What is a Zero Coupon Bond and How Does it Work?

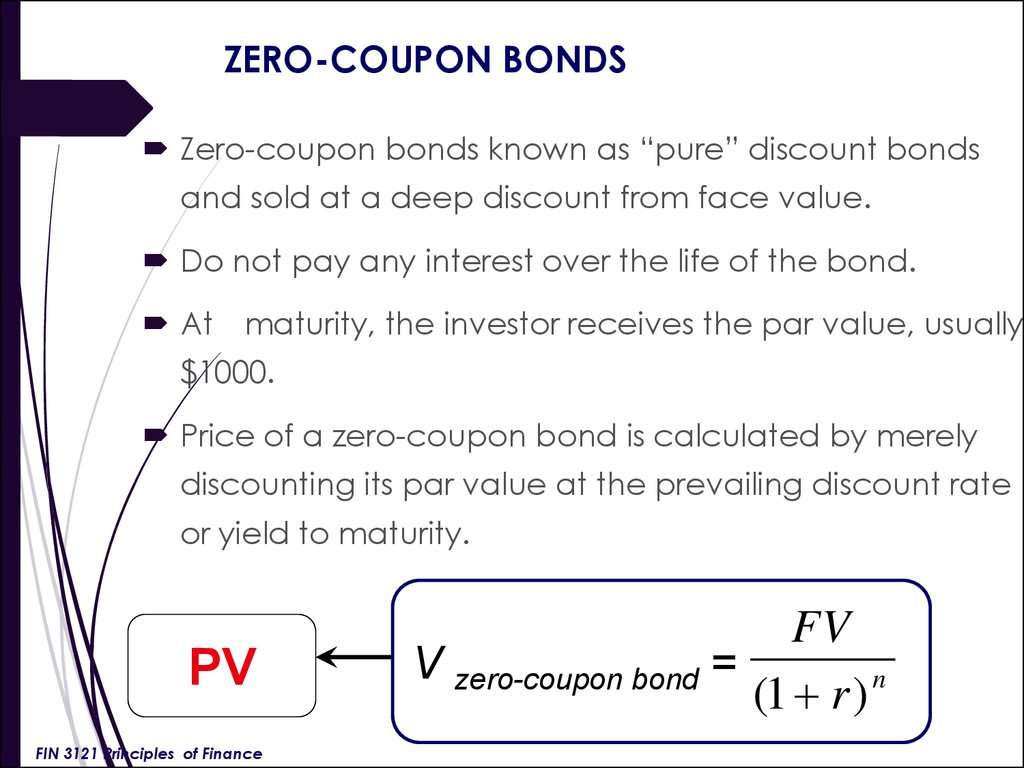

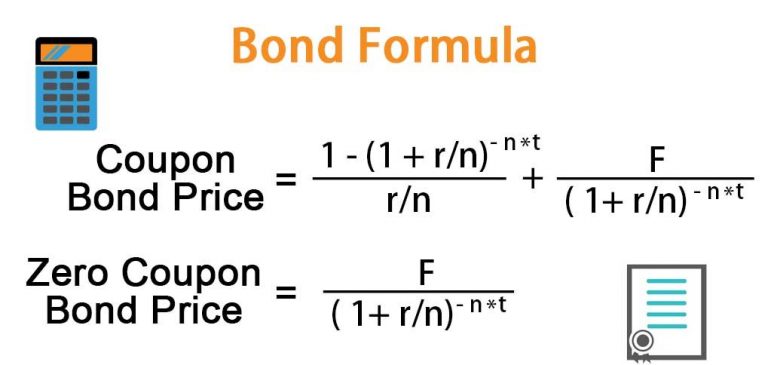

Zero coupon bonds are a unique type of bond that offers investors a distinct set of benefits and characteristics. Unlike traditional bonds, which make regular interest payments to investors, zero coupon bonds do not provide periodic interest payments. Instead, they are sold at a discount to their face value, and the investor receives the full face value at maturity. This approach allows investors to benefit from the compounding effect, as the entire investment grows over time. Zero coupon bonds are often used by investors seeking to lock in a fixed return over a specific period, making them an attractive option for those with a long-term investment horizon. As investors consider zero coupon bonds, it’s essential to understand the concept of duration, which plays a critical role in measuring the bond’s sensitivity to interest rate changes.

Understanding the Duration of a Zero Coupon Bond

The duration of a zero coupon bond is a critical concept that investors must grasp to make informed investment decisions. In essence, duration measures the bond’s sensitivity to changes in interest rates. It represents the weighted average of the times until the bond’s cash flows are received, with the weights being the present values of those cash flows. The duration of a zero coupon bond is calculated using a formula that takes into account the bond’s face value, coupon rate, and time to maturity. Understanding the duration of a zero coupon bond is vital, as it helps investors anticipate how changes in interest rates will affect the bond’s value. A longer duration indicates that the bond is more sensitive to interest rate changes, while a shorter duration suggests that the bond is less sensitive. By grasping the concept of duration, investors can better navigate the complexities of zero coupon bond investing and make more informed decisions.

How to Calculate the Duration of a Zero Coupon Bond

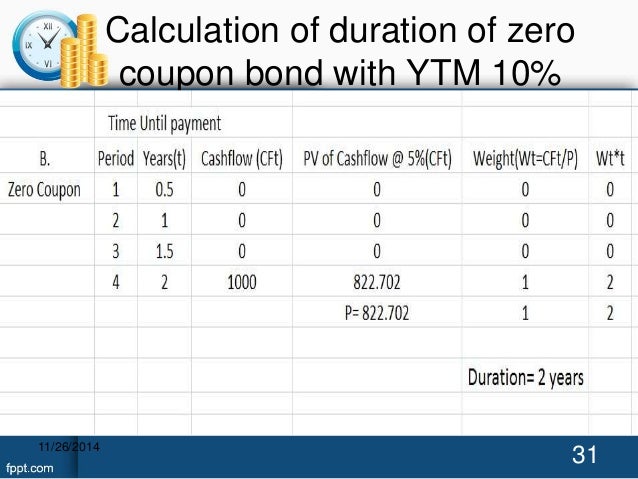

To calculate the duration of a zero coupon bond, investors can use the following formula: Duration = (1 + YTM)^(-1) \* (M – 1) / YTM, where YTM is the yield to maturity, M is the maturity period, and Duration is the Macaulay duration. This formula provides a precise measure of the bond’s sensitivity to interest rate changes. For example, let’s consider a zero coupon bond with a face value of $1,000, a yield to maturity of 5%, and a maturity period of 10 years. Using the formula, we can calculate the duration as follows: Duration = (1 + 0.05)^(-1) \* (10 – 1) / 0.05 = 8.24 years. This means that for every 1% change in interest rates, the bond’s price will change by approximately 8.24%. By understanding how to calculate the duration of a zero coupon bond, investors can better assess the bond’s risk profile and make more informed investment decisions.

The Impact of Interest Rates on Zero Coupon Bond Duration

Changes in interest rates have a significant impact on the duration of a zero coupon bond. When interest rates rise, the duration of a zero coupon bond decreases, making it less sensitive to further interest rate changes. Conversely, when interest rates fall, the duration of a zero coupon bond increases, making it more sensitive to further interest rate changes. This inverse relationship between interest rates and duration is crucial for investors to understand, as it affects the bond’s price and yield. For instance, if interest rates rise from 5% to 6%, the duration of a 10-year zero coupon bond may decrease from 8.24 years to 7.51 years, reducing its sensitivity to further interest rate changes. On the other hand, if interest rates fall from 5% to 4%, the duration of the same bond may increase from 8.24 years to 9.15 years, making it more sensitive to further interest rate changes. By grasping the impact of interest rates on the duration of zero coupon bonds, investors can better navigate the complexities of the bond market and make more informed investment decisions.

Why Duration Matters in Zero Coupon Bond Investing

When investing in zero coupon bonds, understanding the duration of the bond is crucial. The duration of a zero coupon bond measures its sensitivity to interest rate changes, and it has a significant impact on the bond’s price and yield. A longer duration means that the bond is more sensitive to interest rate changes, and its price will fluctuate more significantly in response to changes in interest rates. On the other hand, a shorter duration means that the bond is less sensitive to interest rate changes, and its price will be more stable. Investors who are risk-averse may prefer shorter-duration zero coupon bonds, as they offer more predictable returns and are less exposed to interest rate risk. Conversely, investors who are willing to take on more risk may prefer longer-duration zero coupon bonds, as they offer the potential for higher returns over the long term. By considering the duration of a zero coupon bond, investors can make more informed investment decisions and optimize their portfolios to achieve their financial goals. The duration of a zero coupon bond is a critical factor to consider, as it can significantly impact the bond’s performance and the investor’s returns. By grasping the concept of duration and its implications, investors can unlock the full potential of zero coupon bonds and achieve success in the bond market.

Comparing Zero Coupon Bonds with Other Investment Options

Zero coupon bonds offer a unique set of characteristics that distinguish them from other investment options. When compared to traditional bonds, zero coupon bonds do not provide regular interest payments, but instead offer a single payment at maturity. This makes them more suitable for investors with a long-term horizon who are willing to forgo regular income in exchange for a higher return at maturity. In contrast, traditional bonds provide regular interest payments, making them more suitable for investors seeking regular income. Stocks, on the other hand, offer the potential for higher returns, but also come with higher risks and volatility. Certificates of Deposit (CDs) offer a fixed return with low risk, but are less liquid than zero coupon bonds. When considering zero coupon bonds as an investment option, it’s essential to evaluate their unique features and benefits in relation to other investment options. By doing so, investors can make informed decisions and optimize their portfolios to achieve their financial goals. The duration of a zero coupon bond is a critical factor to consider when making these comparisons, as it can significantly impact the bond’s performance and the investor’s returns. By understanding the duration of zero coupon bonds and how they compare to other investment options, investors can unlock the full potential of these unique instruments and achieve success in the bond market.

Real-World Examples of Zero Coupon Bonds in Action

Zero coupon bonds have been used in various ways by governments, corporations, and financial institutions to raise capital and manage risk. For instance, the U.S. Treasury Department has issued zero coupon bonds, known as Treasury Strips, to finance government operations. These bonds are popular among investors seeking low-risk, long-term investments. In the corporate world, companies like Coca-Cola and IBM have issued zero coupon bonds to raise capital for specific projects or to refinance existing debt. The duration of these bonds is critical in determining their sensitivity to interest rate changes and their overall performance. In another example, the European Investment Bank has issued zero coupon bonds to finance infrastructure projects in the European Union. These bonds have a longer duration, making them more sensitive to interest rate changes, but also offering higher returns to investors. By examining these real-world examples, investors can gain a deeper understanding of how zero coupon bonds are used in practice and how the duration of zero coupon bonds affects their performance. This knowledge can help investors make informed decisions when considering zero coupon bonds as an investment option.

Conclusion: Mastering the Duration of Zero Coupon Bonds

In conclusion, understanding the duration of zero coupon bonds is crucial for investors seeking to navigate the complexities of the bond market. By grasping the concept of duration and its significance in measuring a bond’s sensitivity to interest rate changes, investors can make informed decisions and optimize their portfolios. The duration of a zero coupon bond plays a critical role in determining its performance, and investors must carefully consider this factor when investing in these unique instruments. Whether used to finance government operations, corporate projects, or individual investments, zero coupon bonds offer a valuable tool for raising capital and managing risk. By mastering the duration of zero coupon bonds, investors can unlock the full potential of these instruments and achieve success in the bond market. As a key component of a diversified investment portfolio, zero coupon bonds can provide a stable source of returns, but only for those who understand the intricacies of duration and its impact on bond performance.