Navigating the World of Futures Trading

Futures trading has become an essential component of modern financial markets, offering investors a unique opportunity to speculate on the future price of various assets. The E-Mini S&P 500 futures, in particular, have gained immense popularity due to their close correlation with the S&P 500 stock index. As a result, understanding the E-Mini S&P 500 futures price is crucial for traders seeking to capitalize on market movements and make informed investment decisions. With the ability to trade E-Mini S&P 500 futures electronically, investors can now access a global market with ease, making it an attractive option for those looking to diversify their portfolios.

How to Read and Analyze E-Mini S&P 500 Futures Price Charts

Accurately reading and analyzing E-Mini S&P 500 futures price charts is a crucial step in making informed trading decisions. A thorough understanding of chart analysis enables traders to identify trends, recognize patterns, and understand technical indicators. To begin, it’s essential to familiarize oneself with the different types of charts, including line charts, bar charts, and candlestick charts. Each type of chart provides unique insights into the E-Mini S&P 500 futures price, allowing traders to tailor their analysis to their specific needs.

When analyzing E-Mini S&P 500 futures price charts, traders should focus on identifying trends, which can be either upward, downward, or sideways. Recognizing trends is vital, as it enables traders to make informed decisions about when to enter or exit a trade. In addition to identifying trends, traders should also be aware of chart patterns, such as triangles, wedges, and head-and-shoulders formations. These patterns can provide valuable insights into potential price movements and help traders anticipate changes in the E-Mini S&P 500 futures price.

Technical indicators, such as moving averages, relative strength index (RSI), and Bollinger Bands, are also essential tools in chart analysis. These indicators provide traders with a more detailed understanding of the E-Mini S&P 500 futures price, enabling them to make more accurate predictions about future price movements. By combining chart patterns and technical indicators, traders can develop a comprehensive understanding of the E-Mini S&P 500 futures price and make informed trading decisions.

Factors Affecting E-Mini S&P 500 Futures Prices

Several factors influence the E-Mini S&P 500 futures price, making it essential for traders to stay informed about market developments to make accurate trading decisions. Economic indicators, such as GDP growth, inflation rates, and employment numbers, significantly impact the E-Mini S&P 500 futures price. For instance, a strong GDP growth rate may lead to an increase in the E-Mini S&P 500 futures price, as it indicates a healthy economy.

Geopolitical events, including political elections, trade agreements, and global conflicts, also affect the E-Mini S&P 500 futures price. These events can lead to market volatility, causing the E-Mini S&P 500 futures price to fluctuate rapidly. Market sentiment, which refers to the overall attitude of investors towards the market, is another crucial factor influencing the E-Mini S&P 500 futures price. When market sentiment is bullish, the E-Mini S&P 500 futures price tends to rise, and when it’s bearish, the price tends to fall.

In addition to these factors, central bank policies, commodity prices, and corporate earnings also impact the E-Mini S&P 500 futures price. Traders must consider these factors when making trading decisions, as they can significantly influence the direction of the E-Mini S&P 500 futures price. By staying informed about these factors, traders can develop a deeper understanding of the market and make more accurate predictions about future price movements.

Understanding the factors that influence the E-Mini S&P 500 futures price is crucial for developing effective trading strategies. By recognizing how these factors impact the market, traders can adjust their strategies to capitalize on opportunities and minimize losses. As the E-Mini S&P 500 futures price is closely tied to the overall performance of the US stock market, traders must stay informed about market developments to achieve success in futures trading.

The Role of Market Volatility in E-Mini S&P 500 Futures Trading

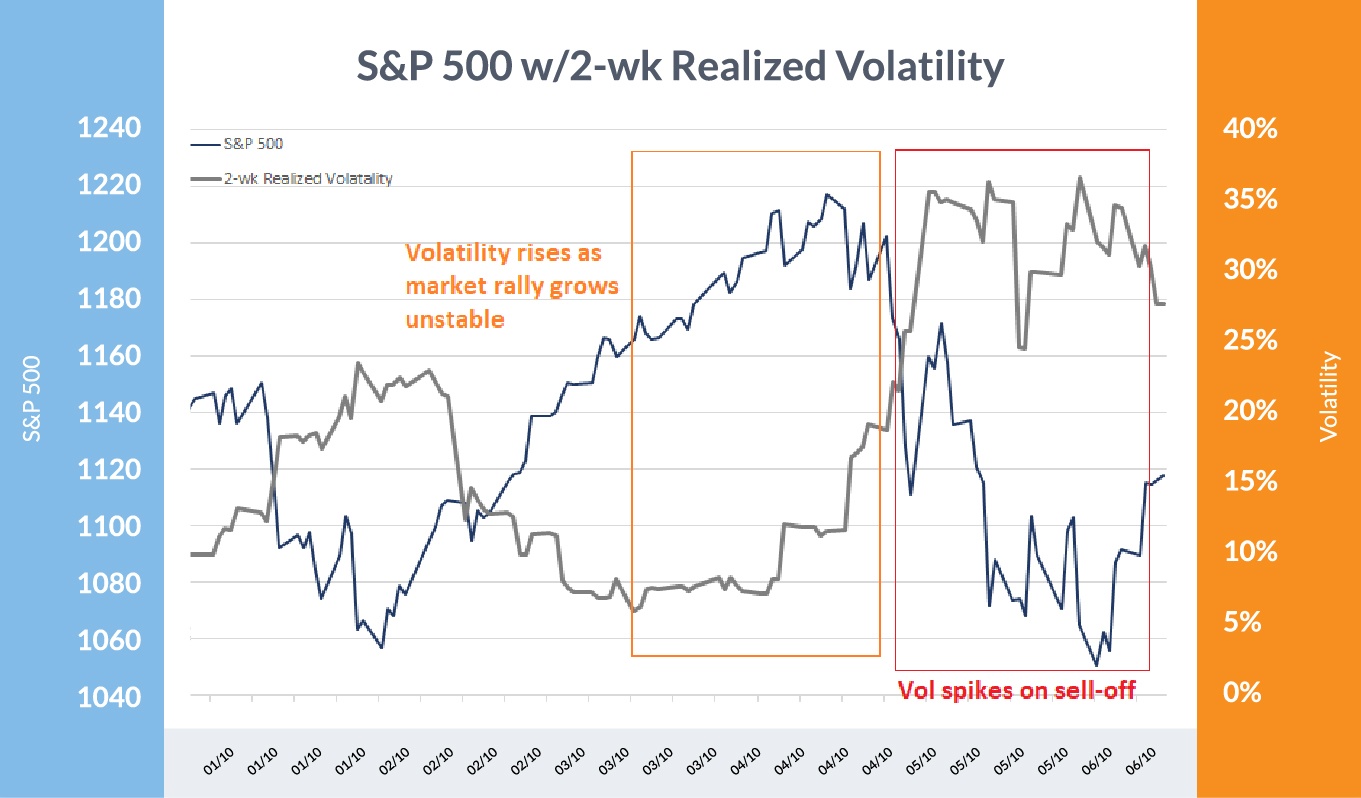

Market volatility plays a crucial role in E-Mini S&P 500 futures trading, as it can significantly impact the E-Mini S&P 500 futures price. Volatility refers to the fluctuations in the market price of a security, and it can be measured using various indicators, such as the VIX index. In the context of E-Mini S&P 500 futures trading, market volatility can be both a blessing and a curse.

On the one hand, market volatility can create opportunities for traders to capitalize on price movements. In volatile markets, the E-Mini S&P 500 futures price can fluctuate rapidly, providing traders with the potential to make significant profits. However, on the other hand, market volatility can also increase the risk of losses. When the market is volatile, the E-Mini S&P 500 futures price can move rapidly in either direction, making it challenging for traders to predict price movements.

To manage risk in volatile markets, traders can employ various strategies, such as stop-loss orders and position sizing. Stop-loss orders allow traders to limit their potential losses by automatically closing a trade when the E-Mini S&P 500 futures price reaches a certain level. Position sizing, on the other hand, involves adjusting the size of a trade based on the level of market volatility. By using these strategies, traders can minimize their risk exposure and capitalize on opportunities in volatile markets.

In addition to managing risk, traders can also use market volatility to their advantage by employing strategies such as scalping and swing trading. Scalping involves making multiple trades in a short period, taking advantage of small price movements in the E-Mini S&P 500 futures price. Swing trading, on the other hand, involves holding a trade for a longer period, taking advantage of larger price movements. By using these strategies, traders can capitalize on market volatility and achieve success in E-Mini S&P 500 futures trading.

Strategies for Trading E-Mini S&P 500 Futures Successfully

When it comes to trading E-Mini S&P 500 futures, having a solid strategy is crucial for achieving success. There are various trading strategies that can be employed, each with its own pros and cons. In this section, we will explore three popular trading strategies for E-Mini S&P 500 futures: day trading, swing trading, and position trading.

Day trading involves holding a trade for a short period, typically within a single trading day. This strategy is ideal for traders who are comfortable with rapid market fluctuations and can make quick decisions. Day traders aim to capitalize on small price movements in the E-Mini S&P 500 futures price, often using technical indicators to identify trading opportunities. The pros of day trading include the potential for high profits and the ability to limit overnight risks. However, the cons include the need for constant market monitoring and the potential for significant losses if trades are not managed properly.

Swing trading, on the other hand, involves holding a trade for a longer period, typically several days or weeks. This strategy is suitable for traders who are willing to hold positions overnight and can tolerate moderate market fluctuations. Swing traders aim to capitalize on medium-term price movements in the E-Mini S&P 500 futures price, often using a combination of technical and fundamental analysis to identify trading opportunities. The pros of swing trading include the potential for higher profits than day trading and the ability to ride out minor market fluctuations. However, the cons include the need for overnight risk management and the potential for significant losses if trades are not managed properly.

Position trading involves holding a trade for an extended period, typically several weeks or months. This strategy is ideal for traders who are willing to hold positions for an extended period and can tolerate significant market fluctuations. Position traders aim to capitalize on long-term price movements in the E-Mini S&P 500 futures price, often using fundamental analysis to identify trading opportunities. The pros of position trading include the potential for high profits and the ability to ride out significant market fluctuations. However, the cons include the need for long-term risk management and the potential for significant losses if trades are not managed properly.

In conclusion, each trading strategy has its own pros and cons, and the choice of strategy depends on the trader’s risk tolerance, market knowledge, and trading goals. By understanding the different trading strategies available, traders can develop a trading plan that suits their needs and increases their chances of success in E-Mini S&P 500 futures trading.

Managing Risk and Emotions in E-Mini S&P 500 Futures Trading

When trading E-Mini S&P 500 futures, it is essential to manage risk and emotions to achieve success. Risk management involves identifying and mitigating potential losses, while emotional management involves controlling fear, greed, and other emotions that can impact trading decisions. In this section, we will explore strategies for managing risk and emotions in E-Mini S&P 500 futures trading.

One of the most effective ways to manage risk is to set stop-losses. A stop-loss is an order that automatically closes a trade when the E-Mini S&P 500 futures price reaches a certain level, limiting potential losses. By setting stop-losses, traders can limit their exposure to market volatility and avoid significant losses. Additionally, traders can limit their position size to manage risk, ensuring that they do not over-leverage their account.

Another essential aspect of risk management is diversification. By diversifying their portfolio, traders can reduce their exposure to any one market or asset, minimizing potential losses. This can be achieved by trading multiple E-Mini S&P 500 futures contracts or by trading other assets, such as stocks or options.

Emotional management is also critical in E-Mini S&P 500 futures trading. Fear and greed are two of the most common emotions that can impact trading decisions, leading to impulsive and irrational decisions. To manage emotions, traders can maintain a trading journal, recording their thoughts and feelings during each trade. This can help traders identify patterns and biases, allowing them to make more informed decisions.

Additionally, traders can employ mental discipline techniques, such as meditation and mindfulness, to control their emotions. By staying focused and calm, traders can make more rational decisions, avoiding impulsive trades that can lead to significant losses.

In conclusion, managing risk and emotions is crucial in E-Mini S&P 500 futures trading. By setting stop-losses, limiting position size, diversifying their portfolio, and managing emotions, traders can minimize potential losses and maximize profits. By incorporating these strategies into their trading plan, traders can achieve success in E-Mini S&P 500 futures trading.

Staying Ahead of the Curve: E-Mini S&P 500 Futures Market Analysis

In the fast-paced world of E-Mini S&P 500 futures trading, staying informed about market trends and analysis is crucial for making informed trading decisions. In this section, we will provide insights into the current market trends and analysis of E-Mini S&P 500 futures prices, including expert opinions and market forecasts.

Currently, the E-Mini S&P 500 futures price is trending upwards, driven by strong economic indicators and a bullish market sentiment. According to expert analysts, the market is expected to continue its upward trend in the short term, with some predicting a potential breakout above the 3,500 level.

However, it’s essential to note that the market is subject to sudden changes, and traders should be prepared for potential reversals. Geopolitical events, such as trade wars and elections, can significantly impact E-Mini S&P 500 futures prices, and traders should stay informed about these events to make informed trading decisions.

In terms of technical analysis, the E-Mini S&P 500 futures price is currently trading above its 50-day moving average, indicating a strong bullish trend. The Relative Strength Index (RSI) is also indicating a bullish signal, with a reading of 65. However, traders should be cautious of potential overbought conditions, which could lead to a correction in the market.

To stay ahead of the curve, traders should continuously monitor market trends and analysis, including expert opinions and market forecasts. This can be achieved by following reputable financial news sources, attending webinars and seminars, and participating in online trading communities.

By staying informed and adapting to changing market conditions, traders can increase their chances of success in E-Mini S&P 500 futures trading. Remember, staying ahead of the curve requires continuous learning and adaptation, and traders should be prepared to adjust their strategies accordingly.

Conclusion: Mastering E-Mini S&P 500 Futures Trading

In conclusion, mastering E-Mini S&P 500 futures trading requires a deep understanding of the market, including the factors that influence E-Mini S&P 500 futures prices, how to read and analyze price charts, and effective risk management strategies. By grasping these concepts, traders can increase their chances of success in the futures market.

It is essential to stay informed about market trends and analysis, including expert opinions and market forecasts, to make informed trading decisions. Additionally, managing risk and emotions is crucial in E-Mini S&P 500 futures trading, as it can help traders avoid impulsive decisions and stay focused on their trading goals.

By incorporating the strategies and concepts discussed in this article, traders can develop a comprehensive approach to E-Mini S&P 500 futures trading, increasing their potential for success in the market. Remember, mastering E-Mini S&P 500 futures trading takes time, effort, and practice, but with the right knowledge and mindset, traders can achieve their goals and succeed in the competitive world of futures trading.

In the ever-changing landscape of E-Mini S&P 500 futures trading, staying ahead of the curve is crucial. By continuously learning and adapting to new market conditions, traders can stay one step ahead of the competition and achieve long-term success. Whether you’re a seasoned trader or just starting out, understanding E-Mini S&P 500 futures prices, managing risk, and staying informed are essential components of a successful trading strategy.