What is a Zero Coupon Bond and How Does it Work?

In the world of fixed-income investments, zero coupon bonds offer a unique opportunity for investors seeking a single, lump-sum payment at maturity. Unlike traditional bonds, which make regular interest payments to investors, zero coupon bonds do not provide periodic coupon payments. Instead, they are sold at a discount to their face value, and the investor receives the full face value at maturity. This characteristic makes zero coupon bonds attractive to investors looking to capitalize on a single, upfront investment. As investors delve into the world of zero coupon bonds, understanding their inner workings is crucial for making informed investment decisions.

The Role of Duration in Zero Coupon Bonds

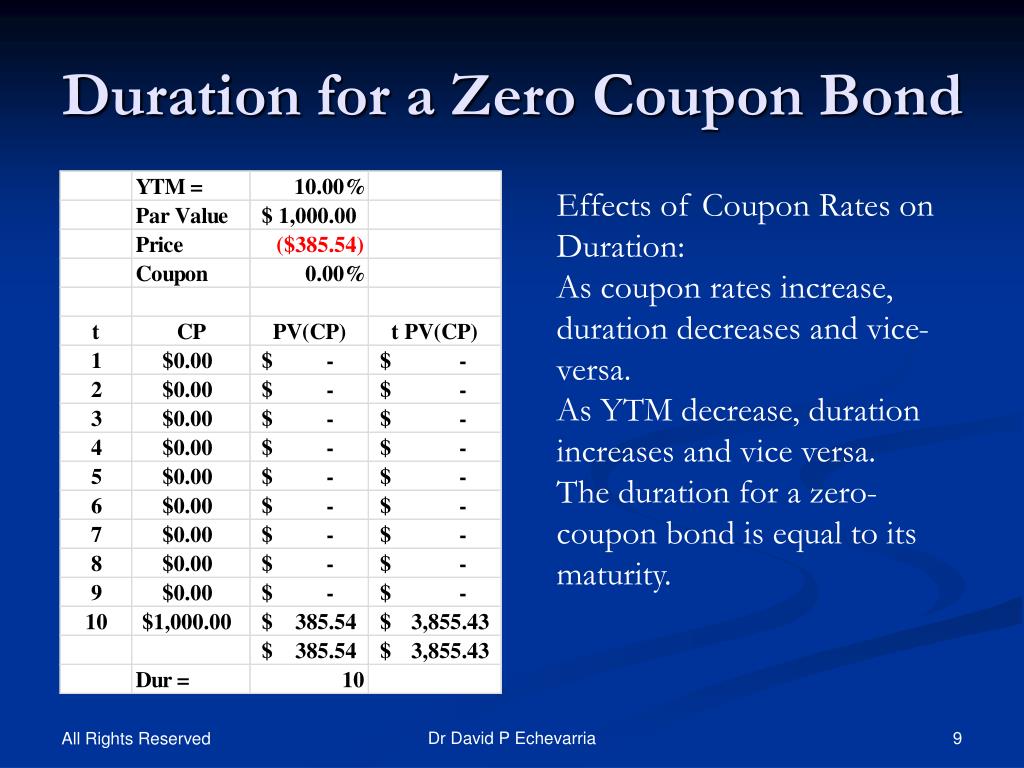

When it comes to zero coupon bonds, understanding the concept of duration is crucial for investors seeking to maximize their returns. Duration, in essence, measures the bond’s sensitivity to changes in interest rates. In the case of zero coupon bonds, duration plays a critical role in determining the bond’s overall value and risk profile. A longer duration of a zero coupon bond indicates that the bond is more sensitive to interest rate fluctuations, making it more volatile and potentially riskier for investors. On the other hand, a shorter duration implies that the bond is less sensitive to interest rate changes, making it a more stable investment option. By grasping the duration of a zero coupon bond, investors can better navigate the complexities of the bond market and make informed investment decisions.

How to Calculate the Duration of a Zero Coupon Bond

Calculating the duration of a zero coupon bond is a crucial step in understanding its behavior and risk profile. The duration of a zero coupon bond can be calculated using the following formula: Duration = (Time to Maturity) / (1 + (Yield to Maturity)^((1/Time to Maturity))). This formula takes into account the bond’s time to maturity and yield to maturity, providing a precise measure of the bond’s sensitivity to interest rate changes. To illustrate this concept, let’s consider an example. Suppose we have a zero coupon bond with a face value of $1,000, a time to maturity of 10 years, and a yield to maturity of 5%. Using the formula, we can calculate the duration of this bond to be approximately 9.2 years. This means that for every 1% change in interest rates, the bond’s price will change by approximately 9.2%. By understanding how to calculate the duration of a zero coupon bond, investors can better assess the bond’s risk profile and make informed investment decisions.

Factors Affecting the Duration of a Zero Coupon Bond

Several factors influence the duration of a zero coupon bond, including the bond’s face value, coupon rate, and time to maturity. The face value of the bond, also known as the principal amount, plays a significant role in determining the bond’s duration. A higher face value typically results in a longer duration, as the bond’s price is more sensitive to interest rate changes. The coupon rate, although zero in the case of zero coupon bonds, still affects the bond’s duration. A bond with a higher coupon rate would have a shorter duration, as the regular interest payments reduce the bond’s sensitivity to interest rate changes. However, since zero coupon bonds do not make regular interest payments, their duration is more heavily influenced by the time to maturity. A longer time to maturity results in a longer duration, as the bond’s price is more sensitive to interest rate changes over a longer period. Additionally, the yield to maturity also affects the duration of a zero coupon bond, with a higher yield resulting in a shorter duration. Understanding these factors is crucial in accurately calculating the duration of a zero coupon bond and making informed investment decisions. By recognizing how these factors interact, investors can better navigate the complexities of the bond market and optimize their investment portfolios.

The Impact of Interest Rate Changes on Zero Coupon Bond Duration

Changes in interest rates have a significant impact on the duration of a zero coupon bond. When interest rates rise, the duration of a zero coupon bond decreases, making it less sensitive to further interest rate changes. Conversely, when interest rates fall, the duration of a zero coupon bond increases, making it more sensitive to further interest rate changes. This is because the present value of the bond’s future cash flows is more heavily influenced by the discount rate when interest rates are low. As a result, the bond’s price is more sensitive to changes in interest rates, leading to a longer duration. For investors, this means that a rise in interest rates can result in a decrease in the bond’s value, while a fall in interest rates can result in an increase in the bond’s value. Bond issuers, on the other hand, may benefit from a rise in interest rates, as it reduces the present value of their future liabilities. Understanding the impact of interest rate changes on the duration of a zero coupon bond is crucial for investors and bond issuers alike, as it allows them to make informed decisions and manage their risk exposure effectively. By recognizing the intricate relationship between interest rates and duration, market participants can better navigate the complexities of the bond market and optimize their investment strategies.

Comparing Zero Coupon Bonds with Traditional Bonds

Zero coupon bonds and traditional bonds are two distinct types of fixed-income investments, each with their unique characteristics and advantages. Traditional bonds, also known as coupon bonds, make regular interest payments to investors, whereas zero coupon bonds do not. This fundamental difference has significant implications for investors and bond issuers. Traditional bonds offer a regular income stream, making them attractive to income-seeking investors. In contrast, zero coupon bonds provide a single payment at maturity, making them more suitable for investors with a long-term horizon. The duration of a zero coupon bond is typically longer than that of a traditional bond, making it more sensitive to interest rate changes. This increased sensitivity can result in higher returns for investors, but also increases the risk of losses. On the other hand, traditional bonds offer more predictable cash flows, reducing the uncertainty associated with interest rate changes. In terms of liquidity, traditional bonds are often more liquid than zero coupon bonds, making it easier for investors to buy and sell them. Ultimately, the choice between zero coupon bonds and traditional bonds depends on an investor’s individual financial goals, risk tolerance, and investment horizon. By understanding the differences between these two types of bonds, investors can make informed decisions and optimize their investment portfolios.

Real-World Examples of Zero Coupon Bonds in Action

Zero coupon bonds are widely used in various aspects of finance, including corporate finance, government debt, and individual investment portfolios. In corporate finance, zero coupon bonds are often used to raise capital for long-term projects or to refinance existing debt. For instance, a company may issue a 10-year zero coupon bond to finance a new manufacturing facility. The bond’s duration will be affected by the company’s credit rating, the bond’s face value, and the prevailing interest rate environment. In government debt, zero coupon bonds are used to manage cash flows and reduce borrowing costs. The U.S. Treasury, for example, issues zero coupon bonds, known as Treasury strips, to provide investors with a low-risk investment option. These bonds have a duration that is sensitive to changes in interest rates, making them attractive to investors seeking to hedge against interest rate risk. In individual investment portfolios, zero coupon bonds can provide a predictable return, making them suitable for investors with a long-term horizon. For example, an investor may purchase a 20-year zero coupon bond as part of a retirement portfolio, taking advantage of the bond’s duration to lock in a fixed return. By understanding how zero coupon bonds are used in real-world scenarios, investors can better appreciate the importance of duration in managing their investments and achieving their financial goals.

Conclusion: Mastering the Duration of Zero Coupon Bonds

In conclusion, understanding the duration of a zero coupon bond is crucial for investors and bond issuers alike. By grasping the concept of duration and its impact on zero coupon bonds, investors can make informed decisions about their investments and manage their risk exposure more effectively. The duration of a zero coupon bond plays a critical role in determining its sensitivity to interest rate changes, and its overall value. As demonstrated throughout this article, the duration of a zero coupon bond is influenced by various factors, including the bond’s face value, coupon rate, and time to maturity. Furthermore, changes in interest rates can significantly affect the duration of a zero coupon bond, making it essential for investors to stay informed about market developments. By mastering the duration of zero coupon bonds, investors can unlock the full potential of these unique investment instruments and achieve their financial goals. Whether in corporate finance, government debt, or individual investment portfolios, zero coupon bonds offer a valuable opportunity for investors to diversify their portfolios and manage their risk exposure. By understanding the duration of a zero coupon bond, investors can make the most of this opportunity and thrive in an ever-changing financial landscape.