E-Mini S&P 500 Futures

Understanding the forces that drive the e-mini s&p 500 futures price is crucial for successful trading. Numerous economic and market factors can significantly impact the value of these contracts. Interest rates, for example, play a vital role. When interest rates rise, borrowing costs increase for companies, which can lead to lower profits and potentially a decline in stock prices, affecting e-mini s&p 500 futures price. Conversely, lower interest rates can stimulate economic growth and boost stock prices. Inflation data is another critical indicator. High inflation can erode corporate profits and consumer spending, leading to market uncertainty and fluctuations in the e-mini s&p 500 futures price. Employment reports also provide insights into the health of the economy. Strong job growth typically signals a healthy economy, which can support higher stock prices. Weak employment data, however, may indicate an economic slowdown and negatively impact the e-mini s&p 500 futures price.

Geopolitical events can also have a substantial impact on the e-mini s&p 500 futures price. Events such as trade wars, political instability, and international conflicts can create uncertainty and volatility in the market. Corporate earnings announcements are closely watched by traders and investors. Positive earnings reports can boost stock prices, while negative reports can lead to declines. Unexpected news or events can also trigger sharp price movements in the e-mini s&p 500 futures price. These events, sometimes unpredictable, highlight the need for traders to stay informed and manage risk effectively. Monitoring these factors allows traders to anticipate potential price movements and adjust their strategies accordingly.

Both short-term volatility and long-term trends in the futures market are influenced by these factors. Short-term volatility may be driven by sudden news releases or unexpected events. Long-term trends, however, are typically driven by fundamental economic factors and shifts in investor sentiment. Successfully navigating the e-mini s&p 500 futures price requires a comprehensive understanding of these influencing factors and the ability to interpret their potential impact on the market. Analyzing these factors in conjunction with technical indicators can provide traders with a more informed perspective. Keeping abreast of market news and economic data releases is essential for making informed trading decisions related to the e-mini s&p 500 futures price.

How to Analyze the S&P 500 E-Mini Contract

Analyzing the e-mini S&P 500 futures price requires a multifaceted approach. Traders often combine technical, fundamental, and sentiment analysis to form a comprehensive view of potential trading opportunities. Technical analysis involves studying price charts and using indicators to identify patterns and trends. Common tools include moving averages, the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD). For example, a trader might look for a “golden cross,” where the 50-day moving average crosses above the 200-day moving average, as a bullish signal for the e-mini S&P 500 futures price. Conversely, a “death cross” could signal a potential downtrend. Identifying support and resistance levels on the chart also assists traders in determining potential entry and exit points.

Fundamental analysis focuses on economic data and news events that could impact the e-mini S&P 500 futures price. Key indicators include interest rate decisions by the Federal Reserve, inflation reports (CPI and PPI), employment data (the monthly jobs report), and GDP growth figures. Strong economic data typically supports higher stock prices, while weaker data can have the opposite effect. Corporate earnings announcements are also closely watched, as they provide insights into the profitability and health of individual companies within the S&P 500 index. Significant geopolitical events, such as trade wars or political instability, can also create volatility in the e-mini S&P 500 futures price. Understanding these factors and their potential impact is crucial for making informed trading decisions.

Sentiment analysis involves gauging the overall market mood and investor confidence. This can be done by monitoring news headlines, social media trends, and investor surveys. High levels of optimism, or “bullish sentiment,” might suggest that the market is overbought and due for a correction. Conversely, extreme pessimism, or “bearish sentiment,” could indicate a potential buying opportunity. The CBOE Volatility Index (VIX), often referred to as the “fear gauge,” is a useful tool for measuring market volatility and investor anxiety. A high VIX typically reflects increased uncertainty and potential for large price swings in the e-mini S&P 500 futures price. By combining these three types of analysis, traders can develop a well-rounded perspective on the e-mini S&P 500 futures price and improve their chances of success.

Trading Strategies for E-Mini S&P 500 Futures

Several trading strategies can be employed when navigating the world of e-mini S&P 500 futures. Each strategy carries its own risk and reward profile, demanding a tailored approach based on individual risk tolerance and investment goals. Understanding these strategies is crucial for anyone looking to actively participate in the e-mini S&P 500 futures market. This section provides a comprehensive overview of popular trading methodologies.

Day trading represents a short-term approach, where positions are opened and closed within the same trading day. Day traders capitalize on intraday price fluctuations of the e-mini S&P 500 futures price, aiming to profit from small price movements. This strategy demands constant monitoring and quick decision-making. Swing trading, on the other hand, involves holding positions for several days or weeks, seeking to capture larger price swings. Swing traders rely on technical analysis and chart patterns to identify potential entry and exit points. Position trading is a long-term strategy, where positions are held for months or even years, based on fundamental analysis and macroeconomic trends. Position traders aim to profit from long-term trends in the e-mini S&P 500 futures price, often ignoring short-term volatility. Hedging is another strategy that involves using e-mini S&P 500 futures to offset the risk of an existing portfolio. For example, an investor holding a portfolio of S&P 500 stocks might short e-mini S&P 500 futures to protect against potential market downturns. Consider for all trading strategies that the e-mini S&P 500 futures price has high volatility.

For instance, a day trader might use a 5-minute chart to identify short-term trends and execute trades based on technical indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). A swing trader might look for breakout patterns on a daily chart, entering a long position when the e-mini S&P 500 futures price breaks above a key resistance level. A position trader might analyze economic indicators such as GDP growth, inflation rates, and interest rate policies to determine the long-term direction of the market, and make decisions based on macro economic trends related to the e-mini S&P 500 futures price. Conversely, an investor worried about a potential market correction might short e-mini S&P 500 futures to hedge their portfolio, limiting their potential losses. Each strategy requires a different skillset and risk management approach, therefore, traders should carefully evaluate their own capabilities before implementing any trading plan. *Disclaimer: Trading involves risk. Not financial advice.*

Managing Risk in E-Mini S&P 500 Futures Trading

Risk management is crucial when trading e-mini s&p 500 futures price. These contracts offer leverage, potentially magnifying both profits and losses. Understanding and implementing effective risk management strategies is essential for protecting capital and achieving consistent results. Several techniques can help traders limit potential losses. Stop-loss orders are a primary tool. These orders automatically exit a trade when the e-mini s&p 500 futures price reaches a predetermined level. This prevents losses from spiraling out of control if the market moves against the trader’s position. Another important aspect is position sizing. Determining the appropriate amount of capital to allocate to each trade is critical. Overleveraging can lead to significant losses, even with small price fluctuations. A common rule is to risk only a small percentage of total capital on any single trade. Diversifying portfolios across different asset classes and markets can also help mitigate risk. This reduces the impact of any single trade or market event on the overall portfolio performance. The concept of margin requirements is fundamental to understanding risk. Margin is the amount of money required to open and maintain a futures position. Exchanges set minimum margin levels to ensure that traders can cover potential losses. However, leverage can amplify gains and losses significantly.

Effective risk management also involves understanding market volatility. The e-mini s&p 500 futures price can fluctuate rapidly due to various factors. These factors include economic news, geopolitical events, and changes in investor sentiment. Monitoring these factors and adjusting trading strategies accordingly is crucial. Traders should also be aware of the potential for “slippage.” Slippage occurs when a trade is executed at a price different from the intended price. This can happen during periods of high volatility or low liquidity. To mitigate slippage, traders can use limit orders, which guarantee a specific execution price. Furthermore, keeping a trading journal is a valuable risk management tool. By tracking trades, analyzing performance, and identifying patterns, traders can learn from their mistakes and improve their decision-making process. Reviewing past trades and understanding the factors that contributed to both successes and failures can lead to better risk management strategies. Emotional discipline is an often-overlooked aspect of risk management. Fear and greed can lead to impulsive decisions that can be detrimental to trading performance. Sticking to a well-defined trading plan and avoiding emotional reactions to market movements is essential for maintaining consistent results.

In summary, managing risk in e-mini s&p 500 futures price trading requires a multifaceted approach. This approach includes setting stop-loss orders, managing position size, understanding margin requirements, diversifying portfolios, monitoring market volatility, and maintaining emotional discipline. By implementing these strategies, traders can protect their capital and increase their chances of long-term success. Remember, consistent profitability in futures trading is not just about maximizing gains; it’s also about effectively minimizing losses. *Disclaimer: Trading involves risk. Not financial advice.*

Choosing a Broker for Trading S&P 500 E-Mini Contracts

Selecting the right brokerage platform is a critical step for anyone looking to trade e-mini s&p 500 futures price contracts. The ideal broker should align with your trading style, capital resources, and risk tolerance. Key factors to consider include trading fees, platform features, margin rates, customer support, and regulatory oversight. Each of these aspects plays a significant role in your overall trading experience and profitability.

Trading fees can significantly impact your bottom line, especially for active traders. Look for brokers that offer competitive commission rates and transparent fee structures. Some brokers may offer lower fees for high-volume traders. Platform features are also important. A user-friendly platform with advanced charting tools, real-time data, and order execution capabilities can enhance your trading efficiency. Consider whether the platform offers mobile trading options, which can be beneficial for monitoring the e-mini s&p 500 futures price market on the go. Margin rates determine the amount of leverage you can access, which can amplify both gains and losses. Understanding the margin requirements and associated risks is essential. Robust customer support is invaluable, particularly for new traders. Choose a broker that provides responsive and knowledgeable assistance when you need it. Finally, ensure that the brokerage is regulated by a reputable authority, such as the Commodity Futures Trading Commission (CFTC) in the United States. Regulatory oversight provides a level of protection and assurance that the broker adheres to industry standards.

Several well-known brokers cater to e-mini s&p 500 futures price traders. Interactive Brokers is recognized for its low fees and extensive range of trading instruments. They offer a sophisticated platform suitable for experienced traders. Another option is TD Ameritrade, which provides a user-friendly platform with comprehensive research and educational resources. Ultimately, the best broker for you will depend on your individual needs and preferences. Take the time to research and compare different brokers before making a decision. Consider opening a demo account to test out the platform and familiarize yourself with its features before committing real capital. Carefully evaluate the e-mini s&p 500 futures price of different platforms and choose the one that provides the most value for your trading needs. Selecting the right broker can significantly contribute to your success in the e-mini s&p 500 futures price market.

Real-Time S&P 500 E-Mini Futures Data: Accessing Market Information

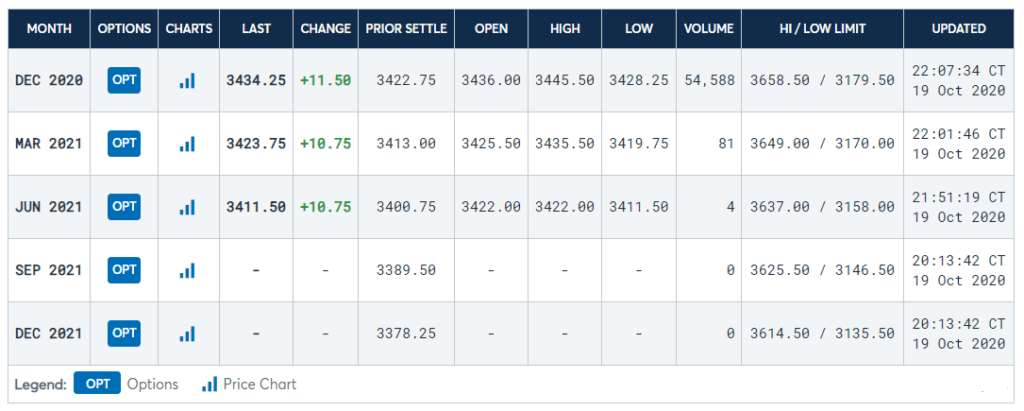

Timely access to real-time data is crucial for anyone trading e-mini S&P 500 futures. This information empowers traders to make informed decisions based on the most current market conditions. Several avenues exist for obtaining this vital data, each with its own strengths and features. Monitoring the e-mini S&P 500 futures price is essential for successful trading.

Financial news websites are a primary source for real-time price quotes, charts, and market analysis. Reputable platforms offer dedicated sections for futures trading, providing up-to-the-minute information on the e-mini S&P 500 futures price, volume, and open interest. Many also include news feeds, economic calendars, and expert commentary that can influence trading strategies. These websites often provide historical data, allowing traders to analyze past performance and identify trends. Analyzing the e-mini S&P 500 futures price history can improve trading strategies. Brokerage platforms themselves offer real-time data feeds to their clients. These platforms typically provide advanced charting tools, order entry systems, and account management features, all integrated into a single interface. The real-time e-mini S&P 500 futures price is readily available on these platforms, along with depth-of-market information and other valuable data points. Some brokers offer free data feeds, while others may charge a subscription fee for enhanced services.

Specialized data providers offer comprehensive market data solutions for professional traders. These services often provide the fastest and most accurate data feeds available, along with advanced analytical tools and customizable alerts. While these services can be more expensive than other options, they can be invaluable for serious traders who rely on real-time information to make split-second decisions regarding the e-mini S&P 500 futures price. Access to timely and accurate data is not just a convenience, it is a necessity for navigating the fast-paced world of e-mini S&P 500 futures trading. Monitoring the e-mini S&P 500 futures price is paramount. By leveraging the various resources available, traders can gain a significant edge in the market and improve their chances of success. Accessing real-time data and understanding the e-mini S&P 500 futures price movements are vital for informed trading decisions.

The Future of E-Mini S&P 500 Futures: Trends and Outlook

The e-mini S&P 500 futures price market is constantly evolving. Several factors will likely shape its trajectory. Technological advancements are key. Regulatory changes and global economic shifts also play a role. These elements create both opportunities and challenges for traders. Understanding these trends is vital for navigating the market effectively.

One significant trend is the increasing automation of trading. Algorithmic trading and high-frequency trading (HFT) are becoming more prevalent. These technologies enable faster execution and more sophisticated trading strategies. They also contribute to increased market volatility. Traders need to adapt to this environment by using advanced tools and risk management techniques. Another trend is the growing influence of retail investors. Online brokerage platforms have made it easier for individuals to access the futures market. This has led to increased participation and liquidity. However, it also means that the market is more susceptible to sentiment-driven swings.

Regulatory reforms can significantly impact the e-mini S&P 500 futures price. Changes in margin requirements, trading rules, and market surveillance can affect market dynamics. Traders must stay informed about these changes and adjust their strategies accordingly. Global economic conditions are another crucial factor. Events such as trade wars, currency fluctuations, and economic recessions can have a profound impact on the S&P 500 index and, consequently, on e-mini futures. Monitoring these developments and understanding their potential impact is essential for making informed trading decisions. Expert opinions suggest that the e-mini S&P 500 futures market will continue to be a dynamic and important tool for investors seeking exposure to the U.S. stock market. However, success in this market requires a deep understanding of the underlying factors, a disciplined approach to risk management, and the ability to adapt to changing conditions. The e-mini S&P 500 futures price reflects these complex interactions.